How can the United States maximize its international competitiveness in the development of artificial intelligence (AI)? To begin with, it can take additional steps to strengthen domestic chip fabrication capacity and friend-shore supply chains. Washington could also tighten export controls on some semiconductors and other technologies. But imposing new tariffs on essential dual-use, militarily relevant AI components from friendly partners risks having the opposite effect.

The Trump administration has launched an investigation under Section 232 of the Trade Expansion Act into the impact of semiconductor imports on national security, a step toward imposing tariffs. But if it moves ahead with tariffs on all semiconductor imports, the United States would raise hardware costs for US AI firms, punish important partners such as Mexico and Taiwan, and lower prices for Chinese competitors. Tariffs targeted at China have their uses in the US-China tech competition, but they shouldn’t be applied haphazardly to US allies and partners.

Semiconductors and dual-use imports

Today, the United States and like-minded allies and partners are competing with China in AI, or what AI entrepreneur Dario Amodei and former US Deputy National Security Advisor Matt Pottinger have described as possibly “the most powerful and strategic technology in history.” AI-related imports enable US AI companies to access cost-effective inputs and continue to outpace Chinese competitors. Since AI is an emergent technology with such large potential utility and consequences, it would be a mistake to allow China to define the rules of engagement.

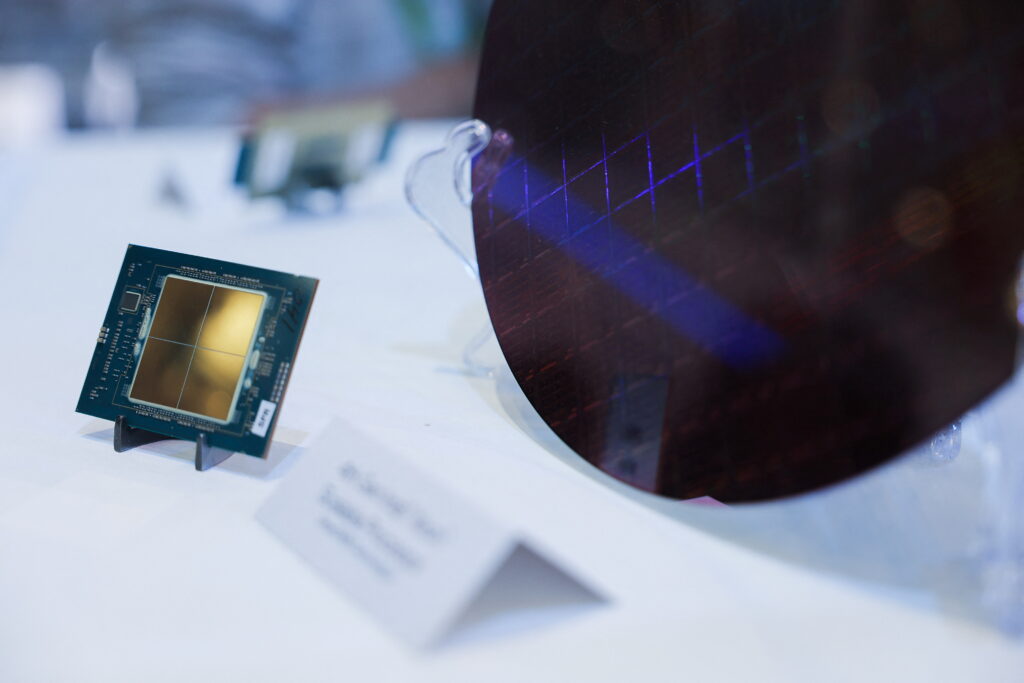

Components are a key cost driver for training AI models. Key AI-related component imports include processing units, such as graphics processing units (GPUs) and central processing units (CPUs), and printed circuit assemblies (PCAs), all of which could be targeted by Section 232 tariffs. GPUS are one of the most popular computing technologies to run AI models due to their ability to train massive models and speed up inference at scale; they’re also used on board autonomous vehicles. Similarly, PCAs are critical because they house and interconnect critical components like GPUs, CPUs, memory, and networking chips inside servers and data center infrastructure. AI is a critical source of demand, although chips and printed circuits are also used by a variety of non-AI applications, including cars, computers, washing machines, routers, etc. Imports of processing units and PCAs have surged in recent months due to both AI-driven demand and companies seeking to get out ahead of tariffs.

PCA unit imports have more than quintupled since 2021, with no productivity changes to explain the jump—pointing to greater hardware needs. Consequently, if PCA prices rise due to tariffs, the US AI buildout could slow.

Two economies are prominent partners of dual-use technology, with both military and civilian applications, for the US AI sector. The first, Taiwan, not only ships leading-edge GPUs to the United States, but the Taiwan Semiconductor Manufacturing Company has committed to investing a cumulative $165 billion in the US tech sector. The second, Mexico, is the largest single aggregate supplier to the United States of GPUs and CPUs, as well as PCAs, by value. Tariffs on semiconductor inputs would punish US partners while limiting the access of US firms to the global market.

Indeed, hardware is a significant cost driver for US AI. Researchers for Epoch AI and Stanford University have found that AI accelerator chips and other server component costs comprise about half of all costs for training and experiments of machine language models. Moreover, building AI models is highly capital intensive: hyperscalers committed $200 billion in twelve-month trailing capital expenditures in 2024; Morgan Stanley projects hyperscaler capital expenditures could reach as high as $300 billion in 2025. Significantly, since hardware acquisition costs are “one to two orders of magnitude higher than amortized costs,” higher prices via tariffs could deter new AI entrants, slow adoption, and stymie dynamism.

Unintended tariff consequences on the Chinese tech sector

While heavy tariffs would harm the US tech sector, they are unlikely to impede China in the AI race. In fact, tariffs could indirectly encourage tech transfer to China by pushing other countries, especially in Southeast Asia, to work more closely with Beijing. In mid-April, after US President Donald Trump’s announcement of global “reciprocal” tariffs and the subsequent ninety-day pause, Chinese President Xi Jinping visited Vietnam, Malaysia, and Cambodia, saying he would “safeguard the multilateral trading system.” China left these meetings with several memorandums of understanding on investment and trade, including a call to increase AI cooperation with Malaysia.

The mention of AI cooperation was striking and potentially significant. Export controls of US-designed semiconductors to China have been leaky: There is some evidence of GPU transshipment to China through Southeast Asia, notably Malaysia. The Wall Street Journal also reports that Chinese engineers are using Malaysian data centers to train AI models. Meanwhile, the export of GPUs and other computer hardware containing semiconductors from Taiwan to Malaysia reached $307 million in April (more than half the value of the same exports for all of 2024). Remarkably, Taiwan’s GPU and CPU exports to countries in the Association of Southeast Asian Nations (ASEAN) hit a record high in April—surpassing exports to the United States by value for the first time on record.

The increase in Taiwan’s semiconductor exports to ASEAN does not, by itself, demonstrate transshipment to China: Malaysia is becoming an increasingly popular spot for international data centers because of the country’s cheap real estate and its proximity to Singapore. It’s possible that the GPUs and CPUs were consumed in the domestic market. Still, it’s worth noting that recent data center entrants in Malaysia include Chinese firms. If US tariffs make countries like Malaysia more willing to work with China, that could increase the risk of US export controls being violated.

If not tariffs, then what?

Given that non-China tariffs appear likely to harm the US tech sector and could strengthen Chinese tech firms via technology leakage, US policymakers should consider alternative tools.

The United States has been able to slow the Chinese tech sector by imposing a series of bipartisan export controls that limit Beijing’s access to high-end semiconductors. Last month, the Bureau of Industry and Security rescinded the AI Diffusion Rule, which strengthened chip-related exports. Some criticize the framework for casting too wide of a net, while others hold that export controls are a crucial economic statecraft tool for protecting US national security interests and preventing technological acquisition by strategic rivals.

Export controls are vital and necessary, but they are not a silver bullet. To outcompete China, the United States must strengthen its own capabilities, including by incentivizing manufacturing and know-how in semiconductors and other strategic technologies. This is precisely the rationale for the bipartisan CHIPS and Science Act, which was signed into law in August 2022. Tariffs alone do not provide enough support to incentivize foreign investment and domestic capacity in chip technologies. While Congress and the White House should make adjustments to the CHIPS and Science Act where appropriate, the program’s overall aims should be maintained.

No one should be unclear on the stakes, amid the global race toward artificial general intelligence (AGI)—or artificial intelligence equal to or exceeding human capabilities. Whether the race is a sprint, a marathon, or something else entirely, the technology’s productivity gains will likely prove sizable. AGI also holds obvious potential risks, but it is in the United States’ best interest to be at the forefront of setting standards and developing the regulatory environment. Accordingly, it is important for the United States to maximize its chances of obtaining this technology and integrating it before China does by securing vital, high-end semiconductors ahead of its rival.

Joseph Webster is a senior fellow at the Atlantic Council’s Global Energy Center and the Indo-Pacific Security Initiative. He also edits the independent China-Russia Report.

Jessie Yin is an assistant director at the Atlantic Council’s GeoEconomics Center. This article reflects their own personal opinions.

Further reading

Fri, Jun 6, 2025

Even as courts step in, Trump still has plenty of tariff options. US trading partners should intensify negotiations.

New Atlanticist By

Section 301 may entail more work for the White House, but it could provide a relatively straightforward pathway to broad-based tariffs.

Tue, Apr 1, 2025

DeepSeek shows the US and EU the costs of failing to govern AI

GeoTech Cues By

The West must urgently consider what DeepSeek’s R1 model means for the future of democracy in the AI era.

Tue, Feb 18, 2025

What’s missing from the AI debate? Patience.

New Atlanticist By Trey Herr

The AI sector is evolving quickly, fueled by a self-reinforcing cycle of investment, commentary, and ambition. In this race for compute, patience is important to sorting out sustainable innovation from speculative excess.

Image: A GPU and wafer on display at Computex in Taipei, Taiwan June 5, 2024. REUTERS/Ann Wang.