The global economic and financial crisis, which originated in the United States in 2008, ultimately triggered a sovereign debt crisis in Europe in 2010. As a result of sky high debts, economies lacking in competitiveness, and over lenient banking regulations, the credit ratings of the Eurozone members Cyprus, Greece, Ireland, Portugal, and Spain plummeted. These countries began facing prohibitively high interest rates when they attempted to borrow from international credit markets. As the situation worsened, Greece effectively lost access to international bond markets, and the European Commission established the European Financial Stability Facility (EFSF) to prevent sovereign defaults of Eurozone member states and to protect the common currency.

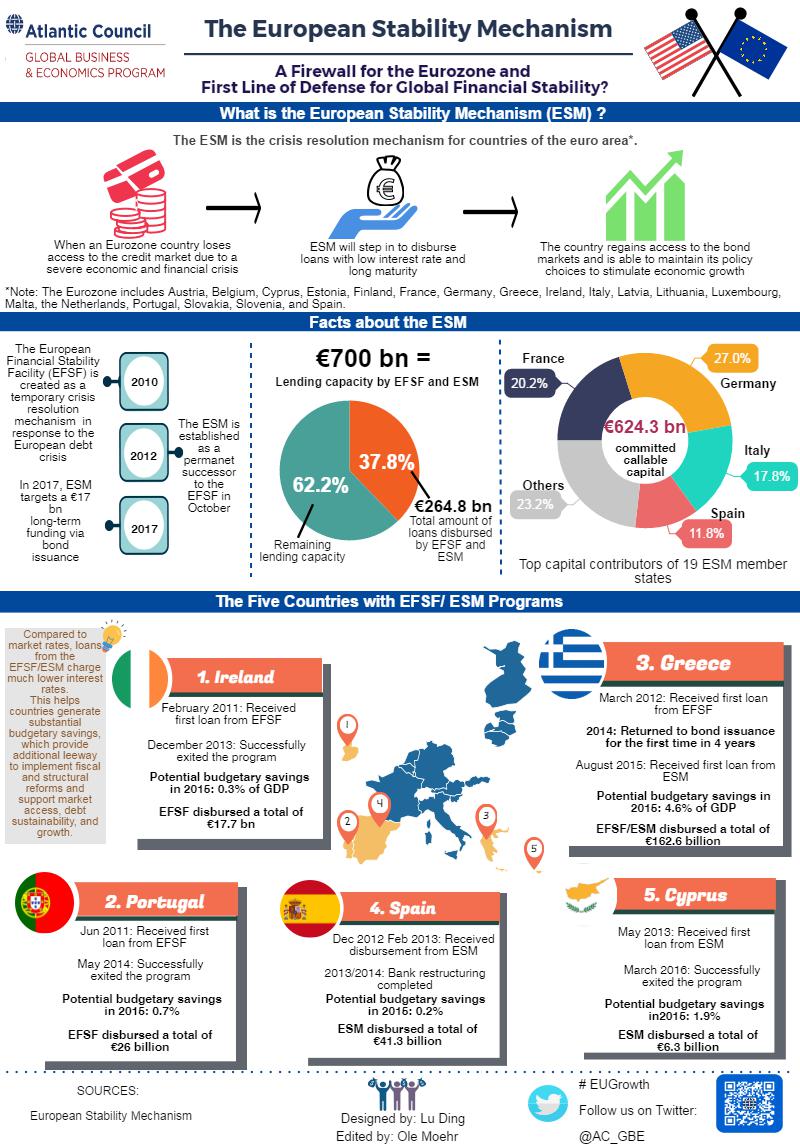

However, the EFSF was only set up as a temporary emergency vehicle. To provide a strong and permanent backstop for euro area countries that are unable to tap the market in times of crisis, European leaders moved to establish the European Stability Mechanism (ESM) in 2012 as a successor to the EFSF.

The ESM has several instruments at its disposal to provide financial assistance to euro area countries. It can grant a loan as part of a macroeconomic adjustment program. Both Cyprus and currently Greece have received such loans. Ireland, Greece, and Portugal have used similar programs delivered by the EFSF. In addition, the ESM provided Spain with a loan to recapitalize the country’s ailing banks.

The EFSF continues to exist as a legal entity. But, it ceased to issue new bonds or make new loans. While the EFSF and ESM remain separate legal entities, they share staff, facilities, and operations. Together, the EFSF and the ESM have a lending capability of €700 billion.

From 2010 to 2016, the EFSF and the ESM disbursed a total of €264.8 billion to five countries. These programs helped to safeguard the euro area and alleviate the debt burden for countries receiving loans. Four out of the five countries (Cyprus, Ireland, Spain, and Portugal) concluded their EFSF/ESM programs without any follow-up arrangements. The EFSF/ESM emergency loan programs enabled these countries to regain the trust of international investors and, in turn, issue bonds with much lower yields than during the height of the debt crisis.

Although Greece has made considerable progress, the unparalleled severity of the country’s economic crisis necessitated another ESM program of up to €86 billion in 2015. This was the third program for the country after a long period of negotiations. For now, Greece remains the only Eurozone country in the ESM/ EFSF’s program.

By passing on low interest rates and lengthening the repayment period, ESM and the EFSF show that the European Union has found a suitable approach to address future debt crises. The successful programs carried out by the EFSF and ESM demonstrate the importance of solidarity among euro area countries and how the crisis has in many ways brought Europe closer together.

This EconoGraphic leads up to our upcoming event on the European Stability Mechanism (ESM) and Global Financial Stability Net, featuring Mr. Klaus Regling, managing director of the European Stability Mechanism (ESM). The Global Business & Economics Program will host this public discussion on April 20, 2017 at 9:00 a.m. at the Atlantic Council. You can sign-up for this timely event here.