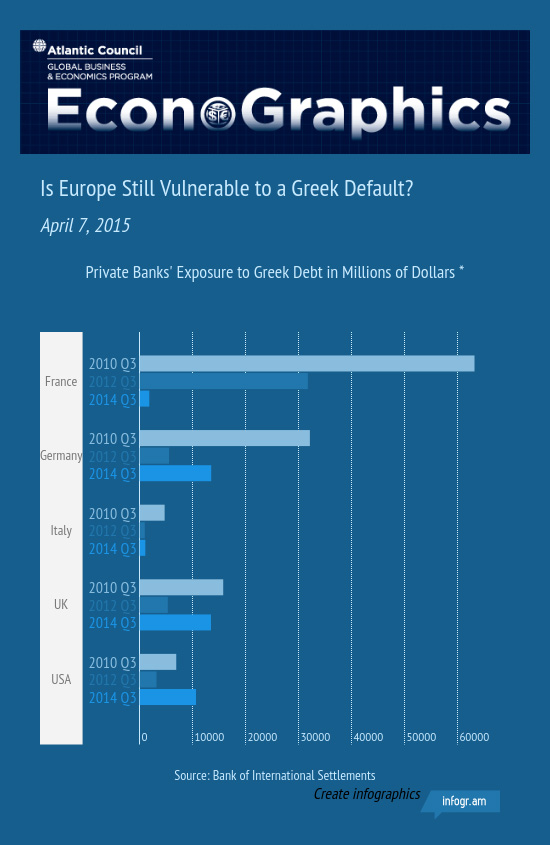

Private banks throughout Europe have significantly reduced their exposure to Greek debt (bank, public, and non-bank private sector debt) over the last five years. After Greece came under market pressure and eventually obtained ECB and IMF financial assistance in 2010, most European banks started to rapidly reduce their exposure to Greece. For instance, between 2010 and 2014 French banks’ holdings decreased from $63 billion to $2 billion.

Interestingly, US banks have actually increased their exposure slightly from $6 billion in 2010 to $10 billion in 2014. Germany is the only Eurozone country where banks have increased their holdings of Greek debt since 2013, and the UK has seen its exposure increase as well.

Is the behavior of UK, German, and American banks a sign of normalization and resumption of confidence towards Greece? Recently, European Commission Vice President Valdis Dombrovskis noted that Greece has not fully washed its hands of the crisis in the eyes of the market: “Greece may need an additional arrangement after this program expires,” he said in March.

Vice President Dombrovskis will be speaking April 16 at the Atlantic Council.