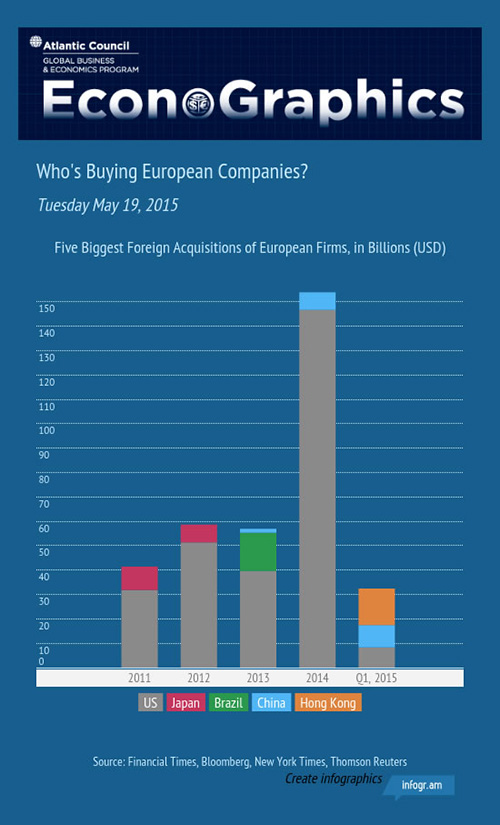

Who is purchasing European companies? Looking at the five biggest foreign acquisitions of European corporates since 2011 shows that the US are the biggest buyers by a considerable margin, with the China, Hong Kong, Brazil, and Japan following behind.

Even after limiting the scope to the five largest acquisitions in each year, US companies have spent more than $250 billion since 2011 swallowing up European corporations. The deals include well-known takeovers like Microsoft’s acquisition of Skype for $8.5 billion in 2011 and GE’s purchase of French energy company Alstom for $17 billion in 2014.

But 2015 is shaping up to be more diverse among the mega-deals in Europe. Already this year, Hong Kong has claimed the largest confirmed acquisition with Hutchison Whampoa’s $15 billion purchase of British telecom O2. China has been active as well, with a $1.4 billion takeover of the UK Chain Pizza Express and Italy’s Pirelli tire company. The US is represented by a $4.8 billion purchase by FedEx of Dutch company TNT.

Will 2015 be the year that non-US companies take the lead in purchasing European companies? With more than half the year left, the field remains open for competition.