Forging the 5G future: Strategic imperatives for the US and its allies

Table of contents

- Executive summary

- Strategic context

- The China challenge

- Regaining 5G leadership: Promote, protect, and push ahead together

- Conclusion

Executive summary

5G technology is a critical pillar of U.S. national security, economic prosperity, and geopolitical influence in the twenty-first century. As the backbone of the next generation of digital infrastructure, 5G enables faster, more reliable communication networks that are essential for national competitiveness, from military operations to economic benefits. As China rapidly emerges as the global leader in 5G tech, it is critical for the United States to regain its historical technological edge in the critical communications field. The stakes are high, as nations that lead in 5G development and deployment will shape global standards, secure strategic advantages, and potentially influence the global digital landscape for decades.

To address this critical topic and determine a strategic path forward for the United States, the Atlantic Council’s Global China Hub undertook a research effort based on a series of public events and private workshops, with additional interviews with relevant stakeholders from regulatory authorities to industry experts. This report presents the findings of that research, assessing US and Chinese 5G development based on two metrics: spectrum availability and network equipment & infrastructure.

The United States faces challenges in managing spectrum for incumbent federal uses and non-federal uses, resulting in a relatively slow pace in approving new spectrum bands for commercial 5G development. The 5G network equipment and infrastructure market is increasingly oligopolistic with less US firm participation. The People’s Republic of China (PRC), for its part, has streamlined its spectrum management and launched diplomatic efforts supporting its spectrum harmonization goals. Furthermore, the Chinese government has invested significant amounts of political and financial capital into the 5G industry in support of increasing their reach and voice on the international stage.

The report outlines a set of recommendations to address existing challenges and revitalize the US approach. The United States should adopt a strategy that allows the global community to gain access to a more secure, trustworthy, and diverse 5G network ecosystem, while minimizing tradeoffs between national security and economic benefits. To this end, this report offers the following three-pronged strategy:

- Promote 5G development by investing at home:

- a. Accelerate spectrum band studies to locate viable options to allocate spectrum in the mid-band range for commercial 5G.

- b. Increase research and development investments in 5G and related technologies such as dynamic spectrum sharing and standalone network technologies.

- Protect against China’s 5G influence at home and abroad:

- a. Fully fund the “Rip and Replace” program which provides telecommunications companies federal funding to remove and replace infrastructure supplied by Chinese companies such as Huawei and ZTE.

- b. Counter the PRC’s influence in key countries by sharing information with other countries regarding the risks of Chinese equipment such as cybersecurity and foreign influence concerns.

- c. Improve the 5G global governance system to level the playing field through increased transparency regarding the PRC’s market-distorting practices, intellectual property theft, and overcapacity issues.

- Push ahead together with allies and partners:

- a. Coordinate with allies and partners to globally harmonize spectrum bands for 5G.

- b. Build partnerships with key regions, especially in the Global South, based on shared values and objectives.

Strategic context

The fifth generation (5G) of mobile and cellular networks is a transformative technology crucial for improving digital connectivity for enhanced efficiency and productivity in both commercial sectors and military applications. 5G offers an improvement in data speed, volume, and latency over fourth-generation (4G and 4G LTE) networks.1Milo Medin and Gilman Louie, “The 5G Ecosystem: Risks & Opportunities for DoD,” Defense Innovation Board, April 2019, https://media.defense.gov/2019/Apr/03/2002109302/-1/-1/0/DIB_5G_STUDY_04.03.19.PDF. With improved wireless connectivity, 5G can unlock new capabilities that support enhancements to a variety of industries and sectors including autonomous vehicles, advanced robotics, and smart agriculture, among others.2Ngor Luong, “Digesting the 2023 World Radiocommunication Conference’s Outcomes and Implications for US-China 5G Competition,” Atlantic Council, April 12, 2024, https://www.atlanticcouncil.org/content-series/strategic-insights-memos/digesting-the-2023-world-radiocommunication-conferences-outcomes-and-implications-for-us-china-5g-competition/. These new connective capabilities offer improvements within military operations including essential intelligence, surveillance, and reconnaissance (ISR) systems and streamline command and control (C2) in military operations.3Ngor Luong, “Digesting the 2023 World Radiocommunication Conference’s Outcomes and Implications for US-China 5G Competition,” Atlantic Council, April 12, 2024, https://www.atlanticcouncil.org/content-series/strategic-insights-memos/digesting-the-2023-world-radiocommunication-conferences-outcomes-and-implications-for-us-china-5g-competition/.

Historically, the United States has been a leader in the telecommunication industry. Thanks to government support for innovation in the private sector, the United States was dominant in earlier generations of mobile and cellular networks. In 1913, the government reached an agreement with AT&T, allowing the company to monopolize but operate as a public utility by providing phone services to the majority of Americans.4Brian Fung, “This 100-year-old deal birthed the modern phone system. And it’s all about to end,” The Washington Post, December 19, 2013, https://www.washingtonpost.com/news/the-switch/wp/2013/12/19/this-100-year-old-deal-birthed-the-modern-phone-system-and-its-all-about-to-end/. As a result, Bell Labs, the research and development (R&D) arm of Bell System, bolstered its innovation in the telecommunication industry, developing critical technologies such as transistors, satellite communications, lasers, communications theory, and cellular communications.5Jon Gertner, The Idea Factory: Bell Labs and the Great Age of American Innovation.” London: Penguin Books, 2012. Private sector innovation, exemplified by Bell Labs, and a variety of innovation policies had enabled the U.S. to surpass Japan in 3G leadership by 2009 and dominate 4G hardware and software since.6Ash Johnson, “Restoring US Leadership on Digital Policy,” Information Technology & Innovation Foundation, July 31, 2023, https://itif.org/publications/2023/07/31/restoring-us-leadership-on-digital-policy/.; Deloitte, “The impact of 4G technology on commercial interactions, economic growth, and U.S. competitiveness,” August 2011, https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology-media-.telecommunications/us-tmt-impactof-4g-060612.pdf; Tom Wheeler, “The real 5G ‘race’ is to serve all Americans,” Brookings, September 25, 2018, https://www.brookings.edu/articles/the-real-5g-race-is-to-serve-all-americans/.

Meanwhile, China initially lagged behind and struggled more in 3G and 4G, but in recent years, China appears to have become a global leader in 5G due to government financial and capital support and market-distortionary practices, as discussed in the latter section of the report. It is also worth noting that without Bell Labs, there would be no Chinese telecom giant Huawei; Futurewei, a US-based research affiliate of Huawei Technologies, tapped technical talent, engineers, and scientists from Bell Labs and Nortel.7Jonathan Pelson, Wireless Wars : China’s Dangerous Domination of 5G and How We’re Fighting Back. Dallas, TX: BenBella Books, Inc., 2021, pg 130.

Policymakers in the United States and the People’s Republic of China (PRC) seek a better understanding of the security concerns and economic opportunities around the technology to lead in the new 5G frontier. For the United States, failure to capitalize on the opportunity presented by 5G will likely impact its ability to maintain a competitive advantage relative to China. To assess US and Chinese 5G capability, this report focuses on two commonly used components of the technology: spectrum availability and network equipment & infrastructure.

Spectrum for 5G

Spectrum is a finite resource with different ranges of frequency allocated for specific uses, such as mobile communication, television broadcasting, satellite communication, and military applications. Not all spectrum frequencies are created equal. In the context of wireless communications, different frequency bands have different tradeoffs between coverage and capacity. Figure 1 shows that low-band spectrum, which exists below 1 gigahertz (GHz) and has relatively longer wavelengths, offers great coverage but lacks the bandwidth to accommodate the transfer of huge amounts of data.8Low-band is generally considered to fall below 1 GHz band; see Table 1 in Gina Raimondo and Alan Davidson, “Annual Report on the Status of Spectrum Repurposing and Other Initiatives,” Department of Commerce, March 2023, https://www.ntia.gov/sites/default/files/publications/annual_spectrum_repurposing_initiatives_report_nec.pdf.; Other sources consider low-band to fall below 3 GHz; see Janette Stewart, Chris Nickerson, and Juliette Welham, “Comparison of total mobile spectrum in different markets,” Analysys Mason, September 2022, https://api.ctia.org/wp-content/uploads/2022/09/Comparison-of-total-mobile-spectrum-14-09-22.pdf. Previous generations of mobile and cellular networks placed more importance on reliability and coverage.9Edward Parker, Spencer Pfeifer, and Timothy M. Bonds, America’s 5G Era: Strengthening Current and Future U.S. Technical Competitiveness in 5G, Santa Monica, CA: RAND Corporation, 2022, https://www.rand.org/pubs/perspectives/PEA435-3.html. As an enabling technology, 5G requires both great coverage and increased bandwidth. By contrast, high-band spectrum or millimeter wave (mmWave) operates above 24 GHz with shorter, more dense wavelengths, enabling the fastest broadband speed over shorter distances. High-band spectrum for 5G may require more cell stations to provide dense cell networks to increase coverage and reduce the chance of signal loss. Midband spectrum, often located between 1 and 8 GHz, is considered an ideal compromise between a higher data rate and sufficient coverage of 5G services given the emergence of advanced technologies.10Milo Medin and Gilman Louie, “The 5G Ecosystem: Risks & Opportunities for DoD,” Defense Innovation Board, April 2019, https://media.defense.gov/2019/Apr/03/2002109302/-1/-1/0/DIB_5G_STUDY_04.03.19.PDF.; Edward Parker, Spencer Pfeifer, and Timothy M. Bonds, America’s 5G Era: Strengthening Current and Future U.S. Technical Competitiveness in 5G. The frequency ranges can vary but are generally understood to be above 1 GHz and recently below 8 GHz. The U.S. National Spectrum Strategy calls for a study of mid-bands including the 7/8 GHz; “Implementing the National Spectrum Strategy,” National Telecommunications and Information Administration, May 6, 2024, https://www.ntia.gov/speechtestimony/2024/implementing-national-spectrum-strategy. Another benefit is related to the use of network equipment and infrastructure; given that midband deployment for 5G results in a better range, fewer base stations are needed to be built to achieve the same performance.11Milo Medin and Gilman Louie, “The 5G Ecosystem: Risks & Opportunities for DoD,” Defense Innovation Board, April 2019, https://media.defense.gov/2019/Apr/03/2002109302/-1/-1/0/DIB_5G_STUDY_04.03.19.PDF.

Nonetheless, all three spectrum bands combined have the potential to harness the benefits of 5G. US carriers like T-Mobile are already considering a “layer cake strategy” to roll out 5G to different geographical areas.12“5G Layer Cake – T-Mobile Newsroom,” T-Mobile, https://www.t-mobile.com/news/media-library/new-5g-layer-cake. High-band spectrum enables services with high performance in dedicated zones in urban areas such as concerts, while mid-band and low-band are suitable for building out a foundation for 5G and low band is particularly suited for broad coverage in rural areas.13“T-Mobile pursues a multi-band 5G spectrum strategy,” Ericsson, 2021, https://www.ericsson.com/49ced5/assets/local/reports-papers/mobility-report/documents/2021/tmobile_5g-spectrum-strategy.pdf.

With different bands used for a variety of purposes and by a range of actors, spectrum is managed by national regulatory authorities such as the Federal Communications Commission (FCC) in the United States, as well as international governing bodies such as the International Telecommunication Union (ITU). These authorities decide on spectrum allocation to allow for frequency, time, and spatial separation, avoiding interference and ensuring efficient use of spectrum. At the international level, harmonizing frequency bands for specific services (e.g., 5G mobile networks) across different regions and countries facilitates the global deployment of technologies and reduces the risk of spectrum interference.

In the United States, spectrum management and allocation for commercial wireless use undergo an auctioning process through the FCC, an independent agency that reports to the Congress. Among the FCC’s non-federal spectrum management responsibilities, its auction authority was granted in 1993 and has been extended several times.14Patricia M. Figliola and Jill C. Gallagher, The Federal Communications Commission’s Spectrum Auction Authority: History and Options for Reinstatement, CRS Report No. R47578, Washington, DC: Congressional Research Service, 2023, https://crsreports.congress.gov/product/pdf/R/R47578. The latest extension allowed the FCC to conduct spectrum auction activities through March 9, 2023.15Paloma Perez Christie, “CHAIRWOMAN ROSENWORCEL STATEMENT ON THE EXPIRATION OF FCC SPECTRUM AUCTION AUTHORITY,” Washington DC, Federal Communications Commission, March 2023, https://docs.fcc.gov/public/attachments/DOC-391576A1.pdf. As of August 2024, its auction authority has not been reinstated.16Paloma Perez Christie, “CHAIRWOMAN ROSENWORCEL HIGHLIGHTS ONE-YEAR EXPIRATION OF AGENCY’S SPECTRUM AUCTION AUTHORITY AND POTENTIAL CREATIVE SOLUTIONS TO MAINTAIN U.S. LEADERSHIP,” Washington DC, Federal Communications Commission, March 2024, https://docs.fcc.gov/public/attachments/DOC-401006A1.pdf. While the FCC does not have the authority to auction new spectrum bands, transfer of granted 2.5 GHz license has at least been temporarily resolved through the 5G SALE Act.17Kelly Hill, “5G SALE Act Signed; T-Mo can get its 2.5 GHz Licenses,”, RCRWireless News, December 22, 2023, https://www.rcrwireless.com/20231222/spectrum/5g-sale-act-signed-t-mo-can-get-its-2-5-ghz-licenses. On the other hand, the National Telecommunications and Information Administration (NTIA) manages and allocates spectrum for government agencies.

The finite nature of spectrum and the variety of users present a significant challenge in managing spectrum. Mid-band spectrum, which is the most optimal for harnessing 5G benefits, is already occupied by federal users. A 2023 Accenture report found that government operators occupy 61 percent of the 3 to 8.4 GHz bands for radiolocation, space research, government satellite, aeronautical uses, and experimental uses.18“Spectrum Allocation in the United States,” Accenture, September 2022, https://api.ctia.org/wp-content/uploads/2022/09/Spectrum-Allocation-in-the-United-States-2022.09.pdf. In recent years, the US government has recognized the importance of mid-band spectrum for 5G buildout. For instance, the FCC’s 5G FAST Plan released in 2018 targeted up to 844 MHz of mid-band spectrum in the 2.5 GHz, 3.5 GHz, and 3.7 to 4.2 GHz range for 5G deployment.19“The FCC’s FAST Plan,” Federal Communications Commission, Washington, DC, September 2018, https://docs.fcc.gov/public/attachments/DOC-354326A1.pdf. However, by 2024, no additional allocation has been completed, and commercial users expressed concerns that the slow pace of spectrum auctioning in the mid-band frequencies could risk the United States operating in insolation.20Doug Brake, “Action Required on Commercial Spectrum to Avoid Isolating the United States,” CTIA, February 15, 2024, https://www.ctia.org/news/action-required-on-commercial-spectrum-to-avoid-isolating-the-united-states.

The significant share of federal users in the mid-band is due in part to incumbency. Spectrum allocation mostly concerned federal users in its earlier days, with incumbent operators making significant investments in complex infrastructure across the country.21Edward Parker, Spencer Pfeifer, and Timothy M. Bonds, America’s 5G Era: Strengthening Current and Future U.S. Technical Competitiveness in 5G, Santa Monica, CA: RAND Corporation, 2022, https://www.rand.org/pubs/perspectives/PEA435-3.html. Prior to the mobile era, mid-bands were considered ill-suited for commercial operations and instead allocated for satellite communication and military uses.22Drew FitzGerald and Sarah Krouse, “5G Push Slowed by Squabbles Over ‘Sweet Spot’ of U.S. Airwaves,” The Wall Street Journal, June 20, 2019, https://www.wsj.com/articles/5g-push-slowed-by-squabbles-over-sweet-spot-of-u-s-airwaves-11561038581. Now, advanced communication technologies enable faster connectivity in higher quantity of data that makes mid-band best suited for mid-band spectrum.

Spectrum reallocation from federal to non-federal uses still faces bureaucratic challenges. A 2022 US Government Accountability Office (GAO) study found that NTIA lacks a comprehensive planning process to reallocate spectrum from federal to non-federal uses given the complexity and number of stakeholders.23Andrew Von Ah, SPECTRUM MANAGEMENT NTIA Should Improve Spectrum Reallocation Planning and Assess Its Workforce, GAO-22-104537 (Washington DC: Government Accountability Office, 2022) For example, in October 2010, following a presidential memorandum directing the NTIA and FCC to make 500 MHz of spectrum available over the next decade, NTIA identified the 3.5 GHz band, also known as Citizens Broadband Radio Service (CBRS), for reallocation from federal to mixed use.24“500 MHz Initiative,” National Telecommunications and Information Administration, November 17, 2016. https://www.ntia.gov/category/500-mhz-initiative. The ten-year reallocation process involved complex technical challenges in spectrum sharing between the US Navy and the private sector, which were resolved through the development of new technologies.25“500 MHz Initiative,” National Telecommunications and Information Administration, November 17, 2016. https://www.ntia.gov/category/500-mhz-initiative. In reallocating the CBRS band, the incumbent satellite operators may need to deploy new infrastructure to make use of the remaining spectrum or operate on different frequency bands.26Marguerite Reardon, “FCC Approves $9.7 Billion Payment to Free up Satellite Spectrum for 5G,” CNET, February 28, 2020, https://www.cnet.com/tech/mobile/fcc-approves-9-7-billion-payment-to-free-up-satellite-spectrum-for-5g. In other cases, there is also a need to balance benefits and risks as they are relevant incumbent operations ; the FCC, over several years, reallocated most of the advanced wireless spectrum (AWS) for commercial use while minimizing impact to the Department of Defense (DOD) operations.27“Advanced Wireless Services (AWS),” FCC, August 15, 2022, https://www.fcc.gov/wireless/bureau-divisions/broadband-division/advanced-wireless-services-aws; Dana Deasy, “Department of Defense Statement on Mid-Band Spectrum,” (Speech, Department of Defense, August 10, 2020), https://www.defense.gov/News/Speeches/Speech/Article/2307288/department-of-defense-statement-on-mid-band-spectrum.

China, on the other hand, has a more direct spectrum allocation process. The State Radio Regulation of China (SRRC) under the Ministry of Industry and Information Technology (MIIT) is responsible for spectrum management and allocation.28国家无线电频谱管理中心, State Radio Regulation of China, http://www.srrc.org.cn/search.aspx?s=5g. China streamlines the spectrum allocation process through its inclusion of both industry and military actors, as delineated in its Radio Management Regulations released by the State Council and the Central Military Commission.29“中华人民共和国无线电管理条例 [Radio Management Regulations of the People’s Republic of China],” State Council of the People’s Republic of China and the Central Military Commission, November 11, 2016, https://perma.cc/C25E-X3JX. Unlike the distinct responsibilities of the FCC and NTIA in the United States, the SRRC manages and allocates spectrum for both commercial and government uses.30Kan Rutian, “Radio Spectrum Management in China,” (presentation, Cedarville University, September 11, 2017), https://www.itu.int/en/ITU-D/Regional-Presence/AsiaPacific/Documents/Events/2017/Sep-SECB/Presentations/D1-2-Kan%20Runtian-Radio%20Spectrum%20Management%20Strategies%20in%20China.pdf.

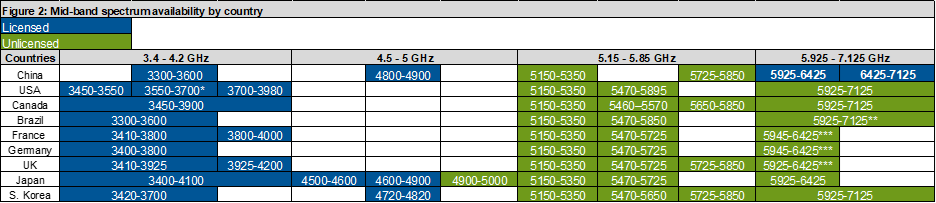

Between 2016 and 2017, the MIIT approved some lower mid-bands of spectrum (3.4 to 3.6 GHz, and 4.8 to 5.0 GHz) and high-bands (24.75 to 27.5 GHz, and 37 to 42.5 GHz) for 5G technological R&D experiments.31Monica Alleven, “China Issues Plan to Use 3300-3600 MHz, 4800-5000 MHz for 5G,” Fierce Network, June 7, 2017, https://www.fierce-network.com/wireless/china-issues-plan-to-use-3300-3600-mhz-4800-5000-mhz-for-5g. In 2017, the ministry issued its frequency use planning of the 5G system in the mid-band range (of 3 to 5 GHz) while noting that China is the first country to do so.32“工业和信息化部发布5G系统在3000-5000MHz频段内的频率使用规划,” The State Radio Regulation of China of the Ministry of Industry and Information Technology, November 15, 2017, https://perma.cc/U8EB-QN83. In 2023, China allocated spectrum in the 6 GHz band for International Mobile Telecommunications (IMT).33“China allows 6GHz spectrum for 5G, 6G systems,” Xinhua, June 27, 2023, https://english.news.cn/20230627/5c9944b83f6c4d948a3c7da8d62ecb02/c.html. As shown in figure 2, China is the first country to license the 6 GHz spectrum band as of 2023. Licensed spectrum is exclusively assigned to operators, while unlicensed spectrum is widely available for non-exclusive use under regulatory constraints. One advantage of licensing spectrum is the certainty needed for sustaining wireless applications that require significant, long-term investments.34Joe Kane, Jessica Dine, “Good and Bad Reasons for Allocating Spectrum to Licensed, Unlicensed, Shared, and Satellite Uses,” ITIF, October 2023, https://itif.org/publications/2023/10/23/good-bad-reasons-for-allocating-spectrum-to-licensed-unlicensed-shared-satellite-uses. As such, by licensing 6 GHz for 5G deployment, China signals its interest in providing reliable 5G services to commercial users, bolstering a foundation to enable other technologies such as smart cities.

Figure 2 also shows that the United States and other key countries such as Canada and South Korea have kept the 6 GHz spectrum band unlicensed. Brazil, which had also earmarked the 6 GHz band for unlicensed use, is now reconsidering that designation and may permit unlicensed use in only the bottom half of the band (5.925-6.425 GHz) and free up the top half (6.425-7.125 GHz) for future IMT systems.35“On April 28th, ANATEL initiated Public Consultation No. 29/2024 which focused on limiting the operational frequency band of WiFi 6 GHz in Brazil,” Global Validity, June 17, 2024, https://globalvalidity.com/brazil-anatels-public-consultation-on-wifi-6-ghz-frequency-band-update/. The United States, the FCC opened the 6 GHz band primarily for Wi-Fi to foster new innovative technologies and services that improve broadband connectivity, especially in rural areas.36“Report and Order and Further Notice of Proposed Rulemaking,” FCC, April 24, 2020, https://docs.fcc.gov/public/attachments/FCC-20-51A1.pdf. The advantages of keeping spectrum unlicensed include fostering innovation, lowering entry barriers, and enabling essential technologies like Wi-Fi.37Joe Kane, Jessica Dine, “Good and Bad Reasons for Allocating Spectrum to Licensed, Unlicensed, Shared, and Satellite Uses,” ITIF, October 2023, https://itif.org/publications/2023/10/23/good-bad-reasons-for-allocating-spectrum-to-licensed-unlicensed-shared-satellite-uses. As such, the US delegation to the World Radiocommunication Conference (WRC) in 2023 viewed the move to keep 6 GHz IMT unlicensed under ITU regulations in its region as a success in protecting US spectrum interests.38“U.S. Department of State Leads Successful U.S. Delegation to World Radiocommunication Conference in Dubai,” U.S. Department of State, December 15, 2023, https://www.state.gov/u-s-department-of-state-leads-successful-u-s-delegation-to-world-radiocommunication-conference-in-dubai.

Note:

*70 MHz of CBRS band (3630-3700 MHz) is unlicensed in the United States; Priority Access Licenses (PALs) have access only up to 3650.

**Although Brazil keeps 6 GHz unlicensed, it now reconsiders freeing up the top half (6.425-7.125 GHz) for future IMT systems.

***In the European Common Proposals to the WRC-23, Europe identified the upper 6 GHz band for IMT under five conditions in the interest of the region.

Although China currently stands alone in licensing 6 GHz for 5G deployment, should other countries follow, it could shift the global 5G landscape and potentially put the United States at a disadvantage. At the WRC-2023, the PRC reportedly conducted more than fifty bilateral engagements and campaigned to gain global support for spectrum harmonization in the 6 GHz band.39Zhou Di, “工信部:中国主推频段为全球5G/6G产业发展奠定宝贵资源基础], Ministry of Industry and Information Technology: China mainly promotes the frequency band to lay a valuable resource foundation for the development of the global 5G/6G industry,” The Paper, December 27, 2023, https://www.thepaper.cn/newsDetail_forward_25804865. With China’s advocacy and Europe’s proposal to identify the upper 6 GHz band for IMT, countries representing over 60 percent of the globe’s population appear to support 6 GHz.40“European Common Proposals to WRC-23 Addendum 4,” World Radiocommunication Conference (WRC-23), October 30. 2023, https://www.itu.int/dms_pub/itu-r/md/23/wrc23/c/R23-WRC23-C-0065!A2-A4!MSW-E.docx. The European Commission has laid out five conditions under which it will identify the upper 6 GHz band for IMT in the interest of the region. The conditions include (1) the protection of relevant primary services is ensured as provided in EUR/65A2A4/2, (2) continued operation of other services is addressed as provided in EUR/65A2A4/2 and EUR/65A2A4/3 with additionally new EESS (passive) primary allocations in the frequency bands 4.2-4.4 GHz, and 8.4-8.5 GHz, to allow the continued operation of sea surface temperature (SST) measurements, (3) no limitations are imposed on the existing services and their future development, (4) the IMT Resolution clearly outlines opportunities for other broadband applications in the mobile services (i.e. WAS/RLAN) as well as sufficient flexibility regarding the future wireless broadband usage, i.e. by IMT, WAS/RLAN or under a shared framework between IMT and WAS/RLAN as provided in EUR/65A2A4/2, and (5) WRC-23 does not approve an agenda item for WRC-27 studying additional IMT identifications in frequency bands between 7-30 GHz where IMT would have the potential to jeopardize important European space and governmental spectrum; “The Importance of 6 GHz to Mobile Evolution,” GMSA, July 25, 2024, https://www.gsma.com/connectivity-for-good/spectrum/gsma_resources/6-ghz-for-5g/#:~:text=The%20World%20Radiocommunication%20Conference%20in,global%20harmonisation%20at%20WRC%2D27. A global harmonization of 6 GHz without US participation could further lower equipment costs for Chinese telecom firms while raising the cost of the competing equipment from trusted vendors, doubling the damage. With incompatible spectrum bands, US firms are locked out of harmonization benefits, including lower technical costs and economies of scale.41“Imperfect Harmony: International Harmonisation and National Spectrum Management,” International Institute of Communications, https://www.iicom.org/wp-content/uploads/IIC-essay-submission_Imperfect-Harmony-International-harmonisation-and-national-spectrum-management-final-version.pdf. Such harmonization also likely boosts the demand for 5G equipment compatible with that range, leaving the United States at risk of developing the technology in isolation.42Ngor Luong, “Digesting the 2023 World Radiocommunication Conference’s Outcomes and Implications for US-China 5G competition,” Atlantic Council, April 12, 2024, https://www.atlanticcouncil.org/content-series/strategic-insights-memos/digesting-the-2023-world-radiocommunication-conferences-outcomes-and-implications-for-us-china-5g-competition/.

Network equipment and infrastructure for 5G

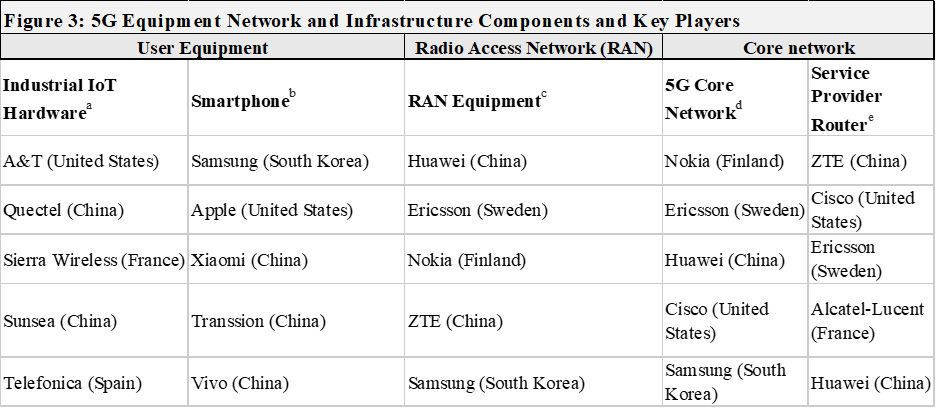

5G network equipment and infrastructure encompasses various components including core network, radio access network (RAN), and user equipment. User equipment is a term that describes 5G-capable smartphones, tablets, laptops, or other types of wireless devices used to access the network. The top players in the hardware space are primarily China, the United States, France, and Spain, as shown in figure 3. The smartphone market is dominated by China, South Korea, and the United States.

RAN is the latest architecture in wireless communications that relies on a fully coordinated, multi-layer network across low-, mid-, and high-bands to provide wireless connectivity. To put it simply, the RAN technology stack includes multiple input multiple output (MIMO) that uses multiple antennas, base stations, and beamforming radio units. Each component of the stack is incompatible with those developed by different companies.43Julia Yoon, “RAI Explainer: Capturing the O-RAN Opportunity: Perspectives on Innovation,” CSIS, July 17, 2024, https://www.atlanticcouncil.org/content-series/strategic-insights-memos/digesting-the-2023-world-radiocommunication-conferences-outcomes-and-implications-for-us-china-5g-competition/. As shown in figure 3, the United States does not have domestic RAN equipment providers and relies on foreign vendors such as Huawei, Ericsson, Nokia, ZTE, and Samsung to build its wireless communication infrastructure.

Updated with the following sources:

a IOT One, “Top 10 IOT,” Networks & Connectivity, 2024, https://www.iotone.com/top10/networks-connectivity;

b International Data Corporation, “Smartphone Market Insights,” August 14, 2024, https://www.idc.com/promo/smartphone-market-share;

c Dell’Oro Group, “RAN Market Still a Disaster, According to Dell’Oro Group,” May 16, 2024, https://www.delloro.com/news/ran-market-still-a-disaster/#:~:text=The%20top%205%20RAN%20suppliers,Nokia%2C%20ZTE%2C%20and%20Samsung;

d Custom Market Insights, “Global 5G Core Network Market Size, Share & Growth 2032,” n.d., https://aws.amazon.com/marketplace/pp/prodview-7as7hcwxvkaxe#overview;

e Market Growth Report, “Global Service Provider Router Market Research Report 2024,” February 7, 2024, https://www.marketgrowthreports.com/global-service-provider-router-market-26800232.

The core network, at the heart of 5G, manages data, traffic aggregation, user equipment communication, as well as providing essential services and enhanced security. The 5G core infrastructure marks a key advancement, leveraging 3rd Generation Partnership Project (3GPP) architecture to optimize 5G standalone technology.44“Global 5G Core Network Market Size, Share & Growth 2032,” Amazon Custom Market Insights, https://aws.amazon.com/marketplace/pp/prodview-7as7hcwxvkaxe#overview. While Huawei is among the top players, it is the only Chinese company in this space (see figure 3). Nokia, Ericsson, Cisco, and Samsung are also among the top global players. The top service providers, however, include two Chinese companies (ZTE and Huawei). In short, Chinese companies are present across all components of 5G network equipment and infrastructure in an ecosystem that already lacks a diversity of vendors. The oligopolistic 5G equipment market poses significant challenges for the United States and other countries evaluating 5G development and deployment options, as discussed below.

The China challenge

The rise of China’s 5G and the role of the government

The PRC has launched numerous policy planning documents that serve as a blueprint for China’s 5G development. The 2007 State Council’s “major special project” on next-generation telecommunications was the first policy that focused on 5G.45“新一代宽带无线移动通信网”国家科技重大专项新闻发布会,” National Science and Technology Major Project, January 6 2017, https://perma.cc/P9H5-395C. China’s Medium- to Long-Term Development Plan for Scientific and Technological Innovation in the Transportation Field (2021-2035), also focuses on improving broadband mobile communications in the context of civil aviation technology.46“Outline of the Medium- to Long-Term Development Plan for Scientific and Technological Innovation in the Transportation Field (2021-2035) 交通领域科技创新中长期发展规划纲要(2021—2035年),” PRC Ministry of Science and Technology, https://cset.georgetown.edu/wp-content/uploads/t0531_transport_tech_plan_EN.pdf. Drafted by the highest echelons of China’s government, the Fourteenth Five Year Plan (2021-2025) states China’s ambition of building a modern infrastructure system. This includes speeding up deployment of 5G networks and advancing technology for future implementation of 6G.47“Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035,” Xinhua, March 12, 2021, translation is available at https://cset.georgetown.edu/wp-content/uploads/t0284_14th_Five_Year_Plan_EN.pdf.

In support of 5G development and deployment, the PRC has also released plans for spectrum management and equipment standard-setting. In its “China Standards 2035” plan, the PRC has encouraged its firms to increase their influence in international standard-setting organizations, including by influencing the process for spectrum allocation.48“‘China Standard 2035’ Will be Released,” Economic Daily, January 11, 2018, https://perma.cc/2GWG-YG3J. In 2022, the PRC updated its policy on standards and called for an 85 percent alignment between domestic and international standards.49“中共中央 国务院印发《国家标准化发展纲要》,” 中国政府网, October 10, 2021, https://www.gov.cn/zhengce/2021-10/10/content_5641727.htm.

The Chinese government provides both political and financial support to its technology industry. Government subsidies have played a part in Huawei’s rise as a leader in the 5G space. For instance, through guaranteed domestic market and credits, the PRC was responsible for helping Huawei secure 10 percent of the global mobile wireless market by the mid-2000s.50Melanie Hart and Jordan Link, “There is a Solution to the Huawei Challenge,” Center for American Progress, October 14, 2020, https://www.americanprogress.org/article/solution-huawei-challenge/. Such financial support allowed the government to exert direct influence on the telecom giant. There is evidence that the PRC controls Huawei via the All-China Federation of Trade Union (ACFTC).51Jonathan Pelson, Wireless Wars : China’s Dangerous Domination of 5G and How We’re Fighting Back. Dallas, TX: BenBella Books, Inc., 2021, pg 66-68.

As a result of the government’s political and financial support, China’s 5G use has surged in recent years. As of February 2024, China has 851 million 5G mobile subscribers, nearly 60 percent of its population.52“China’s 5G Subscribers Exceed 850 Million in February,” The State Council Information Office of the People’s Republic of China, April 1, 2024, http://english.scio.gov.cn/pressroom/2024-04/01/content_117098049.htm#:~:text=The%20number%20of%205G%20mobile,telecommunication%20enterprises%20or%20China%20Broadnet. In July 2021, China had built 916,000 5G base stations.53“Goal for 2023: 560 million 5G users in nation,” State Council of the People’s Republic of China, July 14, 2021, http://english.www.gov.cn/statecouncil/ministries/202107/14/content_WS60ee1a81c6d0df57f98dcce7.html. As of September 2023, Chinese telecommunication operators had built 3.2 million 5G base stations in the country, nearly a 250 percent increase from 2021.54Cui Shuang, “China has built a total of 3.189 million 5G base stations” [我国累计建成5G基站318.9万个],” Science and Technology Daily, October 20, 2023, https://perma.cc/DP9P-Q2G6.

The competition for global market dominance

One mechanism the PRC has employed to help its firms reach the international market is to provide export financing loans to operators in other nations who in turn use the capital to buy Chinese telecom firms’ equipment. In 2015, the National Development and Reform Commission (NDRC) released a white paper on China’s Digital Silk Road (DSR), an integral part of its Belt and Road Initiative, calling for more Chinese technological partnerships with countries along the historical Silk Road.55“《推动共建丝绸之路经济带和21世纪海上丝绸之路的愿景与行动》,” China Meteorological Administration, May 8th 2017, https://www.cma.gov.cn/2011xzt/2017zt/20170502/2017050203/202111/t20211103_4143424.html. Following the launch of DSR, the PRC announced in 2020 a $1.4 trillion investment over six years to help Chinese tech giants like Huawei lay 5G wireless networks and install surveillance technologies around the world.56“China Has New US$1.4 Trillion Plan to Seize the World’s Tech Crown from the US,” South China Morning Post, May 21, 2021, https://archive.ph.

China’s use of export financing to gain market share in 5G is global. According to Aid Data, between 2000 and 2021, Huawei and ZTE participated in 157 loan-backed projects across fifty-eight countries. Huawei and ZTE are present in Africa (eighty-nine projects), followed by Asia (twenty-nine projects) and Europe (twenty-four projects).57“Global Chinese Development Finance,” Aid Data, 2024, https://china.aiddata.org. At the country level, Russia is the most frequent recipient of China’s export financing (see figure 4). Recently, Brazil entered memorandum of understanding (MoU) agreements with China in 2023 to buy Huawei’s 5G equipment.58Hana Anandira, “Brazil Strengthens China Ties in Boost to Huawei,” Mobile World Live, April 14, 2023. https://www.mobileworldlive.com/featured-content/top-three/brazil-strengthens-china-ties-in-boost-to-huawei. While many projects are focused on previous generations of mobile and cellular networks, they are helpful in setting the stage for Huawei and ZTE to further provide 5G network equipment and infrastructure.59Melanie Hart and Jordan Link, “There Is a Solution to the Huawei Challenge,” Center for American Progress, October 14, 2020, https://www.americanprogress.org/article/solution-huawei-challenge.

China’s state-owned banks provided massive loan agreements to issue guarantees ensuring Huawei has the winning combination of low prices and aggressive government support to gain significant market share.60Jonathan Pelson, Wireless Wars : China’s Dangerous Domination of 5G and How We’re Fighting Back. Dallas, TX: BenBella Books, Inc., 2021, pg 170. Huawei has entered bids for every contract the company could find globally, and its bidding is often low, compared to other major carriers. The company didn’t appear to independently cover the cost of network equipment, as it received more than $75 billion from the PRC during its rise to global dominance.61Jonathan Pelson, Wireless Wars : China’s Dangerous Domination of 5G and How We’re Fighting Back. Dallas, TX: BenBella Books, Inc., 2021, pg 109-110.; Chuin-Wei Yap, “State Support Helped Fuel Huawei’s Global Rise,” The Wall Street Journal, December 25, 2019, https://www.wsj.com/articles/state-support-helped-fuel-huaweis-global-rise-11577280736. No other carrier can match this; for example, in the 1990s, the former US-based telecom multinational company Lucent Technologies extended over $7 billion in vendor financing and took a significant loss when the loans weren’t paid back; it eventually became part of Alcatel-Lucent of France.62Jonathan Pelson, Wireless Wars : China’s Dangerous Domination of 5G and How We’re Fighting Back. Dallas, TX: BenBella Books, Inc., 2021, pg 170.

Most recently, there are legitimate reasons to doubt the PRC’s ability to continue offering below-market-rate credits given the slowdown of the Chinese economy. However, as stated in the decision document from the Third Plenum of the 20th Party Congress (a Communist Party meeting generally held every five years to set the national economic policy direction) in July 2024, the leadership still emphasizes the importance of promoting next-generation information technology and leveraging China’s market to open up to the rest of the world.63“中共中央关于进一步全面深化改革 推进中国式现代化的决定,” PRC State Council, July 21, 2021. https://www.gov.cn/zhengce/202407/content_6963770.htm. In short, the PRC and its firms still have an appetite to continue exporting Chinese 5G technology globally.

Another mechanism the PRC uses to support its 5G industry is exerting influence on standard-setting bodies. The Chinese government offers patent subsidies to increase Chinese commercial presence in standard setting bodies like the 3GPP. The Chinese government financially supports domestic firms to earn memberships and participate in the standardization decision-making process.64Melanie Hart and Jordan Link, “There Is a Solution to the Huawei Challenge,” Center for American Progress, October 14, 2020, https://www.americanprogress.org/article/solution-huawei-challenge/. A 2019 study by IPlytics found Chinese firms owned 1,529 standard-essential 5G patents, or 36 percent of all 5G standard-essential patents, more than the 14 percent held by US firms including Qualcomm and Intel.65“Who is leading the 5G patent race?” IPlytics, July 2019, https://web.archive.org/web/20190720004121/https://www.iplytics.com/wp-content/uploads/2019/01/Who-Leads-the-5G-Patent-Race_2019.pdf. Huawei has also sent 3,098 engineers to 5G standard-setting meetings and has filed 19,473 technical contributions.66Melanie Hart and Jordan Link, “There Is a Solution to the Huawei Challenge,” Center for American Progress, October 14, 2020, https://www.americanprogress.org/article/solution-huawei-challenge/.

Additionally, during the 2015-2022 tenure of former ITU Secretary-General Houlin Zhao, the influence of Chinese telecom companies grew, with Huawei, for instance, introducing more than 2,000 standard proposals to ITU study groups on 5G and other critical technologies like cybersecurity and artificial intelligence.67Kristen Cordell, “The International Telecommunication Union: The Most Important UN Agency You Have Never Heard Of,” CSIS, December 14, 2020. https://www.csis.org/analysis/international-telecommunication-union-most-important-un-agency-you-have-never-heard; Madhumita Murgia and Anna Gross, “China and Huawei Propose Reinvention of the Internet,” Financial Times, March 27, 2020. https://www.ft.com/content/c78be2cf-a1a1-40b1-8ab7-904d7095e0f2. Zhao, who is Chinese, ran uncontested. But in 2022, the United States campaigned for Doreen Bogdan-Martin, the current Secretary-General, to counter China’s influence.68“Doreen Bogdan-Martin: Secretary-General-Elect, International Telecommunication Union,” U.S. Department of State, https://www.state.gov/doreen-bogdan-martin-itu-secretary-general-candidate/endorsements. Notably, Chinese participants often make dozens of low-quality proposals in ITU-T subcommittees using government subsidies for each international standard proposed or set.69Matt Sheehan and Jacob Feldgoise, “What Washington Gets Wrong About China and Technical Standards,” Carnegie Endowment for International Peace, February 27, 2023, https://carnegieendowment.org/research/2023/02/what-washington-gets-wrong-about-china-and-technical-standards?lang=en.

Concerning partnerships

Partnering with China on 5G technology presents a complex set of challenges and risks for countries worldwide, particularly for the United States and its allies. The main concerns revolve around security, economic competitiveness, and the potential for long-term geopolitical consequences.

Reliance on networks with Chinese components in the supply chain can pose security threats to the United States and its allies and partners. There are cybersecurity risks in procuring equipment from untrusted vendors, including product backdoors and supply chain vulnerabilities. Supply chain attacks threaten national security through sabotage and harm economic competitiveness by exposing private sector firms to espionage and intellectual property theft.70“Potential Threat Vectors to 5G Infrastructure,” Cybersecurity and Infrastructure Security Agency, 2021, https://www.dni.gov/files/NCSC/documents/supplychain/Potential_Threat_Vectors_to_5G_Infrastructure_.pdf.

According to Chinese policy, domestic firms are required to maintain backdoors to give the government access to data for public security and intelligence gathering.71Lorand Laskai and Adam Segal, “The Encryption Debate in China: 2021 Update,” Carnegie Endowment, March 31, 2021, https://carnegieendowment.org/posts/2021/03/the-encryption-debate-in-china-2021-update?lang=en. Evidently, Chinese backdoors have been installed in products shipped abroad that could offer intel to the Chinese government; for instance, UK company Vodafone found hidden backdoors in Huawei equipment.72Daniele Lepido, “Vodafone Found Hidden Backdoors in Huawei Equipment,” Bloomberg, April 30, 2019, https://www.bloomberg.com/news/articles/2019-04-30/vodafone-found-hidden- -in-huawei-equipment. Another case concerns Huawei’s capacity to spy on 6.5 million users in the Netherlands via its partnership with the Dutch telecom giant, KPN.73Jon Henley, “Huawei ‘May Have Eavesdropped on Dutch Mobile Network’s Calls,’” The Guardian, April 19, 2021, https://www.theguardian.com/technology/2021/apr/19/huawei-may-have-eavesdropped-on-dutch-mobile-networks-calls. Such a security breach of a country’s 5G network is also costly. If the vendor is compromised, the replacement of that vendor would require almost a complete rebuild of the network.74Potential Threat Vectors to 5G Infrastructure, Cybersecurity and Infrastructure Security Agency, 2021, https://www.cisa.gov/sites/default/files/publications/potential-threat-vectors-5G-infrastructure_508_v2_0%2520%25281%2529.pdf.

A bifurcated world with China leading in global 5G also would impose significant economic competitiveness and innovation costs. Chinese telecom firms, benefiting from massive subsidies, have driven prices down and boosted global market share on an uneven playing field. Huawei’s prices are at least 30 percent lower than market prices.75Ellen Nakashima, “U.S. Pushes Hard for a Ban on Huawei in Europe, but the Firm’s 5G Prices Are Nearly Irresistible,” Washington Post, May 29, 2019, chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.cisa.gov/sites/default/files/publications/potential-threat-vectors-5G-infrastructure_508_v2_0%2520%25281%2529.pdf.; Chuin-Wei Yap, “State Support Helped Fuel Huawei’s Global Rise,” Wall Street Journal, December 25, 2019, https://www.wsj.com/articles/state-support-helped-fuel-huaweis-global-rise-11577280736. Non-Chinese firms would lose out on economies of scale, economic strength, and other competitive exports. As a result of these dynamics, under the current model non-Chinese firms already cannot effectively compete with the PRC companies. Moreover, as trusted vendors’ respective market shares decrease, their incentive to invest in 5G and 6G R&D may also diminish.76This observation is based on the theory of innovation and market share such as in Richard Blundell, Rachel Griffith, John van Reenen, “Market Share, Market Value and Innovation in a Panel of British Manufacturing Firms,” The Review of Economic Studies, Volume 66, Issue 3, July 1999, Pages 529–554, https://doi.org/10.1111/1467-937X.00097. These factors all threaten to create a Chinese monopoly in the 5G market that would likely reduce competition in the long run in ways that would not benefit the global community.

The United States has begun to grapple with the problems of partnering with untrusted Chinese vendors, implementing initiatives like the FCC’s “Rip and Replace” program.77The FCC’s “Rip and Replace” program mandates the removal of Huawei and ZTE equipment and services from communications networks within communications providers who receive FCC subsidy funds. Burt Braverman and Melissa Burgess, “What ACS Providers Need to Know About the FCC’s Rip, Replace, and Reimbursement Program,” Davis Wright Tremaine LLP, September 23, 2021, https://www.dwt.com/blogs/broadband-advisor/2021/09/fcc-final-procedures-reimbursement-program#:~:text=These%20procedures%20address%20the%20reimbursement,services%20from%20their%20communications%20networks. The US government has also issued warnings to allies and partners concerning the use of Chinese 5G equipment in critical infrastructure. For example, US National Security Advisor Jake Sullivan, raised concerns about Huawei’s equipment in Brazil’s 5G network in 2021.78Jeff Mason and Michael Martina. “U.S. Warned Brazil That Huawei Would Leave It ‘high and Dry’ on 5G,” Reuters, August 9, 2021, https://www.reuters.com/technology/us-warned-brazil-about-chinas-huawei-5g-network-white-house-official-2021-08-09.

However, challenges persist as many nations continue to engage with Chinese vendors. In Paraguay, President Santiago Peña met with Huawei’s CEO earlier in 2024 to request more telecommunications investments.79“Peña Se Reúne Con Directivos de Huawei y Avanza En El Deshielo Comercial Con China,” LPO Usa – La Política Online, February 26, 2014, https://www.lapoliticaonline.com/paraguay/politica-py/santi-se-reune-con-directivos-de-huawei-y-confirma-acercamiento-comercial-con-la-china-popular-aun-siendo-aliado-de-taiwan/. Huawei offers smartphone sales, broadband partnerships with Paraguay’s Ministry of Education, and youth talent programs, likely aiming to secure a foothold ahead of Paraguay’s 5G auction expected in late 2024.80“Inclusive Education in Paraguay.” Huawei Enterprise, October 22, 2021, https://e.huawei.com/es/case-studies/industries/education/2021/promoting-education-equity-in-paraguay.

The decision to partner with China on 5G is fraught with risks that go beyond the immediate benefits of lower costs and advanced technology. Countries must weigh these short-term gains against the long-term implications for their security, economic competitiveness, and geopolitical standing. The choice of 5G partners will likely shape the global 5G landscape, with significant consequences for national and international security.

Regaining 5G leadership

Regaining 5G leadership #1: Promote 5G development by investing at home

The United States has long been at the forefront of science and technology (S&T) innovation since the 1940s, if not earlier. In 1945, Vannevar Bush, a leading engineer and administrator who headed the US Office of Scientific Research and Development during World War II, laid down the case for a continuous and sustainable flow of S&T knowledge to serve the national interest.81Vannevar Bush, “The Endless Frontier – 75th Anniversary Edition,” National Science Foundation, July 2020, https://www.nsf.gov/about/history/EndlessFrontier_w.pdf. This statement is still relevant in the twenty-first century. Increased US investment to promote 5G innovation at home is not just about building faster networks. It’s about continuously securing economic, technological, and strategic advantages that will define the future. To preserve US 5G leadership in the rapidly evolving digital world, the US should accelerate the spectrum band studies of key mid-band spectrum, as mapped out in the National Spectrum Strategy, in order to locate viable options for increasing mid-band spectrum allocation for commercial use, as well as increase R&D investments in 5G and related technologies.

First, the US should accelerate studies of the spectrum band to locate viable options for increasing mid-band spectrum allocation for commercial 5G. To implement the National Spectrum Strategy, NTIA is streamlining the two-year technical studies of the lower 3 GHz band (3.1 to 3.45 GHz) for potential reallocation for shared federal and non-federal use and licensed through auction, as well as the 7/8 GHz band (7.125 to 8.4 GHz) for wireless broadband use on a licensed or unlicensed basis.82Charles Cooper, “An Update on Implementing the National Spectrum Strategy,” NTIA, April 25, 2024, https://www.ntia.gov/blog/2024/update-implementing-national-spectrum-strategy. To put it simply, results from these studies will determine the degree to which mid-band spectrum can be reallocated to benefit commercial 5G deployment while avoiding harmful interference with incumbent operators. A 2023 CTIA report noted that the lower 3 GHz band is already widely used in the global 5G networks in nearly 50 countries, including many in Europe, Latin America, and some in Africa.83“Successful Military Radar and 5G Coexistence in the Lower 3GHz Band: Evidence from Around the World,” CTIA, August 15, 2023, https://api.ctia.org/wp-content/uploads/2023/08/Lower-3-GHz-Report.pdf. For the 7/8 GHz bands, industry actors have argued that there is a key opportunity for the United States to focus on these bands in leveraging the same advantages provided by the upper 6 GHz band. First, given its proximity to the unlicensed 6 GHz band in the United States, the 7/8 GHz spectrum bands could be developed within the same tuning range as the upper 6 GHz band. This capability potentially enables a globally harmonized licensed tuning range that includes the unlicensed band, which allow the US to take advantage of economies of scale in trusted network equipment designed to span the full range.84Thomas C. Power and Umair Javed, “Comments of CTIA In the Matter of Implementation of the National Spectrum Strategy,”U.S. DEPARTMENT OF COMMERCE NATIONAL TELECOMMUNICATIONS AND INFORMATION ADMINISTRATION, January 2024, https://api.ctia.org/wp-content/uploads/2024/01/240102-Final-CTIA-Comments-on-NSS-Implementation-Plan.pdf. Second, there is evidence that some of the bands in the 7/8 GHz are underutilized by federal operators, making it suitable for reallocation.85Thomas C. Power and Umair Javed, “Comments of CTIA In the Matter of Implementation of the National Spectrum Strategy,” U.S. DEPARTMENT OF COMMERCE NATIONAL TELECOMMUNICATIONS AND INFORMATION ADMINISTRATION, January 2024, https://api.ctia.org/wp-content/uploads/2024/01/240102-Final-CTIA-Comments-on-NSS-Implementation-Plan.pdf.

However, some potential drawbacks of opening up 7/8 GHz warrant further assessment. Freeing up the 7/8 GHz band to meet the needs of commercial 5G likely requires reallocation of some federal operations out of this band that currently support fixed, fixed satellite, mobile, mobile satellite, space research, earth exploration satellite, and meteorological satellite services.86Gina Raimondo, National Spectrum Strategy (Washington, DC: White House, 2023), https://www.ntia.doc.gov/sites/default/files/publications/national_spectrum_strategy_final.pdf. For instance, federal users operate in the 7.125-7.250 GHz for utilities such as fixed point-to-point microwave communication systems for national and military test range communications.87“Federal Spectrum Use Summary 30 MHz – 3000 GHz,” National Telecommunications and Information Administration, June 21, 2010, https://www.ntia.doc.gov/files/ntia/Spectrum_Use_Summary_Master-06212010.pdf. The 7.25 to 8.4 GHz band is used for the Defense Satellite Communications Systems (DSCS) series of geostationary satellites that provide “secure jam-resistant communications for applications including command and control, crisis management, intelligence, early warning detection, and diplomatic communications.”88“Federal Spectrum Use Summary 30 MHz – 3000 GHz,” National Telecommunications and Information Administration, June 21, 2010, https://www.ntia.doc.gov/files/ntia/Spectrum_Use_Summary_Master-06212010.pdf. NTIA’s studies of the 7/8 GHz spectrum provide further assessment of the feasibility of reallocation from federal to non-federal users. The National Spectrum Strategy emphasizes greater collaboration and information sharing between various stakeholders, offering optimism in solving some of the existing challenges in spectrum reallocation.

Second, the United States should increase R&D investments in 5G and related technologies. While recognizing existing challenges in spectrum reallocation, the US should explore more avenues to share spectrum domestically to harness the full benefits of 5G. Currently, the US military already operates its systems in the same spectrum bands as the lower 3 GHz commercial 5G networks in Japan, Taiwan, South Korea, and several NATO member states, likely through static coordination.89“U.S. Military Systems Coexist with Full-Power 5G in Lower 3 GHz Band in Over 30 Countries,” PR Newswire, August 15, 2023, https://www.prnewswire.com/news-releases/us-military-systems-coexist-with-full-power-5g-in-lower-3-ghz-band-in-over-30-countries-301901283.html. Meanwhile, domestically due to incumbency issues, these bands have long been allocated for federal uses. There is an opportunity to scale static or semi-static spectrum sharing in the United States with greater coordinated access and certainty.90James Andrew Lewis and Clete Johnson, “Modernizing Spectrum Allocation to Ensure U.S. Security in the Twenty-First Century,” CSIS, September 26, 2023, https://www.csis.org/analysis/modernizing-spectrum-allocation-ensure-us-security-twenty-first-century.; “Strategic Objective 2: Ensure Spectrum Resources Are Available to Support Private Sector Innovation Now and Into The Future,” NTIA, https://www.ntia.gov/issues/national-spectrum-strategy/spectrum-strategy-pillars/pillar-one/objective-two. For example, wireless industry stakeholders have made the case for the United States to segment the lower 3 GHz band, similar to other countries, to allow for commercial wireless to operate above with military radars tuned below to fully utilize the spectrum.91Kelly Hill, “CTIA report suggests segmenting spectrum below 3.3 GHz,” RCR Wireless, August 16, 2023, https://www.rcrwireless.com/20230816/spectrum/ctia-report-suggests-segmenting-spectrum-below-3-3-ghz.

One area that the government should continue to focus on is the development of experimental dynamic spectrum sharing technology. DOD and NTIA have initiated this “moonshot” effort to maintain the US military advantage and increase economic benefits by exploring new ways of sharing the spectrum with commercial partners. The NTIA studies that focus on the lower 3 GHz band will also explore dynamic spectrum sharing and other opportunities for private-sector access in the band.92Gina Raimondo, National Spectrum Strategy (Washington, DC: White House, 2023), https://www.ntia.doc.gov/sites/default/files/publications/national_spectrum_strategy_final.pdf. It is worth noting, however, that DSS is not a quick solution. DOD and NTIA outlined a twelve to eighteen month plan in collaboration with industry to advance DSS research.93“Pillar Three: Unprecedented Spectrum Innovation, Access, and Management through Technology Development,” NTIA, https://www.ntia.gov/issues/national-spectrum-strategy/spectrum-strategy-pillars/pillar-three. But others estimated that it will likely take five to seven years, if not longer, to leverage the DSS technology for spectrum sharing.94James Andrew Lewis, “Managing the United States’ Spectrum Gamble,” Center for Strategic & International Studies, May 15, 2024, https://www.csis.org/analysis/managing-united-states-spectrum-gamble.

It is also is critical to increase R&D investment in building trusted and vertically integrated standalone (SA) networks. SA is fully independent with no reliance on 4G networks and offers key features such as faster data speed and lower latency.95Vikram Malhotra, “Standalone Mode vs. Non-Standalone Mode in 5G.” Qualcomm Academy, March 7, 2024, https://academy.qualcomm.com/blogs/NSA-vs-SA-in-5G. At the international level, the SA mode in 5G could give countries in the Global South community, such as Ethiopia, Guinea, and Zimbabwe, more options, even if they already had established contracts with Huawei to build telecom networks with previous generations such as 3G and 4G.96Melanie Hart and Jordan Link. “There Is a Solution to the Huawei Challenge.” Center for American Progress, August 22, 2024, https://www.americanprogress.org/article/solution-huawei-challenge/.

Additionally, investment in open radio access network (ORAN) is key to supporting a diverse 5G ecosystem where operators in the Global South countries have viable options to build their own infrastructure. ORAN technology allows operators to mix and match parts from different vendors.97Eva Dou, “Trump dreamt of a ‘Huawei killer.’ Biden is trying to unleash it,” The Washington Post, February 12, 2024, https://www.washingtonpost.com/technology/2024/02/12/oran-biden-china-huawei-technology. This technology will diversify the 5G equipment market, allowing operators to avoid relying on a single major vendor from China.

Regaining 5G leadership #2: Protect against China’s 5G influence at home and abroad

The United States needs to offer an alternative to China’s 5G model to safeguard security and economic interests. This involves protecting against the risks of using Chinese 5G equipment network at home, sharing information of such risks with allies and partners, and improving the 5G global governance that is based on openness, transparency, and consensus.

First, the United States should fully fund the “Rip and Replace” program to deal with the China challenge at home. In light of concerns about the security of information and communications technology and services (ICTS) by Chinese providers, US policymakers have implemented a series of measures to remove them.98For example, Section 889 of the 2019 National Defense Authorization Act (NDAA) prohibits federal agencies from entering into contracts of certain Chinese-origin telecommunications equipment or services. “NDAA Section 889 Telecommunications Prohibition: Prohibition on Certain Chinese-origin Telecommunications Equipment or Services,” Columbia Research, https://research.columbia.edu/ndaa-section-889-telecommunications-prohibition. The FCC, authorized by the Secure and Trusted Communications Network Act in 2020, plans to rip and replace covered ICTS already deployed in their networks.99Secure and Trusted Communications Networks Act of 2019, 116 Congress, March 12, 2020, https://www.congress.gov/116/plaws/publ124/PLAW-116publ124.pdf. However, a 2023 report by the Center for Security and Emerging Technology (CSET) found that in recent years at least 1,681 state and local governments purchased federally banned ICTS from Huawei and ZTE.100Jack Corrigan, Sergio Fontanez, and Michael Kratsios, “Banned in D.C.: Examining Government Approaches to Foreign Technology Threats,” (Center for Security and Emerging Technology, October 2022). https://doi.org/10.51593/20220007. With the widespread integration of banned Chinese ICTS, the “Rip and Replace” program faces significant challenges in securing appropriate funding to close the $3 billion funding gap in order to implement the initiative effectively.101Monica Alleven, “White House requests $3B to fill rip and replace funding gap,” Fierce Wireless, October 26, 2023, https://www.fiercewireless.com/wireless/white-house-requests-3b-fill-rip-and-replace-funding-gap.

It is equally important for the United States to fully demonstrate to its allies and partners the effective implementation of these policies at home in response to China’s concerning activities. The FCC’s “Rip and Replace” program could welcome participation from companies based in key allied and partnered countries. For instance, as stated in a joint statement by President Joe Biden and Prime Minister Narendra Modi, US-India collaboration on 5G includes Indian participation in that program.102White House Office of Public & Media Affairs, Joint Statement from the United States and India, Washington, DC, June 2023, https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/22/joint-statement-from-the-united-states-and-india.

Second, the US should counter China’s influence in key countries by continuing to share information with others regarding the risks. This helps assist different countries in standing up their own initiatives to replace China’s untrusted network. Numerous countries have already chosen to independently align their 5G policies with those of the United States. In August 2023, Costa Rican President Rodrigo Chaves banned companies from receiving national 5G infrastructure contracts if from a country that is not a party to an international cybersecurity convention; recently, a Costa Rican court suspended the government’s exclusion of Huawei as a 5G provider, halting the award of such infrastructure contracts until further evidence is reviewed.103Juan Pedro Tomás, “Costa Rican Court Suspends Exclusion of Huawei as a 5G Provider,” RCR Wireless News, February 14, 2024, https://www.rcrwireless.com/20240214/5g/costa-rican-court-suspends-exclusion-huawei-5g-provider. Germany, meanwhile, plans to replace parts made by Huawei and ZTE from its 5G networks by 2026.104Michael Nienaber, “Germany to Cut Huawei from 5G Core Network by End-2026,” Bloomberg, July 10, 2024, https://www.bloomberg.com/news/articles/2024-07-10/germany-agrees-to-strip-huawei-from-5g-core-network-by-end-2026.

Challenges, however, remain. Governments must balance the appeal of relatively affordable, well-made Chinese 5G equipment against concerns about China’s geopolitical aims and the potential risks of incorporating Chinese technology into their broadband networks. In Indonesia, there is some evidence suggesting that relatively cheaper costs of Huawei’s and ZTE’s products in part help major ICT providers in the country grow their profiles, through their cybersecurity and vocational training programs and other local services play a role.105Gatra Priyandita, Dirk van der Kley, and Benjamin Herscovitch, “Localization and China’s Tech Success in Indonesia,” Carnegie Endowment for International Peace, July 2022, https://carnegieendowment.org/2022/07/11/localization-and-china-s-tech-success-in-indonesia-pub87477. In other cases, countries have to consider their partnership with China as part of a larger diplomatic move. For instance, the Brazilian government is still considering whether to reverse its 5G auction regulations to permit Huawei’s involvement, following the successful procurement of Chinese vaccines.106Mitch Hayes, “Hearing on China in Latin America and the Caribbean, Testimony before the U.S.-China Economic and Security Review Commission,” 117th Congress, 2021, https://www.uscc.gov/sites/default/files/2021-05/Mitch_Hayes_Testimony.pdf. Therefore, as the United States monitors concerning PRC activities, it should also share such information with leaders of other nations for consideration and offer alternatives on a case-by-case basis.

Third, the US should improve the 5G global governance system to level the playing field. The PRC’s history of intellectual property theft and market-distorting behaviors has raised legitimate concerns. Addressing these challenges requires greater transparency to redress the PRC’s unfair standards process. With respect to the PRC’s market-distorting policies, the international community needs a coordinated approach to investigate the impact of China’s direct subsidies to Huawei and export financings on the global 5G market. The international community’s concern about China’s non-market practices extends beyond the 5G industry. Trade ministers from the Group of Seven (G7), comprising the United States, United Kingdom, Canada, France, Germany, Italy, and Japan, raised concerns over Chinese electric vehicles flooding the global market and thereby expressed the need to counter these unfair practices with trade tools.107Angelo Amante, “G7 Trade Ministers Toughen Talk on Tackling Unfair Trade,” Reuters, July 17, 2024, https://www.reuters.com/world/g7-trade-ministers-toughen-talk-tackling-unfair-trade-2024-07-17/.

It also is imperative to promote strong governance principles at standard-setting bodies, both in industry-led groups such as the 3GPP and government-based organizations such as the ITU, which are based on openness, transparency, and consensus. This includes tracking individual leadership roles, the quality of contributions to, for example, the ITU-T committee, and the nature of discussion to reach a consensus. In doing so, the United States should engage with industry actors to fully understand unfair trade practices as they relate to standard-setting.

Regaining 5G leadership #3: Push ahead together with allies and partners

Addressing China’s unfair practices alone is not enough. It is critical for the United States to create a clear global vision to govern both infrastructure and spectrum resources for 5G. This will enhance interoperability among US allies and partners critical for any joint effort.

In an increasingly complex and interconnected world, US policies cannot operate in a vacuum to be effective. Together with allies and partners, the United States can address shared challenges and uphold principles that ensure stability and prosperity. To fully harness the benefits of 5G, the US should harmonize its spectrum management and allocation policies together with allies and partners and build key partnerships based on shared values.

First, the US should coordinate with allies and partners to globally harmonize spectrum bands for 5G. The United States must ensure that its approach to identifying and allocating spectrum for 5G does not result in isolation on the global stage. Currently, studies of the lower 3 GHz band and the 7/8 GHz band need to move fast to ensure that the United States can capitalize on globally favored spectrum bands. This means coordinating with the ITU and other countries to accelerate the studies of NTIA-identified bands. There are clear benefits for the United States in identifying spectrum bands with which other countries can align. Commercially, it reduces the cost of equipment and expands business opportunities. Diplomatically, there are opportunities to develop a robust equipment ecosystem with like-minded allies and partners like South Korea and Japan using similar spectrum bands.

Such coordination is challenging. At the WRC in 2015, the ITU rejected the proposed studies of the 28 GHz band, despite ongoing millimeter wave research and testing in the United States and other like-minded countries.108Michael O’Rielly, “2015 World Radiocommunication Conference: A Troubling Direction,” Federal Communications Commission, January 15, 2016, https://www.fcc.gov/news-events/blog/2016/01/15/2015-world-radiocommunication-conference-troubling-direction. Instead, the ITU prioritized the study of the 26 GHz band, now a globally accepted high band for 5G adoption, which was supported by multiple regions, such as Africa, Europe, and China.109Ross Bateson, “WRC and the ITU (1) Recent Activity on IMT Expansion,” GSMA, November 2017, https://www.gsma.com/connectivity-for-good/spectrum/wp-content/uploads/2017/11/12-Day-2-Session-5-WRC-15-Bands-Implementation-Preparation-Ross-Bateson.pdf. This example indicates the role the ITU plays in accelerating the global adoption of certain bands for 5G and the need for the United States to closely coordinate with Global South countries.

The United States has previously demonstrated a clear success of swift promotion of spectrum bands, such as the GPS band, in concert with partners in the Global South. In the mid-1990s, the US community involved in spectrum and 3G/4G assumed that US allies such as the UK and Germany had a consensus in the ITU discussions on spectrum allocations. Once disagreements between countries became evident, however, the United States engaged with different ITU regional organizations, and in 1997, successfully aligned its interests with many countries, especially those in the developing world to protect the GPS band.110Wendy Lubetkin, “Reallocation of GPS Spectrum Could Compromise Global Systems,” USInfo, November 24, 1999, https://usinfo.org/usia/usinfo.state.gov/topical/global/ecom/99112401.htm.

On the other hand, global harmonization led by China without US participation could create a bifurcated 5G world, with that country setting the global standard and the United States adopting a separate, incompatible standard. On the security front, the United States might face high-band interoperability challenges, as DOD operations around the world may have to rely on networks with Chinese components in a supply chain that lacks supplier diversity (as shown earlier).111Milo Medin and Gilman Louie, “The 5G Ecosystem: Risks & Opportunities for DoD,” Defense Innovation Board, April 2019, https://media.defense.gov/2019/Apr/03/2002109302/-1/-1/0/DIB_5G_STUDY_04.03.19.PDF. On the economic front, Chinese vendors could further benefit from selling to the global market, while US vendors would remain reliant on widely used spectrum bands. It is thus imperative for the United States to promote globally accepted spectrum bands in order to regain leadership in 5G.

Second, the United States should build partnerships with key regions based on shared values and objectives. This involves emphasizing the US commitment to digital sovereignty in establishing 5G partnerships with other countries and sharing information to promote trusted alternatives, encouraging partners to consider the economic and security costs of working with authoritarian regimes like the PRC and its firms.

The US-Costa Rica alliance serves as an important example of an effective 5G partnership based on shared values and objectives. In April 2024, the two countries released a joint statement emphasizing their “strategic alignment with an affirmation of the visionary principles encapsulated within the 2021 Prague Proposals on Telecommunications Supplier Diversity.” These principles focused on using technologies like 5G for economic growth and societal betterment while also maintaining security.112“Joint Statement on Enhancing Digital Economy Cooperation Between the United States of America and the Republic of Costa Rica,” US Department of State, April 11, 2024, https://www.state.gov/joint-statement-on-enhancing-digital-economy-cooperation-between-the-united-states-of-america-and-the-republic-of-costa-rica.

To support wireless connectivity and innovation in key regions like Latin America, the United States must ensure that its spectrum policy avoids situations that could make China’s alternatives more attractive to countries in the region. In doing so, the United States should clearly articulate its domestic 5G spectrum policy and deliver a unified message to allies and partners. Such messaging should emphasize a shared vision for sustaining democracies through civil society actions, independent media, transparent infrastructure bidding, anti-corruption measures, and laws regulating foreign influence.113David Shullman, “China Pairs Actions with Messaging in Latin America. The United States Should Do the Same.” Atlantic Council, February 12, 2024. https://www.atlanticcouncil.org/in-depth-research-reports/issue-brief/china-pairs-actions-with-messaging-in-latin-america-the-united-states-should-do-the-same. In particular, for 5G development, it is critical for the United States to ramp up engagements with the region around trusted suppliers and efficient allocation of spectrum in order to remain aligned and together achieve rapid progress on this new frontier in wireless technology.

Conclusion

The economic and security benefits of 5G have sparked intense competition among countries for leadership in this technology. Competition with China will require not just proactively investing in promoting the technology at home, but also closely coordinating with key allies and partners to ensure the long-term sustainability of 5G growth. China’s strategy to suppress 5G competition and exert influence presents great risks to the global community, which warrants close monitoring and greater information sharing. The strategy outlined above will help the United States and its allies and partners forge a new path in 5G.

About the author

Explore the program

The Global China Hub researches and devises allied solutions to the global challenges posed by China’s rise, leveraging and amplifying the Atlantic Council’s work on China across its sixteen programs and centers.

Image: Shutterstock.