On a scale of zero to ten: “twelve.” That’s how US President Donald Trump rated his meeting with Chinese President Xi Jinping at an air base in Busan, South Korea, on Thursday. The two leaders agreed to pull back some trade measures and work together on other pressing issues. After the meeting, Trump said that he agreed to cut tariffs on Chinese imports to the United States, while China agreed to increase purchases of US soybeans. Other issues discussed include trade measures on rare earths and computer chips, as well as US concerns over ownership of the social media platform TikTok. To see if a more positive US-China relationship has indeed gotten off the ground at Gimhae air base, or if we should expect turbulence ahead, Atlantic Council experts are lined up on the runway below with their insights.

Click to jump to an expert analysis:

Josh Lipsky: A trade truce, if they can keep it

Matthew Kroenig: This relationship will get worse before it gets better

Melanie Hart: Beijing is wielding the power of the calendar to its advantage

Jeremy Mark: China has the advantage as talks continue—and the US risks losing the leverage it has

Tressa Guenov: The US needs to up its game to counter Chinese espionage

Markus Garlauskas: With “Taiwan is Taiwan,” Trump dispels fears he will fold to Xi on Taiwan

Reed Blakemore: The G7 must be ready for China to try this export control tactic again

Kit Conklin: A floor for the US–China trade relationship—for now

Joseph Webster: Promises of an Alaska-to-China energy acceleration may be overblown

Dexter Tiff Roberts: Even the biggest victories from the meeting could prove hollow

A trade truce, if they can keep it

The long-awaited meeting between Trump and Xi delivered real results—and a lot of stepping back from ledges both sides created over the past year. China walks away with approximately the same tariff rate as most of its Asian neighbors, a welcome victory that will ensure its exports continue to provide ballast to a struggling domestic economy. The United States gets soybean purchases, which will alleviate some of the pressure the administration had been feeling from farmers—as a bipartisan vote against tariffs in the Senate showed this week. Key questions surround China’s one-year pause on rare earth export controls, including whether US allies will get the same exemption. Europe will be trying to negotiate a similar arrangement this week, but without the tariff leverage Trump has wielded effectively.

Meanwhile, it appears at least at this point there is no loosening of US export controls on high-end chips, something that was rumored throughout the day yesterday and created fears in Washington (as well as London, Tokyo, and Brussels) that China would be able to supercharge its artificial intelligence (AI) capabilities.

But many of these wins just get us back to where we were before the US-China trade wars of the spring. In fact, China still faces higher tariffs than it did when Trump came into office. And many of the most difficult issues in the relationship were left to be discussed another day. But will that day come? As we’ve seen over the past six weeks, it only takes one misstep or misinterpretation on either side for another round of tit-for-tat escalation and a full-blown trade war between the world’s largest economies.

Next week brings a critical Supreme Court hearing on the challenge to the president’s tariff authority—the very authority he’s used to levy tariffs on China and dozens of other countries. China and the rest of the world will be watching closely. But no matter what happens, Trump won’t fully relinquish what he sees as the best tool in his economic arsenal—and that means a trade truce is likely the best either side can hope for in the near future.

—Josh Lipsky is the chair of international economics at the Atlantic Council and the senior director of the Atlantic Council’s GeoEconomics Center. He previously served as an advisor at the International Monetary Fund.

This relationship will get worse before it gets better

The United States and China are locked in what will likely be a decades-long rivalry that includes significant economic, technological, ideological, diplomatic, and military dimensions. Whether China buys a “tremendous amount of soybeans” is not the central issue and will not resolve the significant underlying issues at dispute between Washington and Beijing.

As just one example, shortly before meeting with Xi, Trump made an unspecified threat to start nuclear testing in response to the nuclear activities of China and Russia. It is unclear whether Trump meant nuclear explosive tests (which the United States has not done in decades) or the testing of nuclear delivery systems (which the United States does regularly).

Either way, expect the bilateral relationship to get worse before it gets better.

—Matthew Kroenig is vice president and senior director of the Atlantic Council’s Scowcroft Center for Strategy and Security and the Council’s director of studies.

Beijing is wielding the power of the calendar to its advantage

The Trump-Xi meeting in Beijing delivered no surprises. As expected, China is rolling out the fentanyl measures it offered earlier this year, and the US side is ratcheting down tariffs accordingly. Both sides are pausing planned measures, with more clarity on the US side than the Chinese side on what that pause really means. China maintains the ability to yank back every concession it provided to the United States.

The real story is a forward-looking one, and a major win for Beijing: China’s biggest concern with Trump is his unpredictability, and they are using an extraordinary line up of pre-scheduled 2026 meetings to box him in and force a degree of, if not quite predictability, at least plannability in US-China relations. We now know what 2026 will look like. Trump plans to visit Beijing in April, and Xi will visit the United States for the Group of Twenty (G20) summit in December (or at least dangle the possibility of that visit). The next fourteen months will be consumed with preparations for those two meetings. Moreover, Trump’s planned visit to Beijing gives China the opportunity to script the next interaction and to press for a new wave of US concessions over the coming months to lay groundwork for a “good” meeting. A similar dynamic will play out next fall.

Chinese leaders are strategic, and their diplomats are strong. Just as in the run-up to this week’s meeting, they will know exactly what they want ahead of these 2026 summits, and exactly where their red lines are. There is still no indication that the US side has the same strategic clarity. The White House will need to prioritize developing it—fast.

—Melanie Hart is the senior director of the Atlantic Council’s Global China Hub.

China has the advantage as talks continue—and the US risks losing the leverage it has

The relatively bland readout issued by China’s Ministry of Foreign Affairs after the meeting contained one profound understatement attributed to Xi: “China-U.S. economic and trade relations have experienced ups and downs recently, and this has also given the two sides some insights (italics mine).” For Xi, one core insight since Trump launched his campaign of punitive tariffs and export controls against China has been how much leverage his country has over the US economy and the US president himself. Beijing’s tight grip on rare-earth exports revealed the depth of US industrial vulnerability in a globalized economy. And the cutoff of Chinese soybean purchases underscored Trump’s own political exposure at a moment in which polls reveal Americans’ deepening unhappiness with the state of the economy.

However the White House chooses to portray the agreement in the coming weeks, there is no avoiding the fact that Beijing has tremendous advantages in the ongoing negotiations. The United States certainly still has its own leverage with China—especially in the realm of advanced semiconductors. But with semiconductor powerhouses such as Nvidia pressing the Trump administration to loosen controls on chip exports and China making rapid gains in the field, that US advantage could quickly evaporate.

—Jeremy Mark is a nonresident senior fellow with the Atlantic Council’s GeoEconomics Center. He previously worked for the International Monetary Fund and the Asian Wall Street Journal.

The US needs to up its game to counter Chinese espionage

Spying was not front and center at the meeting between Xi and Trump—at least according to the public readouts—but this should be an opportunity for Trump to take a clear and redoubled stance against China’s pernicious espionage activities and information operations against the United States and its allies. That adversaries spy on each other is, of course, not news (China recently accused the United States of a breach of its systems), but the diffuse nature of the Chinese espionage threat remains a serious challenge to US national and economic security that the Trump administration must address along with traditional trade and economic issues.

On any given day, it is reasonable to assume that China is almost certainly conducting multiple espionage attacks or operations against US national security infrastructure, personnel, or other critical infrastructure. There are hundreds of open-source documented cases of traditional espionage by China or its apparent agents in recent decades. On the cyber side, massive Chinese telecommunications breaches such as Salt Typhoon—assessed by multiple US agencies to be ongoing to this day—may have netted data from every single American and affected some eighty countries worldwide, according to experts. China’s sustained cyber breaches of US water, energy, transit, and other critical infrastructure systems are also well documented.

It is not hard to imagine China’s potential disruptive or coercive intentions with those infiltrations in the event of a military contingency or diplomatic crisis. China’s vast spying is not new, but AI’s exponential acceleration raises the stakes for the Trump administration. The Trump-Xi meeting is a reminder that the United States is behind and needs to up its game now against a determined and effective foe.

—Tressa Guenov is the director for programs and operations and a senior fellow at the Scowcroft Center for Strategy and Security. She previously served as the principal deputy assistant secretary of defense (PDASD) for international security affairs in the Office of the Under Secretary of Defense for Policy.

With “Taiwan is Taiwan,” Trump dispels fears he will fold to Xi on Taiwan

TAIPEI—For days leading up to the summit, some commentators took it as a given that Taiwan would be on the agenda, while highlighting the risk that Xi would seek to use trade issues as leverage to extract concessions from Trump on Taiwan. Their speculation appeared to be validated when a Chinese government spokesperson warned just a day before the meeting that China would not rule out the use of force to bring Taiwan under its control—an ominous formulation that was not new, but a departure from a softer tone that Beijing had struck days before.

Meanwhile, international media reporting was rife with worries that Trump might change the US position on the status of Taiwan, even citing the fears of unnamed officials in the White House, despite Secretary of State Marco Rubio having already dismissed the idea of Taiwan being a bargaining chip in the talks. Taipei wisely played it cool, with Foreign Minister Lin Chia-lung projecting confidence and dismissing these fears as unfounded.

Then, when Trump himself was pressed by a reporter not long before the meeting, he also spoke dismissively: “I don’t know that we will even speak about Taiwan . . . There’s not too much to ask about. Taiwan is Taiwan.” After the summit, Trump related that “Taiwan never came up,” suggesting that Xi hesitated, perhaps realizing that he did not have the leverage to get his way.

Though there may now be a “truce” of sorts on trade, as Josh Lipsky assesses, there is no “truce” in the ongoing struggle for the future of Taiwan. The Chinese Communist Party’s intimidation campaign to subjugate the small, but strategically key, island democracy will therefore continue. Fortunately, it also seems that Washington’s support for maintaining the status quo of Taiwan’s self-rule will do so as well.

—Markus Garlauskas is the director of the Indo-Pacific Security Initiative of the Scowcroft Center for Strategy and Security.

The G7 must be ready for China to try this export control tactic again

Trump returns to Washington having secured an important pause in China’s exploitation of its leverage in rare earth element supply chains. An agreement to walk back China’s export controls to pre-September 29 levels for one year provides some urgently needed relief.

Yet while a cooling of temperatures in the rare earth supply chain is critical, there is a lesson to be learned in how China used export restrictions as a valuable lever in trade negotiations. Not only can one expect Beijing to use a similar tactic should US-China trade tensions resurface over the course of the next year, but it appears for now that the walk back applies strictly to the United States, with Europe and other Western partners still exposed to Beijing’s supply chain leverage as they negotiate their own deals. Further still, the scale of supply chain influence China displayed earlier this month by implementing export controls well beyond raw ores and precursors to manufactured components will likely remain a source of uncertainty for the private sector. The durability of this temporary pause and the subsequent risks of supply chain controls emerging once more will remain a top-of-mind issue.

This underscores the need to treat this deal as a moment of relief, but not a solution. Expect this administration to continue to aggressively pursue supply chain partnerships such as those recently announced with Australia and Japan. Meanwhile, as Group of Seven (G7) energy ministers meet this week in Toronto, critical mineral supply chains will be at the top of the agenda, with ambitions to better coordinate supply chain security among the G7 members becoming a major priority. If the G7 can find the right mix of coordinated investment, trade tools, and market supports, the opportunity for true supply chain resilience is possible. Otherwise, negotiating with Beijing to secure these brief moments of supply chain relief will become the norm—and come at the expense of a number of other priorities in the US-China relationship.

—Reed Blakemore is director with the Atlantic Council Global Energy Center, where he is responsible for the center’s research, strategy, and program development.

A floor for the US–China trade relationship—for now

Welcome to the new era of supply chain warfare, where geoeconomics are the frontlines of great power competition. The new US–China trade deal is a temporary cease-fire, not détente. Beijing has agreed to suspend its planned export controls on rare-earth elements—a move that had threatened to severely disrupt global manufacturing and reaffirmed China’s dominance in critical mineral supply chains. In exchange, Washington has paused the expansion of export restrictions on Chinese subsidiaries and eased select measures targeting the maritime, logistics, and shipbuilding sectors.

The deal sets a temporary floor for the US–China trade relationship, restoring a measure of predictability for industries navigating two competing economic systems. Yet it leaves the structural imbalances of that relationship largely intact. China retains significant leverage over rare-earth refining and processing, while the United States will continue to deploy economic security tools to safeguard control over critical and emerging technologies. These enduring realities point toward the eventual return of trade and national security barriers that will surpass the scope of this agreement. For example, there is no scenario in which the US Department of Defense and US defense industrial base should rely on China for critical minerals, even if Beijing’s export controls are delayed for twelve months.

As the Trump administration recalibrates its economic security strategy, both sides are likely to reimpose targeted restrictions—driven less by market efficiency than by strategic necessity. In the months ahead, the contest will continue to unfold in the gray zone between trade and security, where control over supply chains increasingly defines hard power. Global policymakers and industry leaders should prepare for renewed volatility in the year ahead.

—Kit Conklin is a nonresident senior fellow at the Atlantic Council’s GeoTech Center.

Promises of an Alaska-to-China energy acceleration may be overblown

Many in the energy community will breathe a temporary sigh of relief at Beijing’s pausing of critical mineral controls for a year. But elsewhere, the Trump-Xi meeting in Busan produced more sizzle than steak.

Trump stated that “a very large scale transaction may take place concerning the purchase of Oil and Gas from the Great State of Alaska.” There are many reasons to be skeptical that a transaction will occur, or that it will be large-scale, however.

Even if such an oil deal materializes, it would be insignificant: Alaska produced only 421,000 barrels per day of crude oil in 2024, or 3 percent of total US output. Any deal with China over Alaskan crude won’t materially impact the US oil and gas complex.

China is also very unlikely to make large purchases of Alaskan liquefied natural gas (LNG). While an Alaskan project would enjoy advantages due to lower shipping distances and canal fees, industry analysts at Rapidan Energy hold that the Alaskan LNG project is not viable, as the second phase alone is projected to cost sixty billion dollars. That’s because Alaska lacks the infrastructure to compete with other players, such as US Gulf Coast states. Alaska has limited natural gas production, challenging geography, a small labor pool, and would require a long greenfield pipeline plus imported steel for both the pipeline and liquefaction facility.

Additionally, China never fulfilled its “Phase 1” purchase commitments, including for LNG, in a prior iteration of the trade war. US-to-China LNG shipments may well rise in the coming months and years, but they will be determined by market factors such as supply and price, not optics.

—Joseph Webster is a senior fellow at the Atlantic Council’s Global Energy Center, a nonresident senior fellow at the Atlantic Council’s Indo-Pacific Security Initiative, and editor of the independent China-Russia Report.

Even the biggest victories from the meeting could prove hollow

A temporary trade truce with no real breakthroughs. That’s the best characterization of the first Xi-Trump face-to-face meeting since 2019.

That hasn’t stopped the US president from trying to spin it as a grand success, calling the meeting “amazing” and rating it a “twelve” on a scale from one to ten, speaking to reporters on the plane back to Washington. Even in his introductory comments before discussions began, Trump exuded positivity, calling Xi “a great leader of a great country” and a “great friend.”

Xi had a much less enthusiastic demeanor, barely smiling during the meeting. And when he stressed the importance of cooperation, he also cautioned that the two countries must avoid “falling into a vicious cycle of mutual retaliation.”

Xi’s most transparent attempt to make nice was his comment that China’s development “goes hand in hand” with the US president’s “vision to ‘make America great again.’”

The biggest victories—Beijing delaying for a year its plans to radically expand its controls over rare earths and Washington postponing plans to implement the “50 percent rule,” a move that would have put sanctions on a far larger list of Chinese companies by including their subsidiaries—could prove hollow.

The United States can always sanction new companies. And the rare earth licensing rules that Beijing put in place earlier this year haven’t gone away, which allows China to slow-walk permits for exports once again. Other supposed victories, such as China’s promise to purchase soybeans, just return things to the status quo of the last few years.

Finally, Trump’s comment that Chinese officials would be talking more to Nvidia going forward, and that Washington would only serve as a “referee,” hinted of a possible further loosening of restrictions on the sale of advanced semiconductors, which would be a huge win for Beijing.

— Dexter Tiff Roberts is a nonresident senior fellow at the Atlantic Council’s Global China Hub and the Indo-Pacific Security Initiative, which is part of the Atlantic Council’s Scowcroft Center for Strategy and Security. He previously served for more than two decades as China bureau chief and Asia News Editor at Bloomberg Businessweek, based in Beijing.

Further reading

Mon, Oct 27, 2025

Trump’s place in history depends on his approach to the CRINK

Inflection Points By Frederick Kempe

After a string of foreign policy wins, Trump's more significant challenge lies ahead: countering the bloc of China, Russia, Iran, and North Korea.

Fri, Oct 24, 2025

The winners and losers from China’s next five-year plan

New Atlanticist By Jeremy Mark

In Beijing, the Chinese Communist Party’s Central Committee met this week to move forward the country’s fifteenth five-year plan.

Wed, Oct 29, 2025

US Congressman Raja Krishnamoorthi on the three wins Trump can secure from his meeting with Xi

New Atlanticist By Katherine Golden

Speaking at an Atlantic Council Front Page event, the congressman said that he hoped Trump would "show strength" at the meeting with China's president.

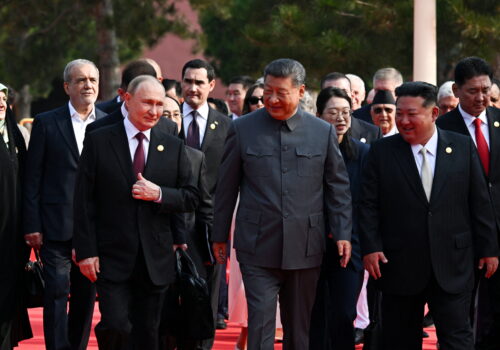

Image: US President Donald Trump and Chinese President Xi Jinping react as they hold a bilateral meeting at Gimhae International Airport, on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit, in Busan, South Korea, October 30, 2025. REUTERS/Evelyn Hockstein