As (somewhat) anticipated, Russia reduced the flow of gas to Ukraine on New Year’s Day because of ongoing disputes over prices for 2009 and unpaid bills. However, unlike the briefer affair in 2006, this spat has evolved into a full-scale crisis with news today that Russia has cut off gas to Europe entirely (see my colleague James Joyner’s piece). I’ve gathered some multimedia about the current gridlock.

It’s hard to see how Russia is doing itself any favors.

Eastern and southern European countries are, expectedly, more dependent on Russian gas than western European ones and as such were the first to be affected by the shortage. Under normal circumstances, Gazprom exports around 300 million cubic meters (mcm) of gas per day to Europe via Ukraine, according to the Globe and Mail. After the new year, this was reduced first to 100 mcm a day, then stopped completely, so western Europe is now feeling the pinch as well.

Before the shut off, the situation looked like this:

|

| Europe’s gas shortages on Tuesday, January 6, before today’s shut off (FT) |

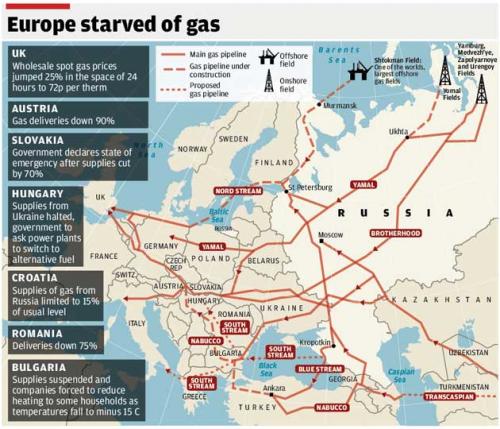

A map of the gas pipelines supplying Europe, with commentary about the current crisis, courtesy of the Independent:

|

| European gas pipelines (Independent) |

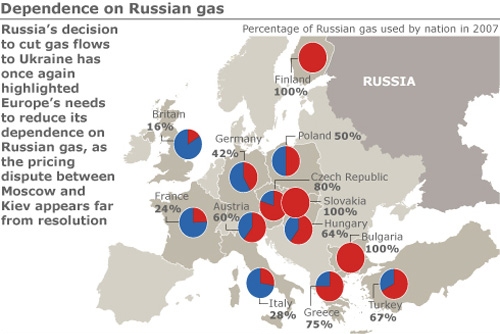

A graphic illustrating the share of various European countries’ gas that is supplied by Russia:

|

| European dependence on Russian gas (IHT) |

And some different figures from the Globe and Mail:

|

| European dependence on Russian gas (Globe and Mail) |

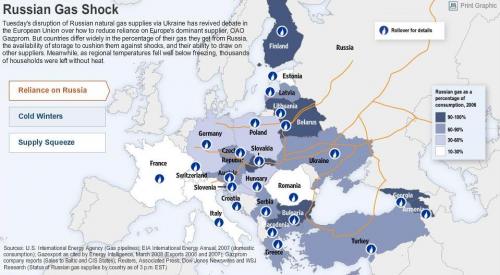

A handy interactive map from the WSJ featuring several countries’ gas dependence on Russia, average winter temperatures, and energy usage breakdowns:

|

| Russian Gas Shock (WSJ) |

Commentary from the WSJ:

A look at the situation in Bulgaria from CNN:

A summary of the pricing dispute by the WSJ:

Late Sunday, face-to-face talks between the two sides had yet to resume. Talks broke down on New Year’s Eve after Ukraine rejected a Russian proposal that Ukraine should pay $250 per thousand cubic meters in 2009, up from $179.50 last year, but still around half the price paid by EU countries. Ukraine proposed a smaller increase to $201, but has since said it is ready to pay $235.

Also in dispute are back payments that Gazprom says Ukraine owes. Ukraine has delivered $1.5 billion for unpaid 2008 bills to an intermediary company that is 50%-owned by Gazprom. Gazprom, however, says it doesn’t expect to get the funds until January 11. Gazprom also says Kiev owes $614 million in late-payment fines; Ukraine says it owes no late fees.

After saying Thursday that it wanted Ukraine to pay $418 per thousand cubic meters of gas, Gazprom upped the ante Sunday. Chief Executive Alexei Miller said the company now wants Ukraine to pay $450 per thousand cubic meters, equivalent to what its closest EU neighbors pay, less transit across Ukraine. He said he hoped that price would bring the Ukrainians back to the negotiating table.

Peter Cassata is associate editor of the Atlantic Council.