Italy’s upcoming withdrawal from the Belt and Road Initiative (BRI) will reshape transatlantic relations for the better, while serving as a closely watched test case for other countries that may be thinking of doing the same.

This week, the Italian government reportedly delivered a formal note to the Chinese government that it will opt out of renewing its agreement, while confirming the desire to maintain a “strategic friendship” with China.

When Giuseppe Conte’s populist government signed the BRI Memorandum of Understanding (MoU) in March 2019, I argued that it was overly optimistic and geared toward short-term gains while being naïve on long-term vision. Ironically, the MoU between Italy and China was signed one day after the European Council met to discuss the European Union’s (EU) common strategy on China before the EU-China Summit. This was the moment when the EU’s diplomatic language started becoming more pointed, describing China as a negotiating partner, economic competitor, and systemic rival in its strategic outlook.

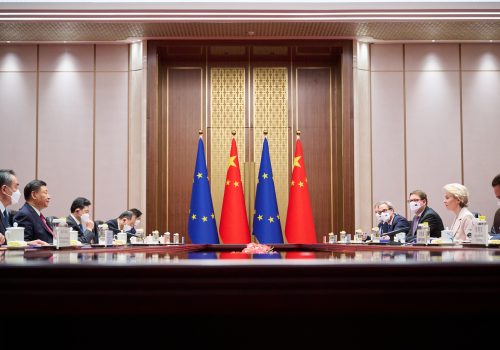

This time, notice of Italy’s decision to leave the BRI—which Prime Minister Giorgia Meloni had been indicating for months—came right before the EU-China Summit got underway in Beijing. Though this was the first in-person EU-China Summit since 2019, expectations for concrete outcomes were never high.

Importantly, Italy’s decision to leave the BRI is not just a reflection of frustration over failed expectations and unmet promises, but is based on a real commitment to defending democratic values and human rights. Meloni, in the footsteps of her predecessor Mario Draghi, has criticized China for everything from its mistreatment of ethnic minorities in Xinjiang to its mismanagement of the COVID-19 pandemic. She’s warned about the risks of any potential attack on Taiwan and called out Bejing’s position on Russia’s 2022 invasion of Ukraine.

Widening trade imbalance

Italy’s membership in the BRI was viewed as one of China’s most symbolic wins in Europe, with Beijing celebrating it as a sign of China’s growing political and diplomatic role in the world. For China, establishing a beachhead in the third-largest economy in Europe and a Group of Seven (G7) country was critical for its European strategy. It also allowed China access to Italy’s advanced industries, brands, and technologies. Although Italy was the true prize for Beijing, by 2019, fifteen other EU countries had become members of the BRI.

Beijing’s Italian gambit rolled in nicely on the heels of more than a decade of Italian economic distress, and some Italian policymakers clearly viewed China as a white knight. The menu for Italy’s BRI MoU included fifty agreements covering six main areas—policy dialogue, transport and infrastructure, trade and investment, financial cooperation, people-to-people connections, and green development cooperation.

In 2019, the Italian government was aiming to expand exports in China and attract investment with an agreement on “unimpeded trade and investment.” Unfortunately, little or nothing has been achieved. Trade between China and Italy has increased 1.6 times since 2019, from $50 billion to $80 billion, but the advantage went to China: Chinese imports into Italian markets rose from just over $35 billion in 2019 to nearly $61 billion in 2022, while Italian exports to China increased slightly from $14.5 billion to $19 billion, according to COMTRADE data. The trade imbalance in favor of China has widened, flooding the Italian market with Chinese products, which now make up 9 percent of Italy’s total imports (second-most in the world). But China is only the tenth-largest export market for Italy, making up less than 3 percent of its total exports.

These numbers explain why any fears of Chinese commercial retaliation against Italian products, especially in the luxury sector, are unfounded because of the importance of the Italian market for Chinese companies. Indeed, the numbers were much smaller when Beijing followed up with trade retaliations against Lithuania after its 2021 withdrawal from what had been a “17+1” format of Central and Eastern European nations’ cooperation with China (it’s now 14+1). In this case, Chinese trade with Lithuania totals a little more than $2 billion, and Lithuanian exports to China fell to $100 million in 2022 from $270 million in 2021.

Chinese investments, construction contracts, and loans in Italy between 2008 to 2020 totaled more than $27 billion, according to the American Enterprise Institute’s China Global Investment Tracker, and have been focused primarily on energy, transport, technology, and finance. Chinese strategic investments included a state-owned firm’s nearly $8 billion investment in Pirelli, the world’s largest tire maker. Investment in the Italian stock exchange and the financial sector have been very important for Chinese companies, both state-owned and private. However, since 2019, new Chinese investments in Italy amounted to just $1.8 billion. Most Chinese takeovers in Italy took place after the 2009 eurozone crisis, when investment from China skyrocketed from €100 million in 2010 to €7.6 billion in 2015.

While the aim of the BRI was to level the economic playing field and increase market access reciprocity, Beijing has always demonstrated resistance when it comes to meeting the standards of free market economies.

“Golden power” rules

Beijing also overplayed its hand during the COVID-19 pandemic with its misinformation campaigns, smashing the enthusiasm of Italians toward Beijing. One poll found that 52 percent of the country believed Chinese pandemic aid to be an attempt at political influence, while 62 percent of Italians had a negative opinion toward China in 2020.

The Italian parliament has played a very important role, using the “golden power” law to protect its national strategic assets. First introduced in 2012 to cover defense and national security, the law was updated in 2019 to cover 5G technology and later extended to a wide range of sectors including health, raw materials, infrastructure, robotics, finance, and media. It is one of the strongest screening laws in the EU.

The Italian government further reinforced that power in 2022, with the addition of prenotification procedures in support of investment screening mechanisms. Upon taking office in 2021, one of Draghi’s first priorities was enforcement of the “golden power” rules, focusing not only on strategic investments in infrastructure but also blocking access to strategic technologies and protecting destressed national companies. He blocked semiconductor manufacturing acquisitions and widened the scope to include food, applied materials, and drone deals that had been concluded during the previous government.

Quo vadis, BRI?

The BRI needs to be understood as an economic, foreign policy, and power projection tool of the Chinese Communist Party (CCP)—and central to Chinese leader Xi Jinping’s global ambitions. Current Chinese statecraft aims to ultimately reshape global norms and institutions to the CCP’s liking. The BRI comprises 149 countries, including thirty-five in Europe and Eurasia, and the tide will not change immediately. Italy’s exit will damage the reputation of an already scaled-back BRI, with China facing its own economic turmoil while its partners deal with debt distress.

In the big picture, perhaps Meloni has been ahead of the curve in reading the CCP. Her courage to take action by calling into question the propriety of an agreement with the CCP—whose fundamental values are in direct contrast to the EU and the transatlantic community—may ultimately prove to be the precedent for other leaders to follow.

Valbona Zeneli is a nonresident senior fellow at the Atlantic Council’s Europe Center and at the Transatlantic Security Initiative of the Atlantic Council’s Scowcroft Center for Strategy and Security.

Further reading

Tue, Dec 5, 2023

Don’t expect much from the EU-China summit

New Atlanticist By Colleen Cottle, Jörn Fleck

If this week's summit does prove to be as empty as anticipated, this should spark the EU to rethink its approach to these meetings.

Thu, Nov 10, 2022

Can Meloni hold together Italy’s fractious governing coalition while staying tough on Russia?

New Atlanticist By Nicholas O’Connell

Italian domestic politics risk spilling across borders and testing EU and NATO unity in the face of Russian aggressions.

Mon, Oct 16, 2023

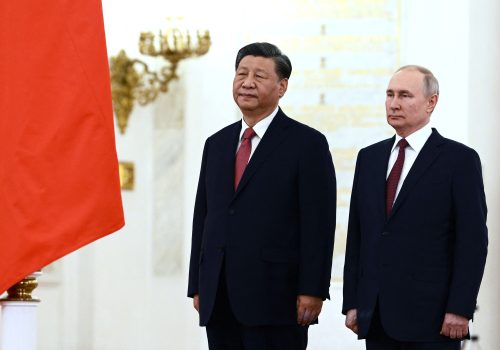

What to look for as Putin and Xi meet at the Belt and Road Forum

New Atlanticist By

The two leaders are expected to meet during the October 17-18 forum, which marks ten years since China’s landmark initiative launched.

Image: Rome, Rai ex Teulada studios, TV broadcast "Porta a Porta". In the photo: Giorgia Meloni (Photo by Marco Provvisionato / ipa-agency/IPA/Sipa USA)No Use Germany.