By Ole Moehr | Graphics by Christina Gay and Raina Hasan

December 2018 is set to become the worst year-end finish for US markets since 1931. A yield curve inversion combined with the fourth annual rate hike by the US Federal Reserve (Fed) and growing geo-political uncertainty, triggered widespread angst among US investors about an economic slowdown and the increasing probability of a recession. This edition of the EconoGraphic assesses key economic indicators to make a case that while a slowing of the US economy seems certain, a recession in the next two years remains unlikely.

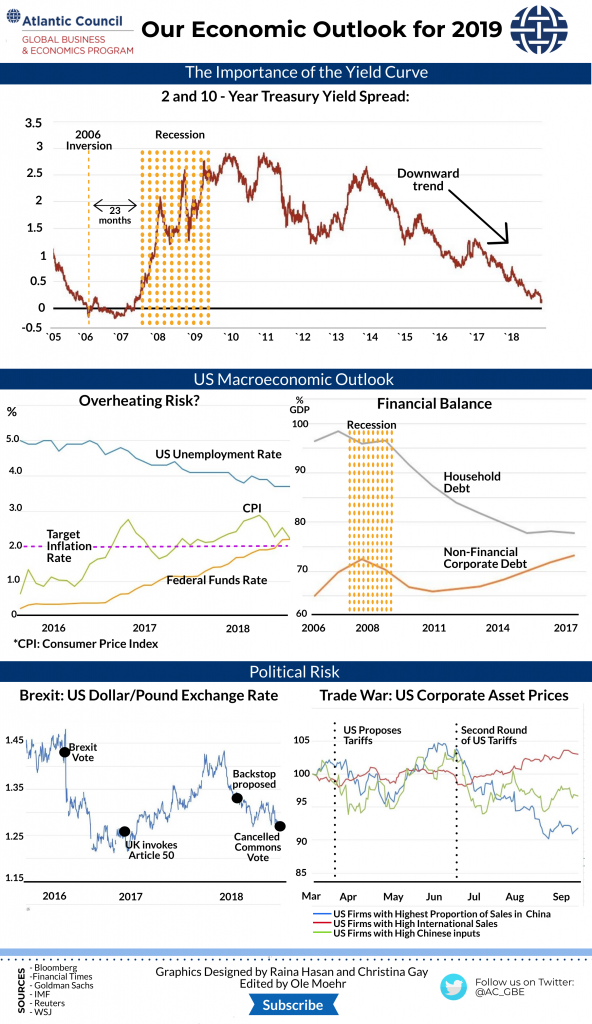

On December 3rd, the yield spread between three and five-year treasury bonds turned negative. A yield curve inverts when borrowing costs of shorter-term bonds exceed those of longer-term bonds. Investors usually demand a higher yield, the so-called term premium, from longer maturity investments that come with greater inherent risk. However, in simplified terms, when investors are expecting an economic downturn in the near future they prefer long-term over short-term debt. This drives down yields of long-term bonds. Yield curve inversions create so much anxiety in the markets because they “have preceded each of the last seven recessions” and are thus considered a reliable recession forecaster. Yet, former and current Fed officials, such as Ben Bernanke and Lael Brainard, argue that market distortions, particularly the Fed’s quantitative easing policies, have contributed to a flattening of the yield curve by reducing the term premium and inflation expectations. In turn, they argue that the yield curve has lost its power to predict recessions. It is worth noting that Mr. Bernanke made very similar comments in 2006 when part of the yield curve inverted. Sure enough, by December 2007 the US economy had entered a recession. Contrary to 2006, the two and ten-year yields, considered the most meaningful comparison, have not yet inverted. Nonetheless, according to the Cleveland Fed and many other experts, the curve’s trend indicates an increasing risk for a recession in the coming years.

Recessions usually result from an overheating economy or a financial crisis. The US labor market’s record low unemployment level creates the risk of causing fast rising inflation that would force the Fed to counter with significant interest rate hikes. Goldman Sachs points out that “the Fed has never engineered a soft landing from beyond full employment.” However, the current record low unemployment rate is accompanied by unusually persistent low inflation and sticky wages (aka a flatter Phillips curve). This might allow the Fed to use its gradual rates hikes (two additional rate increases are scheduled for 2019) to cool down the US economy just enough to avoid an inflation overshoot, which would necessitate a strong Fed response and likely cause a recession. While the tight labor market is a concern, the US economy currently does not have the type of imbalances that sparked the financial crisis in 2007. Household debt is a case in point. American households are on a more solid footing today by reducing their debt burden and securing very low interest rates on new mortgages in the aftermath of the crisis, which, in turn, will help households to weather any additional Fed rate hikes. On the other hand, the low interest rate environment is partly responsible for the rise in non-financial corporate debt. Since the height of the last recession, non-financial companies have increased their debt burden by $2.6 trillion. Many economists consider this financial imbalance, together with leveraged-buyout lending, as potential systemic risks that are vulnerable to further rate hikes and could trigger a recession.

The political risks in 2019 must not be underestimated. For example, a no-deal, disorderly Brexit combined with an Italian banking crisis would push Europe’s economy to the brink and could cause severe economic repercussions for other major economies including China and the United States. The US-China trade war has dented businesses’ confidence around the world and hit certain US sectors extremely hard, such as American soybean farmers. At the same time, the trade war has had an overall negligible impact on US economic growth thus far. Should the trade tit-for-tat escalate further, however, for instance with new tariffs on consumer goods and cars, it could contribute to pushing up inflation to a level that compels the Fed to step-in with additional rate hikes. As explained above, such action by the Fed could then result in a recession.

In sum, we maintain a somewhat positive outlook for 2019. Yes, we predict that the market is beyond its peak and investors will continue to suffer losses due to slowing economic growth and a tightening monetary cycle. But on the bright side, the Fed’s disciplined gradualism has good prospects of hitting a sweet spot that enables continued economic growth, low unemployment, price stability, and avoids a recession in the next two years.