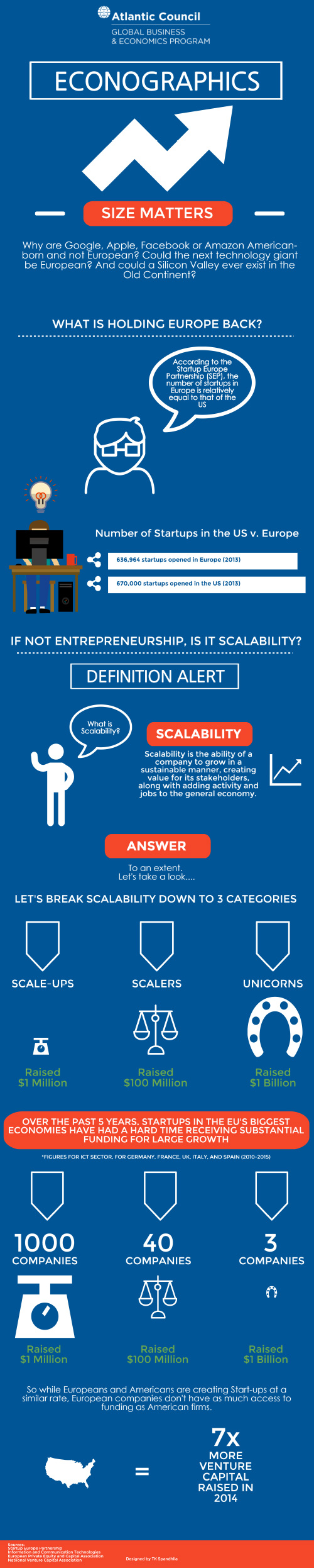

Why are Google, Apple or Facebook American-born but not European? Concerns about Europe’s lack of innovative start-ups prompted the European Commission (EC) to launch the Entrepreneurship 2020 Action Plan, aimed at bolstering entrepreneurship culture. Yet blaming European culture would be misleading as vibrant start-up ecosystems in London, Berlin, Milan or Amsterdam attest. In fact, the number of startups in Europe is similar to the US in relative terms, according to the Startup Europe Partnership (SEP).

The difference is of size. Europe does not lack start-ups but scale-ups: rapidly growing companies with potential to trigger growth and job creation for the general economy. SEP found only 3 new start-ups in the ICT sector (Information and Communication Technologies) that raised more than €1 billion in the last 5 years in the EU’s top five economies. More than 1000 raised at least €1 million but only 40 of those raised more than €100 million. Compare that to the mean IPO valuation of American start-ups (at the time of offer) of $133 million.

One reason for this might be funding: European start-ups don’t “scale-up” as much as Americans because they have less opportunities to secure capital. The numbers back this: according to the European Private Equity and Capital Association (EVCA), European start-ups raised €4.1 billion from venture capital in 2014, compared to $29.9 billion by their American counterparts, according to the National Venture Capital Association (NVCA). Venture Capital Investment also shows that 95% of investment went to firms with 99 employees or less, highlighting the small average size of the European start-up ecosystem.