The United States has among the lowest top income tax rates in the developed world. And also the highest rates of compliance in paying taxes. One suspects these facts are related.

Atlantic business editor Megan McArdle observes, “I know, it’s common to claim that Americans are tax haters. But actually, Americans, even the wealthy, pay their taxes at a rate that would shock an Italian. We grumble, but in the end, we pay.”

She cites no figures but, through the power of the Internet, I found J.D. Tuccille‘s March column listing data from several sources. He cites a 2007 GAO study showing a compliance rate of 84% in the United States and two separate studies by Edward Christie and Mario Holzner for the Vienna Institute for International Economic Studies. Here’s my aggregation:

| United States | 84.00% |

| United Kingdom | 77.97% |

| Switzerland | 77.70% |

| France | 75.38% |

| Austria | 74.80% |

| Belgium | 70.15% |

| Netherlands | 72.84% |

| Portugal | 68.09% |

| Germany | 67.72% |

| Italy | 62.49% |

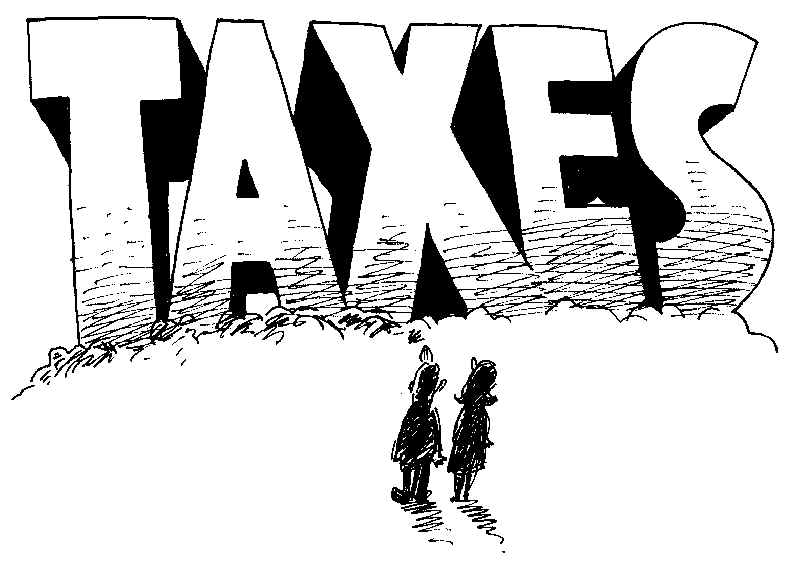

Contrast these compliance rates with the top income tax rates — and the levels at which those rates kick in — published by The Economist recently:

As the short piece containing the graphic notes, “taxation is rarely simple. At $218,055, the income level at which Britain’s new rate kicks in is considerably higher than in Sweden or Belgium. Switzerland and America may seem softer on their high earners, but local income taxes could bump up the top rate in those countries to over 40%.” So, looking only at nation-level income taxes distorts the picture a bit.

Regardless, the United States has lower levels of taxation on high earners than any Western state except Switzerland. Both have among the highest rates of compliance. Indeed, while they eyeball correlation is not perfect, it seems that higher rates of taxation increases the incentive for avoiding taxes.

Christie and Holzner’s paper “What Explains Tax Evasion? An Empirical Assessment based on European Data” [PDF] demonstrates that it’s a bit more complicated than that, with a host of cultural and structural factors accounting for the differences. What’s especially interesting is that European compliance rates are comparatively low despite the prevalence of sales and value added taxes, which are more difficult to avoid than the income taxes popular in the United States.

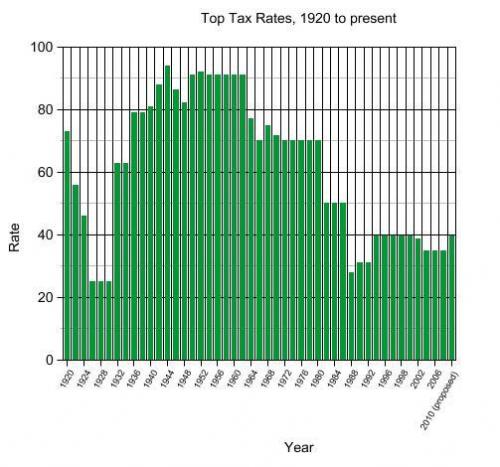

It should be noted, too, that the current levels of taxation on the wealthy are among the lowest in American history. The top tax rate [PDF] has fluctuated wildly since the passage of the 16th amendment in 1913 and was above 60 percent for most of the 20th Century. John Cole graphed it thusly:

Compliance was quite high even in the long period when the top rate topped 90 percent, so the explanation in the American case is likely a matter of cultural norm rather than the amount of taxation.

James Joyner is managing editor of the Atlantic Council.

Image: Taxes.1.jpg