It is Europe’s time to shine on IMEC

Officially announced at the Group of Twenty (G20) Summit in New Delhi in 2023, the India–Middle East–Europe Economic Corridor (IMEC) is an ambitious project aiming to provide far-reaching connectivity and deeper economic cooperation from India across Eurasia. Built upon overland rail and shipping hubs, the completed corridor would support regional prosperity, political cooperation, supply-chain and energy security, and digital interconnectivity among the IMEC signatories and corridor countries.

The benefits are clear. According to initial estimates, IMEC’s overland transportation route could reduce logistics costs by 30 percent and transportation time by 40 percent relative to shipping via the Suez Canal. The new route would also likely provide important structural benefits, such as reducing the risk of supply chain shocks and lowering energy costs. There are also geopolitical implications: Washington, Europe, and India have welcomed the IMEC proposal as a potential counterweight to China’s Belt and Road Initiative.

As the main market at the end of the proposed route, Europe has a critical role to play in ensuring IMEC’s success. With its strong regulatory and logistics capacity, the European Union (EU) will need to take a leading role in setting the rules of the game for IMEC while making much-needed investments to resolve specific bottlenecks around financing, customs alignment, and conflict-resolution mechanisms. To do this, however, Europeans will need to act decisively and quickly.

Where IMEC has paused

The initial IMEC signatories include the leaders of India, the United States, the United Arab Emirates (UAE), Saudi Arabia, Italy, France, Germany, and the European Commission. Although not yet signatories, Greece, Israel, and Jordan are implicitly included in the initiative, given the proposed route that goes through the Port of Haifa as the gateway to the Mediterranean.

Momentum for the project was strong when it was first announced. However, recent instability in the Middle East has led to substantial uncertainty. Just weeks after the IMEC memorandum of understanding was signed at the G20 Summit, Hamas’s October 7 attack against Israel—and the continuing Israel-Hamas conflict—effectively put the brakes on another important initiative: a Saudi-Israeli normalization deal. Normalization was widely regarded as a critical enabler for progress on IMEC given the centrality of the Saudi Arabia-Jordan-Israel railway link in the project. While normalization would certainly ease political and logistical hurdles, it’s not an absolute requirement, and the project could still move forward with careful diplomatic management.

This will be an important hurdle to overcome given that a normalization deal does not seem imminent. Immediately following a meeting between US President Donald Trump and Israeli Prime Minister Benjamin Netanyahu in February, where Trump called for turning Gaza into a “Riviera for the Middle East,” the Saudi Ministry of Foreign Affairs reiterated the country’s position that it will not seek a full-normalization agreement or engage on Gaza reconstruction until there is “a credible, irreversible pathway to a Palestinian state,” and the establishment of a more enduring cease-fire agreement. The Saudi foreign ministry’s statement did not mention IMEC by name, but it appears to be affected by this pause.

Where IMEC is moving forward

Despite the lack of top-down progress toward a secretariat or coordinated development plan among the various signatories, there have still been positive developments on IMEC in the interim. Building on a 2024 Intergovernmental Framework Agreement signed between the UAE and India, both countries have deepened their cooperation on IMEC by launching a digital trade corridor and working together on port modernization. As a result of improving bilateral ties, UAE-India trade reached $65 billion in 2024, representing 20.5 percent growth from 2023. India is now the UAE’s second-largest export market, comprising 9 percent of its total foreign trade and 14 percent of its non-oil exports. This year, UAE-India trade is anticipated to reach $85 billion.

There is other positive news as well. Several European countries have appointed special envoys to IMEC, including France and Italy. And earlier this month, Israel and Cyprus announced new energy development projects under the framework of IMEC, calling to relaunch the Israel-Cyprus-Greece trilateral forum.

Where Europe steps in

These are all steps in the right direction, but today, it is important for Europe and the United States to double down on their support for IMEC so that this progress doesn’t falter. The EU and Washington can do this by promoting policies that continue to build momentum in various bilateral relationships and sectors underpinning IMEC, which will also reaffirm their leadership roles within the project. This is especially true for European policymakers, who now have a unique opportunity on the tail end of Trump’s visit to the Gulf in May to step up their leadership on IMEC. Doing so now would signal the European Commission’s increasing commitment to securing its core energy, commercial, and connectivity interests from the Mediterranean to the Indian Ocean, while also demonstrating its ability to advance a foreign policy agenda that can gain support in a skeptical Washington. So, how should the EU do this?

To begin with, Europe should name an official EU coordinator for IMEC. Based in Brussels, this person could coordinate the Europe side of the project, working primarily with the EU commissioner for international partnerships and the EU commissioner for trade and security. The goal should be to integrate regional partners, work on project timetables and cost estimates, and coordinate with France, Italy, and Greece to discuss IMEC’s terminal port. All three of these countries—with their ports of Piraeus, Thessaloniki, Trieste, and Marseille—are vying to host IMEC’s terminal port. At the moment, Greece and Italy seem to make the most sense, simply by virtue of their proximity to both the Middle East and existing infrastructure. In reality, each of these ports will likely play its role in the project, but the final decision will come down to questions of strategic alignment, investment commitments, and geopolitical concerns, including China’s role in the Port of Piraeus. A high-level EU coordinator is necessary to work through these ongoing and often difficult debates.

Funding must come next. As the EU discusses how to mobilize funding for major defense projects, such as Readiness 2030, it should also rethink how it mobilizes funding for major connectivity projects. Later this year (potentially alongside the planned EU-India Summit tentatively scheduled for the last quarter of 2025) the EU should host a major “IMEC summit” co-hosted with India, the UAE, Saudi Arabia, and the United States. This summit could include the announcement of an IMEC fund, which could be seeded with money out of the EU’s Global Gateway Initiative, the European Investment Bank, and contributions from member states. This would put needed heft behind IMEC (and Global Gateway, for that matter), while simultaneously showcasing the EU’s ability to lead on major initiatives. In turn, these tangible commitments could potentially attract more private and Gulf investment.

Although the idea of EU-level debt issuance comes with real questions and caveats about the drawbacks and risks over joint borrowing, the EU could create an IMEC fund building on financial mechanisms already in place. For instance, the European Investment Bank (EIB) already issues “green bonds,” known as Climate Awareness Bonds (CABs) and Sustainability Awareness Bonds (SABs). These bonds finance projects that support climate action and environmental sustainability. The EIB could issue CABs and SABs that help fund “green” portions of IMEC, such as a renewable energy grid and a green hydrogen pipeline, but it could also create IMEC-specific bonds that could attract investors interested in the project more generally. These could help with things like port upgrades or rail construction.

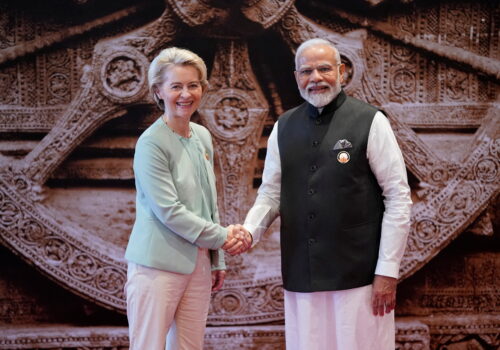

Finally, a strong India-EU partnership will be key to advancing IMEC. In February, European Commission President Ursula von der Leyen and the EU College of Commissioners visited New Delhi. This first-of-its-kind trip highlighted the EU’s recognition that it needs to look beyond the United States for stable long-term economic partnerships. For its part, India appears ready to jump at this opportunity. Thus, IMEC’s chances of success could be bolstered by the EU and India continuing to build the economic and connectivity projects already underway. Officially signing the free trade agreement after years of negotiations, for example, will be a difficult but necessary step in that direction.

Stronger European leadership alone will not overcome all the hurdles ahead for IMEC. It is unlikely, for example, to deliver an Israeli-Saudi normalization deal or bring peace to the Middle East. However, it is important both for the EU and Washington that IMEC projects develop in line with their shared values, priorities, and vision for a secure region-spanning architecture.

Factoring in the view from Washington

For a Washington that wants to see results and is renegotiating how it works with its allies, firm, coordinated, and proactive European leadership that makes tangible—if incremental—progress on IMEC would likely be perceived positively. As IMEC moves forward, the United States will likely emphasize the importance of mitigating Chinese influence across dual-use infrastructure and in the sectors promoted by the project. Washington will also be interested in ensuring open competition for tenders and contracts related to IMEC projects and guaranteeing a role for US companies in the initiative. Europe needs to step up its proactive leadership of IMEC to get ahead of these concerns, particularly before a ministerial meeting is set to determine the path toward a more formalized governance architecture.

History shows that when Trump sees an area ripe for investment, he commits. Now is the right time for Europe to lead on IMEC as the United States is actively deepening its relationships with all the corridor countries, particularly Saudi Arabia and India, and is calling on European leaders to do more. The problem each side keeps running into is the classic “first-mover problem,” whereby early players shoulder an outsized share of risk given the overall uncertainty. The success of IMEC could potentially reshape connectivity and trade throughout the globe and lay the framework for more projects of its kind. The EU should jump at the opportunity to help make it something tangible.

Rachel Rizzo is a nonresident senior fellow at the Atlantic Council’s Europe Center.

Nicholas Shafer is a consultant at the Atlantic Council’s N7 Initiative.

Further reading

Thu, Mar 27, 2025

A US-Saudi deal without Israel? Here’s what the US should ask for.

New Atlanticist By Kirsten Fontenrose

Trump could deliver a stronger security agreement with Saudi Arabia that includes the hefty asks from the kingdom without normalization with Israel. But should he?

Mon, Feb 10, 2025

The continent-spanning win Trump can secure with Modi

New Atlanticist By William F. Wechsler

When the Indian prime minister visits the White House this week, high on the agenda should be the India-Middle East-Europe Economic Corridor (IMEC).

Wed, Feb 26, 2025

The European Commission is headed to India. Here’s what to know about the landmark visit.

New Atlanticist By

European Commission President Ursula von der Leyen is bringing a sizable party from the European Union’s College of Commissioners with her to New Delhi this week. Atlantic Council experts answer the pressing questions about the trip.

Image: A view of the COSCO-owned container terminal in Piraeus, Greece, on April 10, 2025. China's state-owned COSCO owns a majority stake in the Piraeus port, transforming it into its 'gateway to Europe'. Concerns over Chinese port ownership are recently thrust into the spotlight after US President Donald Trump announces reciprocal tariffs on China. (Photo by Nicolas Koutsokostas/NurPhoto) Via REUTERS