In The Euro’s Difficult Future – Competitiveness Imbalances and the Eurozone’s North-South Divide author Luigi Bonatti, a professor of economics at the University of Trento in Italy, stresses that the existing North-South competitiveness divide creates growing tensions between member countries and fuels hostility towards European Union institutions. The paper illustrates why this competitiveness divide is structural, cannot be tackled by macroeconomic policies, and could threaten the euro’s survival.

Key Findings

- Firms’ competitiveness is substantially affected by the characteristics—in terms of quality and cost—of the areas in which they are located.

- Input cost differentials across areas are often insufficient to offset the gap in terms of overall productivity.

- An area’s capacity to attract and foster the development of “competitive” firms is often enduring.

- Competitive firms create “good” jobs, invest more, and allow regions to raise more tax revenues for any given tax rate.

- Wide and persistent competitiveness imbalances bring about unequal distributions of high- and medium-value-added activities across regions and countries.

- Persistent competitiveness imbalances collide with the worldwide tendency towards an equalization of workers’ education levels and aspirations.

- Competitiveness imbalances between the eurozone’s North and South widened before the debt crisis, but the South masked the effects on income and unemployment by going into debt.

- In the aftermath of the crisis, the divide in income and labor-market performance between the North and South has grown.

- The widening structural divide between the eurozone’s North and South is increasing tension between member countries over economic policies and is fueling hostility toward European institutions.

Introduction

In the eurozone (EZ), spare capacity and labor market slack—which are mainly concentrated in areas of the South affected by structural weaknesses—cannot be removed through greater government spending. However, the weak governments of these Southern countries have no political capital to tackle these weaknesses. Thus, these governments seek some relief by advocating for a continuation of quantitative easing (QE) policies by the European Central Bank (ECB), softening the budget deficit limits dictated by the European Commission, and requesting some form of debt mutualization (or, in the case of Greece, debt forgiveness). In the meantime, populist parties capitalize on the discontent, particularly widespread in the South among the young generations1It is worth noting that in Southern Europe populist motives and anti-establishment drivers appear to be more diffuse among the young cohorts than among the older generations, while in other countries—as Brexit and the election of Donald Trump demonstrated—the opposite is true. that are disproportionally suffering from the shortage of decent job opportunities. In contrast, countries in the EZ’s North, such as Germany, have tight labor markets; their recent growth performances have not been disappointing considering that their workforces are shrinking as their populations age. In a scenario where global deflationary impulses appear to be subdued and inflation—together with interest rates—is expected to gradually pick up, the North will probably be less tolerant towards the South’s excessive deficits and oppose the extension of the ECB’s QE after December 2017. Furthermore, the North’s resistance towards additional cross-border fiscal transfers (and debt mutualization or relief) to the South is likely to strengthen under the influence of new nationalistic parties.

It is apparent that this divide is putting the euro’s very survival at risk. This paper discusses in-depth what causes this divide and argues that expansionary macroeconomic policies cannot move the economies of the EZ’s depressed areas towards a higher sustainable growth path.

Spatial concentration of ‘good’ jobs and the routinization hypothesis

Basic Keynesian economics suggests that a fiscal stimulus is appropriate when there are productive assets (including human resources) that are underutilized because of a lack of demand. However, some facts seem to indicate that at the origin of the excess capacity and idle labor currently existing in some areas there are structural factors that are difficult to improve with fiscal expansions. These structural factors are rooted in persistent competitiveness imbalances between countries and regions. Different areas have varying capacities to attract and foster the development of competitive firms, which are those that “hire more workers, offer better job security, pay higher wages, invest more (including in human resources), generate greater revenues and profits, and therefore allow regions to raise more tax revenues for any given tax rate.”2Gábor Békés and Gianmarco I.P. Ottaviano, “Micro-Founded Measurement of Regional Competitiveness in Europe,” in Carlo Altomonte and Gábor Békés, eds., Measuring Competitiveness in Europe: Resource Allocation, Granularity and Trade (Brussels: Bruegel Blueprint Series, Vol. XVIV, 2016): 36-37. Indeed, an area’s quality-cost effectiveness has a remarkable impact on its firms’ competitiveness.3In response to the criticism of Paul Krugman (“Competitiveness: A Dangerous Obsession,” Foreign Affairs 73, no. 2, 1994: 28-44) and others about the use of the term “competitiveness” with reference to nations or regions, Békés and Ottaviano (in “Micro-Founded Measurement of Regional Competitiveness in Europe,” 36) rightly point out that “the only meaningful outcome that can be called ‘competitiveness’ of a region is the performance of its firms relative to their competitors in benchmark regions.” (italics added) The concentration of competitive firms in an area brings Marshallian externalities—such as knowledge spillovers, better opportunities to access indivisible infrastructures (e.g., highways, railways, bridges), and ample supply of business services and skilled labor—that make the area more attractive for firms. Input cost differentials across areas are often not sufficient to offset the overall productivity gap that is created by more effective institutions, higher endowments of social capital, and economies of agglomeration in the high-performing areas. These and similar features, which are inherited from the past, are difficult to modify—at least in the short run—by policy actions.4Hoyt Bleakley and Jeffrey Lin, “Portage and Path Dependence,” Quarterly Journal of Economics 127, 2012: 587-644.

Technological developments and spatial shifts in manufacturing industries from advanced economies to emerging economies provide additional challenges for low-performing areas whose businesses struggle to create high-paying jobs and attract highly skilled labor. Consistent with the routinization hypothesis,5David H. Autor, Frank Levy, and Richard J. Murnane, “The Skill Content of Recent Technological Change: An Empirical Exploration,” Quarterly Journal of Economics 118, 2003: 1279-1333. medium-skilled workers performing routine tasks are displaced by automation, while new technologies increasingly combine highly educated workers engaged in creative and abstract tasks (i.e., high-value-added functions) with sophisticated tangible and intangible assets. Investment in intangible assets (e.g., design, research and development [R&D], software and databases, brand names) represents a growing fraction of total investment in the advanced economies6Carol Corrado, Jonathan Haskel, Cecilia Jona-Lasinio, and Massimiliano Iommi, “Intangible Capital and Growth in Advanced Economies: Measurement Methods and Comparative Results,” CEPR Discussion Papers 9061, 2012; Lewis Alexander and Janice Eberly, “Investment Hollowing Out,” prepared for the 17th Annual Jacques Polak Research Conference at the International Monetary Fund, 2016. and typically gives rise to imperfect competition in product markets, which results in substantial mark-ups for the few market leaders.7Adair Turner, “Wealth, Debt, Inequality and Low Interest Rates: Four Big Trends and Some Implications,” mimeo, 2014. Thus, strategic and high-value-added functions related to the intangible-intensive sector have been concentrated in relatively few places,8As Richard E. Baldwin and Simon J. Evenett (in “Value Creation and Trade in 21st Century Manufacturing,” Journal of Regional Science 55, 2015: 31) state, “high levels of productivity, specialization advantages, and innovation resulting from the agglomeration of skills and tasks imply that not every activity creating value is at risk of migrating across borders.” while companies have offshored lower-value-added tasks as part of the international fragmentation of production that occurred in the two decades preceding the global crisis.9Richard E. Baldwin, “Globalisation: The Great Unbundling(s),” in Globalisation Challenges for Europe, (Helsinki: Office of the Prime Minister of Finland, 2006); Marcel P. Timmer, Abdul Azeez Erumban, Bart Los, Robert Stehrer, and Gaaitzen J. de Vries, “Slicing Up Global Value Chains,” University of Groningen, GGDC Research Memorandum 135, 2013. Together with the emergence of global value chains,10There is some evidence that the slower pace of expansion of global value chains is an important determinant of the decline in the long-term responsiveness of international trade with respect to income observed in the 2000s (see Cristina Constantinescu, Aaditya Mattoo, and Michele Ruta, The Global Trade Slowdown: Cyclical or Structural?, International Monetary Fund Working Paper, WP/15/6, 2015). low-skilled service jobs (e.g., personal and health care, retail, hotel and restaurants, security) have steadily increased in the advanced economies. These low-skilled jobs cannot be eliminated by existing technologies and reflect the growing share of services in total domestic demand. The growing demand for unskilled workers by the labor-intensive service sectors is met by the virtually unlimited world reservoirs of underemployed labor in low-productive occupations in rural areas or in the informal parts of urban economies.

The German economy’s virtues and detractors

The polarization of the labor market that is underway in most advanced economies is particularly accentuated in the countries where manufacturing has shrunk the most. In this respect, it is significant that the preservation of Germany’s strong manufacturing base is considered a priority by its establishment. Germany’s export-oriented manufacturing industry is an important source of relatively stable and well-paid jobs for medium-skilled workers, supported by a training system functional to it, and the core of a corporatist socioeconomic model hinging on cooperative long-term relationships among entrepreneurs, unions, schools, and banks. Despite the emphasis that the Obama administration placed on relaunching the US manufacturing sector, the German growth model has remained very different from that in the United States, where gross domestic product (GDP) growth is typically driven by the expansion of domestic demand, concentrated on services, associated with large personal debts, and characterized by high income inequality. Hence, it should come as no surprise that Germany’s main social and political forces have resisted International Monetary Fund and Organisation for Economic Co-operation and Development (OECD) suggestions of implementing financial market reforms and service market liberalizations that would have made the German growth model more similar to that of the US.11Luigi Bonatti and Andrea Fracasso, “The German Model and the European Crisis,” Journal of Common Market Studies 51, no. 6, 2013: 1023-1039. In contrast, reforms carried out by the German government in the early 2000s were aimed mainly at restoring the competitiveness eroded in the previous decade following unification to better compete with the new emerging industrial powers, with the understanding that low-growth Europe was going to become less and less important in the future as a market for German investment goods and high-quality consumer durables. It is significant that no similar reform package was implemented by the countries in the South in the aftermath of the introduction of the euro. Actually, in the 2000s Germany progressively increased its exports towards non-European and non-OECD countries (in 2015, only 9.1 percent of total German exports were directed towards the Southern European members of the EZ, i.e., Greece, Italy, Portugal, and Spain). A comparison of countries’ proportions of world merchandise exports indicates that Germany is practically the only advanced economy that has maintained an almost constant share of the total, notwithstanding the rapidly expanding shares of large emerging economies.

Germany can preserve its large capital goods and consumer durables industries only by relying on buoyant foreign demand for its products, and the reforms of the early 2000s were instrumental in strengthening its world competitiveness by letting real wages grow slower than labor productivity. Also in China real wages persistently lagged labor productivity in the years of its spectacular growth, and it is not by chance that the world’s two best performers in terms of exports shared this pattern, while for most of their trade partners wages did increase faster than productivity. However, in the absence of rigidities limiting the possibility of exchange rates to respond to the divergent evolution of economic fundamentals, such a differential in the dynamics of wages and productivity would have brought about an appreciation of the Chinese and German currencies relative to the currencies of their trade partners, thus offsetting at least part of their gains in competitiveness. In the case of China, this did not happen because the government managed for years to keep the yuan underappreciated; in the case of Germany, this did not happen because the external value of the euro does not fully reflect the differential in economic fundamentals between Germany and non-euro countries (since the external value of the euro also reflects the economic fundamentals of the rest of the EZ), and because competitiveness disparities within the EZ cannot be corrected through nominal exchange rate movements. This may help to explain the high level reached by the German current account surplus (above 8 percent of its GDP), which has also recently been indicated by many commentators (especially in the Anglo-Saxon countries, but not only) as proof that Germany is pursuing a “beggar-thy-neighbor” policy, a sort of “social dumping” (by a country with one of the highest labor costs in the world) that damages the rest of the world and in particular its EZ partners. In general, it is hard to claim that a country is damaging the rest of the world if it spreads part of the benefits of its productivity gains to its trading partners in the form of lower prices for its products, without preventing (by raising trade barriers or manipulating the external value of its currency) its trading partners from doing the same with the products they produce.

Furthermore, this accusation implies that a country’s efforts to improve its position in the international division of labor by retaining and attracting high- and medium-value-added activities are incompatible with the cooperative behavior that should predominate in international economic relations, even when the country in question fully complies with the rules that govern world trade. In particular, for a European Union (EU) member, this accusation would imply that any gain in competitiveness—achieved through the capacity of its political and institutional system to induce economic and social actors to forgo immediate advantages for greater benefits in the medium to long term (capacity that other member states do not have)—is an unacceptable dereliction of its duty of solidarity towards other member states.

In the name of this solidarity, Germany is also blamed for not having pursued a more expansionary fiscal policy, which would have helped the countries in the South of the EZ recover in the aftermath of the European debt crisis. In reality, it is likely that the positive spillovers to the South generated by a fiscal stimulus in Germany would have only slightly attenuated the intensity of the consolidation efforts that the countries in the South had to make anyway as a consequence of their unsustainable imbalances.12See, e.g., Jan in ‘t Veld, “Fiscal Consolidations and Spillovers in the Euro Area Periphery and Core,” European Economy – Economic Papers 506, European Commission, Directorate General Economic and Monetary Affairs (DG ECFIN), 2013. Moreover, in recent years the German economy has been close to full employment, and any firm stimulus to domestic demand has to be met by large inflows of immigrant workers (that a large portion of the German society finds undesirable) and is inevitably associated with increases in the production costs of the tradable sector that will reduce its competitiveness (and may undermine the success of the German model). In addition to these effects, an expansionary fiscal policy today is deemed to be at odds with the needs of a rapidly aging society that will face higher health and pension costs in the future. Indeed, basic principles of economics indicate that it is perfectly normal for a mature economy whose population is aging to run current account surpluses (implying that it is the persistent US current account deficit that is pathological). These considerations explain why the German government is reluctant to implement large fiscal stimuli and why a country like Germany running a current account surplus should be considered structural. What is abnormal is the high level reached by this surplus in recent years, which—as already emphasized—is to a large extent an (undesired) result of the distortions caused by the euro.

Eurozone areas with endemic competitiveness problems: the case of Greece and South Italy

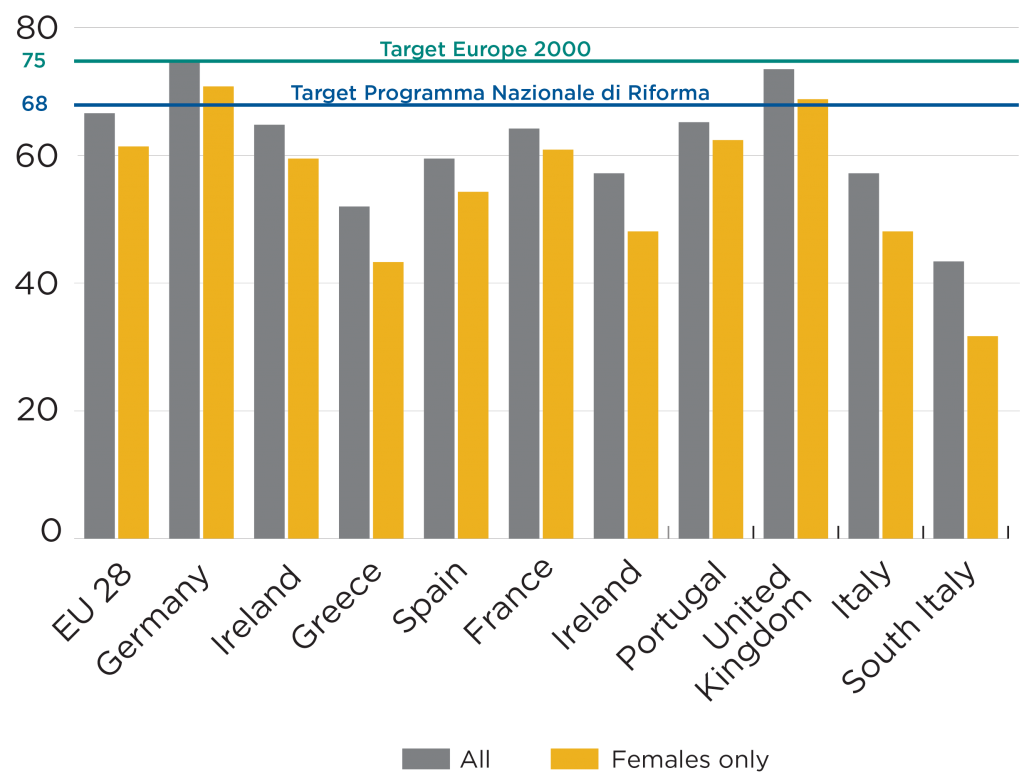

The Southern European members of the EZ are among the countries in the developed world where all measures of labor underutilization are the highest (see figures 1 and 2). In large sections of these countries, the level of private wealth accumulated in the past and the public entitlements promised to most people—and above all the standards of living and aspirations to which they have grown accustomed—have become hardly reconcilable in the course of the globalization process with the quality of their institutions and social capital, their comparative advantages and role in the international division of labor, and their overall productivity levels. Unable to offer an environment suitable for the flourishing of medium- and high-value-added activities and too costly for attracting and retaining activities at the low end of the value chain, these areas can be considered among the losers of the globalization that has taken place in recent decades. Increasing private (and—in the case of Greece—public) foreign indebtedness, or large public transfers (in the case of South Italy), have permitted them to conceal their structural weaknesses and to live beyond their means for years. After the outbreak of the European debt crisis, a rapid (and in the case of Greece, brutal) downward readjustment of living standards toward a realistic level occurred. As a matter of fact, during the adjustment process made necessary in the Southern EZ countries by the imbalances that led to the crisis, all the sectors that had inflated in the years preceding the crisis because of growing domestic demand (e.g., for construction, public services, retail) shrank and lost jobs. Furthermore, the tradable sector has not succeeded in replacing the jobs lost in the non-tradable sectors because the choice made by the EZ Southern members to keep the euro has allowed them to only partially regain (through painful internal devaluations) the competitiveness lost in the pre-crisis period. Hence, the fall in domestic demand experienced by the Southern European countries was not counterbalanced by an offsetting increase in foreign demand. In fact, the gradual elimination of the external deficits that these countries displayed in 2010 was achieved overwhelmingly through the fall in imports brought about by the reduction in domestic demand. Therefore, it is legitimate to think that a significant fiscal stimulus would provide the countries in the South with some temporary relief, mainly due to the effects of the stimulus on the sectors not exposed to international competition (such as construction), though without moving the economy towards a sustainable high-growth path. Indeed, one should expect that the external constraint would soon be binding again (also because international investors would be less willing than in the recent past—given the lessons of the recent sovereign debt crisis—to give credit to countries with weak economic fundamentals). Previous experiences also show that adjustments and reforms that may improve these fundamentals are often softened or postponed when expansionary policies give some relief. Thus, anticipating that the acceleration of growth, fueled by the increase in domestic demand due to fiscal expansion, will be transient because of the above-mentioned constraint, it is likely that investment in new productive assets will languish, thus dampening the impact of the stimulus on GDP growth.

Greece and South Italy exemplify some of the reasons it is unrealistic that sustainable long-term growth can be revived by fiscal stimuli.

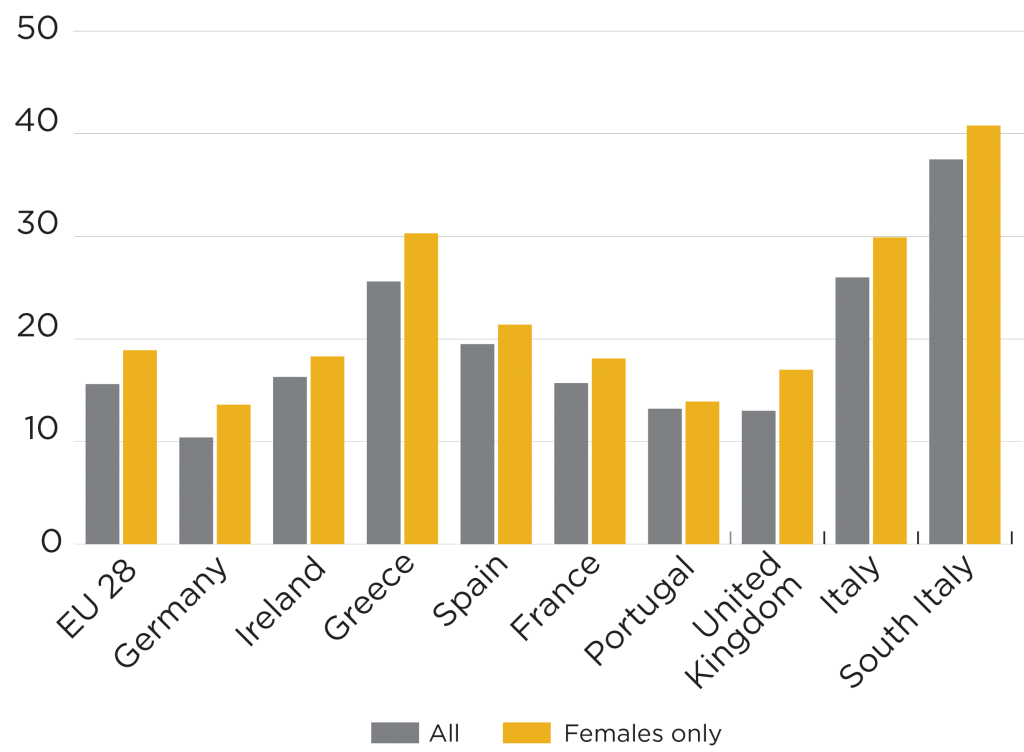

Greece and South Italy exemplify some of the reasons why it is unrealistic that sustainable long-term growth can be revived by fiscal stimuli in the large areas of Southern Europe that have exhibited the worst performances in recent years with regard to GDP growth and labor-market indicators. Greece (slightly fewer than eleven million inhabitants) and South Italy (slightly fewer than twenty-one million inhabitants and approximately one-third of Italy’s total population) share some structural features:13Cinzia Alcidi, Luigi Bonatti, and Andrea Fracasso, “The Greek Crisis and Its Structural Features: Some Insights from a Comparative Exercise,” in Luigi Paganetto, ed., Stagnation versus Growth in Europe. Capitalism in the 21st Century, (Basel and Cham: Springer International Publishing, 2016): 133-154. 1) a restricted employment base (in particular, very low female and youth employment rates) and relatively large proportions of workers in public employment and in irregular occupations (as a consequence of very large informal economies); 2) a small manufacturing sector and an endemic competitiveness problem: economic activity heavily depends on domestic demand (and on public expenditure) and GDP growth is typically driven by the non-tradable sectors of the economy (tourism in Greece being a relevant but partial exception); 3) (very) small average firm size: firms tend to be active in low-valued-added service sectors, spend little on R&D, and are less innovative (as a result, in recent years labor productivity and total factor productivity growth have been quite disappointing); 4) poor social capital endowments and low-quality institutions. Moreover, both economies were hit in the last twenty-five years by three common shocks: 1) the accession to the global market of China and Eastern Europe, 2) the introduction of the euro (both shocks exacerbated their common problem of having the cost structure of a rich country but the overall productivity of a middle-income country), and 3) the fiscal contraction that followed the euro debt crisis, which was not alleviated by an increase in exports because of their poor price and non-price competitiveness.

An important difference between Greece and South Italy is that the former had access to external funds mainly by borrowing from abroad (although Greece has been a net recipient—since its accession to the European Community in 1981—of non-negligible amounts of European funds), while southern Italy is part of a transfer union and is the recipient of substantial and permanent fiscal transfers from the rest of Italy (on average close to 20 percent of its GDP) that support its private and public expenditures. Until the early 1990s, the wide gap between tax revenues and government outlays in South Italy was largely financed through the accumulation of public debt. When this was no longer possible, the transfers in favor of South Italy have effectively kept Italian tax rates very high, with depressing effects on competitiveness and long-run growth for the economy of the entire country.14In the 1990s, the interregional fiscal transfers in favor of South Italy became a major political issue in Italy, with a party whose constituency was exclusively in Italy’s North (the “Northern League”) asking for a form of fiscal federalism that would have implied their substantial reduction. Not having achieved any results in that direction in spite of its long participation in governing center-right coalitions, the Northern League has tacitly dropped this request, trying to enlarge its constituency nationwide by transforming itself into an anti-immigrant and anti-euro party. One should expect that sooner or later these large fiscal transfers from Italy’s North to its South will return as a hot political issue in the country. Moreover, exactly as wages and prices inflated in Greece in the 2000s as an effect of the inflow of foreign capital that financed its excess of public expenditures, public transfer inflows have helped permanently raise the level of prices and production costs of the Mezzogiorno relative to its own productivity. One should also add that, since the beginning of the 1970s, the nominal wage levels negotiated at the national level have been extended to the whole of Italy, in spite of the remarkable productivity and unemployment differentials between Northern and Southern Italy (and in spite of the fact that the cost of living is significantly cheaper in Italy’s South). As a result, salaries and wages in the formal segment of South Italy’s labor market respond very slightly to the labor-market conditions prevailing in the area. In other words, the Mezzogiorno was already part of a malfunctioning currency union long before its accession to the EZ, whereas Greece’s problem of having production costs quite higher than those of its neighboring countries (with similar productivity levels) was dramatically exacerbated by its accession to the EZ and the consequent heavy borrowing from abroad.15As a measure of the price and cost competitiveness of Greece in the aftermath of the outbreak of its debt crisis, consider that in 2011-2013 the price level was on average 55 percent higher in Greece than in Turkey, while in 2012 the hourly wage in the manufacturing sector was (in euros) 14.7 in Greece, 2.9 in Bulgaria, 6.6 in Poland, and 3.8 in Romania.

South Italy displays many symptoms of the so-called public resources curse whereby the separation on a permanent basis of a society’s possibility to consume and enjoy welfare benefits from its capacity to generate income makes in the long term this society addicted to these public funds, thus creating distorted incentives both for ordinary citizens and local elites. This has become more apparent since the early 1970s, when Italy decentralized spending decisions concerning a large portion of public funds to locally elected political bodies (regioni). Some have argued that, given the low stock of civic capital in southern Italy, and therefore the clientelistic and often corrupt habits of the local elites, this power devolution has worsened the allocation of public resources in the area and has led in many cases to wasteful expenditures of public funds, with negative effects on economic growth. Hence, all considered, it is unsurprising that southern Italy’s per capita GDP has not converged with that of the rest of Italy (South Italy’s per capita GDP has remained below 60 percent of the rest of the country).

Figure 1. Employment rates for 20- to 64-year-olds, 2014

Figure 2. Not (engaged) in education, employment, or training (NEET), 15- to 34-year-olds, 2014

Being part of the developed world has not helped the depressed areas of Southern Europe reduce their competitiveness gaps in the aftermath of the economic crisis. In these areas, most populations have become accustomed to levels of private and public consumption quite higher than those of countries—like most Eastern European countries—with comparable levels of overall productivity, but whose populations have had lower standards of living over recent decades. Furthermore, people’s aspiration levels in the less productive areas of the rich world are not significantly lower than those prevailing in the most productive areas. This is part of a more general trend that is underway worldwide (also in many developing countries), namely that—also as a result of the growing percentage of the population that attains medium or even high levels of education—there is an increasingly large number of young people with high (or relatively high) levels of education that have to accept jobs for which they are overqualified. The hypothesis that is put forward here is admittedly speculative, although it is supported by some evidence. The tendency for competitiveness imbalances between countries and regions to be wide and persistent (also because of the growing importance of agglomeration economies) determines an unequal spatial distribution of high-value-added activities (i.e., those activities that can generate “good” jobs). This trend conflicts with the tendency towards an equalization of workers’ education levels and aspirations that is also underway worldwide. In addition, as a result of both the technological progress and the composition of the world demand for goods and services, the volume of medium-value-added activities (i.e., those activities that can generate jobs paying decent wages) is scarce worldwide relative to the increasing number of people who qualify for these jobs and aspire to them. As previously discussed, rigidities and distortions due to government policies have played some role in exacerbating these discrepancies, pushing many young people in the developing world with some education to emigrate, whereas in Southern Europe there is a more visible manifestation evidenced by the extremely large segment of native young people who are unemployed or prefer to stay out of the labor market (in areas where the presence of foreign immigrants employed in low-productive activities is not negligible).

Implications for the survival of the Eurozone (EZ)

In the rich world, underutilized human and non-human resources are concentrated in uncompetitive areas. An argument that is often raised by pundits and commentators is that the depressed areas located in the developed world cannot compete in terms of cost with the emerging economies, and therefore should upgrade the technologies and quality of their products, thus increasing overall productivity. However, this is exactly what many emerging economies are now trying to do by investing heavily in human capital and R&D so as to escape the so-called medium-income trap. As a result, they still enjoy a significant cost advantage relative to the depressed areas of developed countries, but they are no longer scarce in skilled workers and advanced technologies. Moreover, such an upgrade is not possible without the capacity to attract competitive firms and to favor their development. State interventions are essential for providing basic public goods—such as law enforcement, property rights protections, and quality education—that are often in short supply in these areas, as well as for offering favorable tax treatments that may at least partially counterbalance the unfavorable socioeconomic environments in which firms have to operate. Nevertheless, these interventions cannot substitute for the market mechanisms that may help create a cost structure (e.g., wages, salaries, rents, prices of services) more consistent with the productivity levels of these areas, thus mitigating their comparative disadvantages and favoring the creation and growth of competitive firms in their territories. The problem is that this cost adjustment implies the relative impoverishment—at least in the short term—of the part of the population (a large share of which consists of public employees) that is occupied in the formal segment of the economy or has valuable properties, and therefore tends to be politically protected, while its potential benefits take time to materialize and are eventually enjoyed by groups with little political voice (e.g., jobless young people, workers trapped in the informal economy).

[T]he growing divide between the South . . . and the North . . . is hardly compatible in the medium-long run with the survival of the EZ.

As the European debt crisis erupted, thus exhausting the possibility for the Southern EZ countries to finance their excess of private and public expenditures by borrowing from abroad, such cost adjustment could not be postponed any longer. Since these countries chose to stick with the euro, it had to take place through internal devaluations. In the case of Greece, whose sector producing internationally tradable goods is small and weak, this process has been particularly painful and has delivered disappointing results in terms of economic growth. Political instability and uncertainty about the future of the country in the EZ have contributed to making Greece’s problems intractable by triggering capital flights and deterring private investment. It is not surprising that having transformed the other EZ members into the largest creditors of Greece, European institutions and countries in the North (above all Germany) have become perfect scapegoats towards which to address Greek mass discontent for the country’s conditions. In the case of Italy, which at the outbreak of the debt crisis did not exhibit a large external deficit—as opposed to other Southern countries—but was in the midst of a prolonged period of very anemic productivity and income growth, similar anti-EU sentiments are fed by the deceptive (but widespread) notion that the country’s inability to exit from two decades of stagnation is due to the budget deficitlimits imposed by the European authorities on behalf of the North.

Against this background, it is apparent that the growing divide between the South, which has suffered the most in the aftermath of the European debt crisis, and the North, which has done fairly well in recent years, is hardly compatible in the medium-long run with the survival of the EZ as it has existed up to now. Pessimism about the EZ’s future is justified by the recognition that nowadays the two (not mutually exclusive) ways for trying to reverse this diverging trend do not appear viable. Indeed, on the one hand, it is unlikely that the Northern countries are going to lift opposition to a fully fledged mechanism of fiscal transfers within the EZ. Their reluctance to accept it is ultimately grounded in the argument that such a mechanism can lead to the crystallization of the productivity gaps and competitiveness imbalances (and the related vicious incentive spirals) often observed in the depressed areas that—like the South of Italy—receive substantial transfers on a permanent basis from richer areas. This is also the main argument—together with the moral hazard problem16The moral hazard problem arises when someone (a person or entity) takes more risks because someone else bears the costs of those risks.—that is invoked to motivate the North’s resistance to some significant (direct or indirect) mutualization of the South’s government debt. There is no hint that this resistance will fade away in the foreseeable future. On the other hand, in key Southern countries like Italy it is difficult to see the collective awareness, popular consensus, and political determination that would be necessary for tackling the structural features that constrain these economies’ long-run growth. Hence, there is a considerable risk in these countries that populistic shortcuts will prevail, thus triggering a reaction in the North and undermining the single European currency.

Policy recommendations

People’s standard of living ultimately depends on the capacity of the area in which they live to foster the development of “competitive firms,” which are those that generate more value added, thus offering better jobs, distributing more profits, and paying higher wages and taxes. The relative scarcity of high- and medium-value-added activities associated with “good” occupations with respect to the growing number of workers that worldwide qualify for them and aspire to them brings about a fierce competition between areas for attracting and keeping them in their territory. The quality-cost effectiveness of the area is the crucial determinant of this capacity. In the eurozone, differences in this effectiveness are at the root of the sharp divide between those areas predominantly located in Northern and Central Europe, which have relatively high per-capita incomes and low unemployment, and those low-competitive areas of Southern Europe, which have high structural unemployment that particularly impacts the young cohorts. Seven policy recommendations follow from this analysis.

Recommendation 1: Efforts should be made to dissipate the illusory conviction—quite diffuse in the eurozone’s South—that increasing the public deficit can be conducive to economic growth and employment. In low-income areas that suffer the most from poor labor-market performances, a fiscal stimulus may please some groups of voters and lead to some transient expansion of the sectors producing for the local market, but at the cost of exacerbating the competitiveness problem that constrains sustainable long-term growth in these areas and of increasing their external deficits, thus perpetuating their dependence on external resources.

Recommendation 2: Reviving sustainable growth in the vast depressed areas of Southern Europe requires a consistent set of actions aimed at improving the quality-cost effectiveness of these areas. This can be accomplished by doing the following: these depressed areas should raise their overall productivity and reduce their cost structures. The abstention from policies that distort incentives and create long-lasting dependencies is an important part of any credible attempt to achieve these objectives.

Recommendation 3: Governments should focus on providing basic public goods—such as law enforcement, property rights protections, and primary education—whose quality is often quite poor in these areas, thus improving the socioeconomic environment in which firms must operate. Public spending should concentrate on carefully selected high-return investment projects (typically in transport and ICT [Information and Communication Technology] infrastructures) that can positively affect the growth potential of the economy.

Recommendation 4: Wage-setting institutions should be reformed so as to let wages reflect more closely—even in the formal segment of the labor market—the relatively low productivity and high unemployment levels characterizing these areas, thus reducing labor costs and the very dualistic nature of the local labor markets, whose irregular segments are extremely ample. This should primarily apply to public salaries, whose nominal levels are generally fixed without accounting for the lower cost of living and higher value of job security enjoyed by public employees in depressed areas, thus creating long queues to access public jobs and distorting educational choices. In addition, barriers to competition in markets for services not exposed to international competition should be lifted, thus reducing consumer prices and costs for local firms producing internationally tradable goods.

Recommendation 5: Fiscal transfers financed with external resources that support private and public consumption in depressed areas should be cut, thus limiting the perverse effects on incentives and societal values of a permanent decoupling between standards of living and productivity levels. The resources thus saved should be allocated to generalized tax and social contribution cuts in favor of the firms localized in these areas. Their automatic nature shrinks the discretionary power of local political and bureaucratic personnel who are often inefficient and corrupt. Proposals for universal basic income schemes in areas with record low employment and job-market participation rates, high incidences of opportunistic behavior, and large black economies should be rejected. Welfare provisions should be redirected in favor of low-income people, who are generally poorly protected in these areas, despite high public spending as a fraction of their GDP.

Recommendation 6: A realistic assessment of the situation should suggest to responsible political leaders and opinion makers of the eurozone’s South to stop asking the eurozone’s North for some form of debt mutualization or substantial fiscal transfers in favor of the Southern countries. Indeed, such reiterated requests face the fierce opposition of a large majority of voters in the Northern countries, an opposition that is grounded in the fear that large and systematic transfers towards the South may lead in the eurozone to the same crystallization of productivity gaps and GDP differentials (and thus to the same unlimited perpetuation of interregional transfers) observed between North and South Italy in the last decades. Given this opposition, insisting on this request on the part of the South’s leaders and pundits can only feed resentment among European peoples and anti-European sentiments within the South. Similar considerations hold for those asking Northern countries like Germany and the Netherlands to change their economic policies to reduce their trade account surpluses, since in these countries such a reduction is considered to be in deep contrast with their national interests.

Recommendation 7: Due to the lack of political determination and popular consensus necessary to tackle the structural features constraining long-term growth in large areas of the eurozone, the centrifugal forces that push in some countries for a withdrawal from the euro may become unstoppable. This may soon be the case for Greece, whose return to robust growth is complicated by its weak production base and huge external debt. Under these circumstances, policy makers should be prepared to manage the possible departure of one or more countries from the eurozone in an orderly and non-traumatic way.