Hong Kong is the quintessential geoeconomic city. For decades, it has served as the link between the East and the West—the gateway for foreign capital and finance to meet Chinese markets, and for China’s markets to access the world. Hong Kong’s export-oriented, services-forward economy was the template for new financial centers across emerging markets. It was part of the original “Asian Tigers” that witnessed rapid economic growth since the 1960s.

Over the past five years, however, Hong Kong has dealt with serious geopolitical headwinds from China. The protests of 2019-2020 captivated the world, and the resulting National Security Law, enacted to tighten Beijing’s control over the city, have left a deep mark on Hong Kong. When we arrived there on March 17, many of the people we met went out of their way to tell us how different the city was than before.

Of course, it wasn’t just the new law that has changed the atmosphere in Asia’s main financial hub. Hong Kong has also dealt with the aftermath of the COVID-19 pandemic, the resulting economic slowdown in the city and elsewhere in China, and its own budget issues. But earlier this year, Hong Kong seemed to be turning a corner. Five years on from the passage of the law and with some signs of economic stimulus from mainland China, the city appeared poised to recapture a little of its lost magic. Then, a series of new headwinds emerged, each one threatening the city and, by extension, economic growth across the region. Here’s what we heard on the ground in our conversations with individuals in both the public and private sectors.

1. US economic slowdown is a self-inflicted wound

Gross domestic product (GDP) forecasts for the United States continue to be revised downward from expectations at the beginning of the year. While we were in Hong Kong, data showed that US core inflation came in slightly below expectation but consumer sentiment declined further. The bankers we spoke to in Hong Kong realized the same thing that their counterparts in New York realized a few weeks ago: US President Donald Trump is serious about tariffs. Federal Reserve Chair Jerome Powell’s press conference on March 19 dominated financial coverage in Asia, especially his point that tariffs would be inflationary.

How did people in Hong Kong react? Uncertain, chaotic, and destabilizing—these were the words we heard used to describe the trade actions of the Trump administration in conversation throughout the week. It was interesting to us that multiple people wanted to emphasize that China was now a “stabilizing” force in the international system while the United States was the opposite. Take it or leave it—that was the message nearly everyone we met wanted to deliver. The other sentiment expressed was relief that the United States was fighting a trade war with Canada and not—at least not yet—with China. Many bankers were surprised the tariffs were only at 20 percent, believed China could largely mitigate the effects at that rate, and felt Beijing was eager to start trade negotiations with the White House.

2. China’s green shoots may be a false spring

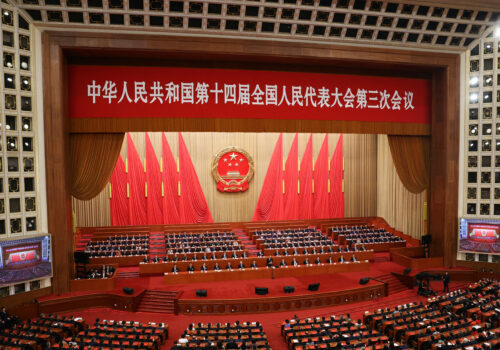

At China’s premier annual economic and political event, the “two sessions” conference earlier in the month, Chinese officials attempted to bolster investor and consumer confidence in the Chinese economy and project Beijing as the protector of the multilateral system. Many banks we met with felt China was finally turning the corner when it came to stimulus.

But after our formal meetings, we got a bit of a different message from analysts. The macroeconomic data on China shows only moderate investment growth, much less than the government action that is needed to address the short- and medium-term problems. These problems include lagging implementation of fiscal reforms and a property market that has not come close to recovery. As one banker put it to us, “They are doing just enough to stay stuck in neutral.”

3. Technology is China’s game-changer—but may trigger a backlash

This year, there’s been a shift in the narrative on China’s economy, propelled by successes in technology in electric vehicles and artificial intelligence. Through automaker BYD and AI platform DeepSeek, China seems again to have found the two-step formula of past success: First, create lower-cost products that are high on the technological value chain, potentially improving exports and domestic productivity. Then, find emerging markets that want these exports and can’t afford the cost of Western tech. It’s Huawei all over again.

All of this goes to show that the approach of limiting exports to China, including advanced semiconductors, can be overcome through massive investments in human capital and computing. The question is how the Trump administration will respond to this newest wave of breakthroughs. On TV while we were on our trip, there was a great deal of coverage of BYD’s latest advancement, an electric vehicle that could charge in as fast as five minutes. As the broadcasters pointed out, five minutes is faster than visiting a gas station.

4. The dollar continues to bind Hong Kong to the West

The strongest link between the United States and Hong Kong remains the Hong Kong Dollar (HKD), which has been pegged to the US dollar since 1983 through the Linked Exchange Rate System. The peg, of course, means that Hong Kong imports its monetary policy from the United States. The HKD permits capital inflow and outflow through offshore renminbi (CNH) clearing, differentiated from onshore renminbi (CNY), which faces stricter capital controls. China obviously benefits from this capital inflow, but it appears increasingly concerned about capital flight occurring through HKD as a conduit. In the short term, China is unlikely to change the peg, but we are twenty-two years away from the expiration of the original terms of the British handover of Hong Kong in 2047. At that point, the future of HKD and Hong Kong more broadly will be as much about territorial sovereignty and geopolitical realities as its role in global finance.

But this goes beyond currency. Hong Kong had previously positioned itself as the site of renminbi internationalization and a market for “dim sum” bonds (offshore renminbi-priced bonds issued in Hong Kong by Chinese and international companies), but the price for unfettered internationalization—loosening up the capital controls—is not something Beijing is seemingly willing to pay. At the same time, while we were there, multiple people told us there’s interest in expanding the “dim sum” bond market. That kind of move would get the attention of bankers and regulators all over the world.

On the regulatory side, Hong Kong’s legislators intend to pass stablecoin regulation smoothly, with regulators moving quickly to establish licensing frameworks that support the growth of domestic fintechs and attract new businesses. Some bankers we spoke with are worried about potential dollarization in neighboring emerging markets from stablecoins, and the international spillovers from the Trump administration’s crypto policy both for financial stability and illicit finance.

These tenuous interlinkages are a part of the tension of Hong Kong. It is a city built on furthering a Western capitalist system—but is increasingly not governed that way.

Hong Kong remains the quintessential geoeconomic city, but its future is uncertain. In the decades after the Cold War, Hong Kong could balance between East and West since both systems benefited from mutual access to the city. Now this question has been raised: What are the US and Chinese long-term interests in maintaining Hong Kong as the gateway between East and West? The answer is being decided now, and everyone in the city can feel it.

Josh Lipsky is the senior director of the Atlantic Council’s GeoEconomics Center. He was previously a senior advisor at the International Monetary Fund.

Ananya Kumar is the deputy director, future of money, at the Atlantic Council’s GeoEconomics Center.

Further reading

Fri, Mar 14, 2025

Five takeaways from Beijing’s largest annual political meetings

New Atlanticist By Melanie Hart

Chinese leaders signaled that they will stick to their state-managed economic approach and view Washington as their greatest external threat.

Tue, Mar 25, 2025

Dispatch from Hong Kong: The Panama Canal port sale has put Chinese authorities in a bind

New Atlanticist By Josh Lipsky

Hong Kong-based CK Hutchison Holdings’ decision to sell its Panama Canal ports to BlackRock stunned officials in Hong Kong and Beijing.

Fri, Mar 21, 2025

China’s exploitation of overseas ports and bases

Issue Brief By Thomas X. Hammes

The control and administration of overseas ports and bases by China poses a serious risk to the United States in the event of a potential conflict. The Chinese People’s Liberation Army could exploit these ports and bases to challenge control of the sea.

Image: The Hong Kong skyline is visible from Victoria Peak in Hong Kong on February 25, 2025. (Photo by Vernon Yuen/NurPhoto)