European venture capital (VC) suffers from fragmentation, undersized funds, lack of private capital, excessive and unfavorable regulations, dependence on public investment, and an often risk-averse culture. These factors that stymie VC in Europe are interconnected and mutually reinforcing.

European venture capital (VC) suffers from fragmentation, undersized funds, lack of private capital, excessive and unfavorable regulations, dependence on public investment, and an often risk-averse culture. These factors that stymie VC in Europe are interconnected and mutually reinforcing.

The European Union (EU) is still not one large VC market; instead, the EU is made up of twenty-eight markets with different regulatory regimes. To market their funds across different EU member states, many VC fund managers must pay a fee and register their funds in each EU country. National corporate tax systems throughout the EU actively discourage equity financing and incentive debt financing. For funds operating across EU borders, double taxation remains a serious obstacle. EU-wide regulations, such as Basel III and Solvency II, impede equity investments by banks and large insurance companies. As a result of this fragmented VC market, today’s typical European VC fund only operates in one EU member state and is much smaller than its US competitors.

The smaller size of the European VC funds makes them a less attractive investment target for large international institutional investors such as sovereign wealth and pension funds. The lack of capital, especially private funding, has made European VC funds dependent on government financing. European governments provide more than 30 percent of the total VC investment in Europe. Ultimately, Europe’s entrepreneurial culture still does not promote the same risk-taking attitude generally considered vital for the success of US VC hubs.

Positive signs

Despite the complex set of obstacles facing European VC, there are many reasons to be optimistic about the future of the VC industry in Europe.

Europe already meets many of the preconditions necessary for a successful VC and start-up environment. The Continent’s excellent research universities are producing world-class scientists, engineers, and programmers capable of building companies to rival their Silicon Valley competitors. It is also easy to forget that Europe’s consumer market is bigger than that of the United States.

In addition, Europe’s VC and entrepreneurial landscape is maturing, illustrated by the rise of major VC hubs such as London, Berlin, Paris, and Stockholm. European entrepreneurs are increasingly returning home, after gaining invaluable expertise in the United States. This expertise from Silicon Valley will be vital for the next generation of European founders.

In 2016, European VC funds raised $9.4 billion, the highest total in over a decade. As a result, an increasing number of US investors are participating in European VC deals. In 2016, US investors took part in 63.8 percent of all European VC deals.

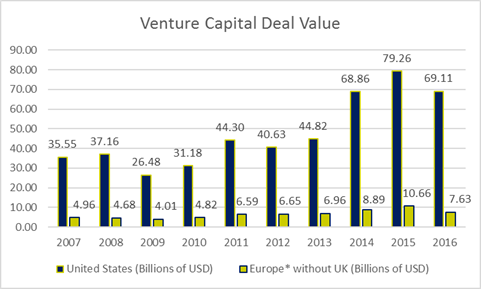

Source: Pitchbook Europe. *Includes EU member states, other European countries. Excludes UK.

Solutions

While there are positive signs for the European VC market, solutions must be provided to address the European VC market’s fragmentation, its undersized funds, the lack of private capital, and the dependence on public funding. VC industry insiders and experts have long championed the idea of establishing a Pan-European VC fund-of-funds (FoF). The rationale behind a European FoF is to create a large fund that attracts more private institutional investors, such as pension and sovereign wealth funds, from Europe and the rest of the world. An FoF could boost the size of VC funds across Europe and unlock cross-border investment. To overcome the dependence on public funding, governments must only act as first movers to catalyze financing by private investors. To be sure, a European FoF would only be an interim solution until the VC ecosystem is self-sufficient

In response to long-standing appeals from VC experts, the European Commission has announced that it will launch an FoF with an initial investment of up to $420 million. The EU investment is limited to make up no more than 25 percent of the FoF with the remaining 75 percent coming from private investors. Simply put, if the EU were to contribute €420 million, the FoF would reach a total of at least $1.7 billion.

In addition to the pan-European VC fund-of-funds, EU member states are working to provide smarter government support that focuses on cross-border investments. In December 2016, France and Germany created a joint $1 billion fund specifically targeted to help start-ups scale up their operations more efficiently and quickly to be able to compete with their better-funded US counterparts.

As part of the its Capital Markets Union Action Plan, a roadmap to strengthening the economy and stimulating investment so as to create jobs, the European Commission is addressing some of the problems outlined above. The Commission is reforming its European Venture Capital Funds (EuVECA) and European Social Entrepreneurship Funds (EuSEF) regulations to enable VC managers to market their funds across the EU. First, to make cross-border marketing cheaper, VC managers will not have to pay fees to register their funds in each EU member state anymore; the process will be more centralized. Second, VC funds of all sizes can now take advantage of the EuVECA and EuSEF labels to market their funds. Third, VC managers can now invest in a much broader spectrum of companies. The EU is also reforming its corporate tax policy to reduce the “debt-equity bias” and, in turn, stimulate demand for market financing.

Ole Moehr is a program assistant with the Global Business and Economics Program at the Atlantic Council. You can follow him on Twitter @AC_GBE.

This blogpost is an excerpt from the EuroGrowth Task Force’s report on European economic growth and why it matters to US prosperity. The Global Business & Economics Program launched the report on March 10, 2017.

Image: European Commission President Jean-Claude Juncker holds up a pen after signing document during the EU leaders meeting on the 60th anniversary of the Treaty of Rome, in Rome, Italy March 25, 2017. (Reuters/Remo Casilli)