In March, the UK, Germany, Italy, and France decided to join the China-led Asian Infrastructure Investment Bank (AIIB), shocking the Obama administration.

But the creation of an AIIB-style institution could have been foreseen in 2010, when the International Monetary Fund’s Board of Governors agreed on a set of substantial reforms to the IMF’s quotas and governance structure. These reforms would have changed the structure of the Fund to better mirror today’s global economic environment, but the changes could not be implemented without the approval of the US Congress. Four and a half years later, Congress has thus far failed to bring the reforms up for a vote. Does the development of the AIIB increase pressure on Congress to sign the IMF’s reform proposal?

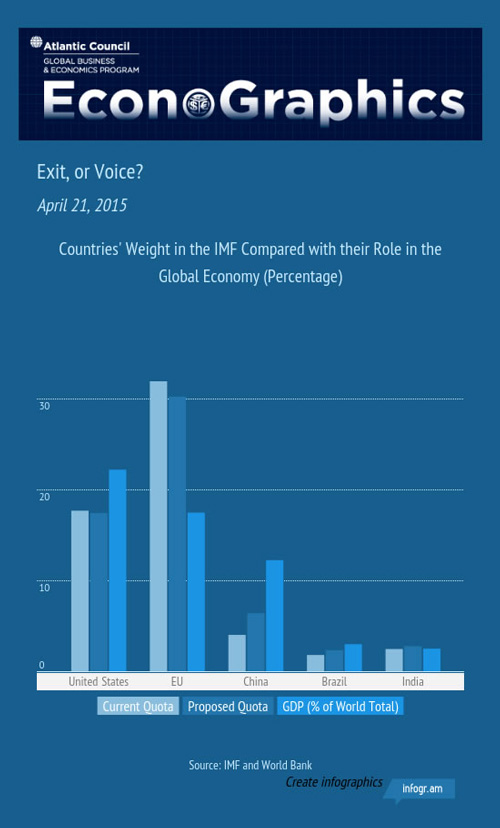

While speaking at the Atlantic Council on April 9, IMF Managing Director Christine Lagarde emphasized the importance of implementing the proposed reforms. In addition to doubling the Fund’s quotas to approximately $655 billion, the reforms would change the distribution of quotas among countries. Emerging market and developing countries would receive a higher share of quotas to reflect the increased importance of these economies. Consequently, China would become the third largest shareholder of the IMF.

The Chinese Vice Finance Minister, Zhu Guangyao, noted in a speech at the Atlantic Council on April 17 that the AIIB will seek a collaborative relationship with the established Bretton Woods institutions and focus mainly on Asian infrastructure investment. The Minister also echoed Ms. Lagarde’s remarks when calling on Congress to ratify the reform of the IMF.

Source: IMF and World Bank