In recent years, the United States has steadily ramped up its commercial engagement in Africa. Nonetheless, many markets across the continent remain underexplored, and many sectors lie untapped. Cameroon is a telling case in point.

US firms have traditionally focused on Cameroon’s hydrocarbons, but reserves and output are steadily declining. As a result, the country urgently needs to diversify its exports to sustain economic growth and preserve its foreign exchange reserves. Two commodities stand out in this regard: cocoa and timber, both of which the United States must import to meet domestic demand. Yet little action has been taken by US policymakers and firms to capitalize on this opportunity.

With the African Growth and Opportunity Act (AGOA) set to expire in the coming months, prompt steps to encourage greater US investment in these sectors could provide a blueprint for mutually beneficial trade—one that creates US jobs while bolstering Cameroonian industry and development.

Cameroon’s cocoa surge meets US demand

Cocoa products are Cameroon’s second-largest commodity export after hydrocarbons, including both raw cocoa beans and cocoa paste. The country consistently ranks among the world’s top ten exporters of these products. Over 90 percent of its cocoa—prized for its flavor and high butter content—is grown by smallholder farmers, with more than five hundred thousand Cameroonians depending on the trade for income. Cocoa exports have surged in recent years, peaking in 2023.

Cameroon’s cocoa trade has expanded even as production has declined elsewhere in Africa. In Ghana and Côte d’Ivoire—the world’s two largest cocoa suppliers—crop disease and drought have led to sharp decreases in yield. This has caused a global price surge, left sourcing firms undersupplied, and triggered a scramble to secure cocoa from Cameroon.

US firms are especially affected. As some of the world’s largest importers of cocoa paste—and with cocoa beans grown in the United States only on a small scale in Hawaii—they rely heavily on imports. The domestic market for cocoa products exceeds $15 billion, yet most US imports still come from Ghana and Côte d’Ivoire. Given the risks of overreliance on these two countries, Cameroon presents a strategic opportunity for diversification—particularly as its government has announced plans to increase cocoa paste exports to 50 percent of total output.

Unlocking untapped potential in the tropical timber sector

Cameroon is also one of the world’s top exporters of tropical timber. Although the United States typically imports this resource from South America and Asia, Cameroon plays a critical role in the global market. Of the three hundred to five hundred species classified as tropical timber, as many as eighty can be commercially grown in the country—including high-value varieties like Ayous, Sapelli, Azobé, and Ebony woods, used in everything from musical instruments to infrastructure.

Cameroon mainly exports logs and sawn wood—products that are largely unprocessed. In recent years, however, the government has sought to limit such exports and boost domestic timber processing. Export duties, which have doubled since 2013, are a key part of this strategy—though still less restrictive than Gabon’s outright ban on logs and certain sawn wood exports.

Most logging land is government-owned and divided into so-called Forestry Management Units (FMUs) through public tenders. Companies gain access either through a sale of standing volume or an exploitation agreement—both of which enable industrial-scale production. Firms can choose FMUs based on the trees they contain, but the public tender process is vulnerable to political manipulation. A lack of centralized oversight also allows illegally sourced timber to enter the legal supply chain, complicating adherence to international conservation standards. Still, timber exports have continued to rise and are projected to grow further in 2025—highlighting the sector’s untapped potential.

Tropical timber is widely used across US industries but cannot be cultivated domestically, making imports essential for meeting demand and sustaining jobs. However, these imports—largely consisting of veneer and plywood—often involve costly shipping and complex, multi-country transit. Cameroon currently produces small quantities of both, and its government is offering new incentives to boost domestic processing.

Turning promise into policy

Rising exports and new domestic incentives make Cameroon an increasingly viable partner—particularly as a reliable source of both timber and cocoa. Yet its full potential remains largely overlooked in the United States. This gap presents an opportunity for the Donald Trump administration to advance mutually beneficial trade ties—a key tenet of its Africa strategy.

The most effective way for the administration to promote US commercial engagement in Cameroon’s cocoa and timber sectors is to help US firms overcome the initial barriers to market entry. Political risk and bureaucratic hurdles have long discouraged investment, making companies hesitant to commit capital. Targeted support—particularly in the form of early-stage equity—could help de-risk these ventures and enable US firms to enter the market.

The administration has already pledged to reorganize its development finance institutions to streamline funding and support US firms with the financial tools they need to grow their presence in Cameroon. The proposed increase of the Development Finance Corporation (DFC)’s budget in FY2026 presents an opportunity to assist US companies in obtaining the resources needed to make this expansion.

Beyond facilitating market entry, preserving trade preferences for Cameroonian cocoa and timber is critical. These products currently enter the United States duty-free under the AGOA, giving them a competitive edge. However, the act is set to expire in September. Without renewal or replacement, tariffs will be reimposed—not just on Cameroonian goods, but on imports from across Africa. This would create logistical bottlenecks and raise costs for US firms importing from the continent.

To avoid these disruptions, bilateral agreements will be essential to sustaining trade and keeping prices stable—for everything from chocolate to wood flooring. In its trade dialogues with Cameroon, the United States should offer some form of continued duty-free access for key agricultural products. Increasing cocoa and timber exports is a priority for Cameroon—and a critical means of supporting US industries, jobs, and price stability at home. An initial agreement eliminating tariffs on these products could serve as a foundation and confidence-building measure for a broader trade framework in the future.

The administration also has an opportunity to deepen the opportunities for US firms in Cameroon by investing in Cameroon’s local agricultural processing infrastructure. It has emphasized its commitment to sustainable, inclusive growth abroad—including through a reimagining of US foreign assistance. Revitalized programs through the United States Department of Agriculture (USDA), the State Department, and the DFC offer opportunities to strengthen infrastructure— from roads to best practices in cocoa and timber farming.

Such targeted investments would not only facilitate exports but also improve livelihoods in Cameroon. In many cases, this infrastructure would serve multiple uses, enhancing connectivity and resilience beyond just the targeted sectors—maximizing the return on US investment.

R. Maxwell Bone is an advisor at Busara Advisors, a strategic advisory and commercial diplomacy firm focused exclusively on Africa.

The Africa Center works to promote dynamic geopolitical partnerships with African states and to redirect US and European policy priorities toward strengthening security and bolstering economic growth and prosperity on the continent.

Further reading

Wed, Jul 23, 2025

The Sahel is pivoting toward Turkey. Here’s what that means for Washington.

AfricaSource By

Washington will need to consider partnering with Turkey when it advances US interests—but it must approach any cooperation with clear eyes.

Mon, Jul 21, 2025

At Trump’s recent summit, the US talked trade. But West Africa wants security first.

AfricaSource By Rose Keravuori

During a mini summit with five West African leaders, the Donald Trump administration prioritized “trade not aid,” strategic minerals, and deportation agreements. But security in the Sahel—now the world’s epicenter of terrorism—remained a blind spot.

Wed, Jul 16, 2025

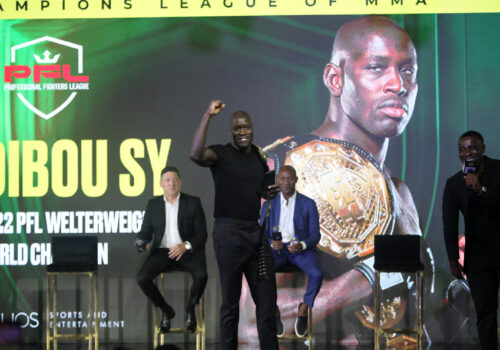

MMA’s arrival in Africa could transform opportunity for the continent’s youth

AfricaSource By

Africa is no longer just a source of talent but increasingly a hub for global sports investment and innovation.

Image: Workers sun-dry cocoa beans in a courtyard in the village of Endaba near the town of Ntui in the Centre Region, Cameroon, September 19, 2024. REUTERS/Amindeh Blaise Atabong.