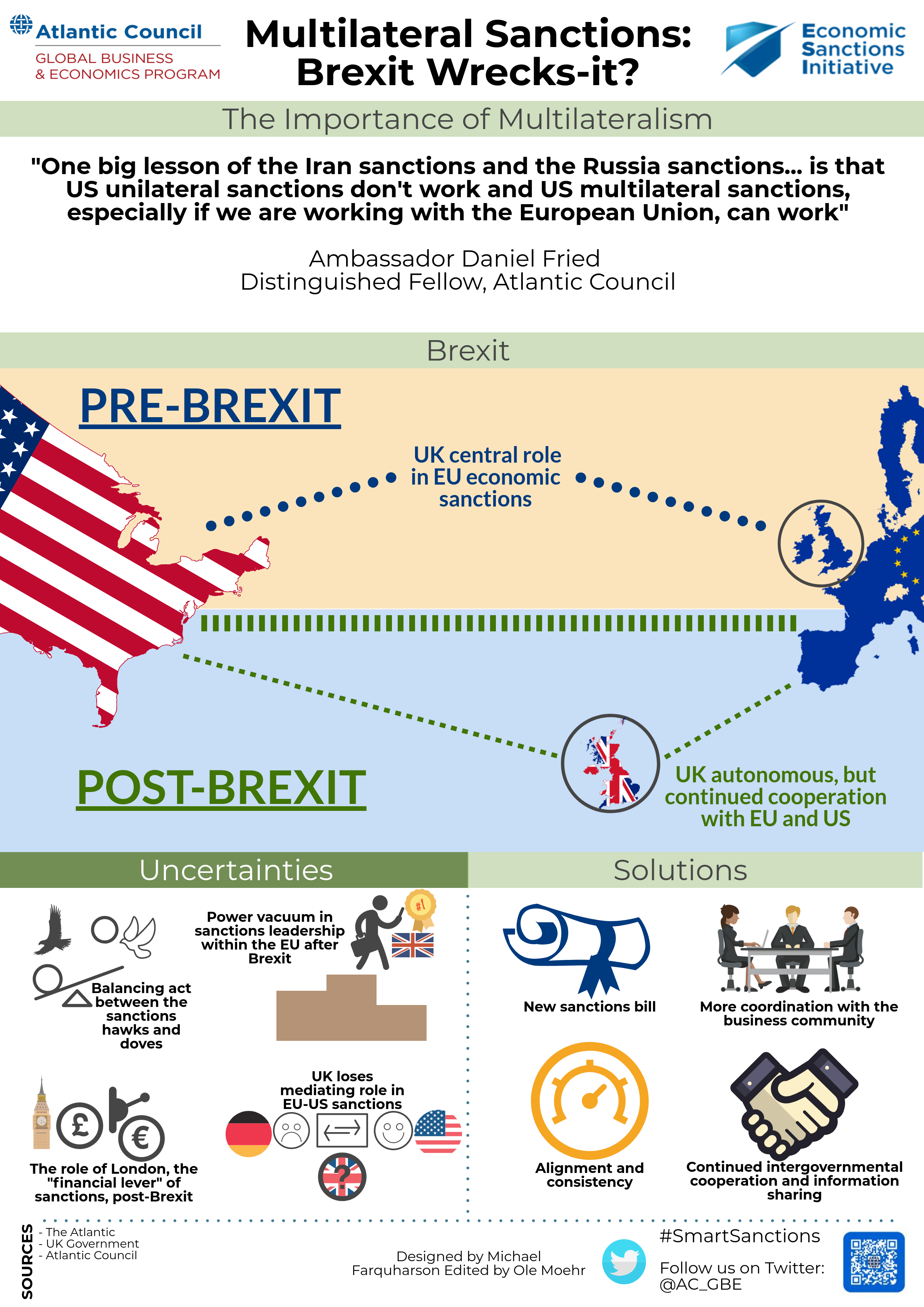

On October 3, 2017, the Atlantic Council hosted a conference with experts from the public and private sector to discuss the impact of Brexit on economic sanctions policymaking. The United Kingdom (UK) currently plays a considerable role crafting and implementing sanctions policy in the European Union (EU). Transatlantic cooperation and sanctions alignment are vital to ensure the effectiveness of this essential foreign policy tool.

Through the City of London, the UK has a special role as the “financial lever” of the EU’s economic sanctions. British support is also provided to the EU through seconded national sanctions policy experts. There is a clear asymmetry of knowledge and influence within the EU given the UK’s close relationship with the United States, its national expertise in sanctions policy, and its position as the financial lever for economic sanctions. The UK’s important position in crafting current EU economic sanctions regimes suggests that post-Brexit divergence is unlikely.

In a post-Brexit world, the UK will have technical autonomy over its sanctions policy. Despite this, the country will be limited in its flexibility on sanctions policy because 99 percent of UK sanctions are United Nations (UN) sanctions, EU sanctions, or supported by both institutions. Sir John Sawers, former chief of the Secret Intelligence Service (MI6), believes that the UK will have little choice but to follow US and EU sanctions after Brexit because of the collective power of the two regimes.

There is no official international agreement in place that requires sanctions cooperation between the United States and the EU, nor between the United States and the UK, but shared foreign policy and national security interests drive collaboration and coordination. Yet, in the case of Russia, a substantial number of EU member states have reservations about the EU-US sanctions regimes because of the commercial interests of European companies in Russia. Brexit will threaten the consensus on sanctions within the EU and may have wider implications for transatlantic cooperation on economic sanctions in general.

The private sector usually bears the brunt of implementing economic sanctions. Thus, companies value stability in international and national regulatory regimes. Vastly divergent sanctions regimes are not desirable, nor implementable for many companies operating on a global scale. If the UK, or the EU, diverge on sanctions policies post-Brexit, it would create more uncertainty for businesses, and increase compliance costs and risk exposure.

In a recent statement on sanctions after Brexit, Downing Street affirmed that it “continues to see a strong mutual interest in cooperation and collaboration with European partners.” Brexit will provide the UK with greater flexibility in its implementation of economic sanctions, but it should take into account the three C’s: cooperation, coordination, and consistency. Close cooperation between the UK, United States, and EU on economic sanctions is essential as it lays the groundwork for coordination and consistency. Multilateral coordination is also vital to ensure the efficacy and alignment of economic sanctions. Finally, consistency is imperative to the business community to ensure compliance costs and disruption are kept to a minimum. The UK, post-Brexit, must adhere to these guiding principles to ensure economic sanctions remain an effective tool in the foreign policy arsenal.