The basics of CBDC

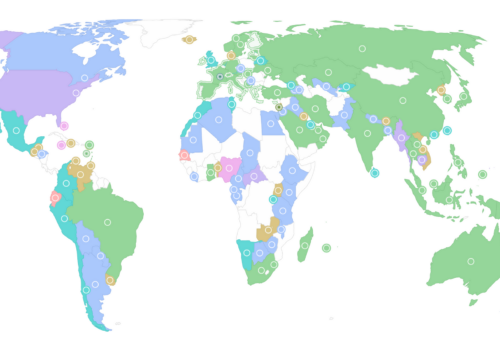

More than 130 countries and currency unions, representing 98 percent of global gross domestic product, are exploring a central bank digital currency (CBDC). But in the United States, CBDC has become highly politicized, with several leading politicians speaking out against its development. The race for the future of money is on, so here are the key items to catch you up on what a CBDC is—and what it isn’t.

What is a CBDC?

CBDC is a digital form of a country’s fiat currency that is a liability of the central bank. A country’s central bank issues a CBDC.

Is CBDC the same as cryptocurrency?

CBDC is different from cryptocurrency. Unlike CBDC, cryptocurrency is not issued and backed by a central bank, they are usually issued by private companies. Cryptocurrencies, such as Bitcoin or Ethereum, are decentralized. This means that control and decision-making in a transaction are transferred to many different entities, instead of relying on intermediaries.

Both cryptocurrencies and CBDCs can run on distributed ledger technology, meaning that hundreds of devices all over the world are responsible for carrying out and verifying transactions. One form of cryptocurrency, a stablecoin, can be pegged to a fiat currency.

How is this different from other forms of digital money?

CBDC is also different from digital money held in bank accounts or payment apps. Digital forms of money held in these apps or accounts are a liability of the commercial bank; CBDC is a liability of the central bank. CBDC is usually intermediated, meaning that it is distributed through banks, payment service providers, and digital wallets. Even in this case, CBDC is still a liability of the central bank.

Are there different types of CBDC?

There are two types of CBDC: retail CBDC (rCBDC) and wholesale CBDC (wCBDC). rCBDC is used by the general public for commercial and peer-to-peer transactions. rCBDC would be used to buy a cup of coffee, for example. wCBDC is used by financial institutions to settle interbank and securities transactions. Its use is comparable to that of interbank transactions with central bank reserves.

Why are countries exploring CBDC?

There are many motivations for researching and developing CBDC, and each country’s motivation will determine whether they explore rCBDC or wCBDC. The motivations for rCBDC include promoting financial inclusion, increasing payment efficiency, lowering transaction costs, and improving safety. The primary motivation for wCBDC is reducing cross-border friction in interbank and securities transactions.

Will CBDC replace cash?

CBDC will complement existing payment methods, not replace them. In its 2023 report, A stocktake on the digital euro, the European Central Bank clarified that a digital euro would “provide an additional payment option to complement cash and current

private digital payment solutions (rather than replace them).” The Federal Reserve and the Bank of England have also stated that CBDC will not replace cash.

Are there any risks in pursuing CBDCs?

As countries explore the benefits and development of CBDC, there are several challenges that arise. If citizens pull too much money too quickly out of commercial banks to purchase CBDC, it could result in a bank run–creating instability in the financial market. This is a challenge in volatile economic conditions.

Another challenge is creating a secure and resilient infrastructure for holding and using a CBDC. Cyber attacks, internet connectivity issues, and interoperability with existing payment systems are challenges for the efficiency of CBDC.

Finally, central banks must also ensure the privacy and safety of a CBDC, which are necessary for gaining public trust and protecting citizen’s rights.

What are the national security implications of CBDC?

The introduction of new payment systems could impact the daily lives of citizens but also potentially compromise a country’s national security objectives. For instance, CBDC can allow countries to build linkages and networks outside of the dollar, which can create opportunities to evade sanctions. Therefore, cross-border collaboration is necessary on issues of CBDC governance, privacy, and security. Private and public entities have already begun to work together to set standards and ensure interoperability. Yet more can be done to ensure that the issuance of CBDC does not jeopardize the national security objectives of a country.

Alisha Chhangani is a program assistant at the Atlantic Council’s GeoEconomics Center. Follow her at @alisha_chh

Leila Hamilton is a young global professional at the Atlantic Council’s GeoEconomics Center. Follow her at @leilathamilton

At the intersection of economics, finance, and foreign policy, the GeoEconomics Center is a translation hub with the goal of helping shape a better global economic future.

Further reading

Wed, Apr 10, 2024

Standards and interoperability: The future of the global financial system

Issue Brief By

Digital assets promise enhanced efficiency, inclusion, transparency, and choice to global payments. But to fulfill this promise, the international community must first develop interoperability standards.

Thu, Jan 25, 2024

The Fed is falling behind as other central banks leap ahead on digital currencies

New Atlanticist By Josh Lipsky, Ananya Kumar

And the innovation gap is not just on CBDCs. FedNow, the long-awaited interbank settlement system, has taken years longer than comparable systems in Europe.

Tue, Jan 16, 2024

Developing an agenda for international financial institutions and central bank digital currency

Issue Brief By

Is the emerging architecture appropriate, effective, and sufficient to manage the global transition to digital money? This report focuses on three domains: financial stability, development and financial inclusion, and global payment systems.