Donald Trump’s decision to be the first US president/president-elect to speak with a Taiwanese leader since 1979 has unleashed anger in mainland China. Condemning Trump’s conversation with President Tsai Ing-wen, China’s Foreign Ministry declared that if Washington fails to respect Beijing’s interests in Taiwan, the “healthy development of China-US relations and bilateral cooperation in important areas is out of question.” A leading American expert on cross-strait relations wrote in the Washington Post that Trump’s “apparent careless indifference” to the One China policy “runs the risk of grossly destabilizing US-China relations, and even risks war.”

Geopolitical analysts cannot ignore the risks of the following potential scenario: It’s 2020 and the Trump administration’s pro-Taiwan foreign policy prompts officials in Taipei to declare Taiwanese independence, resulting in the People’s Liberation Army (PLA) forcefully reuniting Taiwan on the verge of the 100th anniversary of the founding of the Chinese Community Party. Within three days the PLA captures the island and secures it under Beijing’s control, creating ripples throughout the entire Pacific region and beyond.

Although this “China storms Taiwan” scenario would unfold far from the United Arab Emirates’ shores, it could severely threaten the Arab Gulf country’s vital geopolitical and economic interests. At the same time, however, and of course depending on how events unfold following a forceful reunification, the UAE has the potential to benefit from such a global security crisis.

Since 1949, Taiwan has maintained self-rule. Yet its de facto independence has come at the cost of denied recognition from and membership in the United Nations instigated by Chinese claims of sovereign rights over the island. By pulling multiple levers, Beijing has discouraged governments around the world from officially recognizing Taiwan or forming any official diplomatic relations with the administration in Taipei. Under such circumstances, Taiwan only enjoys full diplomatic relations with twenty-one UN member states (all in Africa, the Americas, and Oceania) plus the Holy See.

Despite failing to receive UN recognition as an official state, Taiwan has become one of Asia’s biggest traders and holds a position in the top category of computer technology producers. Taiwan’s role as an important gateway to trade investment in East Asia and mainland China has helped it slowly develop deep economic relations around the world. One such relationship is reflected by its gradually flourishing relationship with the UAE. Former Taiwanese President Ma Ying-jeou underscored this notion by stating that Taiwan-UAE trade exchanges have increased over the past few decades. Trade between the two reached $6.7 billion in 2013 with about 75 percent being Emirati exports to Taiwan. The UAE’s main exports to Taiwan are oil, gas, and aluminum. Taiwan mainly sells auto parts, accessories, electronics, machinery, and textiles to the UAE.

Like Taiwan, the UAE holds geostrategic significance as a crossover between Asia, the Middle East, Africa, and Europe. The Arab Gulf country is an immense attraction for Taiwanese businesses in particular, partly due to the announcement of direct flights between the two destinations in 2014. Moreover, Taiwan’s values, interests, and ambitions align with those of the UAE, thus facilitating and encouraging the establishment of Taiwanese enterprises in the Emirates’ energy, construction, environment, and information and communication technology sectors.

However, the growing UAE-Taiwan relationship does not tell the whole story. The One China policy is a reminder that certain conditions limit existing partnerships with Taiwan. The policy dictates that countries which wish to have diplomatic relations with the People’s Republic of China (PRC) must break official relations with the administration in Taiwan, officially known as the Republic of China (ROC), and vice versa. Establishing “official” diplomatic relations with one of the states signifies an acceptance that this entity is the single legitimate representative of the whole of China. Put simply, official norms of international relations do not define the activities between the UAE and Taiwan because Abu Dhabi recognizes Beijing, holding formal diplomatic connections with the PRC instead of the ROC.

The UAE’s support for China’s stance on Taiwan factors into the economic relations between the Emirates and China which have boomed since Abu Dhabi and Beijing established formal diplomatic relations in 1984. China, the largest trading partner with the Arab Gulf, is the UAE’s top import partner and fourth-largest export partner (behind Iran, India, and Japan). The UAE is China’s second-largest trading partner in the Persian Gulf and the largest Middle Eastern market for Chinese products, accounting for one-third of China’s trade with the Gulf Cooperation Council (GCC) countries and 20 percent of all Sino-Arab trade. According to the Dubai Economic Council, total trade is expected to reach $60 billion this year, up from $54.8 billion in 2015. Furthermore, the UAE is vital for the Chinese economy, because the Arab Gulf country functions as the Chinese product “transfer center” or “lily pad” to Middle Eastern and African markets. Abu Dhabi and Beijing have also signed agreements to foster reciprocal cooperation in the aviation, health, and legal sectors to include support for China’s One Belt, One Road initiative.

China depends on the growth of its economy and subsequently its armaments industry to provide the required military strength to capture Taiwan and to simultaneously deal with Washington’s response to Beijing’s possible seizure of the island. Aside from military might, China’s capacity for weapons research and manufacturing has greatly increased, boosting its military deterrence and thus posing a grave threat to self-rule in Taiwan. Among the new weapons China acquired, both locally produced and purchased from Russia, were nuclear-powered and conventional submarines, strategic bombers, stealth fighters, early warning aircraft, and ballistic and air defense missiles. The implications are that any decline in Chinese productivity will damage Beijing’s ability to launch an armed adventure against Taiwan. This decline may occur if there were to be another global economic crisis brought on by other regional risk factors in the next five to ten years.

As the UAE enjoys strong multilateral trade relationships with both China and Taiwan, a conflict between the two would negatively affect the Arab Gulf country’s exports. Increasing outlays on military armaments would redirect expenditures toward defense and away from trade, causing the UAE to suffer economic losses.

On the other hand, if lasting unification results in the predicted politically, militarily, and economically stronger “United China” then the UAE should expect to reap even greater profits with the Taipei, Beijing, and Hong Kong districts now acting under an umbrella of cooperation comprised of shared knowledge, capabilities, and resources, thus invoking the full potential of China. However, it must be kept in mind that China has been known to breach its pledges on numerous occasions in the case of its unification with Hong Kong, so the UAE must remain aware and informed of potential alternative outcomes.

The UAE must maintain awareness of the Trump administration’s policy toward the ongoing dispute between Taiwan and China, and be cognizant of Beijing’s moves and motives on and against Taiwan. Specifically, the UAE sees the China question brought up by Trump to be one of navigation through unmarked waters, where preparation and foresight will be a federal requirement. Emirati officials know that Taiwan is now a high-stakes question, and there is serious thinking required about protecting the Arab Gulf country itself and its interests in light of a Taiwan Strait crisis. Finally, a key question is whether the UAE will see eye to eye on Trump’s use of Taiwan as bargaining chip with China. With Trump, the UAE faces a different geo-economic reality with the United States likely to be more aggressive with China. Consequently, the stakes are high.

Theodore Karasik is the senior advisor at Gulf State Analytics (@GulfStateAnalyt), a Washington, DC-based geopolitical risk consultancy. Giorgio Cafiero is the CEO of Gulf State Analytics.

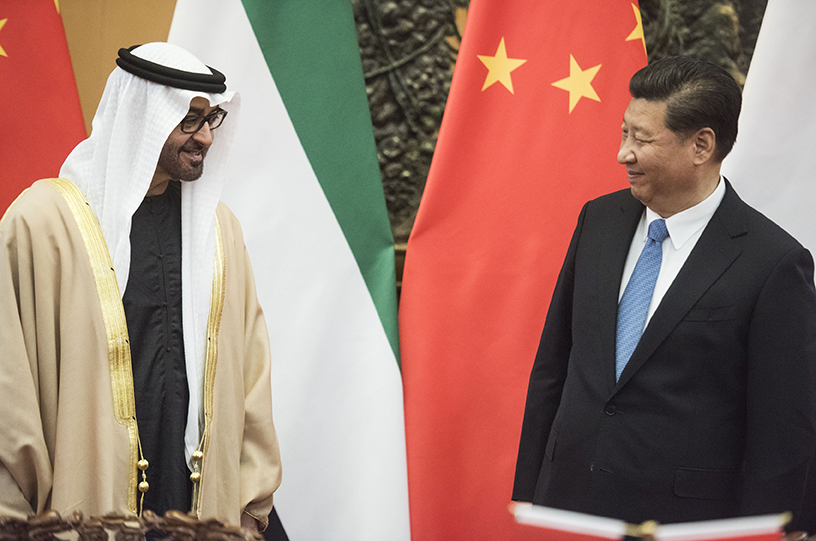

Image: Sheikh Mohammed bin Zayed al-Nahyan (left), crown prince of Abu Dhabi and deputy supreme commander of the United Arab Emirates’ armed forces, met Chinese President Xi Jinping in Beijing on December 14, 2015. (Reuters/Fred Dufour)