The Trump Administration’s “maximum pressure” approach against Iran to reduce Iranian crude oil exports to zero as soon as possible is expected to rattle markets and could undermine the credibility and effectiveness of US sanctions. This edition of the EconoGraphic outlines how re-imposed US sanctions against Iran will affect the global oil market, the price of oil, US consumers, and the American economy. In addition, we explore how Beijing might retaliate, if the People’s Bank of China (PBoC) is hit with secondary sanctions.

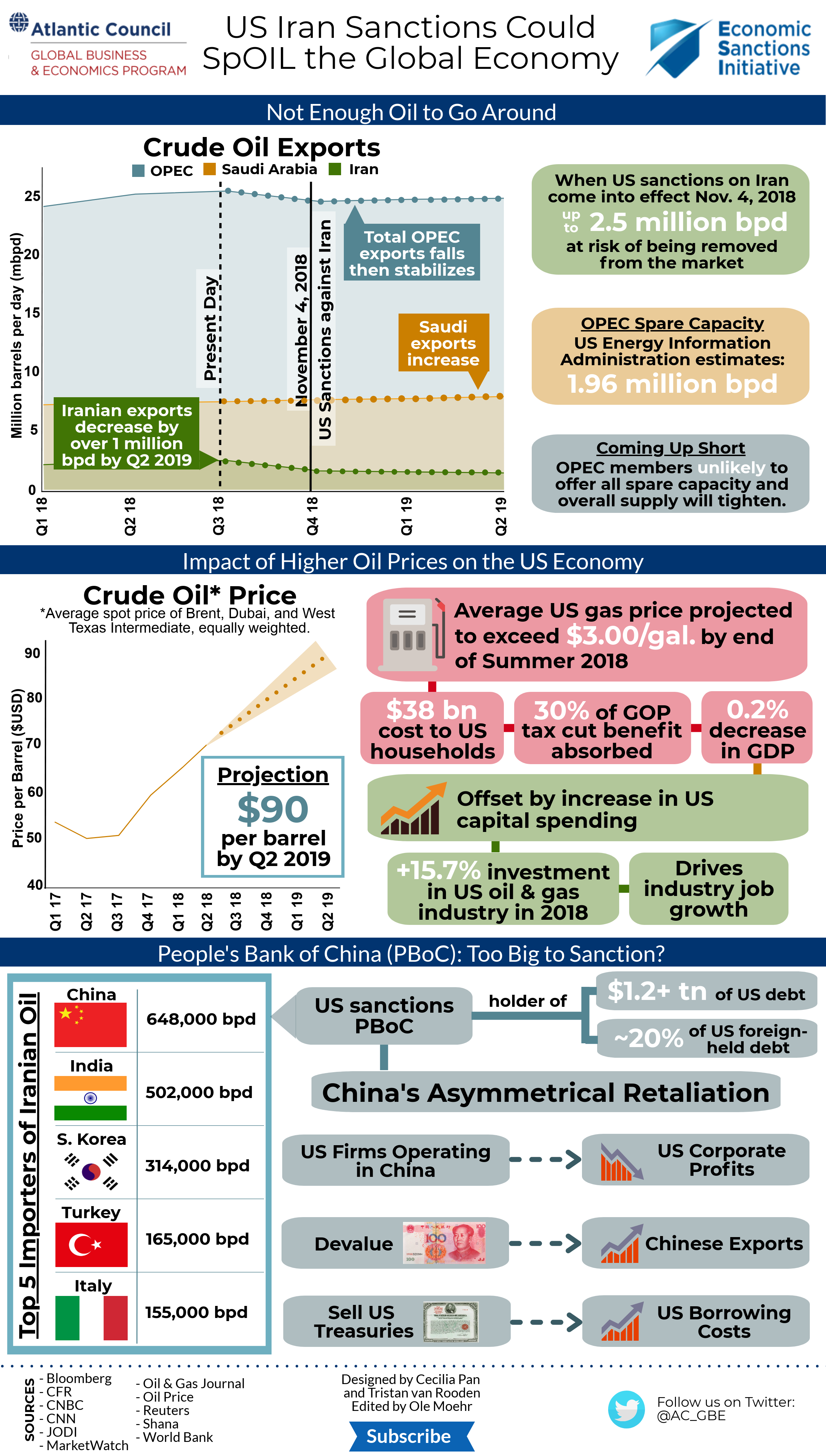

The re-imposed US sanctions against Iran, which will take effect on November 4th, are expected to reduce Iranian crude exports by at least 1 million barrels per day (bpd) in the short-to-medium term. While other OPEC members countries, especially Saudi Arabia, and oil-producing countries, such as Russia, have capacity to increase their crude production and exports, estimates differ on whether their spare capacity will be sufficient to meet global demand in a tight oil market. For a variety of reasons, several major oil-producing countries, including Angola, Canada, Iraq, Kuwait, Libya, and Venezuela, are not meeting their production targets. US shale producers face infrastructure bottlenecks that prevent higher production in the short-term. The resulting shortfall in global crude supply will likely exacerbate upward pressure on the oil price caused by US sanctions against Iran.

Morgan Stanley estimates that the lower oil supply will increase the price for Brent crude to $85 per barrel in the next six months. Whereas, Bank of America Merrill Lynch projects that the oil benchmark will hit $90 in the second quarter of 2019. In turn, Americans will have to pay higher prices for airline tickets and at the pump ahead of this year’s midterm elections. Analysts at Morgan Stanley have calculated that US consumers pay an extra $10.6 billion per year for each 10-cent increase in the price of gas. Of course, higher gas prices are also reducing any effect of the Trump Administration’s tax cut on US workers’ disposable income. At the same time, rising oil prices trigger more investment by the US oil and gas industry. Increasing investment generates stronger economic and job growth in the oil producing states. Many economists therefore contend that moderately higher crude prices are a wash for the overall US economy. However, when prices rise above certain threshold, say $100 per barrel, the economy begins to suffer.

Any entity that continues to purchase Iranian oil after November 3rd could be subject to US sanctions. The US administration has said that it wants to cut oil purchases to zero as soon as possible, so it remains to be seen whether US sanctions will be strictly enforced come November 4th. The Chinese government has already indicated that it will continue to import crude from Iran. This raises the prospect of the PBoC becoming a target of US secondary sanctions because all Iranian oil transactions go through the Central Bank of Iran. Beijing would likely retaliate in an asymmetrical, yet proportional fashion. For instance, the Chinese government could target US companies operating in China through regulatory or other measures to hurt profits. Beijing could also use the sanctioning of the PBoC as a reason to devalue the renminbi. This would make Chinese exports more attractive and could negate the effect of US tariffs on Chinese goods. However, emerging markets volatility would likely ensue because these economies would be compelled to mirror the renminbi’s downward trajectory to keep their products competitive. Finally, the Chinese government could sell its stock of US treasuries to inflict pain on the US economy. In the short-term, Chinese treasury sales would drive up long-term interest rates in the United States, increase borrowing costs for consumers and the private sector, and put pressure on equity markets. This would damper economic momentum in the United States. Higher interest rates would also hurt emerging economies. However, economists expect the Federal Reserve to quickly react by reducing both the speed of its rate hikes as well as the quantitative tightening. Put simply, the Federal Reserve can offset the impact of Chinese treasury sales by buying “more [treasuries] than China can sell.”

Nonetheless, US sanctions against the PBoC could throw the global economy into severe turmoil. If the US administration follows through with its ”maximum pressure” approach against Iranian oil exports, it must make a choice whether to impose sanctions against the PBoC or pull-back and potentially undermine of US sanctions’ credibility and effectiveness in the future.