Escalating trade tensions between the world’s major economies are widely considered the greatest threat to the global economy’s health. Following the White House’s cancellation of its threatened tariffs on all Mexican imports on June 7, attention swiftly turned back to the brewing US-China trade war. This edition of the EconoGraphic, however, puts the focus on how US tariffs on cars and car parts might disrupt transatlantic trade flows. The graphic highlights the importance of the transatlantic auto trade for the EU and US economies, outlines the role of European car manufacturers and suppliers in the US auto supply chain, and previews the potential impact of US car tariffs on both economies.

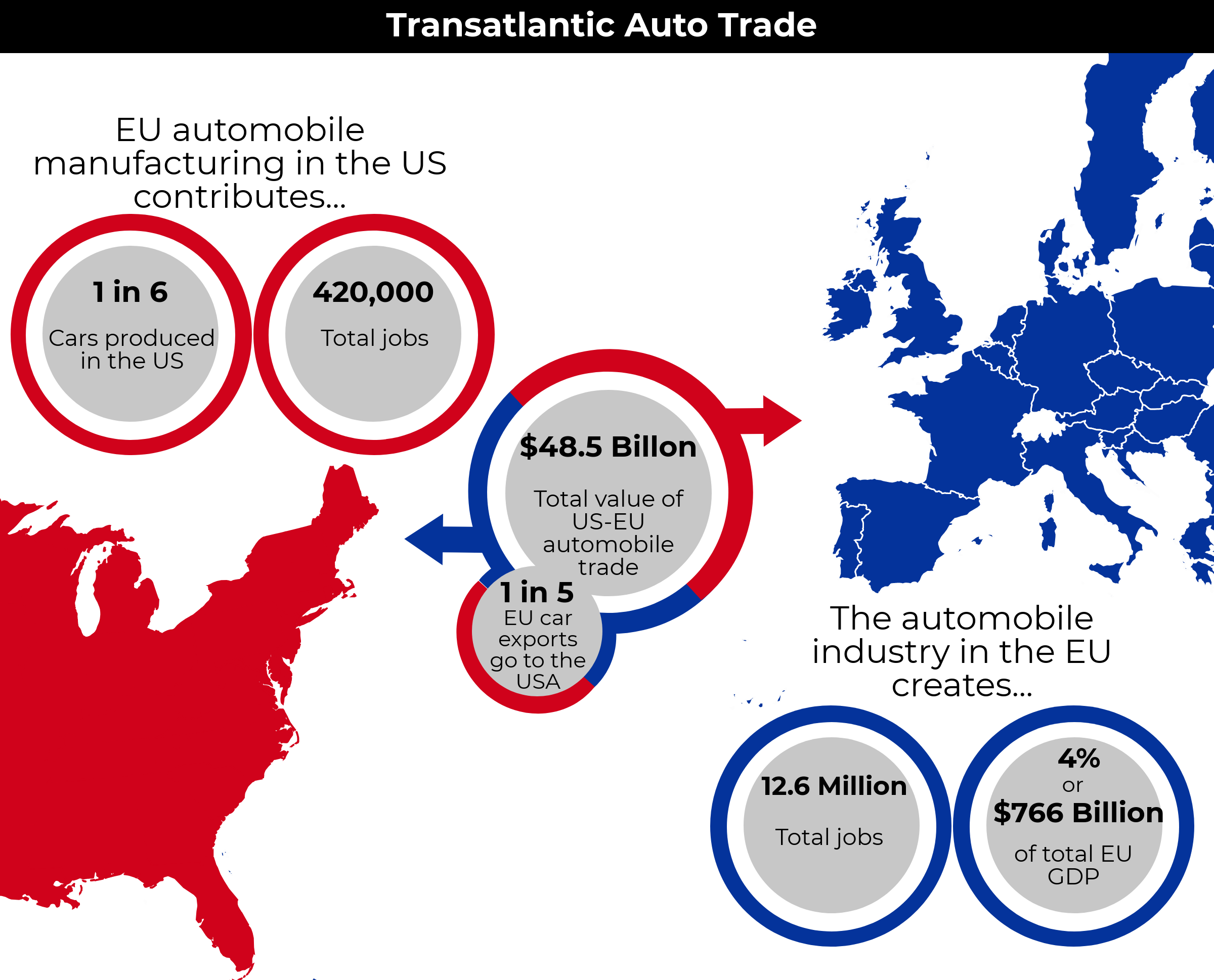

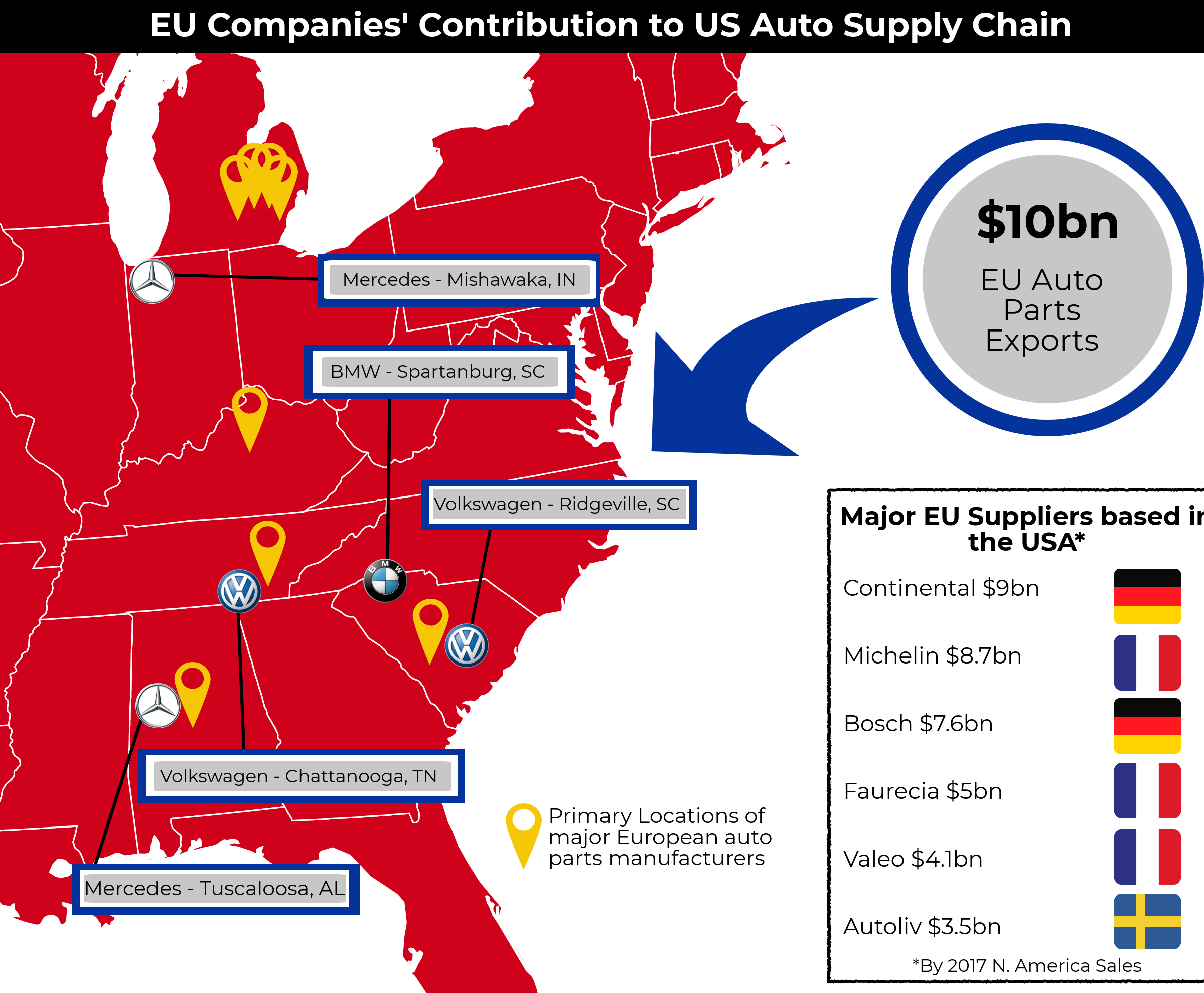

To put trade volumes into perspective, it is worth noting that the global auto trade amounts to eight percent of global trade, which is significantly larger than US-China trade flows at three percent. The United States is the most important export market for European cars, accounting for 29 percent of the value of all exported cars from the EU. By comparison, US-based companies are delivering 19 percent of their car export value to Europe. European car manufacturers, such as Volkswagen and BMW, contribute to this number by exporting more than 50 percent of the cars they produce in the United States. Almost six percent of the EU’s working population is employed in the car sector. On the other side of the Atlantic, the German car companies BMW, Mercedes, and Volkswagen have created almost 120,000 jobs by building manufacturing plants across the southern United States.

These German car plants rely on a downstream network of American and European suppliers as well as retailers. Taken together, these US-based auto supply chains provide more than 400,000 jobs. In 2018, European auto manufacturers built 1.7 million cars in the United States, which amounted to 15 percent of total US car production. When factoring in European-owned Fiat Chrysler, EU car makers contributed 27 percent to total US auto output. Global Value Chains (GVCs) connect the US domestic auto supply chains to Europe, Asia, and the rest of the world, and facilitate the exchange in intermediate goods that is key to keeping the car plants humming.

A 25 percent US tariff on cars and car parts would deal a blow to the European auto industry. Germany in particular would feel significant pain, given that it is responsible for 55 percent of all EU auto exports. Would the US car industry benefit as a result of the tariffs? GVCs would channel some of the tariff pain back to US-based car manufacturers right away by forcing these auto makers to pay a premium on essential car parts from Europe and Asia. Despite higher input costs, some economists expect expect the US auto sector to benefit from the tariffs because consumers might be more likely to buy US-built cars and foreign car manufacturers might increase their production capacity in the United States to avoid the tariffs. However, EU retaliatory tariffs against other sectors of the US economy would likely negate any positive jolt the US car industry delivers to the overall American economy. As usual, European and US consumers and workers would foot the bill for a transatlantic car tariff tit-for-tat that increases prices for cars and other goods while eliminating jobs on both sides of the Atlantic.