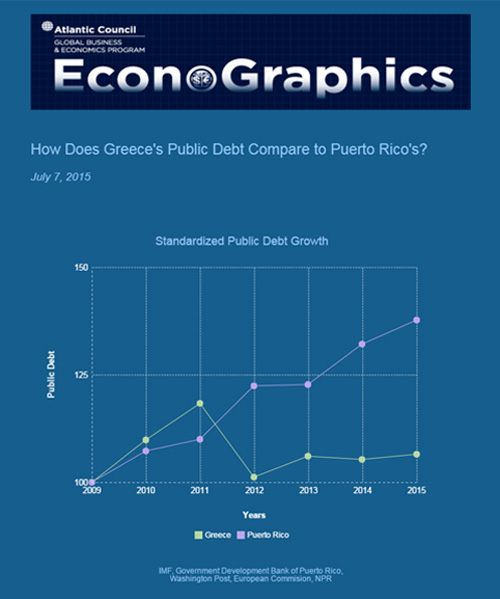

As Greece reaches crisis over its debts to Europe, Puerto Rico’s public debt has reached an impressive $72 billion, nearly 70% of its economic output. Meanwhile, Greece has slashed the growth of its debt since 2012.

What explains these different trajectories for Puerto Rico and Greece?

In 2006, pharmaceutical companies and other manufactures abandoned Puerto Rican markets after the termination of corporate tax breaks. As the economy worsened, approximately 4.7% of the country’s population migrated weakening the local workforce. That same workforce has now reached an unemployment rate of 12.4%. Although concerning, this rate is half of Greece’s 25.6% unemployment. Puerto Rico is also unable to rely upon tax revenues since 44% of certain sales tax is lost to the informal market.

Puerto Rico’s situation therefore differs from Greece on multiple accounts. According to the Wall Street Journal, “Greece’s debt burden is much bigger. Its economy…accounts for a greater share of the Eurozone than Puerto Rico’s does relative to the United States.” Puerto Rico’s banks are also federally insured and its debt is currently held by private investors instead of international institutions such as the IMF.

These factors should mean that resolving Puerto Rico’s debt crisis will be relatively easier than Greece’s protracted saga in Europe.

Sources: WSJ, Eurostat and NPR