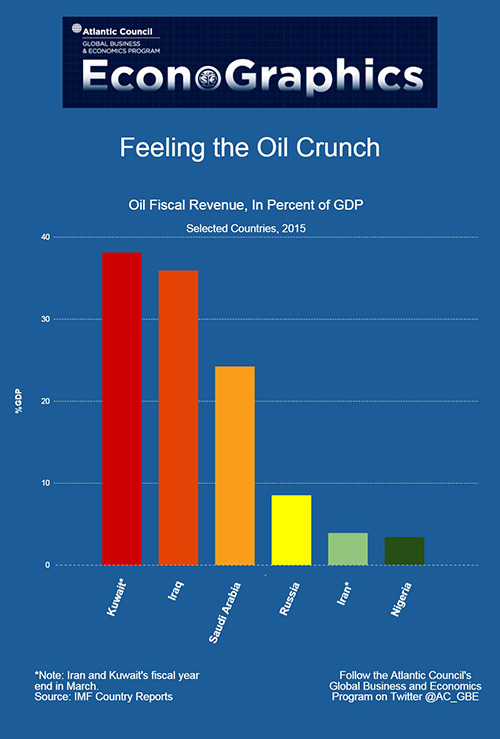

Oil prices have fallen to their lowest since 2003, sitting under $30 a barrel in recent days. Declining expectations of global growth plus the addition of post-sanction Iranian supply don’t spell a substantial price recovery in the immediate future. Under this new market realities, oil-exporting countries come in different form to weather the storm.

The fiscal impact of tanking oil prices varies greatly according to each countries dependency on oil fiscal revenues, as shown in this week’s Econographics. Another factor is the break-even price at which exporting countries would be able to balance their budgets, albeit it is hard to come-by. For instance, the IMF estimated Iran’s break-even price at $143 in 2013 and $94.2 in 2014. A third factor would be fiscal reserves piled up during bonanza years that may act as a buffer for bleaker times. In a report from October, the IMF estimated that Kuwait’s reserves could last for more than 20 years at current spending levels, whereas Saudi Arabia’s could risk draining its financial assets within five years. Finally, flexible exchange rates may provide another buffer, as in the case of Russia, where the plunge of the ruble counterbalanced the pressure of falling oil prices.