As Greece entered in 2016, the first review of the bailout agreed in August 2015 is not completed yet. Creditors and the Greek Government are meeting next week to discuss a plan for major reforms of the pension system. The goal is to assure the long-term sustainability of the Greek public finances, with proposed cost-saving measures targeting 1 percent of its GDP. Proposals include raising social contributions from employers and employees and consolidating multiple pension organizations into a single operator, among others.

Since 2010, Greece’s Government has raised the formal retirement age to 67, up from 60; limited early retirement age; slashed the replacement earnings rate and raised the amount of years needed to get a full pension, from 35 to 40. To be sure, these reforms have helped steer the course: an Allianz report from 2014 found Greek pension system climbing eight spots in the financial sustainability index, after it was dead last in 2011.

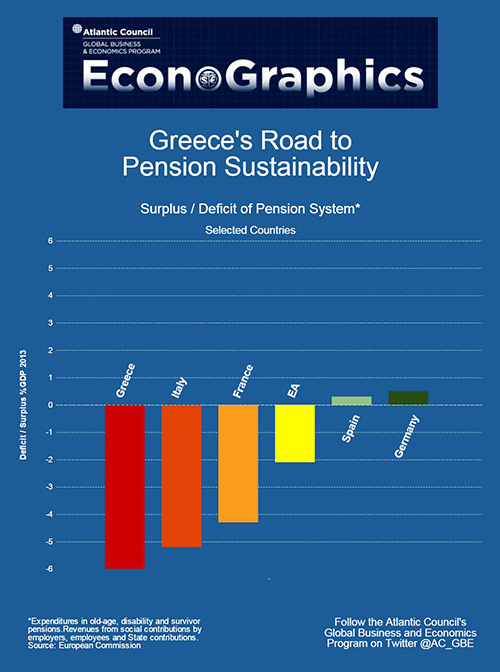

However, the troubles are not over just yet. Greece still generates lower revenue to finance its pension spending than other EU countries and has the greatest pension deficit. Facing an aging population and high unemployment rates, Greece’s road ahead is everything but clear.