Great sea connections: Financing the Eastern Mediterranean’s energy transition

Author’s note

This paper draws on my professional experience working on energy and climate issues in the Eastern Mediterranean, as well as many conversations with policymakers, technical experts, and civil society stakeholders from Athens to Beirut and from Istanbul to Cairo. The renewable energy revolution offers both cleaner power and a practical foundation for cooperation through shared infrastructure and capital flows. The region’s energy future is as much about finance, diplomacy, and institutional trust as it is about technology. My aim here is to explore how financial mechanisms can bridge historic divides and support a shared energy transition. My hope is that this paper contributes to reimagining the Eastern Mediterranean not as a collection of competing interests, but as an interconnected energy community bound by mutual prosperity and resilience.

Table of contents

- Introduction

- Rising tides: Meeting the Mediterranean’s surging energy needs

- From pledge to power: Speeding the region’s renewable revolution

- Beyond borders, beyond banks: Innovative financing for regional energy

- Shared foundations: Creating a regional energy community

- Shared horizon: Finance and diplomacy for a unified Eastern Mediterranean energy landscape

Introduction

The Eastern Mediterranean region stands at a critical juncture in its energy development. Positioned as a geopolitical crossroads with significant renewable energy resources and strategic importance, the region encompassing Greece, Cyprus, Turkey, Syria, Lebanon, Israel, Palestine, Jordan, and Egypt has the potential to become a leader in sustainable energy while strengthening regional cooperation and economic integration.

This study examines how the Eastern Mediterranean can secure a sustainable energy future through a two-pronged approach: strategically financing next-generation grid technologies that leapfrog legacy infrastructure challenges, while simultaneously developing integrated financing mechanisms that foster cross-border cooperation. This dual strategy aligns technological innovation with regional stability and market integration needs, creating a framework for sustainable development that transcends political boundaries.

The Eastern Mediterranean’s abundant renewable energy potential, particularly in solar and wind resources, presents a transformative opportunity. The region could generate approximately 144 percent of its projected 2050 electricity demand through renewable energy sources.1Pantelis Kiriakidis, et al., “Projected Wind and Solar Energy Potential in the Eastern Mediterranean and Middle East in 2050,” Science of the Total Environment 927 (2024), https://www.sciencedirect.com/science/article/pii/S0048969724022630. Yet despite this potential, significant challenges persist. Aging and fragmented grid infrastructure, geopolitical tensions, and uneven regulatory frameworks hinder energy integration.

Additionally, ongoing political conflicts, geopolitical tensions, and maritime boundary threats in the region complicate the development of cross-border infrastructure, while the region remains heavily dependent on fossil fuels at a time when global climate commitments push for rapid energy transition.2Moritz Rau, Günter Seufert, and Kirsten Westphal, “The Eastern Mediterranean as a Focus for the EU’s Energy Transition,” Stiftung Wissenschaft und Politik, 2022, https://www.swp-berlin.org/10.18449/2022C08/.

Meeting these challenges requires more than traditional approaches. This paper argues that innovative financing mechanisms can serve dual purposes: funding advanced infrastructure development while simultaneously functioning as instruments of regional cooperation. By strategically structuring financial tools that encourage cross-border collaboration, the Eastern Mediterranean can transform its energy landscape while creating economic interdependencies that help overcome historical political tensions.

The analysis unfolds in four parts. First, it examines the regional context—focusing on power demand trends, the state of grid infrastructure, and the region’s renewable energy potential. Second, it analyzes how COP28 commitments (made at the 2023 climate conference) intensify the need for rapid renewable integration and technological leapfrogging. Third, it evaluates the financing mechanisms available to fund this transition, from multilateral development banks and green bonds to Islamic finance and bilateral investment. Finally, it explores how these financing tools can support frameworks for regional collaboration, including physical infrastructure development, regulatory harmonization, energy diplomacy, and governance structures.

Rising tides: Meeting the Mediterranean’s surging energy needs

The region’s energy landscape is characterized by growing demand, aging infrastructure, and untapped renewable potential against a backdrop of complex geopolitical relationships. These interrelated factors explain why the strategies of technological leapfrogging and regional integration are necessary for sustainable energy development in the Eastern Mediterranean.

Regional power demand trajectory

Electricity demand across the Eastern Mediterranean is expected to grow substantially in the coming decades. Turkey, a pivotal economy in the region, saw its electricity consumption reach 348 terawatt hours (TWh) in 2024, marking a 3.8-percent increase from the previous year.3“Electricity,” Republic of Türkiye, Ministry of Energy and Natural Resources, last updated April 16, 2025, https://enerji.gov.tr/infobank-energy-electricity. Projections indicate a rise to 380 TWh in 2025, 455 TWh by 2030, and 510 TWh by 2035.4Ibid.

This growth trajectory is mirrored in Egypt, Syria, and Lebanon, driven by population growth, urbanization, and economic development. Meeting this demand sustainably requires a massive expansion of renewable energy capacity and modernized infrastructure to support it.

Recognizing the potential and cost competitiveness of renewable energy systems, countries in the region have established ambitious renewable energy targets. Turkey aims to double its electricity capacity by 2035, with renewable energy providing nearly 65 percent of power.5Karim Elgendy, “Charting Energy Transitions in the Eastern Mediterranean and Arabian Peninsula,” Atlantic Council, December 8, 2023, https://www.atlanticcouncil.org/in-depth-research-reports/report/charting-energy-transitions-in-the-eastern-mediterranean-and-arabian-peninsula/. Egypt has set a target of renewable energy providing 42 percent of its power by 2030 and 58 percent by 2040, while Greece plans to cover at least 60 percent of its power needs with green electricity by 2030.6“Egypt Reaffirms 42% Renewable Energy Goal by 2030, Urges International Help,” Reuters, November 12, 2024, https://www.reuters.com/business/energy/egypt-reaffirms-42-renewable-energy-goal-2030-urges-international-help-2024-11-12/; “Clean Energy for EU Islands: Greece,” European Commission, last visited March 25, 2025,https://clean-energy-islands.ec.europa.eu/countries/greece.

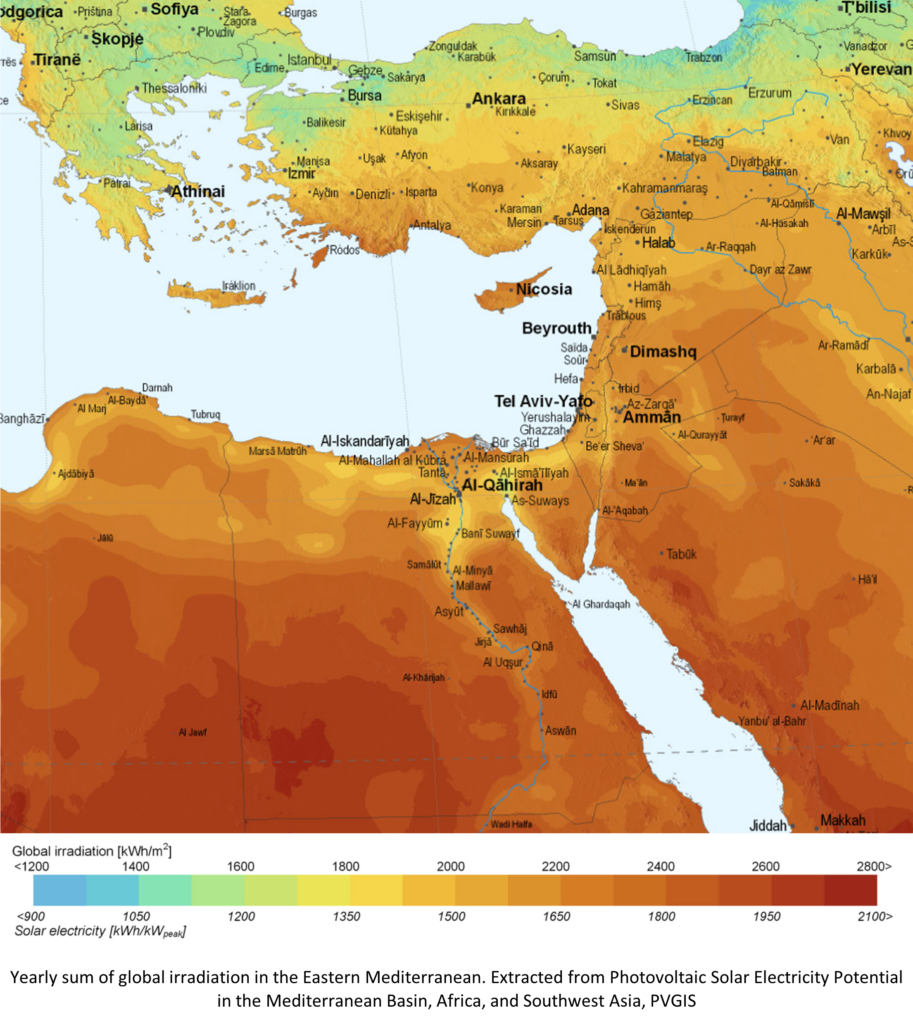

Untapped renewable potential

The Eastern Mediterranean possesses immense renewable energy potential that remains largely untapped, though Turkey and Greece have made progress in this area. The whole Mediterranean basin’s current renewable capacities stand at 90 gigawatts (GW) for solar photovoltaic and 82 GW for wind energy, with a potential exceeding 3 TW for the whole basin—a figure that underscores the opportunity for rapid expansion.7“Setting the Scene for an Interconnected, Renewable Mediterranean Energy System,” ECCO, 2023, https://eccoclimate.org/setting-the-scene-for-an-interconnected-renewable-mediterranean-energy-system/.

The Eastern Mediterranean’s total renewable energy capacity in 2023 was around 90 GW, with research suggesting that the region could potentially generate 144 percent of its projected 2050 electricity demand through renewable energy sources.8“Renewable Capacity Statistics 2024,” International Renewable Energy Agency, March 2024, https://www.irena.org/Publications/2024/Mar/Renewable-capacity-statistics-2024; Kiriakidis, et al., “Projected Wind and Solar Energy Potential.” Egypt could produce 188 percent of its demand from solar and wind energy, with 76 GW of surplus electricity production. Syria could produce 592 percent of its total demand, while Turkey and Greece could produce 105 percent and 96 percent, respectively, of their 2050 demand.9Kiriakidis, et al., “Projected Wind and Solar Energy Potential.”

According to the author’s estimates, if the pipeline of solar, wind, and hydropower projects in Egypt is fully implemented—including projects that are announced, planned, or under construction—its renewables generation capacity would grow twelvefold, in line with those of other North African nations. If the pipeline of solar, wind, and hydropower projects in Greece is fully implemented, this would result in a sevenfold increase in renewable energy generation capacity.10Authors’s calculations based on Global Energy Monitor datasets, last visited March 25, 2025, https://globalenergymonitor.org. These estimates are not just an opportunity to enhance energy security and accelerate the energy transition. They are also an economic opportunity with the potential to create jobs, stimulate investment, and position the region as a global leader in the growing clean energy sector.

The rapidly growing power demands across the Eastern Mediterranean necessitate expanding renewable energy capacity while also fundamentally rethinking how electricity is transmitted and shared. Addressing this challenge requires examining the current state of interconnection infrastructure and identifying opportunities to transform the region’s fragmented grid systems into an integrated network.

The interconnection imperative

Cross-border transmission grid interconnections are of cornerstone importance in the development of power systems. Grids that depend on intermittent renewable energy sources, such as solar and wind, benefit greatly from interconnections for balancing the intermittent nature of renewable sources. Because different countries have varying electricity demands throughout the day, spare capacities and shortfalls can be balanced between different grids.

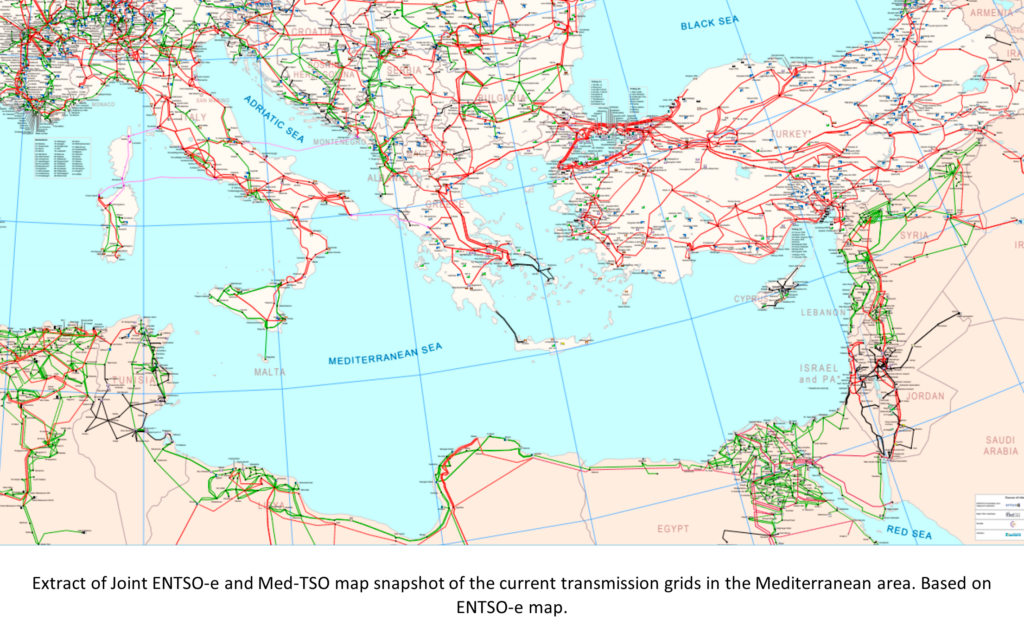

The Eastern Mediterranean’s grid infrastructure presents a fragmented landscape in which cross-border electricity trade is limited. Northern countries such as Greece benefit from advanced energy grids, while southern and eastern regions lag behind. Across the whole Mediterranean, northern-shore countries have sufficient, albeit underutilized, interconnections, while southern-shore countries lack interconnection infrastructure and synchronization. Additionally, there are few north-south interconnections, with only a link from Spain to Morocco and another from Turkey to Syria.11Antonio Moretti, et al., “Grid Integration as a Strategy of Med-TSO in the Mediterranean Area in the Framework of Climate Change and Energy Transition,” Energies 13, 20 (2020), https://www.mdpi.com/1996-1073/13/20/5307. This disparity creates both a challenge and an opportunity for leapfrogging conventional development paths.

Eastern Mediterranean countries continue to prioritize energy self-sufficiency through domestic power generation rather than regional power trading. With the exception of the Palestinian territories, which import nearly all (99.4 percent) of their electricity due to minimal local generation capacity, several countries maintain exceptionally low power import levels—around 1 percent of their total consumption—including Cyprus (0 percent), Lebanon (0.078 to 3.61 percent), Jordan (0.29 to 2 percent), and Egypt (0.29 to 0.41 percent). Similarly, with the exception of Greece and its integration into the European electricity market, power exports remain negligible throughout the region, with most countries exporting less than 1 percent of their generated electricity. This self-contained approach stems from incompatible technical systems among national grids that impede synchronous operation, difficulties in maintaining grid stability across borders, and persistent political tensions that discourage deeper energy integration.12Ramzi El Dobeissy and Mayssa Otayek, “The Potential of Electricity Interconnections,” American University of Beirut, January 2023, https://www.aub.edu.lb/ifi/Documents/publications/research_reports/2022-2023/Electricity-Interconnections-Eastern-Mediterranean.PDF.

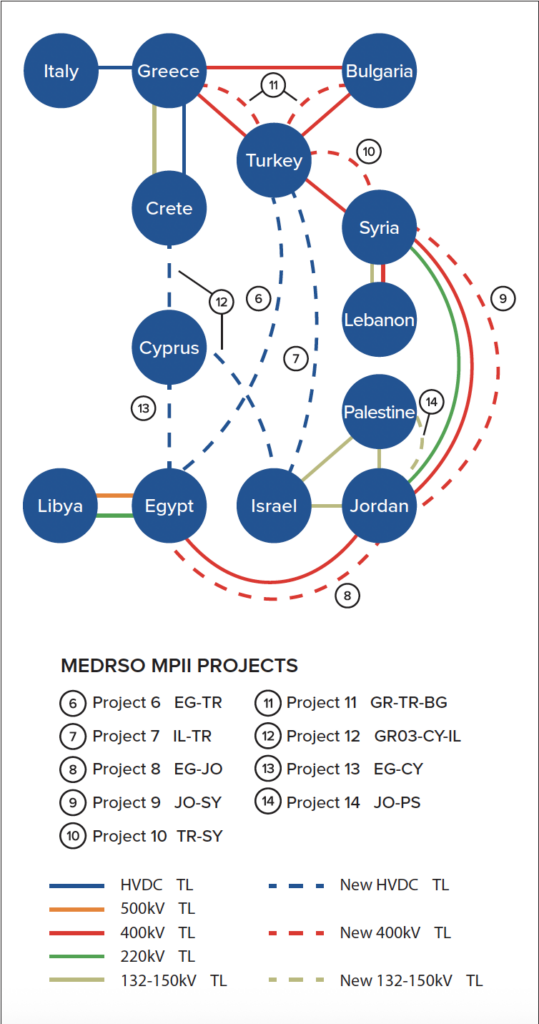

Some interconnections exist in the Eastern Mediterranean but are underutilized or nonoperational. Many of the interconnections are used purely on an emergency basis to cover unexpected or scheduled outages, or are not in operation at all. Key connections such as Turkey-Syria (400 kilovolts (kV)), Jordan-Syria (400 kV), and Lebanon-Syria (400 kV, 220 kV, and 66 kV) are currently inactive, largely due to regional conflicts and technical incompatibilities between national grids, including different frequencies and control systems.13Ibid.

Yet some progress toward greater regional integration is under way. A “super grid” is slowly emerging across the Mediterranean. The Mediterranean Master Plan 2022 outlines several Eastern Mediterranean interconnectors including: the Great Sea Interconnector between Greece, Cyprus, and Israel (1000 MW); the EuroAfrica interconnector to link Cyprus and Egypt (1000 MW), the Green Energy Interconnector (GREGY) between Greece and Egypt (3000 MW of primarily renewable power); and a number of capacity-expansion proposals such as the ones between Egypt and Jordan (1100 MW), Jordan and Syria (800 MW), Syria and Turkey (600 MW), and Jordan and the Palestinian territories (100 MW).14“Masterplan of Mediterranean Interconnections 2022,” Mediterranean Transmission System Operators, May 31, 2023, https://med-tso.org/en/masterplan-of-mediterranean-interconnections-2022/; El Dobeissy and Otayek, “The Potential of Electricity Interconnections.”

These projects are designed to enhance electrical integration, facilitate renewable energy exchange, and improve security of supply. The Great Sea Interconnector, which is under construction, is expected to be operational by 2030 with a capacity of up to 2 GW, while the GREGY project is expected to be completed by 2031.15Gianluca Muscelli, “Integrated Electricity Grids in the Mediterranean? A Bridge for Energy Cooperation between Europe and North Africa,” ECCO, December 4, 2023, https://eccoclimate.org/integrated-electricity-grids-in-the-mediterranean-a-bridge-for-energy-cooperation-between-europe-and-north-africa/; “GREGY Interconnector,” Energy Press, last visited March 25, 2025, https://energypress.eu/tag/gregy-interconnector/. These developments have been planned for more than a decade. An older proposal, the Mediterranean Electricity Ring, aimed to connect Mediterranean countries via a circle of interconnections to facilitate cross-border power exchange. In the Eastern Mediterranean, this included connecting Egypt, Jordan, Syria, Lebanon, Turkey, and Greece.16Abdenour Keramane, “The Energy Ring and the Euro-Mediterranean Electricity Market,” Les Notes IPEMED, Institut de Prospective Economique du Monde Méditerranéen, September 2010, https://www.ipemed.coop/adminIpemed/media/fich_article/1315774972_LesNotesIPEMED_11_BoucleElectrique_sept2010.pdf.

However, significant challenges remain. Tensions caused by maritime disputes between regional countries such as Greece, Turkey, and Cyprus, the unresolved Cyprus question, and the protracted Israel-Palestinian conflict, all impede the development of cross-border infrastructure.17Rau, Seufert, and Westphal, “The Eastern Mediterranean as a Focus for the EU’s Energy Transition.”

In addition, the geopolitical diversity, uneven political stability, and limited political trust among Eastern Mediterranean countries dampen some national governments’ interest in exploring partial reliance on external electricity. Reasons cited often include the potential for electricity being used as a geopolitical lever, the risk of disruption caused by internal conflict, infrastructure failure, governance breakdown propagating across borders, and concerns about expanding cybersecurity vulnerabilities by exposing national grids to transboundary breaches.

Additionally, many countries maintain vertical monopolies in their electricity sectors—e.g., utilities such as Electricité du Liban (EDL) in Lebanon, Israel Electric Corporation (IEC) in Israel, and, to some extent, various companies in Jordan—which enable them to control generation, transmission, and distribution, thus limiting market competition and cross-border electricity flow.

Technical barriers are equally significant, as systems have evolved separately with different standards and technologies. Alternating-current (AC) interconnections require high degrees of technical compatibility and operational coordination, creating stability risks when disturbances in one location impact other areas of the network. These challenges are compounded by insufficient regulatory frameworks and governance structures needed to support cross-border trading.18El Dobeissy and Otayek, “”The Potential of Electricity Interconnections.”

From pledge to power: Speeding the region’s renewable revolution

Developing renewable energy capacity and establishing physical interconnections form the backbone of regional energy integration, and these efforts need to rapidly scale up due to the urgency of the climate crisis. Global climate commitments and obligations provide a framework for measuring progress and highlight the gap between current trajectories and required outcomes.

Meeting COP28 targets

The commitment at COP28 to triple the world’s installed renewable energy generation capacity by 2030 provides a clear imperative for action in the Eastern Mediterranean. Nations collectively committed to this target as part of the global stocktake of the 2015 Paris Agreement.19“What Is the Global Stocktake?” McKinsey & Company, August 28, 2024,

https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-the-global-stocktake. In addition, 130 nations—including Greece, Cyprus, and Turkey—also joined the Global Renewables and Energy Efficiency Pledge, a voluntary coalition committing to triple their renewable energy capacity and double the rate of energy-efficiency improvement.20“Global Renewables and Energy Efficiency Pledge,” COP28, last visited March 25, 2025, https://www.cop28.com/en/global-renewables-and-energy-efficiency-pledge. In September 2024, nine northern Mediterranean countries (often known as the MED9) agreed to collaborate on making the region a renewable energy hub, aligning with this global target.21Karim Elgendy, “The Mediterranean Must Work Collectively to Harness the Power of Renewables,” Atlantic Council, March 11, 2025, https://www.atlanticcouncil.org/blogs/energysource/the-mediterranean-must-work-collectively-to-harness-the-power-of-renewables/.

A growing grassroots initiative known as TeraMed is seeking to mobilize Mediterranean countries to triple their renewable energy capacity and reach 1 terawatt in combined generation capacity.22“1 Terawwatt Renewable Energy Capacity Installed in the Mediterranean Region by 2030,” TERAMED Initiative, last visited March 25, 2025, https://teramedinitiative.com/.

As of 2023, Eastern Mediterranean countries had an installed renewable power capacity of 90 GW, accounting for 42 percent of their total electricity generation.23“Renewable Capacity Statistics 2024.” To meet the COP28 target, the region must reach 405 GW of capacity by 2030, requiring a steep annual growth of 45 GW. Unsurprisingly, the region is not on track. With the exceptions of Greece and Egypt, all Eastern Mediterranean countries must accelerate their efforts if they are to meet the threefold-increase target.24Elgendy, “The Mediterranean Must Work Collectively to Harness the Power of Renewables.”

In my view, meeting these ambitious renewable targets requires more than simply adding generation capacity. The Eastern Mediterranean needs advanced infrastructure solutions that can both accommodate the tripling of renewable energy and overcome existing grid fragmentation. Smart grid technologies represent the critical connective tissue that will enable this rapid transition.

Smart grid innovation: The digital backbone of renewable integration

To effectively integrate the growing share of renewables and enhance grid stability, the Eastern Mediterranean must leapfrog conventional infrastructure by investing in smart grids. In addition to interconnections, smart grid technologies enable better management of intermittent renewable sources, improve reliability, and reduce losses. These technologies include battery storage, advanced metering infrastructure, dynamic line rating, and other network automation, data management, and analytics technologies for real-time monitoring and control.

Battery storage is particularly crucial for managing the intermittency of renewable energy sources, ensuring grid stability as the share of renewables increases. However, large-scale battery storage projects are still nascent in the Eastern Mediterranean—with the exception of Turkey, which set a target for battery energy storage capacity to reach 7.5 GW by 2035.25Karim Elgendy, “From Grey to Green: Türkiye’s Energy Transition(s),” CeSPI Osservatorio Turchia, October 2023, https://www.cespi.it/sites/default/files/osservatori/allegati/approf._26_turkiyes_energy_transitions_elgendy_0.pdf.

Flexibility mechanisms, including demand response and renewable hydrogen production, further enhance grid stability. Technologies such as electrolysis using solar and wind electricity for hydrogen production are gaining traction. Turkey has plans to develop 5 GW of electrolyzer capacity for green hydrogen production by 2035, and to expand capacity to a staggering 70 GW by 2053.26Ibid. Similar applications are being explored in Egypt, which plans to become a transit route for renewable hydrogen.27Rau, Seufert, and Westphal, “The Eastern Mediterranean as a Focus for the EU’s Energy Transition.”

Smart meters also help manage the grid better through demand-side management. In the Eastern Mediterranean, Greece is leading on smart meters. It plans to roll out 3.12 million units by 2026, funded by the European Investment Bank, to enhance energy efficiency and support demand response.28“HEDNO Smart Meters I Project Pipeline,” European Investment Bank, August 2, 2023, https://www.eib.org/en/projects/pipelines/all/20220823.

Deploying advanced grid technologies across borders also requires moving beyond identifying technical requirements to addressing the fundamental question of funding this transition. Additionally, this paper argues that the financing challenge is not merely about capital mobilization but also the creation of financial structures that simultaneously enable technological leapfrogging and regional cooperation.

Beyond borders, beyond banks: Innovative financing for regional energy

The transition from technical requirements to financial realities necessitates examining the substantial capital investments needed to realize the Eastern Mediterranean’s energy transformation. While technological solutions provide the roadmap, financing mechanisms will determine the pace and scale of implementation, particularly when the magnitude of required investment exceeds traditional national budgetary capacities.

Quantifying the investment challenge

The Eastern Mediterranean’s energy transition demands significant capital to expand limited renewable energy capacity, modernize aging grids, and develop cross-border interconnections.

Renewable energy projects typically cost around $1 million per megawatt of installed capacity. Their costs are already competitive, and they are the cheapest form of new generation capacity across the region. Moreover, those costs are expected to continue falling and renewables are expected to be the cheapest source of electricity in most countries—including for storage—by 2027.29Femke J. M. M. Nijsse, et al., “The Momentum of the Solar Energy Transition,” Nature Communications 14 (2023), https://www.nature.com/articles/s41467-023-41971-7.

However, given the sheer scale of buildup required to meet COP28 commitments, the enormity of the financing required cannot be overstated. If the region is to build 45 GW of renewable energy capacity this year, this would require approximately $45 billion just for generation capacity at current costs, excluding transmission and storage infrastructure.30“Renewable Power Generation Costs in 2023,” International Renewable Energy Agency, 2024, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2024/Sep/IRENA_Renewable_power_generation_costs_in_2023.pdf.

Transmission infrastructure is another challenge, especially given how its cost is often borne by grid operators rather than by private developers. The Great Sea Interconnector, for example, is estimated to cost approximately €1.9 billion ($2.08 billion).31Great Sea Interconnector, last visited March 28, 2025, https://www.great-sea-interconnector.com/en.

By 2030, the region’s total investment needs for sustainable energy transition could well exceed $300 billion. The magnitude of investment required highlights why ordinary national financing approaches are insufficient for the Eastern Mediterranean’s energy transformation. Instead, the region needs to scale finance beyond national resources and to explore financing instruments that mobilize capital at scale and also create structures for regional cooperation, serving as both financial tools and diplomatic instruments in a region where political tensions have historically impeded collaboration.

Financing the energy transition

The Eastern Mediterranean’s sustainable energy future will require mobilizing diverse financing sources and mechanisms. A mix of public and private funding sources—ranging from multilateral lenders and climate funds to innovative partnerships and financial instruments—can bridge the investment gap and accelerate the energy transition.

In developing countries within the Eastern Mediterranean, this challenge is made more difficult by the higher cost of capital, as investors demand high-risk premiums due to country, currency, or sector uncertainty.

This section outlines key financing sources and provides case studies and examples of how each source is being applied (or could be applied) in the Eastern Mediterranean. Each financing mechanism not only brings capital but can also serve as a catalyst for regional cooperation and innovation in energy infrastructure.

1. Multilateral development banks

Multilateral development banks (MDBs) provide a foundational source of capital and risk mitigation for large-scale energy projects in the region. Institutions such as the European Investment Bank (EIB), the European Bank for Reconstruction and Development (EBRD), the Asian Infrastructure Investment Bank (AIIB), and the World Bank offer concessional loans, grants, guarantees, and technical assistance to support renewable energy and grid modernization. For example, the EBRD has invested more than €3.8 billion in renewable energy across emerging markets, supporting 119 projects totaling more than 6 GW of capacity.

In the Eastern Mediterranean, MDB financing often underpins ambitious projects. For example, the EBRD and partners launched a $500-million framework that helped finance sixteen solar plants (750 MW) in Egypt, including in the Benban solar park.

Another notable initiative with a renewable energy component is the Southern and Eastern Mediterranean Sustainable Energy Financing Facility (SEMED SEFF), a joint program of the EBRD, EIB, Agence Française de Développement, and KfW, a German state-owned bank. With a €141.7-million budget, SEMED SEFF catalyzed investments in Jordan and Morocco to cut more than 150,000 tons of carbon dioxide annually and boost renewables (25 percent of its funds went to renewable energy projects).32“Southern and Eastern Mediterranean Regional Sustainable Energy Financing Facility,” EU Neighbours South, last visited March 28, 2025, https://south.euneighbours.eu/project/semed-seff-southern-and-eastern-mediterranean-regional-sustainable/.

MDBs not only supply affordable long-term loans; they also crowd in other investors. In Egypt’s Benban project, for instance, the EBRD, the International Finance Corporation (IFC), the AIIB, and the African Development Bank (AfDB) cofinanced solar plants alongside private developers, dramatically lowering financing costs and risk.33“AIIB Investment’s Portfolio in Egypt Hits $1.3b,” Egyptian Gazette, September 25, 2023, https://egyptian-gazette.com/egypt/aiib-investments-portfolio-in-egypt-hits-1-3b/. By leveraging MDBs’ preferred creditor status and technical expertise, such involvement signals to markets that projects are bankable.

By providing concessional finance, convening power, and technical and policy assistance, MDBs help Eastern Mediterranean countries undertake projects that might otherwise be too costly or complex, from large wind and solar farms to regional grid interconnectors. Their financing comes with due diligence and policy guidance, encouraging reforms (such as market liberalization or improved procurement frameworks) that improve the overall investment climate. Going forward, scaling up MDB capital—including through their climate-focused funds and guarantees—will be crucial to meet the region’s renewable investment needs at the pace demanded by global climate commitments.

2. Green finance and investment

Green finance refers to capital raised for climate-friendly and sustainable projects through instruments such as green bonds, green loans, and ESG (environmental, social, governance) investments. In the Eastern Mediterranean, green bonds specifically are emerging as an important tool to tap global capital markets for renewable energy and low-carbon infrastructure. The global green bond market has expanded rapidly to more than $2.5 trillion outstanding by 2024.34“Green Bond Market Guide,” Goldman Sachs Asset Management, November 1, 2024, https://am.gs.com/en-gb/institutions/insights/article/2024/green-bond-market-guide.

Eastern Mediterranean nations have started to issue their own green bonds to fund clean energy, often with strong investor demand. Egypt was an early mover, launching a $750-million sovereign green bond in September 2020.35“Supporting Egypt’s Inaugural Green Bond Issuance,” World Bank, March 15, 2022, https://www.worldbank.org/en/news/feature/2022/03/02/supporting-egypt-s-inaugural-green-bond-issuance. Cyprus followed in 2022, issuing a €1-billion green bond. In 2023, Israel and Turkey debuted their first sovereign green bonds, raising $2 billion and $2.5 billion, respectively.36“Green Bond Allocation,” State of Israel Ministry of Finance, January 2024, https://www.gov.il/BlobFolder/reports/green-bond-framework/en/files-eng_Publications_Israel-Green-Bond-Framework-SOI.pdf; “ESG Issuances,” Republic of Turkey Ministry of Treasury and Finance, last visited April 3, 2025, https://en.hmb.gov.tr/esg-issuances. Greece signaled plans to issue a sovereign green bond as well. While a national issuance expected for 2024 remains pending, the Bank of Greece issued a €500-million green bond in 2020.37“Sustainability and Green Bond Frameworks,” National Bank of Greece, last visited March 29, 2025, https://www.nbg.gr/en/group/investor-relations/debt-investors/sustainability-and-green-bond-frameworks.

Other private institutions have also issued green bonds, including banks and other businesses such as renewable energy companies. Lebanon’s Fransabank SAL issued its first green bond in 2018, valued at $60 million, with support from the IFC and EBRD. The proceeds were directed to support sustainable finance initiatives. Jordan’s Kuwait Bank followed in 2023 and, in collaboration with the IFC, issued its first green bond, valued at $50 million. The funds were allocated to renewable energy, low-carbon transport, and sustainable water and wastewater projects. Additionally, Arab Bank in Jordan issued a $250-million sustainable bond in October 2023 to support green and sustainable initiatives.38Jessica Obeid, “Turning MENA Markets Green: Why Sustainable Finance Matters and How to Do It,” SRMG Think Research and Advisory, 2024, https://awsprod.srmgthink.com/featured-insights/411/special-report-turning-mena-markets-green.

However, the market remains nascent and fragmented. Strengthening regulatory frameworks, standardizing green taxonomies, and building technical capacity among issuers and investors will be key to unlocking green capital at scale. For instance, Turkey developed its own sustainable finance framework in 2021, while IFC support enabled Egypt to develop green bond guidelines and the Amman Stock Exchange to produce sustainability reporting guidelines.39“Republic of Turkey—Sustainable Finance Framework,” Republic of Turkey, November 2021, https://ms.hmb.gov.tr/uploads/2021/11/Republic-of-Turkey-Sustainable-Finance-Framework.pdf; Obeid, “Turning MENA Markets Green.” The European Union recently introduced the European Green Bond Standard, a voluntary framework to ensure transparency and combat greenwashing, which could serve as a model to harmonize practices in the region.40“European Green Bond Standard,” European Commission, last visited March 28, 2025, https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/european-green-bond-standard-supporting-transition_en.

3. International climate finance

International climate finance refers to dedicated funds and initiatives aimed at supporting climate change mitigation and adaptation in developing countries. For Eastern Mediterranean nations (many of which are middle-income or emerging economies), these funds are an important supplement to domestic resources. Key global climate funds include the Green Climate Fund (GCF), Climate Investment Funds (CIF) such as the Clean Technology Fund, and the Global Environment Facility (GEF). Historically, the Middle East and North Africa (MENA) region has underutilized these funds: MENA has received only about 6.6 percent of cumulative financing from the major global climate funds through 2023.41Jessica Obeid and Alice Gower, “Mind the Gap: Highlighting MENA’s Climate Finance Challenge,” SRMG Think Research and Advisory, December 2023, https://www.srmgthink.com/highlighting-menas-climate-finance-challenge.

Eastern Mediterranean countries are now working to improve their access to these pools of finance by developing strong project proposals and institutional capacity. Egypt has been notably successful in tapping climate funds, securing about one-third of all GCF resources allocated to MENA as of 2023. About 85 percent of Egypt’s GCF funding has been in the form of loans. Jordan has also received international climate finance, accounting for roughly 10 percent of GCF funding in MENA (with around half in loans). Meanwhile, Turkey has benefited from World Bank funding via the Türkiye Green Fund (TGF), receiving a $155-million loan for the greening of firms through equity financing, while Lebanon has benefited from GEF grants, receiving about 8 percent of GEF’s MENA allocations.42“$155 Million World Bank Loan to Expand Equity Finance for the Greening of Turkish Firms,” World Bank, press release, November 9, 2023, https://www.worldbank.org/en/news/press-release/2023/11/09/-155-million-world-bank-loan-to-expand-equity-finance-for-the-greening-of-turkish-firms; Obeid and Gower, “Mind the Gap.” These funds often work by blending with multilateral bank financing or by de-risking projects to attract private investors (through instruments like guarantees and concessional tranches).

4. Islamic finance

Islamic finance is a growing source of funding for the energy transition and is particularly relevant in the Muslim-majority countries of the Eastern Mediterranean. Islamic finance follows sharia principles, such as prohibition of interest, and typically uses profit-sharing or asset-backed structures.43“Islamic Finance and Renewable Energy,” Greenpeace MENA, 2024,

https://www.greenpeace.org/static/planet4-ummah-stateless/2024/11/d63785ad-iffe_report_en-.pdf. Green sukuk (sharia-compliant bonds earmarked for environmental projects) have emerged as a key instrument to raise capital for renewables while tapping into Islamic investor pools. The global sukuk market has seen strong growth and greening in recent years. The first half of 2024 set a record, with $9.9 billion in green and sustainability sukuk issuances, indicating accelerating interest.44Ibid.

While most green sukuk so far have originated in Southeast Asia and the Gulf, Eastern Mediterranean nations are starting to consider them.45“Unlocking Islamic Climate Finance,” Asian Development Bank, November 2022, https://www.adb.org/publications/unlocking-islamic-climate-finance. Egypt, for example, has been considering sukuk as a financing tool. It passed a Sovereign Sukuk Law in 2021 and could issue green sukuk to fund projects under its renewable energy and sustainable transport plans.46“Sovereign Sukuk Act Signed into Law,” Enterprise (Egyptian news site), 2021, https://enterprise.press/stories/2021/08/19/sovereign-sukuk-act-signed-into-law-51060/.

Importantly, major finance institutions are steering toward climate action. In 2021, Emlak Katılım issued the first green sukuk in Turkey with a total value of 51.8 million Turkish lira.47Esma Karabulut, “Technical Assistance for Assessment of Türkiye’s Potential on Transition to Circular Economy,” Circular Economy Workshop, October 4, 2022, https://webdosya.csb.gov.tr/db/dongusel_en/icerikler/deep-project-presentat-on-en_esma-karabulut-20221024144340.pdf. The Islamic Development Bank (IsDB) has also issued sukuk to raise funds for green projects. For example, in 2024 it issued a $2-billion benchmark sukuk earmarked partly for green development programs.48“IsDB Issues US$2 Billion Sukuk in First Benchmark of the Year,” Islamic Development Bank, May 8, 2024, https://www.isdb.org/news/isdb-issues-us-2-billion-sukuk-in-first-benchmark-of-the-year.

Beyond sukuk, Islamic finance can support renewable energy through Islamic banks and funds investing in project equity or providing sharia-compliant loans (such as profit-sharing and loss-sharing musharakah (a joint-venture structure) or lease-based Ijarah financing). Islamic finance also opens opportunities for waqf (endowment funds) or zakat (charitable contributions) to be structured for community-level clean energy access or climate resilience projects, although such models are still in experimental stages.

5. Bilateral investment

Financing and development support from one country to another plays a pivotal role in the Eastern Mediterranean’s energy landscape. Bilateral investment often comes either directly from foreign governments (through aid, export credits, or state-owned banks) or via government-backed companies and sovereign wealth funds pursuing projects abroad. In the push for renewables, several powerful bilateral actors have emerged: notably the Gulf states (such as the United Arab Emirates (UAE) and Saudi Arabia) and China. They view renewable energy projects not only as commercial opportunities but also as avenues to strengthen strategic ties and influence in the region.

The UAE and Saudi Arabia have invested significantly in Egypt’s renewable energy projects, using investors such as ACWA Power, Masdar, and AMEA Power to fund new wind and solar capacity.49“Gulf Renewable Power Tracker,” Columbia University Center on Global Energy Policy, last visited March 29, 2025, https://www.energypolicy.columbia.edu/the-gulf-renewable-projects-tracker/. For example, Masdar has partnered with Egyptian firms to develop a gigantic 10-GW onshore wind farm, one of the world’s largest, which it announced on the sidelines of COP27.50Maha El Dahan, “COP27: UAE and Egypt Agree to Build One of World’s Biggest Wind Farms,” Reuters, November 8, 2022, https://www.reuters.com/business/cop/cop27-uae-egypt-agree-build-one-worlds-biggest-wind-farms-2022-11-08/.

China is increasingly becoming a major bilateral financier in Eastern Mediterranean energy. Chinese state-owned enterprises and funds have targeted renewable energy acquisitions and projects, especially in economies where financing gaps exist. In Egypt, Chinese banks and companies have supported the Benban solar complex; for example, the AIIB provided $210 million in debt financing for eleven solar plants (totaling 490 MW) in Benban’s second phase.51“AIIB Supports Renewable Energy Development in Egypt,” Asian Infrastructure Investment Bank, September 5, 2017, https://www.aiib.org/en/news-events/news/2017/AIIB-Supports-Renewable-Energy-Development-in-Egypt.html. Chinese firms have also supplied solar panels and construction for many Benban projects. China also has energy investments in Turkey, Lebanon, and Greece. China’s Silk Road Fund has acquired a 49-percent stake in ACWA Power’s renewable energy portfolio.52“Silk Road Fund Becomes a 49% Shareholder in ACWA Power Renewable Energy Holding LTD,” ACWA Power, June 23, 2019, https://www.acwapower.com/news/silk-road-fund-becomes-a-49-shareholder-in-acwa-power-renewable-energy-holding-ltd/. These investment patterns are part of the increasing “greening” of China’s Belt and Road Initiative (BRI) and reflect China’s willingness to invest in lower-income Eastern Mediterranean nations, though these investments often serve dual purposes of commercial returns and strategic positioning.53Clemens Hoffmann and Ceren Ergenc, “A Greening Dragon in the Desert? China’s Role in the Geopolitical Ecology of Decarbonisation in the Eastern Mediterranean,” Journal of Balkan and Near Eastern Studies 25, 1 (2023), 82–101, https://www.tandfonline.com/doi/full/10.1080/19448953.2022.2131079.

The European Union (EU) and its member states also act bilaterally through programs like the EU-funded Neighbourhood Investment Platform, which gives grants to complement loans for energy projects in the Mediterranean neighborhood.54“Neighbourhood Investment Platform,” European Commission, last visited March 20, 2025, https://enlargement.ec.europa.eu/neighbourhood-investment-platform_en. Europe often emphasizes grid interconnections and market integration (e.g., funding studies for a EuroAfrica interconnector between Egypt and Greece), Gulf countries favor high-profile generation projects, and China is active across the value chain from generation to transmission.

Bilateral investments bring substantial capital and can fast-track projects, but they also entail geopolitical balancing as recipient countries in the Eastern Mediterranean navigate offers from multiple suitors. When managed well, bilateral financing can complement multilateral efforts. It also can foster regional cooperation. For instance, the UAE not only invests in Arab neighbors but has discussed energy deals involving Israel (such as solar facilities in Jordan exporting power to Israel as part of a desalinated water and solar energy swap between Israel and Jordan).55Veronika Ertl, Benjamin Nickels, and Hamza Saidi, “Climate Change and Geopolitical Dynamics in the Middle East and North Africa,” Konrad Adenauer Stiftung, July 19, 2024, https://www.kas.de/de/einzeltitel/-/content/climate-change-and-geopolitical-dynamics-in-the-middle-east-and-north-africa.

6. Debt financing

Debt financing (i.e., borrowing funds to be repaid with interest) is one of the predominant ways to fund energy infrastructure, including renewable projects, worldwide. In the Eastern Mediterranean, debt financing takes multiple forms: loans from commercial banks or international institutions, bonds issued in capital markets, export credits or supplier credits for equipment, and concessional and blended debt.

Given that debt is cheaper than equity, developers typically seek debt to cover most of the project costs. For investors and lenders, renewable energy projects can be attractive debt opportunities because they generally generate steady cash flows once operational.

Finance for regional cooperation

A comprehensive financing strategy leveraging all of the above mechanisms is crucial for the Eastern Mediterranean to realize its energy transition ambitions. Multilateral and climate funds provide scale and patient capital, green and Islamic finance tap new investor pools, and bilateral investments bring in strategic funding.

Additionally, financing structures such as project finance, public-private partnerships, power purchase agreements, and blended finance can help reduce risk. Green investment banks can help mobilize funding for green projects, while innovative tools like fintech and results-based financing fill niche gaps.

In my view, the region’s success in meeting COP28 goals hinges less on the availability of technology and more on the ability to align financial incentives across borders.

By structuring these financing approaches with regional cooperation as their foundation, these instruments create shared financial interests across borders, incentivizing collaboration and helping overcome entrenched political obstacles. Financial mechanisms explicitly requiring cross-border participation serve as powerful diplomatic tools in addition to their capital mobilization function.

For instance, multilateral investment funds that mandate co-investment from multiple Eastern Mediterranean countries establish joint ownership stakes in critical infrastructure, creating a financial incentive to maintain peaceful relations. Similarly, blended finance structures offering preferential terms for projects with cross-border components make cooperation economically advantageous compared to purely national approaches. For example, a Mediterranean renewable energy fund requiring participation from Greece, Turkey, and Cyprus could provide a neutral financial platform in which shared economic benefits supersede maritime disputes.

The strategic design of these mechanisms must include governance frameworks that span national boundaries, with representation requirements ensuring all stakeholders have meaningful input in investment decisions. Interconnection-specific project bonds co-issued by multiple countries can create shared liability structures in which default risks are mutually borne, fostering accountability across traditional divides.

When properly implemented, these tools can transform abstract diplomatic goals into concrete economic incentives. Countries with historical tensions can begin to view their neighbors not as competitors but as essential partners in accessing capital markets and achieving energy security. Countries that once viewed energy resources as potential flashpoints for conflict can instead develop economic interdependencies that make continued cooperation the most rational choice.

Shared foundations: Creating a regional energy community

While innovative financing mechanisms provide the tools for transformation, their successful implementation depends on creating supportive physical, institutional, and diplomatic frameworks. The mobilization of capital through green bonds, MDB funding, climate finance, and other financial instruments discussed above is necessary but insufficient on its own to achieve regional energy integration.

Having participated in several regional energy dialogues, I have observed that trust between regulators remains limited. Finance can be the tool that enables cooperation in more sensitive policy areas. Yet it must be paired with robust infrastructure development, harmonized regulatory environments, diplomatic initiatives that overcome historical tensions, and coordinated governance structures that span national boundaries. The implementation of regional energy integration requires establishing concrete structures for collaboration that can transform the Eastern Mediterranean’s abundant renewable resources into a shared, resilient energy architecture that benefits all participating nations. These efforts must include

- physical infrastructure development and grid integration;

- interconnected energy markets and regulatory alignment on grid codes, tariff structures, and cross-border trading;

- regional cooperation and diplomatic engagement; and

- regional governance frameworks.

Scaling cross-border initiatives for a connected grid

Cross-border energy cooperation in the Eastern Mediterranean is advancing through several key initiatives aimed at integrating renewable energy sources and enhancing grid connectivity. There are nine interconnection projects and proposals at different stages of development across the region. If implemented fully, they can help create a more unified energy market capable of efficiently distributing energy across the Mediterranean while addressing the intermittency challenges of solar and wind.

The Great Sea Interconnection, set to link Cyprus, Greece, and Israel, is perhaps the region’s flagship project and will facilitate the trade of renewable electricity across borders. Similarly, Egypt and Greece are exploring the GREGY interconnection. Beyond the Eastern Mediterranean, Italy and Tunisia are advancing the ELMED interconnection between them, which is expected to be operational by 2027.56“ELMED Project,” last visited March 25, 2025, https://elmedproject.com. Technologies already exist to manage some of the perceived risks of interconnections. Using high-voltage direct current (HVDC) transmission lines offer greater controllability and can be isolated more easily than traditional AC interconnections. Interconnections can also be directed to non-critical loads or areas in order to reduce risk to cross-border disruptions, while robust cybersecurity standards and protocols can help protect critical infrastructure.

Harmonizing regulations for seamless market operation

Achieving a fully integrated energy market in the Eastern Mediterranean requires harmonized regulations to ensure fair access to grids, promote investment, and reduce the cost of risk capital. Countries involved in interconnection projects need to have the regulatory framework in place to allow for successful entry of foreign electricity into domestic electricity markets and successful export of their electricity to foreign markets. This is especially difficult for countries in which electricity utilities hold vertical monopolies in all sectors of the economy. Turkey, Cyprus, Greece, and Egypt have unbundled or are on the way to unbundling their electricity markets; meanwhile, Jordan, Lebanon, and, to a lesser extent, Israel have electricity utilities that hold vertical monopolies and are responsible for generating and supplying electricity to all sectors in the economy.57El Dobeissy and Otayek, “The Potential of Electricity Interconnections.”

The EU’s internal energy market policies are a model for regulatory convergence, emphasizing transmission ownership unbundling between electricity generation or supply companies and transmutation ones, consumer rights, and the role of regulatory actors such as the Agency for the Cooperation of Energy Regulators (ACER).58“Internal Energy Market,” Fact Sheets on the European Union, April 2024, https://www.europarl.europa.eu/factsheets/en/sheet/45/internal-energy-market. The EU’s Electricity Directive 2019/944 mandates nondiscriminatory access to transmission and distribution systems, a principle that could be adapted for the Eastern Mediterranean to attract private investment.59Ibid.

However, this EU model cannot be fully replicated in the Eastern Mediterranean due to different system maturity levels. The Association of Mediterranean Energy Regulators (MEDREG), comprising twenty-seven energy regulators from twenty-two countries, recommends that regulatory frameworks must be tailored to specific subregional contexts, and that Eastern Mediterranean countries need to develop more regulatory solutions independent from those of the EU.60Francesco Valezano, “Decarbonization, Decentralization and Digitalization in the Mediterranean,” Revolve, August 12, 2019, https://revolve.media/features/decarbonization-decentralization-and-digitalization-in-the-mediterranean.

Progress in regulatory harmonization could also increase infrastructure investments significantly in the Eastern Mediterranean. However, this progress is slow due to the region’s diverse regulatory environments, with countries such as Syria, Lebanon, Turkey, and Egypt maintaining state-controlled energy sectors, while others like Greece and Cyprus align with EU directives to liberalize the energy market. Overcoming these disparities will require sustained dialogue, capacity building, and incentives for alignment.

Energy diplomacy: Transforming geopolitical challenges into opportunities

Geopolitical tensions are another major barrier to cooperation in the Eastern Mediterranean. Political and security dynamics significantly influence energy cooperation in the region. Long-standing disputes—such as those between Greece, Turkey, and Cyprus over maritime boundaries, the Syrian civil war, the unresolved Cyprus question, the recently intensified Israeli-Palestinian conflict, and the Israel-Lebanon conflict—have all historically hindered regional collaboration and the development of cross-border infrastructure, particularly affecting projects like the EastMed Gas Pipeline.61Rau, Seufert, and Westphal, “The Eastern Mediterranean as a Focus for the EU’s Energy Transition.” Overcoming these challenges will require financial resources as well as diplomatic engagement and innovative governance structures.

However, the shift toward renewable energy and the EU’s focus on a green energy economy present new opportunities for cooperation. Initiatives such as the East Mediterranean Gas Forum (EMGF)—established in 2019 as a platform focused on natural gas development, it includes Egypt, Greece, Cyprus, Israel, Jordan, and the Palestinian territories, along with France and Italy—can be both reformed to become more inclusive of all Eastern Mediterranean counties and expanded beyond natural gas to include renewable energy, power infrastructure, and advancing electricity interconnection and trading.62Ariel Ezrahi, “An Energy and Sustainability Roadmap for the Middle East,” Atlantic Council, November 22, 2024, https://www.atlanticcouncil.org/in-depth-research-reports/report/an-energy-and-sustainability-road-map-for-the-middle-east/. Some energy policy experts have advocated for renaming the EMGF as the East Mediterranean Energy Forum (EMEF) to reflect this broader mandate.63Ibid. Such a forum should include a regulatory platform, in which each country is represented by its national regulatory authority or electricity governing body, to jointly promote greater harmonization of regional energy markets and legislation.

Energy cooperation is increasingly recognized as a tool for regional stability and economic integration. The development of renewable energy projects and interconnectors can create shared economic interests, reducing the potential for conflict.64“Rethinking Gas Diplomacy in the Eastern Mediterranean,” International Crisis Group, April 26, 2023, https://www.crisisgroup.org/middle-east-north-africa/east-mediterranean-mena-turkiye/240-rethinking-gas-diplomacy-eastern; “Regional Integration: Sub-regional Regulatory Convergence,” Association of Mediterranean Energy Regulators, December 2020, https://www.medreg-regulators.org. This approach transforms energy from a source of competition to a platform for collaboration, potentially easing long-standing tensions through mutual economic benefits and shared climate goals.

An increased shift toward renewable energy sources not only ensures long-term sustainability and economic benefits for the region, but also has higher potential than gas diplomacy. Unlike natural gas and other tradable commodities, renewable energy systems are an undisputed resource. Additionally, collaboration on renewable energy projects through interconnections provides synergies between partnering countries due to the benefits they provide to both grids.

Shared horizon: Finance and diplomacy for a unified Eastern Mediterranean energy landscape

The Eastern Mediterranean stands at the cusp of a transformative energy transition in which innovative financing can simultaneously advance technological leapfrogging, economic development, and regional cooperation. By strategically structuring investment mechanisms that require collaboration, the region can convert financial transactions into diplomatic bridges.

Financial innovation offers three distinct diplomatic dividends beyond its direct economic benefits.

First, joint financing creates structured engagement opportunities that maintain dialogue even during political tensions. When countries coinvest in renewable infrastructure through mechanisms such as regional green bonds or mixed-ownership projects, they establish technical and financial communication channels that persist through diplomatic fluctuations. These ongoing interactions build relationships among technical experts and financial officials that can later facilitate broader cooperation.

Second, shared financial liabilities transform political calculus by creating mutual dependencies. When neighboring countries with historical tensions become co-guarantors of infrastructure loans or joint issuers of project bonds, they develop a tangible economic interest in maintaining stable relations. The economic costs of diplomatic ruptures become quantifiable and immediately visible to stakeholders on all sides.

Third, financial innovation creates positive-sum narratives in a region often characterized by zero-sum competition. By enabling countries to collectively tap into previously inaccessible capital pools—such as global ESG funds seeking large-scale sustainable investments—regional financial mechanisms demonstrate that cooperation delivers benefits unattainable through individual action.

If the Eastern Mediterranean realizes this vision of financially driven integration, it could emerge as a global model for how innovative capital structures can overcome entrenched geopolitical challenges. The region’s abundant renewable resources, which have the potential to generate more electricity than its projected future demand, provide the natural foundation, while innovative financing creates the institutional architecture for a sustainable energy future that transcends historical divisions and creates shared prosperity across borders.

The path forward requires financial creativity, diplomatic persistence, and technical expertise—but the potential rewards extend far beyond renewable kilowatts to include a fundamental reconfiguration of regional relationships built on shared economic interests rather than historical grievances.

Acknowledgments

The Atlantic Council would like to extend special thanks to Limak Holding for its valuable support for this report.

About the author

Karim Elgendy

Executive Director,

Carboun Institute;

Associate Fellow,

Chatham House

Karim Elgendy is an expert on energy transition and climate policy in the Middle East and North Africa. His research examines the intersection of climate diplomacy, energy geopolitics, and sustainable development across the region. Elgendy investigates how countries navigate energy transitions and climate change impacts within shifting geopolitical landscapes, and analyzes how regional and global power dynamics influence climate action and policy implementation. He possesses deep expertise in energy and climate policies across the Eastern Mediterranean and Gulf Cooperation Council states, with particular focus on renewable energy, climate resilience, and diplomacy.

Elgendy has authored numerous articles and policy publications in leading journals and platforms. He has presented at over one hundred public speaking engagements and has delivered guest lectures at several prestigious universities. His expert analysis is regularly featured in broadcast, print, and digital media outlets, and he has appeared in most mainstream media outlets.

Appendix: Acronym glossary

| Acronym | Full name |

| ACWA Power | Arabian Company for Water and Power Development |

| ADB | Asian Development Bank |

| AIIB | Asian Infrastructure Investment Bank |

| COP | Conference of the Parties (UN Climate Conference) |

| EBRD | European Bank for Reconstruction and Development |

| EDL | Electricité du Liban |

| EIB | European Investment Bank |

| EMEF | East Mediterranean Energy Forum (proposed) |

| EMGF | East Mediterranean Gas Forum |

| ENTSO-E | European Network of Transmission System Operators for Electricity |

| ESG | Environmental, social, and governance |

| GEF | Global Environment Facility |

| GREGY | Greece-Egypt Interconnector |

| GCF | Green Climate Fund |

| IEC | Israel Electric Corporation |

| IsDB | Islamic Development Bank |

| MDBs | Multilateral development banks |

| MEDREG | Association of Mediterranean Energy Regulators |

| PV | Photovoltaic |

| RCC | Regional Coordination Committee |

| RIG | Regional Implementation Group |

| RSG | Regional Stakeholder Group |

| SEMED SEFF | Southern and Eastern Mediterranean Sustainable Energy Financing Facility |

| TSO | Transmission System Operator |

| UAE | United Arab Emirates |

Explore the program

The Atlantic Council Turkey Program aims to promote and strengthen transatlantic engagement with the region by providing a high-level forum and pursuing programming to address the most important issues on energy, economics, security, and defense.

Image: Photo by Efe Kurnaz on Unsplash