“Salute to the Houthis!” This nationalist cheering appeared across Chinese social media as Western commercial vessels ran a gauntlet of drone and missile attacks in the Red Sea against ships they claimed were traveling to Israel. Meanwhile, ships marked “Chinese Vessel & Crew” sail through these same waters relatively untouched. It’s not a coincidence. Maritime tracking data now confirms what Houthi officials have been openly sharing: Chinese ships receive special treatment in a conflict zone that has become a crucible of hostility toward US interests.

This preferential treatment is no accident, but rather the result of careful diplomatic choreography. Recent US Treasury sanctions reveal that Houthi leaders, including Mohamed Ali al-Houthi of the Supreme Political Council, coordinated directly with Chinese officials to guarantee their vessels would not be targeted. This informal pact was formalized during diplomatic talks in Oman, culminating in explicit safe passage guarantees, even as drone and missile strikes against US and other Western shipping escalated. While Houthi officials publicly claim to discriminate between Western and Chinese vessels, their targeting systems remain rudimentary and prone to error, occasionally resulting in mistaken attacks on Chinese ships traversing the narrow Bab el-Mandeb strait, but have shown progress in improving their accuracy, thanks to Chinese technology.

For Beijing, its real battle starts on the economic front via the Islamic Republic proxies, where control of vital maritime corridors potentially yields greater advantages than any negotiated trade agreement.

SIGN UP FOR THIS WEEK IN THE MIDEAST NEWSLETTER

This strategic calculation is reflected in China’s official messaging. Xinhua News Agency portrays the crisis as revealing “United States’ impotence” against “non-traditional opponents like the Houthis” while claiming US military intervention has “only triggered more resistance” and exposed “the decline of US economic influence and the gradual disintegration of its alliance system.” Behind this rhetoric lies a clear economic imperative: transit the Red Sea. For Beijing, preserving freedom of movement in this corridor is non-negotiable. While overall shipping traffic through the Red Sea has plunged by nearly 70 percent since attacks began, the proportion of China-linked tonnage has surged, a silent testament to the effectiveness of the arrangement.

The impact on European economies has been severe. Major European shipping companies have been forced to reroute vessels around the Cape of Good Hope. This creates an artificial competitive advantage for Chinese goods, which continue to flow unimpeded through the Red Sea corridor while European competitors face delays and higher expenses. German and French manufacturers are already reporting supply chain disruptions and lost market share to Chinese competitors, a tangible economic victory for Beijing, which was achieved primarily through proxy conflict rather than direct trade competition with the United States.

This arrangement goes beyond short-term tactical cooperation. US sanctions against Chinese satellite and shipping firms provide evidence that Beijing’s technological and logistical support has strengthened Houthi capabilities and created advantages for Chinese maritime interests. Multiple Chinese companies, including Shenzhen Boyu Imports and Exports among others, have been sanctioned for supplying dual-use components that bolster the Houthis’ missile and UAV capabilities. Beijing may not be firing missiles, but it supplies the parts, the software, and the satellite eyes that help aim them.

China’s technological and diplomatic support network

In April 2025, the United States sanctioned Chang Guang Satellite Technology Co. Ltd. (CGSTL) for providing satellite imagery to Yemen’s Houthis that enabled precise strikes on US naval assets in the Red Sea. CGSTL had previously been sanctioned in 2023 for providing battlefield intelligence during its military operations in Ukraine, establishing a pattern of the company acting as a de facto intelligence asset for US adversaries. But CGSTL is no ordinary company, embedded within the Chinese Academy of Sciences and backed by Jilin’s provincial government, it exemplifies China’s military-civil fusion policy, functioning more as an extension of Beijing’s intelligence apparatus than an independent enterprise. Despite Washington’s repeated warnings, Beijing has maintained a posture of strategic denial: providing the tools of war while feigning neutrality and taking no visible corrective action.

The technology pipeline from China to the Houthi forces represents a sophisticated approach to proxy warfare. The New York Times documented Chinese-origin hydrogen fuel cells recovered from Houthi drones used in shipping attacks, which extended flight range and reduced detectability. Perhaps most damning was the interception of 800 drone propellers with Chinese identifiers at the Omani border, the same model identified in UAVs used by the Houthis, Iranian-aligned militias in Iraq, and Russian-backed forces in Ukraine. Rather than shipping complete weapons systems, China exports the critical components, guidance modules, propulsion systems, and power supplies, allowing non-state actors to wage asymmetric warfare while Beijing maintains plausible deniability through intermediaries like online vendors operating through Chinese e-commerce platforms.

Iran gains leverage, China gains reach

China’s support for Iran strategically allows Beijing to reach its objectives without direct involvement or accountability. In January 2025, two Iranian ships carried over one thousand tons of sodium perchlorate from China to Iran’s Bandar Abbas port, an essential ingredient for solid missile fuel. That’s enough to manufacture around 260 medium-range missiles. While China has supplied missile technology to Iran for decades, the scale and visibility of these shipments signal a strategic expansion in the partnership despite China’s denial of involvement.

The implications ripple across the region. As Iran’s missile program grows, so does its capacity to arm and sustain proxy groups like the Houthis in Yemen. These groups don’t need long-range missiles; they need enhanced UAVs, better targeting systems, and reliable supply chains, all of which have visibly improved. China doesn’t have to arm the Houthis directly. Strengthening Iran enables a regional network that quietly serves Chinese interests by keeping the United States entangled in costly, low-return conflicts.

The quiet alignment between Beijing and Tehran came into sharper focus on April 26, 2025, when a large explosion hit the Bandar Abbas port. While Iranian officials denied importing missile fuel, private security company Ambrey confirmed the port had received these chemicals from China in March. Around the same time as the satellite company sanctions, Washington also targeted companies involved with the Tinos I, a Panama-flagged tanker that secretly carried Iranian oil to China. This operation was backed by Iran’s Revolutionary Guard Corps, creating a two-way street: Iran gets money for its oil, and China gets both fuel and influence.

China’s strategic ambiguity and dual narrative

Beijing has perfected a two-track approach to the Red Sea crisis. Publicly, Chinese officials initially avoided condemning Houthi attacks, instead calling vaguely for “relevant parties” to play “constructive” roles in maintaining stability. Only as international pressure mounted did China’s United Nations representatives acknowledge Houthi disruption of trade, while Chinese vessels continued receiving preferential treatment through Houthi waters.

This calculated ambiguity extends to social media, where Chinese users openly celebrate Houthi attacks on Western interests, with one boldly stating: “I want to see news of American and British warships being blown up,” sentiments mirroring earlier support for forces opposing Western interests in Ukraine and Gaza.

China’s approach is strategically precise: Beijing doesn’t want Houthi forces to either triumph completely or collapse. It needs them to be active and disruptive, just enough to keep US naval resources tied up while Chinese ships sail through relatively unimpeded. Every Houthi missile that doesn’t target a Chinese vessel becomes a tax on American presence, a stress test for global shipping, and a demonstration of how much disruption Western powers can absorb before retreating or escalating.

The Russia-China-Iran nexus

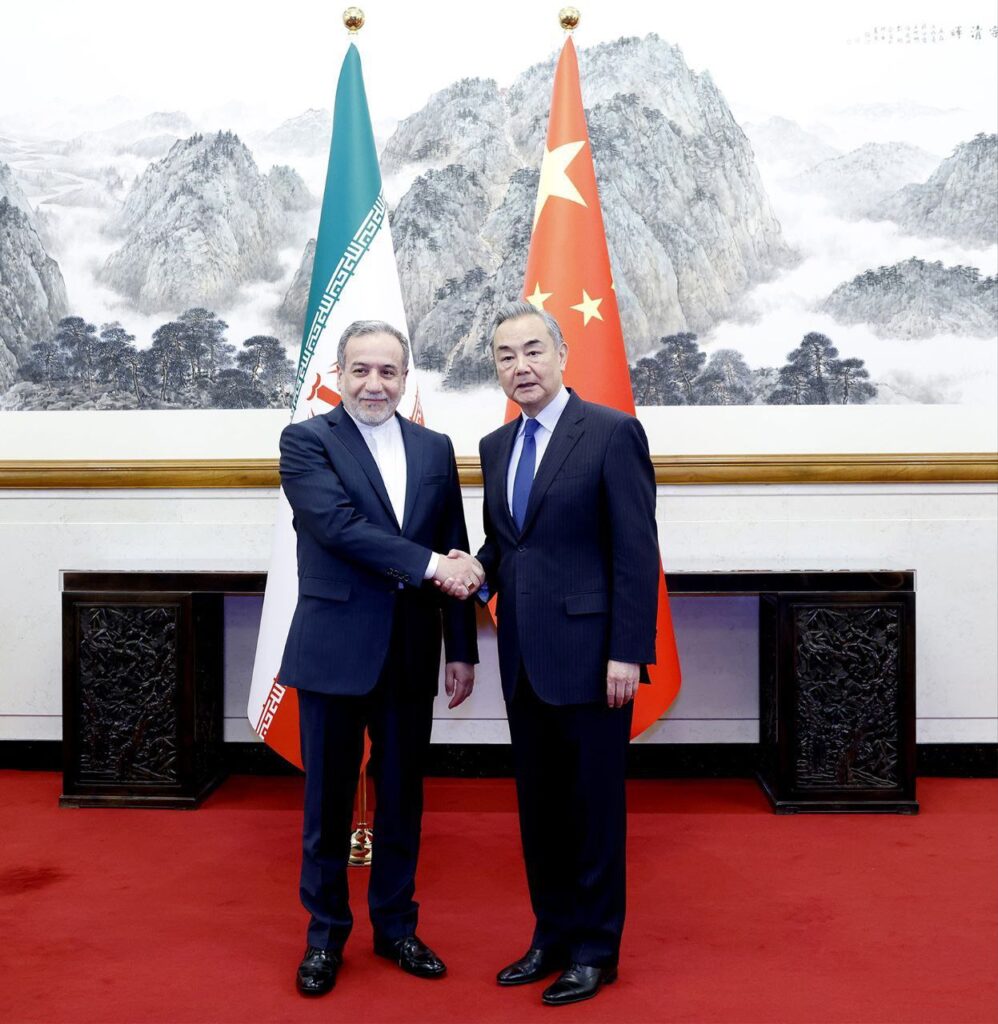

This alignment is now formalized through strategic coordination. Iranian Foreign Minister Abbas Araghchi’s strategic visits to Moscow and Beijing ahead of each US negotiation round in April 2025 reveal a deliberate synchronization of diplomatic positions. Their March 2025 trilateral talks in Beijing produced a unified stance against Western pressure, with China proposing alternatives directly challenging US positions.

Beyond diplomacy, Russia could potentially take custody of Iran’s highly-enriched uranium in future deals, providing technical cover for Iran’s nuclear program. Meanwhile, Chinese firms supply the dual-use technologies empowering Iran’s proxies, including the Houthis. The same drone components documented in Houthi arsenals have appeared in Ukraine, following an identical playbook of low-cost attrition, proxy warfare, and Western hesitation.

This alliance continues to deepen, as evidenced by Russian President Vladimir Putin’s recent twenty-year strategic partnership with Iran in April 2025. While China supplies technology and Iran manages proxies, Russia provides diplomatic cover and international legitimacy, creating a sophisticated system for reshaping regional power dynamics without direct confrontation, while securing preferential maritime passage for Chinese vessels.

Business first, influence follows

Beijing’s approach to the Houthis represents calculated and deliberate statecraft, not opportunistic coincidence. The Houthi movement now operates with Chinese satellite technology that they could never independently develop, and launches strikes using guidance systems built from Chinese electronics. Washington can sanction individual companies, but unless it confronts the triangulated relationship between China, Iran, and regional proxies, it will always be playing catch-up as Chinese vessels continue to navigate contested waters with relative security.

If Washington truly wants to win its economic competition with China, it should focus less on tariffs and more on territorial contestation, pushing China out of strategic regions like the Red Sea, where physical presence, not paper restrictions, determines the future of markets. This requires building stronger strategic relationships with European allies, who are being courted now by China against the United States, who are suffering the economic consequences of this crisis, and who have shared interests in preserving free navigation through vital maritime corridors.

Equally important is engaging with the Yemeni people themselves, who are tired of being manipulated by international powers and feel unheard in discussions about their country’s future. Any sustainable solution must address their legitimate grievances rather than treating Yemen merely as a venue for great power competition.

Ultimately, Washington must understand that Yemen is no longer a peripheral conflict. It is a live demonstration of how China converts commercial access into strategic leverage, curating conflict, denying responsibility, and watching as US power is bled by a thousand proxy cuts. Meanwhile, while American policymakers debate whether the Houthis are even worth worrying about, Beijing is busy carving safe lanes for its ships and weaponizing instability to tilt global trade in its favor. And as Chinese netizens jubilantly salute the Houthis online, Beijing’s calculated gambit in the Red Sea will continue to yield dividends that no trade negotiation could ever deliver.

Fatima Abo Alasrar is a Senior Analyst with the Washington Center for Yemeni Studies and a Board Member of Peace Track Initiative. She can be found on X at @YemeniFatima.

Further reading

Thu, Apr 10, 2025

No, Iran didn’t abandon the Houthis. It just wants Trump to think so.

MENASource By

Instead of interpreting Iran's narrative shift as a break from the Houthis, we might see it as tactical storytelling. And the story's working.

Fri, Mar 14, 2025

The United States’ Houthi terrorist designation unmasks Russia’s Yemen strategy

MENASource By

Yemen's Houthi rebels have become a tool of foreign powers, shifting from an Iran proxy to a Russian asset.

Wed, Mar 19, 2025

Trump’s military cudgel in Yemen will not achieve US regional objectives

MENASource By

Donald Trump risks falling into US pattern of short-sighted military action at the expense of constructing a sustainable plan for Yemen.

Image: An aerial view of the Greek-flagged oil tanker 'Sounion' draws worldwide attention in August 2024 after it is heavily damaged by Houthis in multiple attacks off Yemen at Piraeus anchorage in Piraeus, Greece, on March 21, 2025. (Photo by Nicolas Koutsokostas/NurPhoto)NO USE FRANCE