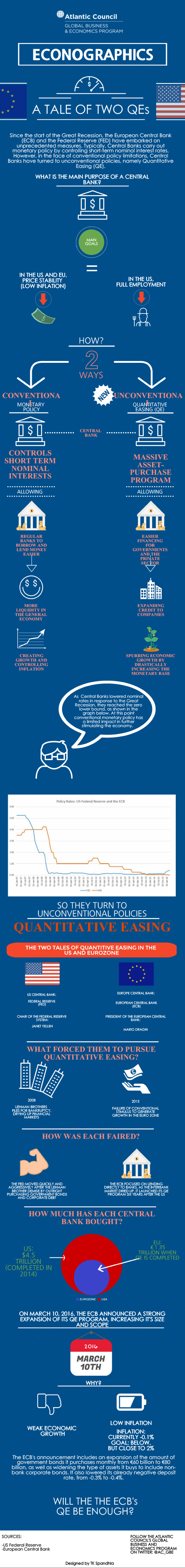

On March 10, the European Central Bank (ECB) announced an expansion of its Quantitative Easing Program (QE), increasing the amount of government bonds it buys monthly from €60 billion to €80 billion. It also extended the range of assets it purchases to include investment grade non-bank corporate bonds. On top of that, the ECB lowered already negative deposit interest rates further down, to -0.4%, and its main interest rate to 0%. So, why have Central Banks embraced QE?

Since the start of the Great Recession the ECB and the Federal Reserve (FED) have embarked on unprecedented measures. Typically, Central Banks carry out monetary policy by buying or selling short-term debt securities, affecting short-term nominal interest rates with the ultimate goal of maintaining price stability. However, as nominal rates reach the zero lower bound, the Central Bank’s ability to further stimulate the economy through conventional policy is limited.

In the face of this “liquidity trap”, Central Banks have turned to unconventional policies, namely QE. QE expands liquidity by dramatically increasing the monetary base, propping up inflation to the desired target level. This is achieved by a combination of large-scale asset purchases and lending programs, resulting in a reduction of real long-term interest rates.

The Fed and ECB have followed very different paths in pursuing QE. In the United States, the Fed moved quickly and aggressively after Lehman Brothers demise, outright purchasing government bonds and corporate debt. After several rounds of QE, the Fed finally halted purchases in 2014, having accumulating $4.5 trillion in assets. Overall, QE had the equivalent effect of a 2.5 percentage point cut in the federal funds rate, according to the FED’s own estimations.

Meanwhile, the ECB’s focused on lending directly to banks, as interbank markets dried up. At the same time, the ECB also bought covered bonds, a form of corporate debt. It was not until March 2015, six years after the US, that the ECB launched full-scale QE. The program is worth around €1.35 trillion in purchases of Euro Zone (EZ) government bonds, out of which around 0.6 trillion have already been spent. It was extended last December as inflation remained far below its 2% target. Finally, the ECB expanded its QE program again on March 10, aiming to reach 18% of the EZ GDP. For comparison, the Fed’s QE reached 25% of the US GDP. Will it be enough?