Beijing extends and pretends to deal with its mountain of local government debt

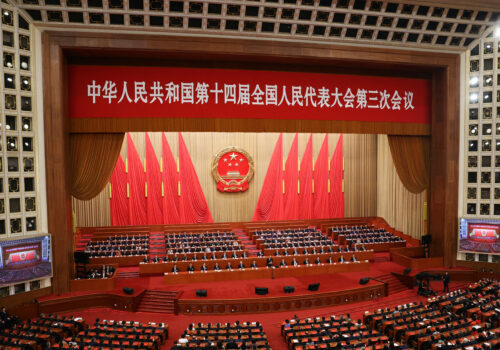

As the pooh-bahs of the Chinese Communist Party gathered recently to extol their vision for urban modernization, China’s paramount leader Xi Jinping offered an assessment of recent developments that appeared slightly at odds with the upbeat tone of the proceedings. The president said that “(I)n the past, GDP was used to judge heroes,” but “One beautiful thing covered a hundred ugly things. Nowadays, in many matters, one ugliness covers a hundred beautiful things.”

Yet as China’s cities, counties, and provinces confront slower economic growth and fiscal belt-tightening, the leadership didn’t mention the “one ugliness” that is weighing on local governments—trillions of dollars of debt. That is because the Chinese government already has declared victory over local government debt and seems to be moving on. A three-year debt restructuring initiative launched last November refinances ten trillion yuan ($1.39 trillion) of “hidden debt,” or bonds issued by investment companies known as local government financing vehicles (LGFVs). But LGFV bonds are only one part of a much larger problem. Local governments throughout China are also on the hook for trillions of dollars of bank loans, unpaid bills, and other obligations that remain unaddressed.

Beijing’s restructuring program is a maneuver that bankers and regulators commonly label “extend and pretend.” The central government has chosen to put off its day of reckoning when it will have to assume the burden of local government debt, instead choosing to whistle past the graveyard. But that strategy could have serious implications for the Chinese economy. Resources at the local level are drying up even as grassroots officials are still expected to service their debts. Despite lower interest rates, there is less money to build infrastructure, provide social services, and invest in industries that create jobs. Not to mention making good on payrolls and accounts receivable. With China already facing a lingering real estate collapse, weak consumption, industrial overcapacity, and falling prices, the continuing debt crisis could produce hollowed-out financial sectors in many parts of the country.

The International Monetary Fund (IMF) pointed to another danger in a recent report assessing the health of China’s financial system. The report warned that the fifty-eight trillion yuan of LGFV debt on the books represented “a serious risk to financial stability.” The report estimated that “support needed to retire debt-servicing capacity where debt is perpetually rolled over (but not reduced) could require debt relief.” The IMF report focused on LGFV debt and did not include debt taken on directly by local governments.

Beijing was having none of the IMF recommendations. A statement from China’s executive director to the IMF, which was included in the report, insisted that the issue of hidden local government debt had been “properly resolved” by the 2024 restructuring. The statement also held that the implementation of “a strict accountability mechanism to prevent local governments from raising new hidden debt” meant that the IMF’s “relevant policy recommendations have already been implemented.”

The Chinese response did offer up a forty-four trillion yuan estimate of overall LGFV debt—three times the figure provided at the time of last year’s restructuring announcement, suggesting that the restructuring will need to be revisited in the future. But Beijing’s representative blithely explained that the Fund had double counted debts by relying on faulty numbers from a Chinese data company—Wind Information Co. (Most foreign analysts, it should be noted, have been barred by Beijing from accessing Wind’s statistics since May 2023.) For the Chinese government to disagree on such an important number in an IMF report that officials had cooperated for months to prepare suggests a late-stage political decision to fudge the numbers. The action is part and parcel of Beijing’s recent efforts to obscure inconvenient economic facts. For example, as youth unemployment soared in 2023, the government recalibrated its data set to reduce the jobless number.

Unsurprisingly, the government’s debt-restructuring numbers have been greeted with skepticism in other circles. The credit-rating agency Fitch Ratings estimated in April that the restructured LGFV debt was only 25 percent of the “hidden” portion of the debt load. Meanwhile, David Daokui Li, a leading Chinese economist, said in February that there were ten trillion yuan in payments “arrears” to contractors and civil servants at the end of 2024.

The size of the debt is only part of the problem. Most LGFVs were originally set up over the past decade to help local governments to take on debt, using land controlled by local authorities as collateral, and revenue from land sales to help service the bonds and loans But that source of revenue dried up with the collapse of China’s real estate bubble in 2021. In May, nationwide revenue from land sales, include tax receipts, fell to its lowest level since 2015, exacerbating the squeeze on financing.

However, the debt-restructuring program also mandated that thousands of LGFVs be turned into commercial entities that will now have to stand on their own two feet. While some of them already function as businesses, the end of the era of runaway real estate development also means the end of the road for many LGFVs. They will transition into unsustainable “zombie companies” that will continue to rely on new borrowing or government subsidies to service their debts.

In a May report entitled “China’s LGFVs in transition: cutting debt may prove easier than making money,” S&P Global estimated that “former LGFVs” would have to increase their pre-tax earnings by some 40 percent a year over three years. Doing so will just enable them to reduce their debt leverage to the level of China’s existing state-owned enterprises—themselves hardly paragons of commercial success. While acknowledging that the government’s debt restructuring initiative has “substantially alleviated the immediate liquidity pressure” on many LGFVs, the report said, “that’s just one side of the equation.” By 2027, S&P said, when the restructuring is scheduled to conclude, LGFVs will no longer “benefit from expectations of implicit (government) repayment guarantees.” They will remain mired in a cycle of increasing indebtedness.

Beijing has been loath to take the debts off the books of local governments because of its own spending priorities and out of concern that such central government largesse will only encourage local authorities and investors to engage in risky behavior. But moral hazard works both ways: the central government’s conflicting demands on local governments over the years already opened the floodgates to unwise lending and investment under the assumption that such ventures would be backed by government guarantees. Witness the flood of investment that provinces and cities have undertaken in such cutting-edge industries as semiconductors, electric vehicles and wind power. For every commercial success, there is also an ocean of red ink that has added to the bad debts.

Solutions to debt crises without cost do not exist. But half measures only add to the final cost of resolution. So far, Beijing has chosen to pursue half measures—or perhaps it’s better to say quarter measures—and the costs continue to mount. The result of such delaying tactics will only be greater problems down the road for an economy that, for all its strengths, can ill afford the real-world impact of procrastination.

Jeremy Mark is a nonresident senior fellow with the Atlantic Council’s GeoEconomics Center. He previously worked for the International Monetary Fund and the Asian Wall Street Journal.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Wed, Jan 10, 2024

China’s local government debts are coming due

Econographics By Jeremy Mark

China's economic slowdown brings local government debts into sharp focus, threatening infrastructure and social services.

Thu, Jan 16, 2025

China’s economic performance: New numbers, same overstatement

Econographics By

Is China's economic slowdown more severe than reflected in official data? Here's a cheat sheet for looking at actual economic performance in 2024 and 2025.

Fri, Mar 14, 2025

Five takeaways from Beijing’s largest annual political meetings

New Atlanticist By Melanie Hart

Chinese leaders signaled that they will stick to their state-managed economic approach and view Washington as their greatest external threat.