Since its birth in 2008, cryptocurrency has grown in popularity and become an important part of the global financial system. Cryptocurrencies may significantly alter financial structures as they exist today and transform the next generation of money and payments. However, these changes come with significant concerns around cryptocurrencies for their potential negative impacts on markets, investors, users, and the environment. Governments around the world are looking to create regulations to prevent these harms while encouraging the innovative capabilities of cryptocurrencies.

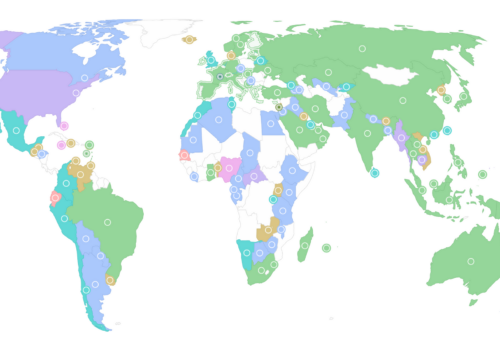

We look at 75 countries—including G20 member states, plus countries with the highest rates of cryptocurrency adoption. This new research categorizes and explains how the world’s largest economies and those with high rates of cryptocurrency activity are regulating cryptocurrencies within their jurisdictions.

75 countries

We analyze how 75 countries have regulated crypto-assets in their jurisdictions. For each country, the regulated actors can be cryptocurrency issuers, exchanges, traditional financial institutions, service providers, or miners.

Legal status

Each country is assigned one of the following regulatory statuses: legal (where all activities are permitted), partial ban (where one or more activity is not permitted), and general ban (where all activity is limited).

Regulatory categories

Countries regulate actors in the crypto sector using tax policy, requirements to combat money laundering and terrorist financing, consumer protection rules, and licensing and disclosure obligations. The map below considers these four categories of regulation.

Click on a country to see status and “see more” to view further details.

Last updated: July 2025

Key findings

Among the 75 countries we studied, cryptocurrency is legal in 45, partially banned in 20, and generally banned in 10. In twelve G20 countries, representing over 57% of the world’s GDP, cryptocurrencies are fully legal. Regulation is under consideration in all G20 countries.

Cryptocurrency adoption rates are weakly correlated with regulatory restrictiveness. Even for countries with partial or general bans in place, adoption rates remain high, suggesting that bans are generally ineffective.

The US is the only advanced economy to consistently rank among the top ten in crypto-asset adoption. The Trump administration’s focus on financial technology innovation and new regulatory clarity, is likely to increase crypto volumes and influence regulatory frameworks abroad.

US stablecoin legislation is imminent. In 2024, 80% of dollar-backed stablecoins flows were outside the US. In response, some emerging markets, including Hong Kong and Brazil, begun developing their own stablecoin regulations.

Both emerging-market and advanced economies still lag on comprehensive regulation and oversight. Only 28 of the 75 countries studied have regulations for taxation, AML/CFT, consumer protection, and licensing. Six of the emerging markets studied have all the above regulations.

Over 90 percent of the countries analyzed have active central bank digital currency (CBDC) projects, indicating that countries adapt and update cryptocurrency regulations simultaneously as they explore CBDCs.

Spotlight on stablecoin regulation

Many jurisdictions in the world are in the process of rolling out regulations for stablecoins, which are fiat-backed tokens. 99% of all stablecoins are pegged to the dollar. Click below to compare where the United States stands in comparison to the UK, EU and Japan, the latter two of which have already begun regulating stablecoins.

Click on each country’s card to view more details.

The role of global governance institutions

Standard setting bodies play an important role in creating governance and industry standards in addition to promoting global cooperation on crypto-asset regulation.

Hover on a card to view more details.

Acknowledgements

Research team: Ananya Kumar, Alisha Chhangani, Leila Hamilton, and Israel Rosales

Development team: Frank Ngoga and Christophe de Jonge

Cryptocurrency adoption rates are from Chainalysis’ “Geography of Cryptocurrency 2024” report.

Related content

Stay connected

Sign up to receive emails on new research & reports, program highlights, and events.