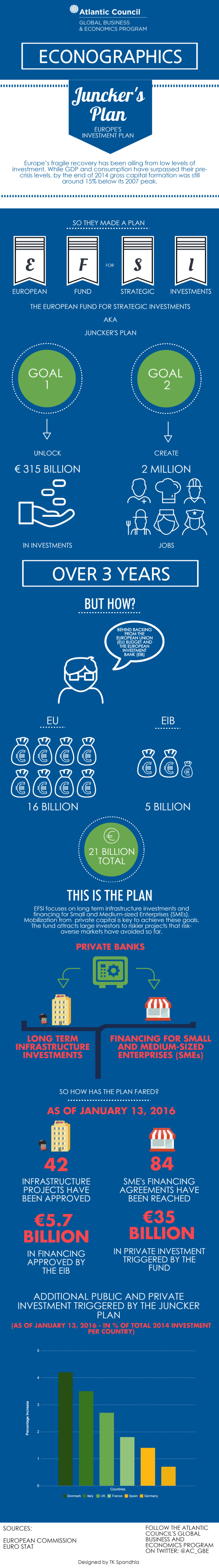

Europe’s fragile recovery has been ailing from low levels of investment. While GDP and consumption have surpassed their pre-crisis levels, by the end of 2014 gross capital formation was still around 15% below its 2007 peak (€230 billion to €370 billion less than the EU’s long term investment average). That is why the EU launched an ambitious investment plan, the European Fund for Strategic Investments (EFSI). Its goal is to unlock investments of €315 billion over 3 years and create more than 2 million jobs.

EFSI is backed by €16 billion from the EU budget and €5 extra billion by the European Investment Bank (EIB), totaling €21 billion. EFSI focuses on long term infrastructure investments and financing for Small and Medium-sized Enterprises (SMEs). Mobilization from private capital is key to achieve these goals. The fund attracts large investors to riskier projects that risk-averse markets have avoided so far. The EU calculates a 1:15 multiplier effect for every €1 guaranteed under EFSI.

So, one year on, how has the plan fared? As of January 13, 2016, 42 infrastructure projects have been approved and 84 SMEs financing agreements reached in 22 of the EU’s 28 countries. This amounts to €5.7 billion financing already approved by the EIB, on top of more than €35 billion of private investment triggered by the fund. In relative terms, the total addition to the selected countries is already significant, measured as a percentage of Gross Capital Formation in 2014 for each country. Several projects are currently under assessment as the EFSI picks up momentum, with two new agreements reached this week in Bulgaria and Spain.