Will Trump’s tariffs survive US courts?

GET UP TO SPEED

It depends on your definition of “emergency.” Donald Trump, in his self-declared “liberation day” on April 2, didn’t just impose tariffs on virtually the entire world. He did it by using a novel legal theory and expanding the use of decades-old legislation called the International Emergency Economic Powers Act (IEEPA) in a way no US president had done before. Now, with those tariffs on pause but set to come into effect in early July, a federal court ruled Wednesday that Trump’s use of that law was unconstitutional. Is this the end of the trade wars? Not at all, according to our experts. Below, they issue their verdict on what trade tools Trump could turn to next and what these developments mean for every country in the thick of negotiations with the administration.

TODAY’S EXPERT REACTION BROUGHT TO YOU BY

- Josh Lipsky (@joshualipsky): Chair of international economics and senior director at the Atlantic Council’s GeoEconomics Center, and former adviser to the International Monetary Fund

- Barbara C. Matthews: Nonresident senior fellow at the GeoEconomics Center and former US Treasury attaché to the European Union

Case law

- The administration will appeal the ruling, and Josh expects an appeals court to issue a stay, meaning the tariffs would return. But this case is almost certainly headed to the US Supreme Court in the coming months.

- Josh calls the decision “a setback for the administration,” which asked for this court to take the case. The unanimous ruling included judges appointed by Trump and former US President Ronald Reagan.

- But Barbara notes that the ruling “is limited in scope and provides many mechanisms” for the Trump administration to “accomplish the same goals.” Specifically, “the court’s rationale supporting White House tariff tools as remedies for balance-of-payments issues potentially renders the April 2 tariffs on relatively firm ground compared with the January 2025 fentanyl tariffs against Mexico, China, and Canada.” That’s because Trump justified the April 2 reciprocal tariffs as rectifying US trade deficits with all countries participating in the global trading system.

- The court was more definitive, Barbara tells us, about the fentanyl tariffs, ruling that both the declared emergency and Trump’s remedy were overly broad. The appeal process will need to address “whether (or not) Congress may delegate its tariff authority, whether Congress limited the scope of national emergency determinations by the White House when it enacted IEEPA,” and “whether tariffs imposed to address a national emergency must be narrowly tailored in relation to the nature of the emergency, the time horizon for the tariffs, or both.”

Sign up to receive rapid insight in your inbox from Atlantic Council experts on global events as they unfold.

Backup plans

- While appeals play out, the administration will have several tools at its disposal to continue its current tariff policy. First, Wednesday’s decision agrees with a 1975 court ruling that Congress may provide the executive branch with “limited authority” to impose tariffs. The ruling then asserts that the authorities granted to the White House under IEEPA are more narrow than those under its predecessor statute, the Trading with the Enemy Act. The decision then “provided a blueprint for how the Trump administration can continue using tariffs to address both geoeconomic imbalances and a wide range of national emergencies with greater precision,” says Barbara.

- While it appeals Wednesday’s ruling, the White House could narrow the scope, timing, or legal foundation for the fentanyl tariffs and the reciprocal tariffs under IEEPA, Barbara says. Such a move would require the administration to admit at least tacitly that the executive branch’s emergency and tariff authorities can be limited by judicial decision. Josh adds that the administration could follow the court’s decision and rely on sections 122 and 338 of the Trade Act, involving balance of payments, to support the April 2 reciprocal tariffs.

- While the ruling was a surprise, Josh notes that a not fully appreciated move in April, in which the administration shifted semiconductors and consumer electronics tariffs to section 232 of the Trade Expansion Act, was a signal that the administration wanted stronger legal footing for some of its toughest levies on China. “In hindsight, that move was more of a tactical retreat. Because that process is well under way, it gives [the administration] a powerful new tariff that could come over the summer.”

- Barbara agrees, noting that Trump has already used “traditional” methods of section 232 and section 301 for other tariffs unaffected by the ruling, such as those on automobiles. Such moves, however, would extend the timeline for trade negotiations and potentially intensify policy volatility until late this year or early 2026.

Trade war and trade peace

- This news comes as countries are racing to strike deals with the administration ahead of a July deadline for the return of the reciprocal tariffs. Josh expects that “other countries will now try to slow-walk their negotiations,” resulting in fewer deals ahead of that July deadline and an August deadline to conclude tariff negotiations with China.

- This decision also impacts congressional budget negotiations ahead of an August deadline to raise the debt ceiling. A Republican budget bill garnered enough votes to pass the House thanks in part to optimistic projections for tariff revenue, Josh points out, which is now in jeopardy. As negotiations turn to the Senate, “keep an eye on the bond market, which already has not reacted well to the bill’s deficit impact,” he adds.

- Barbara notes that Congress could choose to use this budget bill to ratify the fentanyl and April 2 tariffs, which could satisfy aspects of the trade court’s ruling, but “any such legislation likely also would face legal challenge.”

- “All of this adds up to more uncertainty—not less,” Josh adds. “Businesses will be unable to make any long-term investment decisions, and the idea that tariffs are going only lower from here may be a miscalculation. Markets seem jubilant that the president may not have as much tariff authority as he thought, but the hangover is coming soon. Trump has many trade tools still at his disposal, and he will not want his core international economic agenda overturned by three judges from a lower court.”

Further reading

Fri, May 16, 2025

The next 120 days of predictably volatile trade policy

Econographics By Barbara C. Matthews

The understandable relief associated with de-escalating the tariff war will soon fade as we enter a long, uncertain summer of tariff pauses and major negotiations. Take a look at some convenings that might be important.

Thu, Apr 10, 2025

China is ready to ‘eat bitterness’ in the trade war. What about the US?

New Atlanticist By Dexter Tiff Roberts

As the US imposes a 145 percent tariff on Chinese imports, officials in Beijing are turning to a belief that Chinese people will endure hardships in service of a national goal.

Fri, Apr 11, 2025

Want to understand the US-China trade war? Start with soybeans and batteries.

New Atlanticist By

As Washington and Beijing hit each other with new tariffs, two goods—soybeans and lithium-ion storage batteries—offer a window into the larger trade war.

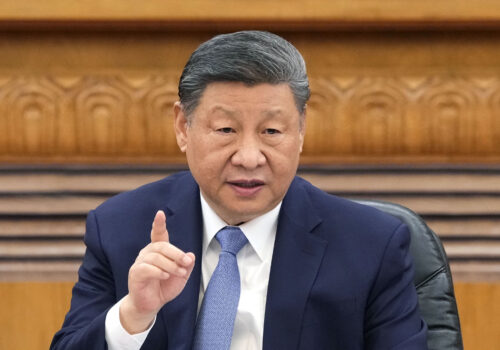

Image: US President Donald Trump before signing an executive order implementing new reciprocal tariffs against US trading partners in the Rose Garden of the White House in Washington, DC, USA, 02 April 2025. Trump has branded the day ëLiberation Dayí, though most economists expect US consumers to foot the costs. REUTERS