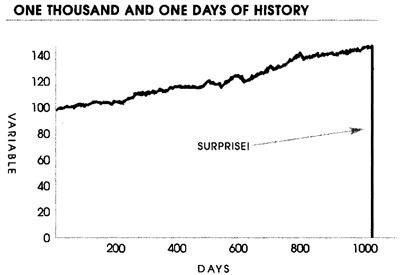

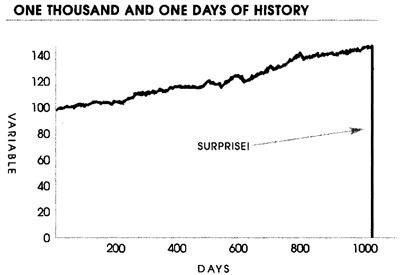

Two plus two equals four. Math has a finality to it, a precision that yields a comfortable black and white. But economics at the state level is not purely math. Macroeconomics is the science that perfectly foresees the future of human activity … after the future has taken place. That is, it is a science that flawlessly predicts history. The reason why it does not portend well is because this is a history that deals with human behavior, probability, irrationality, diplomacy, competition, and chance. The problem lies also in our models. Sometimes variables and trends follow a linear pattern, suckering us into a false sense of comfort and perceived control. When this happens, we blind ourselves to presentism or normalcy bias. But sometimes variables follow a non-linear pattern by plateauing, geometrically increasing or decreasing, oscillating, or ending up like Nassim Taleb’s proverbial “Thanksgiving turkey” (at first a nice and predictable growth, but then a complete surprise).

Some variables of course are completely random. One can easily go into details after the fact, but rarely before. Anyone who attempts to forecast the future, whether professional or amateur, needs to approach the task with requisite humility: just ask Nate Silver and his presidential election predictions. With those caveats, I think one can at least trace the outlines of more probable outcomes. I offer the following map, not as fait accompli, but as things to watch out for.

Global. Europe is mixed politically with a zeitgeist not quite uniformly of “throw the bums out” but definitely of discomfiture, especially after Brexit. As of early December 2016, Germany’s Chancellor Angela Merkel still had an approval rating of 57 percent and Austria did not elect populist presidential candidate Norbert Hofer, but opted for the establishment candidate Alexander Van der Bellen. Nevertheless, looking forward there is a strong chance that the Netherland’s Geert Wilder’s Party for Freedom wins more seats than any other party in March or that the National Front’s Marine Le Pen of France wins the presidential election in May. Neither victory would comfort markets as they typically prefer the status quo. Le Pen has indicated she will pull France out of both NATO and the EU, while Wilders has stated he would pull the Netherlands out of the EU. Islamic terror attacks will also continue in Europe, and the continent’s migrant crisis—including its increasing fiscal costs and rising crime wave—will expand, fomenting larger protests and riots. This will drag Chancellor Merkel’s popularity downward, and I think she stands less than a 50 percent chance of being reelected. Her successor will not be from the populist Alternative for Germany party, but a stronger than expected showing from that party could have negative economic ramifications almost as large as a Le Pen victory. The European Union may not last much longer.

Europe’s banks and bond markets are still wobbly as indicated by the bailout of Italy’s Monte Pachi and the European Central Bank’s announcement to continue quantitative easing of €60 billion through the end of 2017. Healthy economies do not need this type of injection, suggesting these institutions are fundamentally weak. The right event could trigger a larger-scale collapse.

The conflict in the Ukraine will not spill over into a larger war anytime soon. Russia is broke and Putin needs to replenish its coffers, mainly by selling natural gas to Europe. But, President Trump will aggressively push some NATO countries into larger defense expenditures, while simultaneously reducing the US military footprint in the Baltics and Poland.

In Asia, China and India accounted for 65 percent of world GDP growth in the third quarter of 2016. This will not continue based on recent events, such as India’s near total cash ban. India’s monetary experiment will suck down GDP growth and black market transactions will increase as capital seeks safety in gold or foreign deposits. It is surprising the country has not experienced massive public protests to date. China and Japan’s debt problems will become the United States’ problems as both countries burn through their US Treasury reserves.

In the Middle East, there are at least three ongoing conflicts in Afghanistan, Syria and Iraq, and Yemen, among other economic woes. Israel, Iran, and Turkey remain wild cards and the most likely locations for black swan events. Another unknown will be the relationship between the US and Saudi Arabia under a Trump presidency.

In South America, the International Monetary Fund believes Venezuela’s inflation will hit 1,600 percent in 2017. What contagion effects this will have on neighboring countries remains to be seen.

Writ large internationally, capital controls will increase. There will be more cash bans, more bank bail-outs and bail-ins (like Cyprus), more negative interest rates, more central bank interventions, more restrictions on assets (e.g. precious metals, local and foreign cash currency, safety deposit boxes, and Bitcoin), and more capital flight into those same assets. Nation-state failures will accelerate.

United States. Regression to the mean is a powerful mathematical phenomenon. It simply states that, on average, things tend back to the mean. Consumer confidence and the stock market will, at the very least, correct down to the longer-term trend lines, while precious metals like gold and silver will correct upwards. Part of this will be the result of the Federal Reserve’s more hawkish stance, the “honeymoon” period of Trump’s election ending, and the fiscal woes of Europe and Asia. If interest rates rise as anticipated though, this will strengthen the dollar, but hurt corporate earnings and stock prices, as well as damper precious metal price growth.

A larger issue will be due to simple home economics numbers and the reality of personal and public debt. Baby Boomers are retiring and pulling their money out of stocks and mutual funds to invest in less volatile assets. However, most don’t know that a part of Social Security has already gone bust. The Bipartisan Budget Act of 2015 shifted funds from the Old Age and Survivors Insurance fund—what most people think of as Social Security—into the Social Security Disability Insurance fund, which according to the Social Security Administration itself, depleted its money in 2016. The Congressional Budget Office predicts that the interest on the national debt will increase “from $270 billion in 2017 to $712 billion in 2026.” But, this report assumes that the interest rates on Treasuries will range between 2.8 and 3.6 percent.

If retirees and other countries don’t seek refuge in the stronger, dollar-denominated US Treasuries, these bonds could regress up to the rate of the roughly 45-year mean, 5.83 percent, or even the mean from the country’s inception, 5.18 percent, making the federal debt interest payments far greater. Most Americans will be loath to accept higher taxes or cut deeply into spending as rising interest rates commensurately raise the cost of auto, credit, and home loans thus already pressuring household checkbooks. One mathematician laid out this conundrum quite clearly and showed how politicians would be forced to go against the majority of their constituents. Neither side of the political aisle wants to take the blame for crashing the party.

This is the world President Donald Trump inherited. I cannot predict history. Nonetheless, the military has taught me that when you have large unknowns, you should compensate with large reserves. What I would advise the President to do is warn Americans that nature abhors straight lines. There is a high probability for a “turkey” event in the world today: the end of the EU, a revolution in India, the debt collapse of China, or another war in the Middle East. President Trump should also warn Americans about the likelihood of regression to the mean. This applies to the stock market, the housing market, and federal interest rates. Bubbles tend to end with a mess. The country should prepare.

Chris Ellis is an officer in the United States Army. He has broad deployed experience including missions to Kosovo, Iraq, Afghanistan, and Kuwait. He holds a bachelor degree from the University of Washington, and master’s degrees from the University of Kansas, the Command and General Staff College, and the School of Advanced Military Studies. His professional writing interests include ethics, science, and disaster preparedness. The views expressed in this article are the author’s own and do not reflect the official policy or position of the US Army, the Department of Defense, or the US Government.