While President Trump is pursuing a protectionist trade agenda – halting negotiations for the Transatlantic Trade and Investment Partnership (TTIP), pulling out of the Trans-Pacific Partnership (TPP), and threatening trade wars against adversaries and allies – Japanese Prime Minister Shinzo Abe has been doing just the opposite. As part of Abenomics’ third arrow, the Prime Minister is forging global partnerships between Japan and other leading economies to foster economic growth. Case in point, the Japan-EU Economic Partnership Agreement (JEEPA) signed on July 17, 2018. This edition of the EconoGraphic will review this ambitious bilateral free trade agreement, assess its impact on the US economy, and explore the consequences of the United States’ retreat from its role as the global leader for free trade.

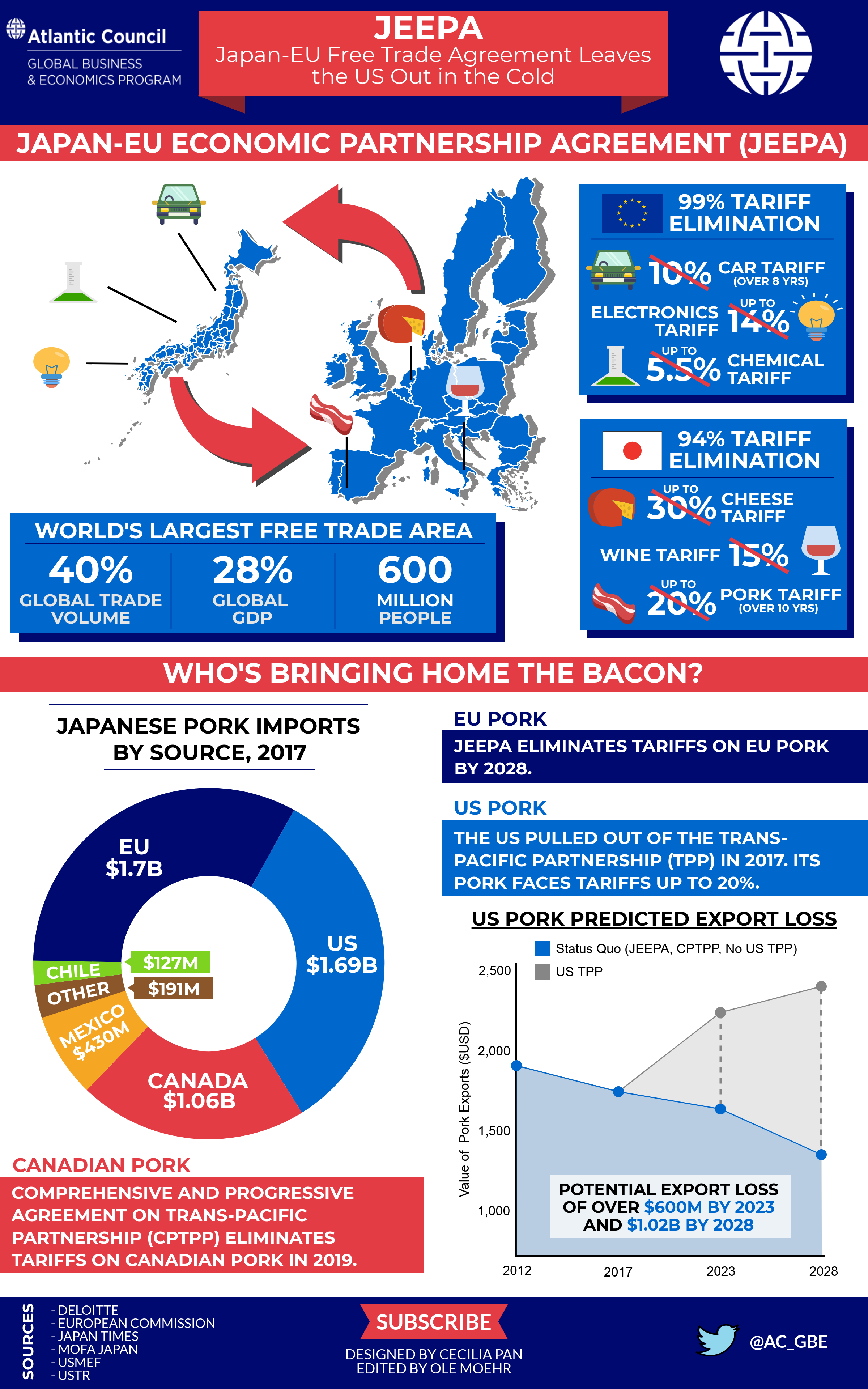

Nearly five years in the making, JEEPA will enter into effect in March 2019. The agreement will create the world’s largest free trade area spanning 28 percent of global GDP, 40 percent of global trade volume, and 600 million people. The EU will eliminate 99 percent of its tariffs on Japanese products, including those of up to 14 percent on electronic appliances, up to 5.5 percent on chemicals, and 10 percent on cars. While some duties will be axed immediately, those concerning sensitive markets, such as cars, will be reduced over time. In response, Japan will eliminate 94 percent of its tariffs, the lower rate of elimination results from the country’s historical protection of its small and scattered agriculture industry. Nevertheless, Japan will remove its tariffs of up to 30 percent on cheese, 15 percent on wine, and up to 20 percent on pork, phased out over ten years. By 2028, the EU can expect increased exports to Japan of up to $115 billion, and Japan to the EU of up to $98 billion.

The elimination of the pork tariff provides the most substantial value for EU exporters. Japan consumes more pork than any other meat; and in 2017, the EU sold pork products worth $1.7 billion to Japan, claiming a 33 percent market share. As the tariffs on pork products are eliminated, EU pork will become more attractive to Japanese consumers. This will hurt US pork producers, who sold 60 percent of their exports valued at $1.69 billion to Japan last year. The US producers’ market share has been declining from 44 percent in 2012 to 33 percent in 2017. While American farmers continue to benefit from a comparative advantage over the EU in producing fresh pork, which requires a short delivery time, they face another challenge from Canada, the third largest supplier of pork imports to Japan. Canada claimed a 21 percent market share at $1.06 billion in 2017 and in March 2018, signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), meaning its pork will no longer face tariffs after March 2019. Conversely, the US, which withdrew from the Trans-Pacific Partnership (TPP) in 2017, will continue to face pork tariffs of up to 20 percent. The US Meat Export Federation (USMEF) estimates that this could result in US pork export losses of up to $600 million by 2023 and $1.02 billion by 2028, relative to the US signing TPP and reaping the benefits of tariff-free trade like the EU and Canada

As the US retreats from its position as the champion for rules-based trade and free markets, other countries continue along the long-term global trend towards more and more rule-based trade. Free trade agreements like JEEPA offer their participants enormous economic benefits by increasing and easing integration. The Trump administration’s protectionist strategy of putting “America first” is threatening to leave America behind.