Today, the cap on US government spending (or the “debt ceiling”) is officially reinstated, and with it, the threat of another clash over the national debt. Policymakers will have a runway of just months before they must decide to lift the cap on borrowing or temporarily allow it to be raised.

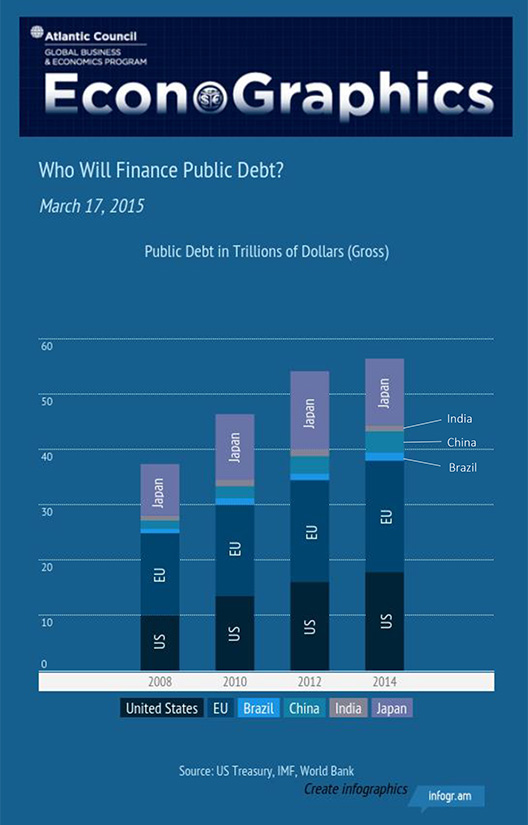

But the US is far from alone in this cycle: Public debt is rising around the globe as a legacy of the great recession. A mix of large fiscal stimulus packages and nationalization of private-sector debt (mainly banks) added around $20 trillion of public debt globally. The result? Large budget deficits and even more borrowing to service those deficits. With global economic growth expected to be anemic, states will struggle to boost tax receipts or reduce spending on aging populations.

With public indebtedness at all-time highs with no turnaround in sight, competition will be higher among countries to finance their public debt and fewer resources will be available to the private sector.