Deploying QT – The Fed readies its new tool to fight inflation

The Federal Reserve’s (Fed) March meeting marked a return to the traditional tool of interest rates after relying on balance sheet policies throughout the pandemic. To rein in inflation, the Fed raised rates by 25-basis points after forecasting only six months earlier that it would keep rates at zero until 2023. At the same time, the Fed ended its asset purchases early to make way for the rate hikes. The asset purchases, known as quantitative easing (QE), helped prop-up financial markets and the economy since the economic crash in March 2020.

At last week’s Fed meeting, the first 50-basis points rate hike in 22 years showed that the Fed means business in its fight against inflation. However, the Fed also decided to reactivate its balance sheet-based tool. Starting on June 1, the Fed will begin to reduce the size of its balance sheet, i.e., conduct quantitative tightening (QT), to amplify the contractionary impact of higher interest rates. This piece explains how QT works, discusses its goals, and outlines potential risks of the policy.

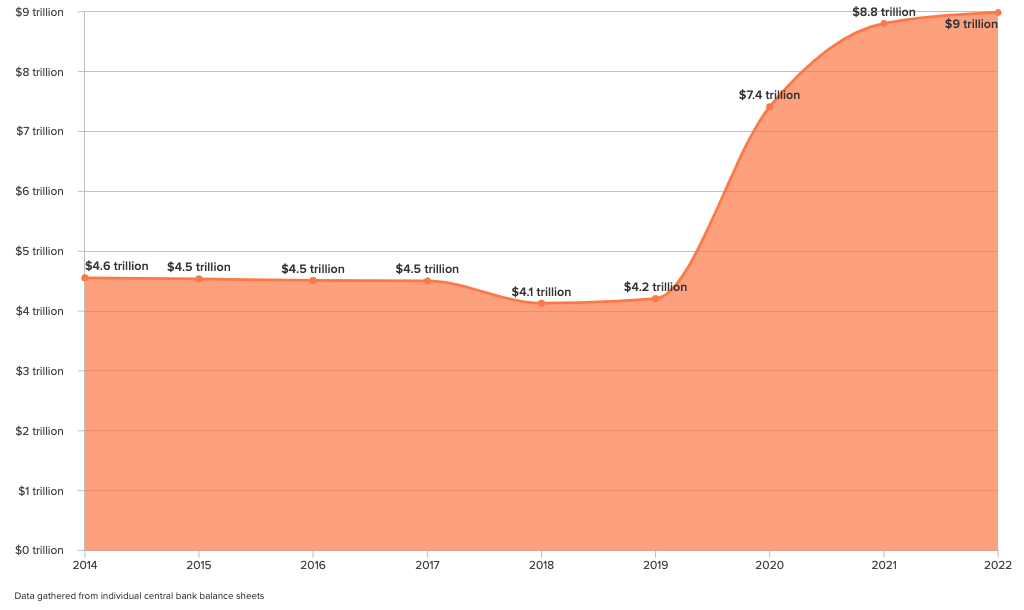

The Atlantic Council’s Global QE Tracker shows that the Fed more than doubled the size of its balance sheet through asset purchases in response to the economic recession caused by COVID-19. Now the Fed is switching roles from a buyer to a seller of treasury bonds and mortgage-backed-securities (MBS). If QE is supposed to “lower borrowing costs, boost spending, support economic growth, and ultimately increase inflation,” QT aims to achieve the opposite. By shrinking its balance sheet, the Fed drains liquidity from the financial system and increases borrowing rates for long-dated assets to weaken inflation. Rather than selling assets outright, the Fed will initially conduct passive sales by not replacing maturing securities. Beginning on June 1, the Fed will let a maximum of $47.5 billion treasury bonds and MBS mature per month. By September, this cap will rise to $95 billion per month. At this rate, the Fed could reduce its balance sheet by roughly $1 trillion—or 11%—over the course of a year. This would be a significantly quicker pace than the Fed’s first attempt at QT between 2017 and 2019, when it shrunk its balance sheet by a maximum of $50 billion per month.

The Fed’s faster QT schedule this time around is a function of its much bigger balance sheet ($9trn vs $4.5 trn)[1] and considerably higher inflation (8.5% vs. 2.75% total CPI) in 2022 compared to 2017. While the Fed was the first central bank to ever introduce QT in 2017, it is now following the lead of the Bank of England (BoE) and Bank of Canada. Both put in place QT programs earlier this spring. Together, major central banks might withdraw up to $2 trillion in liquidity from the global economy over the next year. This would amount to roughly 20% of the combined asset purchases the world’s four largest central banks (Fed, European Central Bank, Bank of Japan, and BoE) have undertaken since the beginning of 2020. If the Fed keeps up the current QT pace until end of 2024, as some market participants expect, it will reduce its balance sheet from currently 37% of GDP to approximately 20%.

QE is supposed to provide additional support to the economy once interest rates reach zero. In contrast, the Fed and other central banks are implementing QT alongside interest rate hikes to achieve further monetary tightening than would be possible by only increasing rates. It remains unclear by how much QT might amplify the impact of rate hikes to contribute to tighter financial conditions. Market analysts estimate the impact could range from 25 to 125 basis points (1.25%). Should the Fed’s QT significantly increase yields of longer-term securities, interest rates might have to rise less than forecasted in the graph above. This would establish QT as an effective complement to raising interest rates as part of central banks’ toolkit to fight inflation.

QT does, however, create potential risks for financial stability both domestically and internationally. The Fed had to end its first QT program in September 2019 after the declining size of its balance sheet contributed to a crisis in overnight lending markets. To avoid a similar outcome, the Fed has put in place an overnight-lending facility to ensure banks have sufficient access to cash.

The uncertain impact of QT also poses a risk for central banks that oversee less stable financial systems. While the Fed and BoE are starting their QT programs, the European Central Bank (ECB) is continuing its asset purchases. Concerns about economically weaker euro area countries, such as Italy and Greece, being vulnerable to increasing sovereign bond yields, are part of the reason why the ECB still conducts QE rather than QT. At the same time, rising interest rates combined with the unprecedented size of QT in advanced economies is likely to pull capital out of emerging markets and increase the risks of sovereign defaults and financial crisis contagion.

The Federal Open Market Committee’s (FOMC) incorrect assessment that inflation would be transitory forced the Fed to make an abrupt course correction at its March meeting. Fed Chair Jay Powell now has the exceedingly difficult task of taming inflation without driving the US economy into a recession. If QT is effective in amplifying the contractionary impact of interest rate increases, it might prove to be a helpful tool to engineer a softer landing for the US economy.

Ole Moehr is a contributor and consultant with the Atlantic Council’s GeoEconomics Center.

Image: The Federal Reserve Building in downtown Washington DC, USA at night. HDR image.