JUST IN

Laissez-faire economics is out; less-than-it-was economics is in. On Tuesday, the International Monetary Fund (IMF) released its latest World Economic Outlook (WEO), which cut its projection for global growth in 2025 to 2.8 percent, down from 3.3 percent in its January forecast, with US growth now pegged at 1.8 percent, down from 2.7 percent. Driving a significant part of these downward revisions are US President Donald Trump’s tariff announcements, along with the associated policy uncertainty and push toward protectionism globally. “We are entering a new era,” the IMF’s chief economist said, as the “global economic system that has operated for the last eighty years is being reset.” Below, Atlantic Council experts at the IMF-World Bank meetings this week in Washington delve into the details and explore what it all means.

TODAY’S EXPERT REACTION BROUGHT TO YOU BY

- Josh Lipsky (@joshualipsky): Senior director of the Atlantic Council’s GeoEconomics Center and former adviser to the IMF

- Jeremy Mark (@jedmark888): Nonresident senior fellow at the GeoEconomics Center and former IMF communications specialist

- Elizabeth Shortino: Nonresident senior fellow at the GeoEconomics Center and former US executive director at the IMF

- Martin Mühleisen (@muhleisen): Nonresident senior fellow at the GeoEconomics Center and former IMF official

Prediction problems

- Predicting the economic future is difficult any time; even more so now. Josh points out that just last week, US Federal Reserve Chair Jerome Powell said “there isn’t a modern experience of how to think about this,” underscoring the difficulty in modeling the global impacts of the Trump tariffs. The new WEO is important, Josh adds, because in effect “the IMF said, ‘We’ll give it a try.’”

- That said, the IMF does hedge somewhat by offering three scenarios. Jeremy notes that the IMF officials focused on WEO’s “reference forecast,” which sees a 0.5 percentage point reduction in global output for all of 2025 when calculating the impact of all of Trump’s tariffs this year through “Liberation Day,” without the subsequent pauses. And it could turn out to be even worse than that, Jeremy adds, since some economists see IMF projections as “too inclined to accentuate the positive”

- “The recent rapid trade and market developments make it next to impossible to produce a reliable baseline forecast for global growth,” says Elizabeth. “The IMF also had to walk a fine line in assessing the impacts of US actions without too overtly criticizing its largest shareholder. Not an easy task on both counts.”

Sign up to receive rapid insight in your inbox from Atlantic Council experts on global events as they unfold.

Certain about uncertainty

- The word “uncertainty” appears more than one hundred times across the WEO and its companion document, the Global Financial Stability Report, Elizabeth notes. “This message is on point, as uncertainty abounds and poses its own strains on the global economy.”

- What does this uncertainty look like? In the United States, further stock market declines, higher interest rates, and exchange rate fluctuations have the potential to create “significant shocks that could destabilize financial markets,” Martin says. At the same time, the WEO states that a resolution of the tariff conflicts or an end to the war in Ukraine could provide a major boost to the global outlook.

- And yet, Martin says, “there should be no illusion about the risks facing the world economy, reminiscent of the last financial crisis, and continued uncertainty on tariffs and other policies risks moving markets closer to the abyss.”

- Those risks come out even more when you dig below the headline numbers. Jeremy notes that the projections of 4 percent growth for China this year and next year “probably won’t go over well in Beijing,” since they are below official figures. Elizabeth points to “a more dire scenario” for global growth nestled in the WEO if the United States extends the Trump first term tax cuts, China’s domestic demand continues to lag, and Europe’s productivity does not grow.

A recession by any other name

- Could the world be headed for a recession? Josh points out that the IMF is not projecting a global recession this year, even though the risk has increased. Moreover, Josh adds, what would qualify as a global recession is different from a recession in a single country, which is generally two consecutive quarters of negative growth.

- “When I was at the IMF, there was a debate about whether GDP growth under 2.5 percent would constitute a recession,” says Josh. “It seems like today the IMF has made a determination about what this looks like in the current situation—2 percent GDP growth—although they call it a global economic downturn.”

- Josh will be paying close attention to how IMF Managing Director Kristalina Georgieva answers the recession question in her Thursday press conference: “Just because the global economy isn’t in a recession by the IMF’s standards at the moment, it doesn’t mean in a few months we won’t cross the mysterious threshold.”

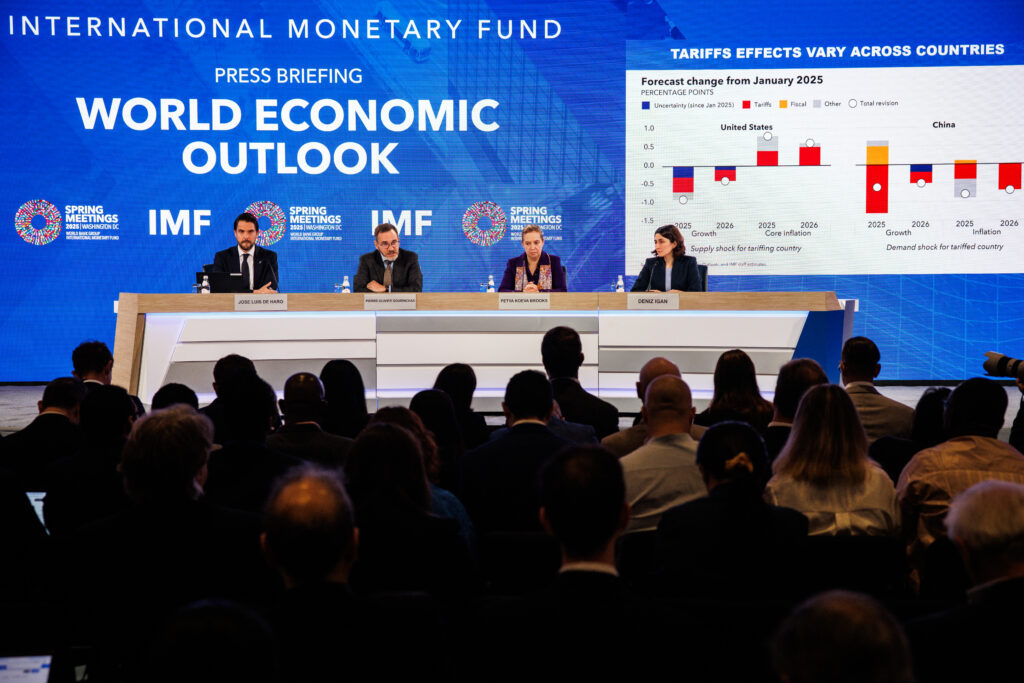

Image: Pierre-Olivier Gourinchas (2nd left), Director of the Research Department at the International Monetary Fund (IMF), speaks while a chart showing the IMFs predicted effects of tariffs on various countries is shown during a press briefing on the World Economic Outlook on April 22, 2025 in Washington, D.C. (Photo by Samuel Corum/Sipa USA)