With the strengthening of the US dollar in the wake of continued interest rate increases by the US Federal Reserve and brewing pressures in a number of emerging market (EM), portfolio flows into EM countries slowed from $13.7 billion in July to just $2.2 billion in August. Companies and banks in both Argentina and Turkey borrowed heavily in dollar denominated debt while interest rates were low and are now faced with mounting debt burdens, which, if not backed by sufficient reserves puts them at risk for default if investors lose confidence. The Turkish lira has fallen over 40 percent in 2018. Its sharp decline in August raised concern of contagion to other markets, as the Indonesian rupiah, the South African rand, and the Indian rupee have also come under pressure. This edition of the Econographic compares situation in Turkey with the Asian financial crisis in 1997, analyzes root causes of the current pressures in Turkey, and assesses the broader implications for EM economies.

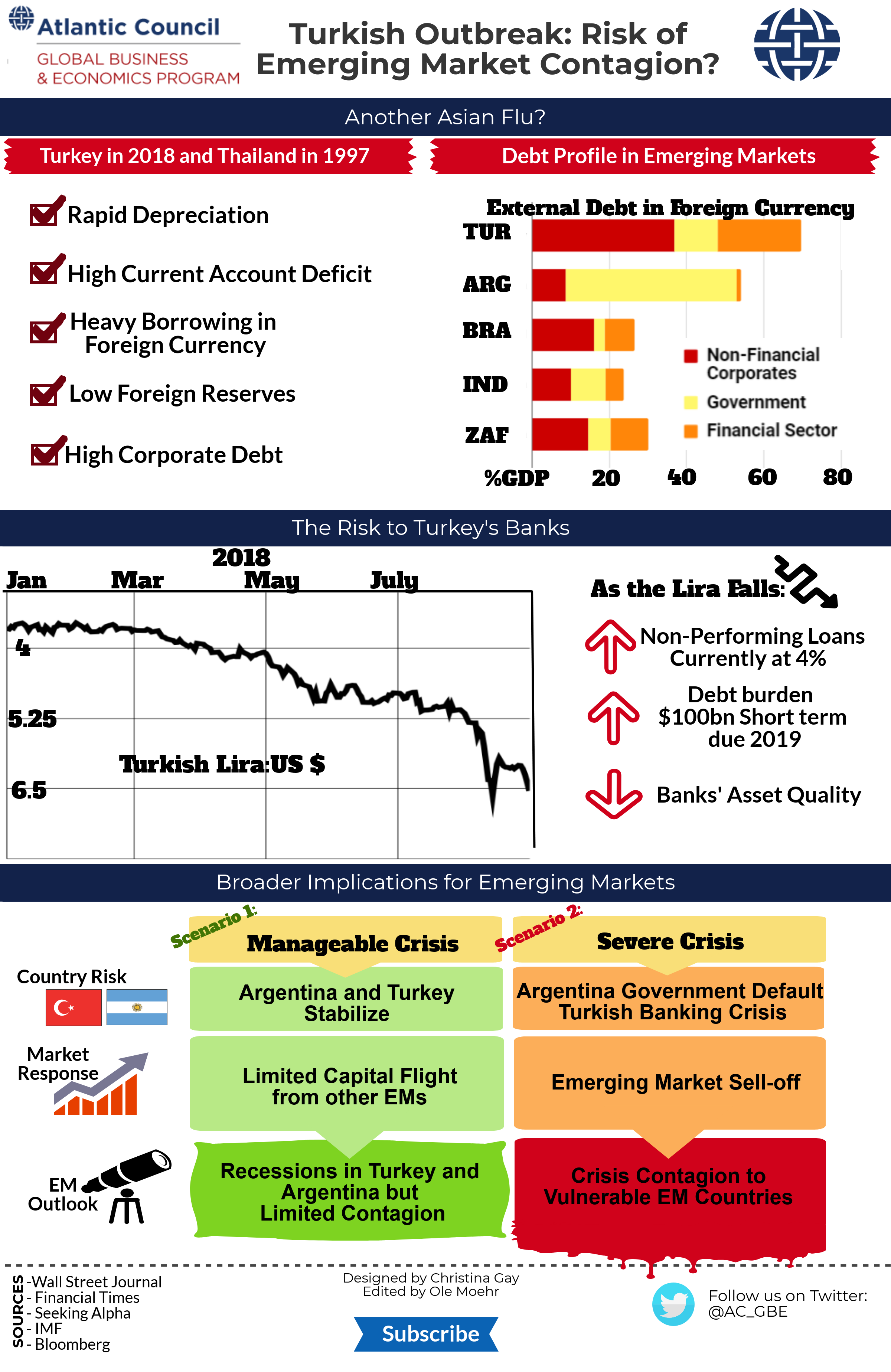

During the Asian financial crisis in 1997, rapid devaluation and high external debt led Thailand close to default when investors lost confidence, panicked, and pulled out from Asian EMs, causing a domino crisis in Indonesia, Malaysia, the Philippines, and South Korea. Both Thailand and Turkey experienced previous years of growth over six percentand heavy speculation in the real estate market. Turkey’s crisis now is largely a consequence of its corporate sector’s dependence on heavy borrowing financed by short-term foreign capital inflows rather than more reliable foreign direct investment, which makes up less than a quarter of external liabilities. Learning lessons from the 1997 crisis, emerging markets countries have since built up foreign currency reserves and reduced their foreign debt burden to insulate themselves from future shocks.

While there is growing market concern over Turkey’s loosened fiscal stance and its nonfinancial corporate debt burden, Turkish banks pose the greatest risk. Turkey’s banks domestic foreign currency deposits stand at $180bn, but foreign currency liabilities top $300 billion. Additionally,$100 billion worth of short term debt is due by the end of 2019 that either needs to be refinanced or rolled over. 70 percent of Turkish debt is denominated in US dollars or euros, compared to the EM average of 35 percent. In 2018, the currency has fallen to 6.6 lira to the dollar. Further depreciations of the lira reduce Turkish bank’s ability to accommodate non-performing loan (NPL) ratios of over five percent, and NPL ratios are already at four percent. At close to six percent, Turkey has one of the largest current account deficits relative to its EM peers. A driving factor is its heavy reliance on imported energy, accounting for 60 percent of its current account deficit.

The Federal Reserve has been steadily raising interest rates, with four additional rate hikes scheduled by the end of 2019. Recent tariffs imposed by the US administration have contributed to market uncertainty and loss of investor confidence. Federal rate increases put pressure on EM market currencies and make paying back dollar denominated debt more expensive. Unlike Turkey, where pressures stem from its debt burden in the financial sector, Argentina is facing affordability challenges for its sovereign debt; almost 80 percent of its total sovereign debt is dollar denominated. Turkey’s central bank initially imposed limited restrictions on interbank lending to avoid a rate hike and large-scale austerity measures. However, on September 12th, Turkey’s central bank raised its benchmark rate of interest to 24% from 17.75% in an effort to calm markets and investor uncertainty. Argentina‘s government signed onto a $50 billion IMF bailout in June, and is implementing largely orthodox economic policies. The Argentine central bank raised interest rates to 60 percent to curb mounting inflation and President Macri rolled out a new austerity program including export tariffs, raising taxes, and cutting its ministries by more than half.

The sheer size of Turkey and Argentina’s debt burdens make them stand out among their EM peers. Without further significant depreciation of the lira and peso, we expect the crisis to cause limited contagion to other emerging markets. However, our baseline scenario is that both Turkey and Argentina will experience a recession. Failure to stabilize the currency in either country could trigger defaults and incite investor panic. A crisis of confidence could lead to large scale sell-off across EM, if market actors stop differentiating between risks and starts pricing assets away from their fundamentals.