As Zambia mourned the death of its former President Edgar Lungu on June 5, a quieter crisis was unfolding in the country’s public hospitals. Just days after Lungu’s passing, the Resident Doctors Association of Zambia suspended all voluntary services nationwide, citing the government’s failure to address long-standing promises. These included the recruitment of additional medical staff, payment of overdue allowances, and resolution of delayed promotions—commitments made during earlier negotiations with the Ministry of Health.

While the tragedy of leadership loss and the strain on frontline medical staff may seem unrelated, they are threads in the same fabric of fiscal and structural fragility that many developing nations face—a fragility tied, in part, to the opaque and discriminatory power of global credit rating agencies.

A system priced on perception

Zambia is one of more than fifty low- and lower-middle-income countries now spending more on servicing external debt than on public health or education, according to data from the International Monetary Fund (IMF). As of July 2024, twenty-two African nations were either already in or at high risk of debt distress, according to the African Development Bank. For many, that distress is not simply the result of bad choices or poor governance—it’s also driven by credit downgrades steeped in Western-oriented bias, with devastating human consequences.

For years, African leaders have called for reforms to the global credit rating system. But today, only four countries on the continent—Botswana, Mauritius, Morocco, and South Africa—hold investment-grade ratings from the Big Three credit rating agencies Moody’s, S&P, and Fitch.

The rest remain classified as “junk,” regardless of their economic trajectories or structural reforms. These ratings carry high costs. A 2023 study by the United Nations Development Programme (UNDP) found that African countries pay, on average, 1.5 percentage points more in interest than other nations with similar economic features. That disparity has cost the continent over $75 billion in excessive borrowing costs—resources that could have funded hospitals, classrooms, or climate adaptation projects.

When ratings fall, lives change

Zambia’s experience serves as a dire warning to many African nations. In November 2020, amid the fallout from the COVID-19 pandemic, the country defaulted on a $42.5 million Eurobond repayment, becoming the first African nation to do so in the pandemic era. Almost immediately, Fitch and S&P Global downgraded Zambia to “Restricted Default” and “Selective Default” respectively.

The downgrades triggered a series of economic consequences: inflation soared to nearly 16 percent by the end of 2020; the kwacha, Zambia’s currency, lost over half its value; unemployment rose to nearly 13 percent; and public debt ballooned to 103.5 percent of GDP—up from 62 percent just a year earlier.

While the crisis was framed internationally as a failure of fiscal discipline, it stemmed primarily from structural vulnerabilities long ignored by lenders and significantly worsened by COVID-19-related shocks—for example, Zambia’s overdependence on raw copper exports, lack of economic diversification, and exposure to global price swings.

To regain access to capital markets, Zambia turned to the IMF. In August 2022, the IMF approved a $1.3 billion Extended Credit Facility, but with strings attached. Subsidies on fuel, fertilizer, and seeds were slashed. Tax exemptions were eliminated. While these measures were intended to stabilize the economy, they exacerbated hardship for ordinary Zambians.

Despite a national health strategy aimed at achieving universal health coverage by 2026, government health spending stood at just 8 percent of the national budget in 2022—well below the 15 percent target African nations committed to under the Abuja Declaration of 2001. Across the country, public hospitals remain overcrowded, understaffed, and underfunded, while medical workers barely earn sufficient incomes.

Medical migration worsens health crisis

The effects ripple far beyond the wards. As health infrastructure deteriorates, skilled professionals are seeking opportunities abroad. According to data from the Global Press Journal, by mid-2023, more than seven hundred Zambians were working in the United Kingdom’s National Health Service—half as nurses, the others as support staff for doctors and midwives.

This migration has not only drained Zambia of vital expertise but reflects a deeper erosion of public trust.

Zambia is far from alone. As of 2024, thirty-six low-income countries were ranked by the World Bank and the IMF as either in or nearing debt distress. The highest number on record came in 2021, when forty countries fell into this category—largely due to pandemic-era disruptions and rigid creditor responses.

Yet debt relief remains elusive, especially when private creditors—often protected by Western legal jurisdictions—refuse to participate in restructuring. Bailouts, often financed with public funds, prioritize financial markets over human needs.

Reforming the ratings regime

That’s why calls to rethink sovereign credit ratings are gaining traction. African policymakers are urging the adoption of homegrown solutions—most notably the African Credit Ratings Initiative supported by the UNDP and AfriCatalyst—to support African countries navigate credit assessments and access affordable capital. Others are pushing for greater transparency in rating methodologies and the inclusion of developmental indicators and climate vulnerability metrics, which better reflect the realities on the continent.

Alongside these reforms, the African Continental Free Trade Area (AfCFTA) could fundamentally shift Africa’s risk profile and reduce its overreliance on external creditors. By connecting 1.4 billion people across 54 countries into a single market, AfCFTA offers African nations a pathway to scale up intra-African trade, diversify export bases, and build economic resilience against global commodity shocks. Greater regional trade integration can lead to stronger fiscal buffers, more predictable revenue streams, and a reduced perception of sovereign risk—all of which could, in time, help countries negotiate better borrowing terms and demand more equitable treatment from global credit markets.

In this context, aligning AfCFTA’s trade reforms with a reimagined financial architecture—including AfCRA and climate-linked development finance—could be transformative. Not only would it allow African nations to retain more value within the continent, but it would also reposition Africa as a cohesive economic bloc, capable of challenging outdated, externally imposed narratives about risk and creditworthiness.

More than metrics

Ultimately, this is not just a technical issue about creditworthiness or bond yields—it’s about justice. When a rating falls, it doesn’t just shake investor confidence in New York or London. It empties pharmacy shelves in the capital Lusaka, delays school construction in Ndola, and sends doctors to London instead of keeping them in Kitwe. Behind every downgrade is a family struggling to afford food, a patient turned away from a clinic, a child missing class because of budget cuts.

If the global financial system is to serve development rather than distort it, reforming the sovereign ratings regime is no longer optional—it is a moral imperative. Because ratings may be abstract, but their consequences are all too human.

Looking ahead, change is possible—and necessary. Governments can begin by investing in stronger data systems and institutional capacity to ensure that credit ratings accurately reflect real risk and resilience, not outdated assumptions. Credit rating agencies must also recognize the profound human consequences of their assessments and adopt more inclusive, context-sensitive approaches. This means going beyond narrow fiscal metrics to account for structural vulnerabilities—such as health system fragility, climate exposure, or commodity dependence—and giving greater weight to a country’s reform efforts and resilience strategies.

Agencies should also engage in transparent, two-way dialogue with African finance ministries, regional bodies, and development institutions to ensure their methodologies reflect local realities rather than global templates. A collaborative approach would mean treating African nations not simply as borrowers to be scored, but as partners in shaping more just and development-oriented financial systems.

The development community, in turn, should treat credit ratings as a development emergency—mobilizing support and reform with the same urgency as a health or climate crisis. Finally, deeper investment in domestic capital markets and financial institutions will empower countries to forge a more independent and stable fiscal future.

Because at the heart of every rating is a story not just of numbers—but of people and their right to health, dignity, and opportunity.

Maggie Mutesi is an analyst at the Africa Credit Ratings Initiative, a platform dedicated to reducing the cost of capital across Africa.

The Africa Center works to promote dynamic geopolitical partnerships with African states and to redirect US and European policy priorities toward strengthening security and bolstering economic growth and prosperity on the continent.

Further reading

Wed, Jul 23, 2025

The Sahel is pivoting toward Turkey. Here’s what that means for Washington.

AfricaSource By

Washington will need to consider partnering with Turkey when it advances US interests—but it must approach any cooperation with clear eyes.

Wed, Jul 16, 2025

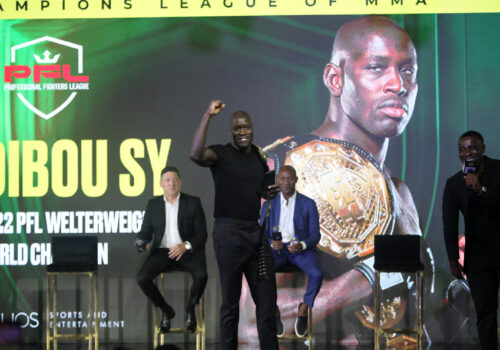

MMA’s arrival in Africa could transform opportunity for the continent’s youth

AfricaSource By

Africa is no longer just a source of talent but increasingly a hub for global sports investment and innovation.

Mon, Jul 21, 2025

At Trump’s recent summit, the US talked trade. But West Africa wants security first.

AfricaSource By Rose Keravuori

During a mini summit with five West African leaders, the Donald Trump administration prioritized “trade not aid,” strategic minerals, and deportation agreements. But security in the Sahel—now the world’s epicenter of terrorism—remained a blind spot.

Image: A view of an empty ward of the emergency unit of National Orthopaedic Hospital, as Nigerian nurses begin a strike over poor support from the government in Lagos, Nigeria. Source: REUTERS/Sodiq Adelakun.