Why the US cannot afford to lose dollar dominance

This Atlantic Council Strategy Paper explores the relationship between the status of the United States as a geopolitical superpower and the role of the US dollar as the world’s dominant currency. It examines how these two facets of US power have reinforced each other and how a decline in either of them could trigger a downward cycle in US influence around the world. The report discusses options for how the United States could counteract such trends, relying on its traditional strengths and strategic alliances.

How to keep the dollar at the center of global trade

Over the past eight decades, the status of the United States as an economic and geopolitical superpower and the role of the US dollar as the world’s dominant currency have reinforced each other. As a synonym for the dollar’s preeminent role in international currency transactions and foreign reserve holdings, dollar dominance has long been associated with the United States’ exorbitant privilege to finance large fiscal and current account deficits at low interest rates. This has helped the United States run a large defense budget and conduct extensive military operations abroad. In turn, the United States has used its military capabilities to support the free flow of goods and capital across the globe, boosting global growth while providing investors with confidence that investments in US financial instruments are secure. This virtuous cycle contributed to the long-lasting stability of the post-World War II international order, leading to a sustained rise in economic welfare in the United States and around the world.

As the size of the US economy relative to the rest of the world continues to shrink, this dynamic may begin to be turned on its head.1Gross domestic product at purchasing power parity (PPP) reflects differences in international price levels and offers the best concept to compare economic output and living standards across countries. According to this measure, the global share of US GDP has declined from 20 percent in 2000 to 15 percent in 2024. See, e.g., IMF Datamapper, https://www.imf.org/external/datamapper/PPPSH@WEO/OEMDC/ADVEC/WEOWORLD/USA. Maintaining a global military presence would be harder to finance in the future if the US dollar were to lose its dominant reserve position, reversing the virtuous cycle and precipitating a US loss in global influence. This is one of the reasons why strategic competitors, such as China and Russia, currently work toward a “dedollarization” of their economic relations and global financial flows more broadly. Although last year’s BRICS summit failed to make progress on an alternative financial order, China and Russia are set on undermining the leading role of the dollar, limiting the United States’ ability to impose sanctions, and making it more costly to service its debt and finance a large defense budget.2The BRICS grouping has expanded beyond its core nations of Brazil, Russia, India, China, and South Africa. The ten non-Western nations in the coalition “now comprise more than a quarter of the global economy and almost half of the world’s population”; see Mariel Ferragamo, “What Is the BRICS Group and Why Is It Expanding?,” Council of Foreign Relations, December 12, 2024, https://www.cfr.org/backgrounder/what-brics-group-and-why-it-expanding.

There is currently no other currency (or arrangement of currencies) that could challenge the US dollar’s preeminence, however. Even a smaller role of the dollar in global trade transactions would not immediately challenge its reserve currency status, given the lack of investment alternatives in other currencies at a scale comparable to US markets. The dollar has also benefited from strong global network effects that would be difficult to replace (that is, the costs for any country to divest into other currencies remain prohibitively high unless other countries do the same). Nevertheless, the tariff measures recently announced by the Trump administration could lead to a decline in the global use of the dollar, especially if they were accompanied by a decline of trust in the United States as a safe and liquid destination for global financial assets. Similarly, a proposal by the current chair of the Council of Economic Advisers to use tariffs as leverage for negotiating favorable exchange rate parities with US trade partners and to restructure their US Treasury holdings into one-hundred-year bonds—a so-called Mar-a-Lago Accord—would deliberately weaken the dollar to support domestic manufacturing. This could further erode the currency’s global dominance. Both scenarios would involve high costs to the world economy, including for the United States. More fragmented markets and higher financial volatility would be associated with income losses and higher inflation. Facing higher borrowing costs, the United States would be forced to make difficult spending decisions between its military budget, social welfare programs, and other priorities. Its global leadership role would decline, allowing strategic antagonists to benefit from any vacuum that a smaller US role would leave behind.

It is therefore vital to US national security that the dollar retain its role at the center of global trade and financial networks. This paper proposes ways for the United States to maintain the attractiveness of dollar-denominated assets for foreign investors, arguing for a speedy resolution of tariff disputes that have a strong potential to weaken its global standing. It underscores the need to compensate for a relative decline in US economic and military capabilities with strong alliances, which would deny China and other autocratic states a strategic opportunity to weaken the United States’ influence on the world stage and the exorbitant privilege that the dollar’s role as the global reserve currency still confers.

Strategic context

For the past eighty years, the United States’ economic and geopolitical preeminence and the role of the US dollar as the world’s dominant currency have contributed to a vast increase in global trade and capital flows. The “exorbitant privilege” to finance large fiscal and current account deficits at low interest rates helped the United States maintain its large geopolitical footprint, which contributed to the stability of the environment fostering global commerce and investment. However, as the center of the world’s population and economic activity has been shifting toward Asia and Africa, the virtuous cycle supporting the US-led global architecture threatens to come to an end, giving way to greater economic and geopolitical volatility.

The exorbitant privilege

The US dollar’s rise as a global reserve currency dates back to about a century ago, when the British empire was in decline after World War I. The United States had become the world’s agricultural and manufacturing powerhouse, its largest trading nation, and a major source of foreign capital around the globe. It was natural for the dollar to also become one of the major currencies used for international transactions, and it eventually started to replace the pound as central banks began to hold larger shares of their reserves in dollars in the late 1920s. The transfer was backed by the economic dynamism of the world’s richest democracy and, after 1945, its might as a victorious military power.

In the early years after World War II, the dollar was the anchor for the Bretton Woods system of fixed exchange rates, established on a US promise to exchange dollars for gold at a fixed parity. It became increasingly clear, however, that the gold-based system was not adequate for a fast-growing global economy that underwent a gradual liberalization of capital flows. In the meantime, French government officials accused the United States of exploiting the status of the dollar to run up large fiscal deficits (driven by the costs of the Vietnam war), a phenomenon they dubbed the “exorbitant privilege.”3Barry Eichengreen, Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System (Oxford: Oxford University Press, 2011). However, when the United States under President Richard Nixon decided to take the dollar off its gold parity in 1971, this did not provoke a major flight away from the US dollar—on the contrary, the dollar itself had by then become the anchor for the global financial system.

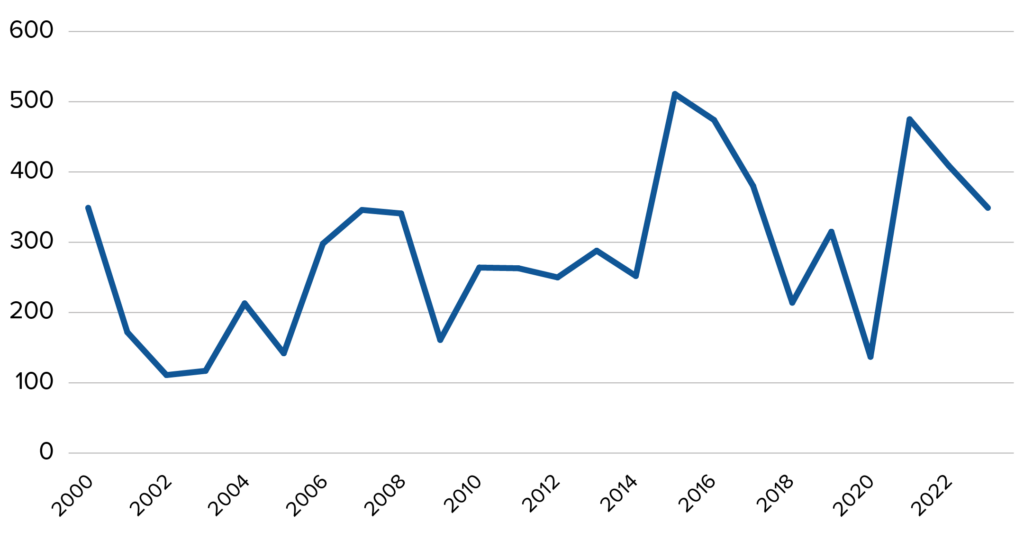

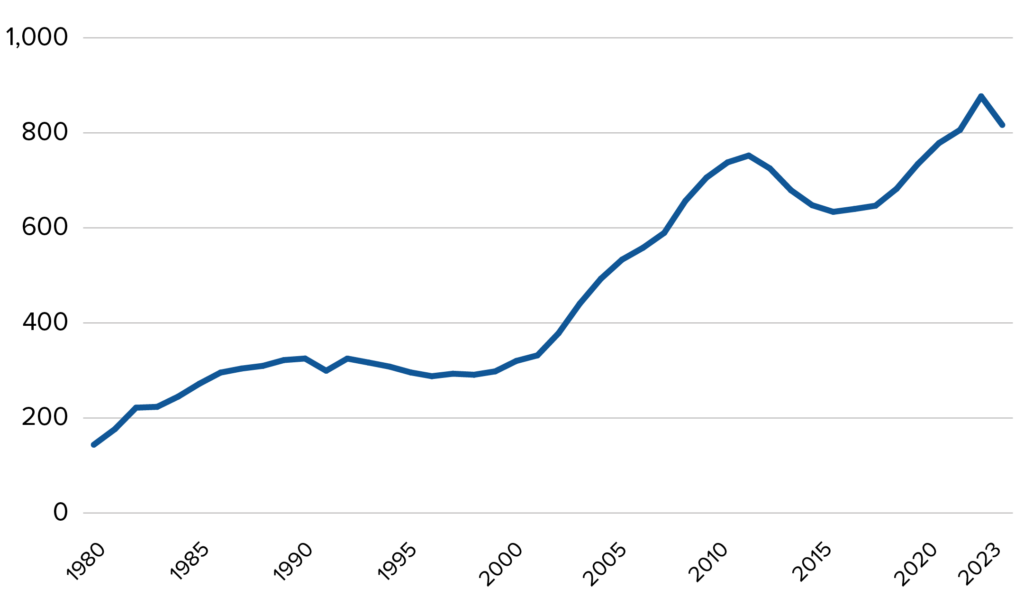

Today, more than fifty years after the “Nixon shock,” the United States still benefits from the dollar’s leading role in the global economy, even as the relative size of the US economy has shrunk. Until recently, dollar payments accounted for 96 percent of trade in the Americas, 74 percent in the Asia-Pacific region, and 79 percent in the rest of the world outside Europe. About 60 percent of global official foreign reserves were held in dollars, and about 60 percent of international currency claims (primarily loans) and liabilities (deposits) were denominated in dollars. The United States was the world’s largest investment destination, with foreign direct investment (FDI) totaling $12.8 trillion. Inward FDI flows have increased five-fold in the last three decades with $311 billion in new investment in 2023 (see Figures 1 and 2).

Figure 1. Inflows of foreign direct investment (FDI) to the United States were the same in 2000 and in 2023 (in millions of dollars)

Figure 2. Stock of FDI in the United States has increased five-fold since 2000 (on a historical cost basis, in trillions of dollars)

In an era of floating exchange rates and liberalized capital markets, one should nevertheless be realistic about the benefits the dollar’s status as a reserve currency. It is true that the United States can borrow exclusively in its own currency; it also enjoys somewhat lower interest costs because other countries’ official reserves are being invested in US Treasury securities; and it generates seigniorage income from dollars being held abroad. But real interest rates among the advanced economies have moved broadly in tandem in recent years, and estimates for the interest savings on US treasury bonds due to the US dollar’s reserve currency status amounted to some 10 to 30 basis points at best. The exorbitant privilege therefore seems to lie mostly in the volume of debt the US government can borrow without incurring higher interest rates. One recent estimate, for example, suggests that the reserve currency status of the US dollar increases the sustainable level of US government debt by 22 percent.4This means that, for example, if the United States could sustain a maximum public debt level of, say, 200 percent of GDP, the loss of dollar dominance would reduce this level to 164 percent of GDP. See Jason Choi, et al., “Exorbitant Privilege and the Sustainability of US Public Debt,” NBER Working Paper 32129, National Bureau of Economic Research, February 2024, https://doi.org/10.3386/w32129.

US deficit financing

The large size of the US economy and demand for US government securities have made US financial markets the deepest and most liquid markets in the world, with about $27.4 trillion in outstanding US government debt as of July 2024. This has been supported by strong institutions and a transparent regulatory environment, the absence of capital flow restrictions, and the wide range of services offered by the US financial industry, which all have attracted foreign capital into the United States. The importance of US debt markets was also evident during times of crisis when global shocks tended to trigger a “flight to safety” into US assets.

The market depth and safety of US dollar assets are features that traditionally distinguished the United States from other major economies that also have large financial markets and issue bonds primarily in their own currency, such as the euro area, Japan, or the United Kingdom. Moreover, these countries do not have their own means to guarantee their geopolitical security; they depend on alliances with the United States as the ultimate sovereign guarantor. This is in large part a function of US military strength and the US nuclear arsenal, backing up NATO’s credibility as a collective defense organization. Although these factors used to be rarely invoked as an explicit factor in investment decisions, investors’ trust in the ability of the United States to preserve its dynamic economy and honor its financial obligations even during times of conflict lies at the heart of the US dollar’s global dominance.

The strong preference of investors for US dollar assets allowed the United States to run permanent current account deficits in recent decades, driven both by government spending and the low saving preferences of its households. As a side effect, the United States has often functioned as a “locomotive” for the global economy, providing growth impulses for export-oriented economies such as China, Japan, or Germany, whose high saving rates and current account surpluses are the counterpart to US deficits. Moreover, for many years, differences in the composition of US financial assets (largely FDI and other equity) and liabilities (lower-yielding bonds) provided the United States with a positive foreign income balance despite the growing amount of net foreign liabilities.

Will the good times last?

Even before the current administration sought to reorient global trade patterns by imposing tariffs on allies and other trading partners alike, the question was whether and how long the United States would be able to hold on to the dollar’s dominant role. There were several developments that pointed to a more difficult future ahead, including demographics, geopolitics, and technological trends. Already at that time, however, it was clear that domestic policy choices would ultimately determine whether the United States would hit a limit in the willingness of foreign investors to finance its rising liabilities vis-à-vis the rest of the world.

First, while the US dollar is still the world’s leading reserve currency, its share in central banks’ reserve holdings has gradually fallen in recent years. The dollar’s share declined from around 70 percent in the 2000s to 60 percent in 2022, when it was followed by the euro (20 percent) and several currencies in the single digits, including the yen, pound, and Chinese renminbi. The renminbi has gained some market share as a reserve currency in recent years; yet China, with its closed capital account and politically uncertain investment climate, has not been able to significantly increase international use of its currency. Instead, most gains have been made by a range of smaller currencies, including the Australian and Canadian dollars, reflecting digital technologies that have facilitated bilateral transactions without involving the US dollar as a bridge currency. Smaller currencies may indeed continue to gain market share, but there could also be other shifts in the global reserve composition, depending on the further evolution and impact of US trade and sanctions policies. The rise in gold prices, for example, has been attributed to central banks increasing their holdings within their reserve portfolios.

Second, US net foreign liabilities have increased sharply since the global financial crisis, increasing to about 70 percent of gross domestic product (GDP) by 2023. To put this in perspective, only Greece, Ireland, and Portugal are larger net debtors among industrial and emerging economies, and US net liabilities are equal to 90 percent of the net assets of all creditor countries combined. Since current account deficits have generally been modest over the past decade, the decline owes to valuation changes stemming from the strong performance of US equity markets relative to international markets, increasing the wealth of foreign investors holding US stocks. To serve these net liabilities, foreigners implicitly expect US companies to remain highly profitable and the United States therefore to run larger trade surpluses going forward. With the dollar gradually appreciating in recent years, it remains to be seen whether these expectations can be met or whether foreign investors will reduce their net holdings of US assets. The increasing negative interest balance (and the fact that much of the positive net returns on FDI were due to profit shifting into Ireland and other low-tax foreign domiciles) has caused some to argue that the extraordinary privilege is no longer in existence.

Third, prospects of continued large budget deficits could make it more costly to finance US government debt in the future. The Congressional Budget Office (CBO) has projected US budget deficits to remain above 6 percent of gross domestic product (GDP) over the coming years. This projection is made on the basis of current law, that is, assuming the expiration of both the 2017 Tax Cuts and Jobs Act (TCJA) passed during the first Trump administration and the healthcare subsidies passed during the Obama administration. Even under this optimistic assumption, government debt is projected to rise from 98 percent of GDP in 2024 to 118 percent of GDP in 2035. While the current administration has vowed to impose significant expenditure reductions to accompany the presumed extension of the 2017 tax cuts, failure to reduce the US deficit could drive long-term interest rates higher in coming years.

Even so, until recently, it seemed too early to worry about the safe asset status of US government securities per se. This was in large part because there are currently no instruments that could match the role of US government securities at comparable volumes. However, the stability of US debt dynamics rests in no small measure on the continued performance of the US economy, which in turn depends on strong institutions and sound economic policies. History shows that political polarization has the potential to undermine both of these pillars, a warning that would be important for the US government to heed while it is reducing government functions and cutting back its public workforce. As Steven B. Kamin and Mark Sobel write, “partisan divisions, political dysfunction, and the resultant inability to cope with the nation’s challenges” should be considered the main risks to long-term US economic prospects and dollar dominance. The administration’s willingness to risk a deep recession to launch an elusive manufacturing renaissance in the United States plays precisely into those concerns.

Even before April 2025, trade restrictions had significantly increased in recent years after declining for most of the twentieth century. The geoeconomic fragmentation driven by the COVID-19 pandemic, Russia’s war of aggression in Ukraine and, most recently, economic tensions between the United States and China, could now drive a major reorganization of global economic and financial relationships into separate blocs with diminishing overlap. A study by the International Monetary Fund (IMF) estimates that greater international trade restrictions could reduce global economic output up to 7 percent. In case of a wider trade conflict, smaller countries could be increasingly forced to choose sides, with those moving closer to China likely aligning their currency use for international transactions and reserves away from the US dollar and the euro.

Fifth, the United States has used sanctions as a tool of foreign policy, particularly against Russia in the wake of its 2022 invasion of Ukraine. This led to the suspension of trading in US dollars on the Moscow Exchange (MOEX), disrupting financial operations not only within Russia, but also affecting other international market players as a result of the extraterritorial nature of the US sanctions. Since 2014, following the sanctions related to the annexation of Crimea, Russia has increased its use of the Chinese yuan, which became MOEX’s most-traded currency (54 percent in May 2024). Concerns about their bilateral trade relations with Russia and China have other countries looking for alternatives to mitigate possible risks associated with US dollar transactions, for example, in the BRICS grouping, which is set to further expand its membership of emerging market economies in coming years. If accompanied by bilateral tariff increases, as currently envisaged by the Trump administration, this could have further implications for the dollar’s role in global trade transactions.

Finally, in the context of a geopolitical fallout, potential tariffs between the United States and the EU could significantly impact the transatlantic economy, which remains the most important bilateral trade and investment relationship for both partners. For example, a 10 percent universal tariff on all US imports is projected to reduce EU exports to the US market by one-third, and subsequent retaliation could similarly hurt US exporters. Higher interest rates in response to tariff-induced inflation would have additional growth implications. All this could heavily weigh on financial markets on both sides of the Atlantic, further reducing the attractiveness of US dollar-denominated assets.

Limits to military superiority

Any developments that weaken the US economy and the role of the dollar could also affect the United States’ ability to preserve its military superiority. China is in the middle of an extraordinary defense buildup that is challenging US strategic positions in the Indo-Pacific theater. Moreover, the Ukraine war has led to stepped-up cooperation between Russia, Iran, and North Korea (which has been contributing troops to compensate for Russia’s losses), and China increasingly supports Russia’s armament efforts by supplying it with drones and dual-use technology.

The United States and Europe have also been pushed on the defensive in Africa as China, especially, has made strategic inroads there, as have Russia, India, and countries in the Persian Gulf. Many countries are looking to China for help in developing their energy and transport infrastructure, imports of low-cost consumer and investment goods, and market access for their own exports, allowing the use of strategic ports and other locations in exchange.

At the same time, China has a hold on supply chains involving critical raw materials, controlling 85 percent of the world’s refined rare earth materials, which are crucial for high-tech military technologies. If made unavailable to the United States, this could significantly complicate the production of advanced weaponry. The global processing capacity for critical raw materials is also highly concentrated in China, providing it with means to influence market prices and access, and creating supply chain vulnerabilities and dependencies.

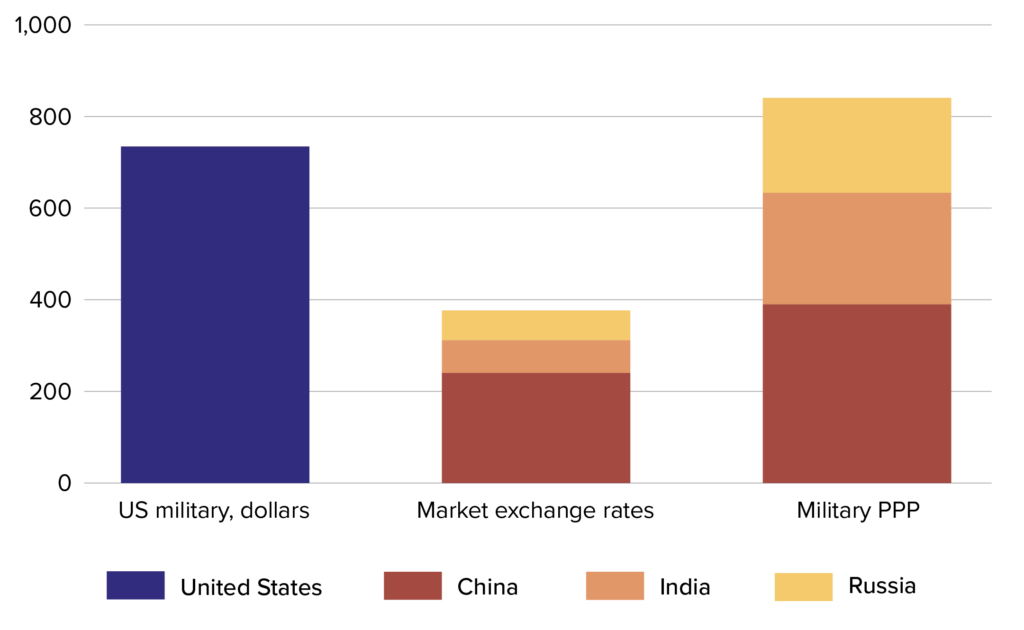

Advances in military technology toward low-cost weapons, lower procurement costs in competitor countries, and a relative decline in US manufacturing capabilities (e.g., in shipbuilding) pose significant challenges to US military strength. While the United States retains a large nominal advantage in military spending over other competitors, the discrepancy is smaller when considering cost differences; in other words, the United States has a smaller advantage in real terms than suggested by simple budget comparisons (see Figure 3).

Figure 3. Combined military spending by China, Russia, and India outstrips the US when calculated by purchasing power parity (2019, in billions of dollars)

In fact, a recent congressional review of US defense strategy has raised concerns that the United States is not ready for a multifront war spanning theaters in Europe and Asia. US forces have also been slow to adopt new battlefield technologies, including a trend toward autonomous weapons systems, which will take considerable time to redress. In addition, the end of the New START treaty in 2026 could trigger a nuclear arms race that would force the United States to expand its nuclear forces after decades of deep cuts.

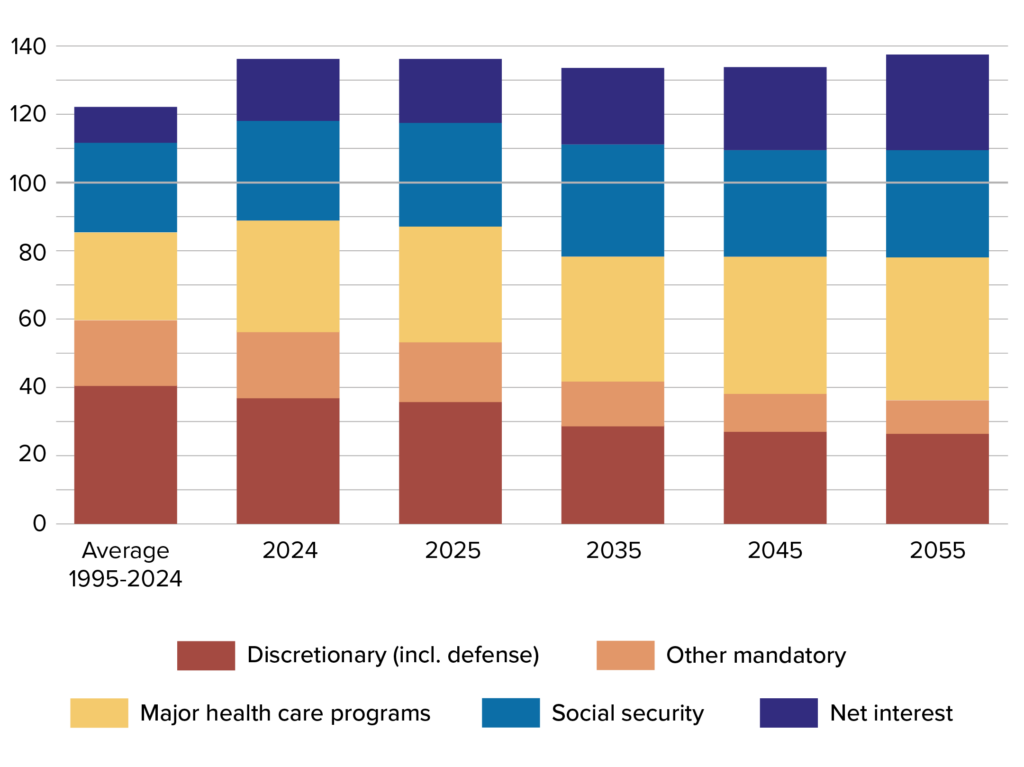

While the United States is still the only country able to project military power at any point in the world, it is unlikely to be able to respond to these challenges on its own. The room to dedicate additional fiscal means to the US defense budget is increasingly circumscribed by growing interest and entitlement spending (see Figure 4), and even under optimistic assumptions, there is a risk of strategic overreach for the United States, given the magnitude of challenges across different regional theaters.

Figure 4. Projected federal outlays show entitlement spending and growing interest may curb defense spending (2025, as a percentage of federal revenues)

While US presidents have long called for European nations to play a bigger part in their own defense, the second Trump administration has ramped up the pressure on NATO allies to take on a larger military role and financing burden in the European theater. However, raising the combat readiness of European armed forces will require several years under the best of circumstances. Unless the United States is willing to cede military dominance in Europe to Russia, it will need to continue supporting its European allies—including in arms production, securing supply chains, and military burden sharing—for the foreseeable future.

If the United States were to forgo a deepening of its alliances in Europe and become outmatched by China in Asia, it could in principle still benefit from the relative safety of its continental geography. However, it would face a loss of military stature and reduced global reach. No longer being a global hegemon, the United States would not be able to protect global trade and financial flows in the way it has done in the past, hurting itself and other economies that similarly benefited from open trade. The United States would leave a vacuum of power that would most likely be filled by China and other autocratic countries, with detrimental effects for its own security and economic stability.

Goals

This paper proposes a strategy to preserve the US dollar’s lead role in international markets, allowing it to continue attracting foreign capital at favorable interest rates. As laid out above, the dominant role of the US dollar has been a key element in a decades-long virtuous cycle that allowed the United States to finance its large military apparatus while expanding its social safety net and keeping a low tax burden.

With the rise in public debt and the sharp increase in net international liabilities, this cycle cannot continue indefinitely. The time has come for the United States to begin reining in deficit spending and rebuilding its fiscal position. Notwithstanding the Trump administration’s commitment to this objective, this process will take time, given continued pressure on defense and entitlement spending. Continued dollar dominance would therefore be critical for keeping a lid on interest rates while nurturing a political consensus that could lead to a lasting decline in government deficits over several administrations.

Continued dollar dominance would also be beneficial from a geopolitical perspective, providing the United States with leverage in shaping the future of global finance, leadership in multilateral organizations, and the continued possibility of sanctioning opponents to raise the cost of acting against US interests. Having said that, the United States’ ability to dominate global developments on its own will likely continue to diminish. To maintain and reap the full benefits of the dollar as a reserve currency, it will need to rely more on networks with countries that have trade, financial, and security interests that align with those of its own. These networks evolve around shared interests, and they will only thrive in an environment of mutual respect and give-and-take.

Breaking up such networks by way of a US isolationist withdrawal—the possibility of which is as high as it has been at any time in the past century—would trigger a fragmentation of the global economic and security landscape with large losses in general welfare (i.e., prosperity and well-being) both in the United States and abroad. It would accelerate the decline in the dollar’s reserve status as it could force countries to fundamentally rethink their security arrangements, possibly leading to a reorientation of trading and financial relationships toward China and other illiberal states.

In fostering US interests, the objective for US policymakers should therefore be to maximize the mutual advantages accruing from working with countries that benefit from the United States’ global economic and security footprint, as well as the stability provided by the dollar as a leading currency. If the United States manages to pursue its domestic interests while remaining at the center of a network of powerful alliances, the dollar’s reserve currency status and its exorbitant privilege could serve US interests for years to come.

Major elements of the strategy

In principle, the new US administration has a strong opportunity to address the geopolitical challenges facing the United States, given its decisive electoral victory and control over both houses of Congress. While there is clearly a risk that ideological priorities might preempt serious work on other issues, the presence of growing external threats should eventually refocus attention on several objectives that would be in the strategic national interest.

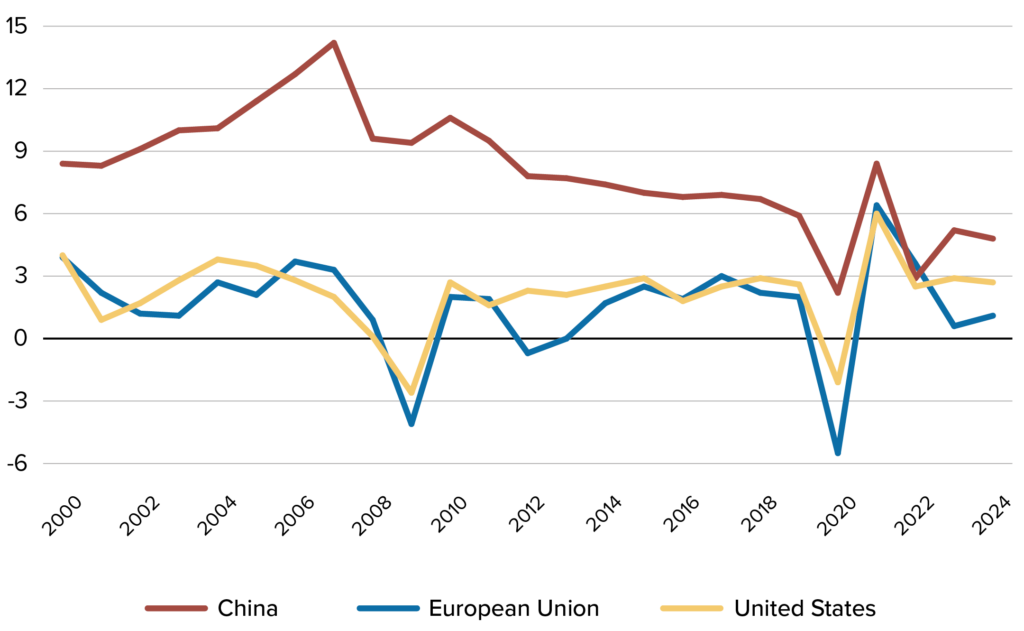

Foster strong and robust long-term growth

The first objective coincides with one of the administration’s key priorities, namely, to create the conditions for strong US economic growth and employment over the long term. This is a necessary condition for the United States to retain its economic and military superpower status: Without a strong economy, the burden of maintaining a global footprint would eventually become suffocating and capital would become increasingly unavailable to support a growing debt burden. In the worst case, the United States would follow the example of the United Kingdom, whose leading global status was gradually eclipsed by other powers during the last century (see Figure 5).

Figure 5. China’s GDP growth rates have outpaced those of the United States and the European Union for more than two decades (2000–2024, measured at constant prices)

The question is how the dynamism of the US economy can be maintained against the background of weakening demographics, rapid technological change, and fragmenting global trade. These trends challenge the business model of established US companies, especially those competing against Chinese or other firms that benefit from the tools of state capitalism being deployed by their home countries. Moreover, supply chains for critical raw materials and intermediate products seem more tenuous in the future, given the dominant position of China in key industries.

From a trade perspective, there are two considerations that the administration should have balanced. On the one hand, firms should be allowed to continue to operate in an open and competitive market environment that rewards innovation and efficiency, in turn allowing the United States to reap the productivity gains necessary to generate future gains in income and welfare. On the other hand, it would be naive to expect US companies (or industries) to thrive in sectors where state-backed competitors enjoy large-scale cost advantages due to extensive subsidies or other forms of state support. This suggests that the new administration should have avoided a protectionist trade stance, shielding a large part of the US economy from foreign competition. However, it should also have been prepared to stave off an economic decline of sectors that could be critical for long-term economic or military purposes.

In early April, however, the administration took an opposite approach by raising tariffs on almost all other countries in proportion to bilateral trade imbalances. (Many of the highest tariff rates were temporarily paused a week later, leaving a 10 percent rate on most of the world for now.) Apart from their economic and financial fallout, these measures are unlikely to significantly reduce the overall US trade deficit, given (a) the substantial difference in domestic saving rates between the United States and large trading partners; (b) retaliatory measures taken by many countries; and (c) trade diversions and exchange-rate adjustments that will counter some of the effects of the tariffs.

It remains to be seen whether investment in the United States will pick up to a significant extent, given the uncertainty about the extent and duration of the trade restrictions currently in place. Moreover, labor-intensive manufacturing industries will have a hard time regaining a footing in the United States, given the falling costs of automation and persistent labor cost differentials with emerging markets and developing countries. A major plank of a strategy to boost employment and long-term growth should therefore lie in a speedy resolution of trade negotiations and a reduction in bilateral tariff rates between the United States and its largest trading partners, particularly Europe, Japan, and China.

The United States should also focus its industrial policy on boosting innovation, protecting or regaining technological advantages, especially in artificial intelligence (AI) and quantum computing, preserving access to supply chains and export markets, and maintaining strategic production capacities, preferably in conjunction with its European and Asian allies.

Beyond trade policies, there is a much larger agenda to strengthen the growth fundamentals of the US economy. This includes building a growing and better educated workforce that can translate AI and other innovative technologies into commercial products that can be sold in a global marketplace. Given the significant returns to scale in digital technologies, the United States should ensure that its institutions are strong enough to ensure a fair and transparent marketplace and combat monopolistic practices.

All of this would help the United States preserve its productivity advantage vis-à-vis the rest of the world, a key condition for durable real wage growth and rising living standards. To ensure that gains are distributed broadly throughout society, the expiration of key provisions of the 2017 TCJA provides an opportunity to boost incentives for new investment and labor-market participation while generating additional revenues from higher incomes and economic rents.

Moreover, while the new administration has a critical view toward illegal immigration, cutting off the legal flow of well-educated foreign students and productive workers into the United States, a key ingredient for its past economic success, would be an unforgivable own goal.

Regain fiscal room to maneuver

Despite the projected increases of US government debt in coming years, the United States has been able to easily finance large deficits and is expected to do so in the future. However, the increasing amount of outstanding debt, as well as the rise in the average interest rate paid by the federal government, are constraining the budgetary room for new initiatives by the incoming administration. The share of discretionary spending—that is, spending not mandated by debt obligations or entitlement programs such as Social Security and Medicare—has already fallen from around 50 percent in the 1990s to below 30 percent today. As this share is projected to shrink further over the coming years, the trade-off between defense spending (which currently accounts for about half of all discretionary expenditure) and other priorities (such as infrastructure spending) is becoming stronger.

Everything else equal, reining in the fiscal deficit would therefore have a positive impact on long-term interest rates and crowd in private investment, a key ingredient for long-term growth. Although the creditworthiness of the United States is not yet in doubt, the increase in US government bond yields after the 2021 inflation scare, as well as the rise in bond yields after the April tariff announcements, has been a wake-up call, indicating a departure from the low-interest environment of the 2010s. It also increased the cost of private-sector investment, including higher mortgage rates that have contributed to a significant drop in new housing construction.

The first-best option to realize budgetary savings would be on the back of sustained robust growth, as discussed in the previous section, whereas deficit-financed tax cuts or spending increases would deepen the United States’ long-term fiscal quandary. Fiscal policy should instead focus on enhancing the efficiency of the tax system and reducing public expenditure—especially in the health sector, where the United States outspends other advanced economies by a large margin while achieving inferior outcomes.

However, imposing across-the-board spending cuts and labor-force reductions are not a proven tool to generate significant fiscal savings. They have a relatively small budgetary effect but a possibly significant impact on the government’s ability to function, which will eventually have to be rectified through new hirings. Given the demographic trajectory, there also is a need at some point for better targeting or changing the economic parameters of US entitlement programs (the “third rail” of US politics), but with continued dollar dominance, the United States would still have the space for a gradual phase-in of policy reforms.

Maintain deep and liquid financial markets

US financial markets are attractive to foreign investors because of their openness and underpinning by transparent and market-friendly rules established by US law. As a result, foreign portfolio holdings in US equities amounted to $13.7 trillion in 2023, and foreign investors owned $7.6 trillion in Treasury securities, equivalent to about a third of publicly held federal debt. Moreover, foreign deposits in the US banking system have steadily risen to about $8 trillion in 2024, highlighting the important role of foreign capital for the functioning of the US economy. Besides maintaining a welcoming framework for foreign investors, the United States will also need to ensure that financial market regulations remain effective and stay up to date with technological developments.

The more volatile geopolitical and economic environment has already tested the resilience of US financial markets, and both regulators and private entities should be prepared to deal with future shocks. As in other advanced economies, for example, US banking regulations have considerably tightened since the 2007–2009 global financial crisis; but the failures of Silicon Valley Bank and several other midsize institutions have revealed continued supervisory problems. US and European regulators were close to concluding an extension of the Basel Accord (Basel 3.1), but momentum has been lost given strong resistance by the financial industry on both sides of the Atlantic. Even if the new administration were unwilling to pursue negotiations within the Basel Committee, or planning to consolidate regulatory agencies, it must not lose focus on ensuring that banks remain well-run and adequately capitalized.

In a similar vein, there have been episodes in recent years when liquidity in US government bond markets collapsed, threatening to severely disrupt the workings of the global economy (with daily trading volumes in the Treasury bond market averaging $600 billion in 2023). Both the September 2019 repo crisis and the March 2020 meltdown required emergency intervention from the Federal Reserve system to keep the markets operational. Changes to the functioning of markets, including channeling a larger number of transactions through clearing agencies and improving transparency, should help reduce uncertainty during times of crisis, provided they are left in place by the new administration.

This, of course, assumes that there are no policy accidents, such as the US Congress not authorizing a debt ceiling increase, which could lead the United States to default on its government bonds and seriously undermine the US dollar’s standing abroad. Similarly, a forced change in the terms of US government bonds as has been proposed by some analysts, especially if directed at foreign investors, carries the risk of a large repricing of US financial instruments that could be traumatic for financial markets worldwide.

In the realm of financial regulation, the United States had until recently taken a conservative approach to innovative technologies such as stablecoins and cryptocurrencies. A 2022 report by the Financial Stability Oversight Council found that activities involving crypto assets “could pose risks to the stability of the US financial system if their interconnections with the traditional financial system or their overall scale were to grow without adherence to or being paired with appropriate regulation, including enforcement of the existing regulatory structure.”

The new administration has adopted a more welcoming approach, with several crypto proponents taking on key roles in US regulatory agencies. This pro-cryptocurrency stance may well lead to stronger innovation, but it could also contribute to heightened market fluctuations and uncertainties. Even under a lighter touch, new rules and regulations are likely to emerge from this transition phase. While this will pose some compliance challenges for companies, it will still be important to balance innovation with financial stability concerns. Introducing appropriate safeguards and maintaining a strong commitment to ethical practices will prove essential for helping businesses navigate the evolving landscape, build trust with consumers and regulators, and ensure the long-term success of digital payments.

By contrast, the Trump administration’s negative stance on the creation of a US central bank digital currency (CBDC) creates a potential risk to the dollar’s global standing. While there is indeed no clear use case for a CBDC at present, and adoption of retail CBDCs in most countries so far has been small, technological developments in this area are hard to predict. The United States might prefer to foster US dollar-based stablecoins rather than a CBDC to cement the dominant role of the dollar, but there is a risk that it could fall behind if a large number of other countries were to shift to CBDC-based settlement technologies. Moreover, given the challenging nature of digital currencies, the United States would not be able to shape international regulations that promote the efficient use of CBDCs and address critical concerns related to money laundering, fraud, and consumer protection.

Strengthen relations with emerging markets and developing countries

As the United States and Europe vie to preserve their geopolitical primacy against the onslaught from Russia and China, it is important to keep in mind that the world’s demographic center of gravity has already begun to shift toward Africa, India, and Southeast Asia. The geopolitical weight of these regions is still relatively modest, but their economic role is expected to steadily increase due to powerful demographics. Compared to China, the United States has been slow to recognize the importance of intensified trade relations with countries that may relatively soon become key export markets for US companies and engines for global growth.

Not long ago, the United States and other industrial countries were the major source for development finance, including through bilateral aid and in their role as majority shareholders in the Bretton Woods Institutions. The results of this decades-long engagement were decidedly mixed, however. Numerous large emerging-market countries thrived after the crises of the 1990s, but loans to many developing countries turned sour as countries failed to sustainably generate increases in per capita incomes. Member countries of the Organisation for Economic Co-operation and Development (OECD) consistently missed their targets for grants and other development aid, and developing countries have accused the industrialized world of not providing adequate compensation for the damage caused by past CO2 emissions.

China has used this opportunity to project itself as a friend and partner for many developing countries. Deploying its ample foreign exchange reserves (which it has been keen to direct away from US Treasury bonds), China’s Belt and Road Initiative has financed investment projects in resource-rich and strategically located developing countries—surpassing one trillion dollars—deepening trade and political relationships in a way that the West has been unwilling to match, and making China the world’s largest debt collector. China has leveraged these relationships to secure access to critical minerals and set itself up as the market leader in their processing and refining, gaining geopolitical leverage against the United States in the event of a future trade war. China has also received considerable diplomatic support from developing countries for its policy of unification with Taiwan.

The United States and its Western partners should urgently contest China’s position as an informal leader of the developing world. There is space to do so, as many countries have been disillusioned by China’s self-interested motives, which have often left them with badly executed infrastructure projects and high debt that proved difficult to restructure. To be successful, however, the United States and its allies must increase the speed and volume of their engagement with developing countries, offering projects and loans that exceed those of Chinese lenders in quality while being competitive in cost and timeliness. The Trump administration should therefore advance the planned restructuring of the former US Agency for International Development (USAID) under the State Department or the Development Finance Corporation (DFC), resuming support for partner countries in need of economic assistance.

Moreover, given tight national budget constraints, the Bretton Woods institutions should be more tightly integrated in a strategy to support friendly countries in the developing world. To do so successfully, they will need to remain firmly under Western control. However, to preserve their legitimacy as international institutions, they will need to stay focused on their essential mandates, which still enjoy widespread support.

However, the past few decades have shown that a strategy based merely on loans and development aid is not enough. Developing countries also require better market access to boost exports and raise their growth trajectories. While this will be hard to legislate both in the United States and Europe, there could be significant long-term benefits from a gradual market opening. First, it would preempt Chinese companies from cornering markets in countries with strong population growth, and second, pressures for migration could diminish as income in source countries would rise over time. Taking the long view, healthy trade and investment relations with the dynamic economies of tomorrow would benefit the standing of the US dollar.

Finally, the use of sanctions as a tool to achieve geopolitical objectives is a double-edged sword, and they should be used in a more targeted and sustained manner. The primacy of the dollar enables the United States to effectively exclude targeted individuals and economies from the global financial system. However, the effectiveness of sanctions declines over time as actors find ways to circumvent them; at worst, the broad application of sanctions against other countries can lead to a reorientation of global trade and financial relations that could undermine the dollar’s preeminence. For example, the desire of BRICS countries to develop alternatives to the use of the dollar may be inconsequential at present, but it could eventually become one of many factors that relegate the dollar to a less dominant position in global payments and reserve arrangements.

Preserve military superiority

The US National Security Strategy (NSS) recognizes China as a major national security challenge, emphasizing its ambition and capacity to alter the rules-based international order. As a result, the 2022 National Defense Strategy (NDS) focuses on bolstering US deterrence against China, with a strong emphasis on collaboration with allies and partners. Russia also poses a direct threat to US and transatlantic security, particularly in light of its invasion of Ukraine and the resurgence of traditional warfare in Europe. Additional challenges include threats from North Korea, Iran, and terrorist organizations as well as the rise of authoritarian powers, disruptive technological advancements, global economic inequality, pandemics, and climate change.

To preserve its power, strengthen deterrence, and build an enduring advantage, the United States should better integrate its military efforts with the other instruments of national power, such as economics and diplomacy. In an era defined by strategic competition and the rapid diffusion of disruptive technologies, preserving technological superiority is essential. This requires robust investment in research and development, particularly in innovative technologies like advanced weapons systems, satellites, AI, autonomous systems, and human-machine teaming to enhance the efficiency and effectiveness of US military forces.

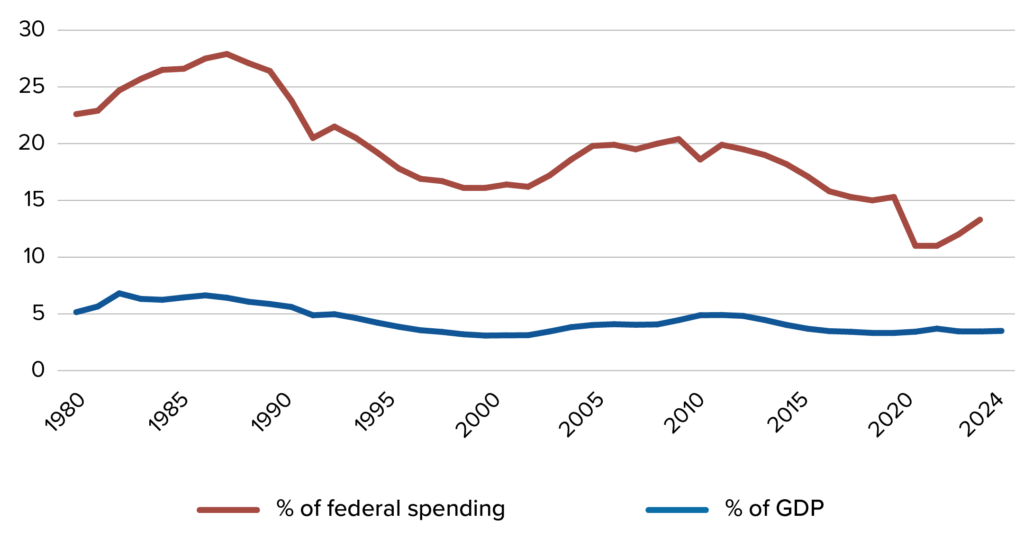

The US defense budget, which was $816 billion in 2023 (see Figure 6), constitutes about 40 percent of global military spending and is projected to increase by 10 percent by 2038 (after adjusting for inflation), reaching $922 billion (in 2024 dollars), according to the CBO; 70 percent of that increase would go to compensate military personnel and pay for operations and maintenance. However, defense spending comprises 3.5 percent of US GDP, down from 5.9 percent in 1989, and 13.3 percent of the federal budget compared to 26.4 percent in 1989 (see Figure 7).

Figure 6. US military spending has increased sixfold from 1980 to 2023 (in billions of dollars)

Figure 7. US military spending has remained steady as a percentage of GDP but fallen as a share of federal spending (1980–2023)

During the first Trump administration, the US defense budget saw significant increases focusing on military modernization and development of new technologies, as well as the creation of the Space Force as a new branch of the military aimed at addressing emerging threats in space. The second Trump administration will likely focus on increasing defense budgets as the “peace through strength” doctrine advocates for a robust military presence to strengthen deterrence.

Aligning defense spending with the goals of the NDS requires prioritization of investment in nuclear modernization, missile defense and defeat programs, and resource allocations across air, sea, and land forces in line with strategic objectives, ensuring the efficient use of budgetary appropriations with a focus on the quality of military capabilities over quantity.

This effort would help sustain the global dominance of the US dollar by deterring geopolitical challenges and ensuring stability in international financial and trade systems, minimizing economic coercion, and reassuring global investors of the security and profitability of the US market. The US Navy plays a crucial role in securing global trade routes by keeping sea lanes open, facilitating the free flow of goods and capital. Additionally, strategic alliances and security arrangements with key oil-producing nations, particularly the Gulf states and Saudi Arabia, reinforce the petrodollar system, sustaining global demand for the US dollar in energy markets. Furthermore, US military and geopolitical strength underpin the credibility of economic sanctions, a critical tool of financial influence and dollar dominance.

Leverage military alliances

The 2022 US NSS emphasized alliances and partnerships as fundamental aspects of the US foreign policy to maintain a competitive edge in an era of strategic competition, including military collaboration, economic partnerships, and diplomatic interactions throughout the transatlantic and Indo-Pacific regions. In this aspect, strengthening relationships with key partners such as India and Japan is regarded as pivotal in addressing China’s increased influence. This includes joint military exercises, as well as sharing intelligence, and combining resources for defense initiatives.

The United States should collaborate with allies to create a secure environment by prioritizing comprehensive resilience in a community that can effectively respond to any security or defense crisis posed by adversaries, authoritarian regimes, malign state and nonstate actors, disruptive technologies, or threatening global events such as pandemics and climate change.

To bolster national security, strengthen military capabilities, foster economic resilience, and maintain global competitiveness, the US administration must prioritize a robust division of labor and responsibilities across key strategic areas, such as manufacturing, military operations, supply chain management, and weapons production. The division of labor with allies and partners enhances further efficiency and productivity, allowing partners to focus on their strengths, streamlining processes in specialized manufacturing companies while reducing costs, and providing access to advanced technologies critical for national defense. Pooling resources and know-how enables allies to share advanced technologies, coordinate and streamline production processes, and build strategic stockpiles.

Collaboration with allies plays a vital role in fostering resilient and redundant supply chains that are critical for diversifying sources of critical materials and reducing vulnerabilities in the face of global disruptions; it also fortifies national defense while promoting mutual security and economic stability. Securing critical supply chains is crucial to safeguard national security and the US administration should develop a National Defense Industrial Strategy to coordinate efforts across government agencies to prioritize resilience and protect the integrity of supply chains critical to defense manufacturing and operations.

Some elements of the above are already in place but need further enhancement and stronger commitment, particularly by leveraging economic opportunities. The United States must align economic and security interests within its alliances. Strengthening NATO’s economic coordination can ensure allies remain integrated into the dollar-based system through trade and defense procurement; it also can promote dollar-based investments in European defense, especially as European NATO partners are committing more resources to the defense sector.

Similarly, an expansion of international alliances and cooperation with a larger number of countries would reinforce dollar-based trade conditions in security agreements and promote standardization with US financial institutions among Indo-Pacific partners. Recommended actions include:

- Expanding the AUKUS security pact (with Australia and the United Kingdom) and the role of the “Quad” alliance (including Australia, India, and Japan) in economic security.

- Enhancing naval cooperation in key maritime regions and with nations that control strategic trade chokepoints.

- Increasing coordination through a strategic allied council, as warranted.

In addition, effective communication would be essential to articulate the nature of the threat with clarity and promote credible narratives to safeguard the information space against propaganda campaigns, cyber influence operations, and the weaponization of social media. Proactive information strategies devoted to strengthening partnerships with like-minded democratic nations can protect public trust and reinforce resilience.

Assumptions and alternatives

This strategy paper is based on several assumptions that are central to its proposals and the period over which they should be implemented.

- First, there is no fundamental change in the principal characteristics of the Chinese economy, namely a heavy degree of state intervention and a closed capital account. India is also assumed to maintain capital account restrictions, and Europe will not implement a single capital market for some time. A change in these conditions could prompt some reserve flows into the respective currencies, but it would still be deemed unlikely that capital markets in these countries would evolve to a point where they could compete with the United States in depth and liquidity.

- Second, US deterrence in key military theaters (Europe, South China Sea, Korean Peninsula) will remain effective for the time being, and the United States does not get drawn into an active military conflict, for example, over Taiwan. Otherwise, the United States would have to shift toward a more decisive and short-term war strategy.

- Third, the United States remains dominant, or at least competitive, in developing critical technologies such as AI, microchip production, cryptology, and communications. It will be able to defend strategic assets, such as major military bases, carrier groups, space technology, or command, control, and communications (C3) infrastructure, against physical or virtual attacks. Failure to do so would make the United States more dependent on the technological capacities of its allies, requiring more effective coordination and systems integration that would be hard to achieve over a short time horizon.

- Fourth, another important assumption is that the new administration will also realize that the United States is indeed lacking the resources to remain the sole military hegemon for much longer. Adopting a more realistic approach will not come without challenges to its own credibility, as the wider US public has yet to realize that technological progress has narrowed the military advantage held by the United States over its competitors, that the room for discretionary government spending could narrow dramatically over the coming years, and that US manufacturing would not be capable of supporting a major military conflict for long. In the event of a future conflict, public support for the Trump administration, or for any US government down the road, could evaporate quickly if these expectations were not corrected through public communication in good time.

The new administration may fear that collaborating more closely with political allies, including the necessary compromises it would require, could lead to a perception that foreign interests are driving US policies. At the same time, the increasing cooperation between China, Russia, and North Korea highlights that the Trump administration would not be able to focus on China alone, as it has stated in the past, while leaving its European partners to deal with Russia entirely by themselves. On the contrary, the lack of an effective European nuclear deterrence might force Europe to increasingly fulfil Russia’s geopolitical demands to avoid armed conflict, potentially allowing Russia to undermine political and economic relations between the United States and Europe. Since Europe remains the United States’ largest trading and financial partner by a significant margin, it should be clear that such a strategy would be entirely self-defeating.

As for some of the tariff and exchange-rate pronouncements by the Trump administration, it is important to keep in mind that an economy with free capital movements and an independent monetary policy cannot pick a specific value for its foreign exchange rate (the “impossible trinity” of economics). In the case of the United States, this means that an imposition of tariffs to weaken the dollar, as has been floated by President Donald Trump during the election campaign, will not change the fact that the US dollar exchange rate remains market determined as long as the United States allows unrestricted capital inflows and outflows and has an independent Federal Reserve. In particular, the exchange rate of the dollar would continue to reflect differentials in saving rates among major trading partners, over which the United States has limited influence.

If the new administration were serious about attempting to depreciate the value of the dollar, it could only do so by undermining its appeal as a safe asset to foreign investors. One way to do this would be to renege on the US commitment to free and open trade and capital flows, which have formed the basis for robust growth over many decades. Tampering with the independence of the Federal Reserve, let alone with the US legal system more broadly, could trigger significant financial volatility, including increases in the market interest rate on US government debt, major stock market losses, and a shock to the US economy that could dwarf any gains from what might be considered as a more favorable exchange rate. The self-defeating nature of such moves would quickly become evident; but if confidence is lost, it would be difficult to restore.

Indeed, there are few credible alternatives for any US administration other than leveraging the strength of the US economy and its currency against the growing autocratic threat while operating in close alliance with other democracies.

- Withdrawing into self-isolation, as in the 1930s, could provide a false sense of security in today’s interconnected world. It would undermine the global dominance of the dollar by weakening its economic and strategic influence as allies and partners may hedge against US unpredictability, seeking alternative financial systems to diversify. Moreover, such a policy would allow other countries to occupy geostrategic positions to the detriment of the US economy and national security.

- Similarly, accommodating strategic opponents like Russia or China would undermine trust in US leadership and lead to strategic losses in all theaters. Without the United States providing strong global leadership, other countries would not be able to thrive without catering to the interests of the other powers, and the United States could enter a phase of economic decline.

Finally, the most likely alternative to the strategy outlined above would be that the United States remains mired in a polarized political environment that leads to short-sighted policy decisions that fall short of the strategic challenges ahead. Most importantly, the United States would not be able to improve its fiscal situation and eventually would lack the resources needed to maintain its strategic financial and economic dominance and the superiority of the dollar. The continued erosion of US power might not be catastrophic for the United States itself, but it could trigger bouts of political instability and economic volatility around the globe, with negative consequences for the role of the US dollar and the welfare of US citizens.

Conclusion

This paper outlines a strategy for the United States to maintain dollar dominance. It argues that the United States will likely remain the world’s largest economic and military power, though it will face increasing difficulties in pursuing its strategic objectives on its own. There is a risk of military overreach as US defense spending is competing with other public expenditure priorities. Additionally, high fiscal deficits could further weaken the exorbitant privilege that has enabled the United States to sustain large fiscal and currency account deficits in the past.

The stakes are now higher compared to eight years ago, when Trump first took office, both because of the run-up in public debt during that period and because Russia and China are now more closely aligned in trying to weaken the democratic West. While reining in the fiscal deficit and boosting the US economy’s growth potential, the administration should proceed cautiously, preserving economic and diplomatic relations with existing allies. The United States should also strengthen partnerships with emerging markets and the developing world, where countering China’s efforts to co-opt countries into its economic and political orbit should become a strategic priority.

Atlantic Council Strategy Papers Editorial Board

Executive editors

Frederick Kempe

Alexander V. Mirtchev

Editor-in-chief

Matthew Kroenig

Editorial board members

James L. Jones

Odeh Aburdene

Paula Dobriansky

Stephen J. Hadley

Jane Holl Lute

Ginny Mulberger

Stephanie Murphy

Dan Poneman

Arnold Punaro

The Scowcroft Center is grateful to Frederick Kempe and Alexander V. Mirtchev for their ongoing support of the Atlantic Council Strategy Paper Series in their capacity as executive editors.

About the authors

Related content

Explore the programs

The Scowcroft Center for Strategy and Security works to develop sustainable, nonpartisan strategies to address the most important security challenges facing the United States and the world.

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Image: Unsplash/Andrew Dawes