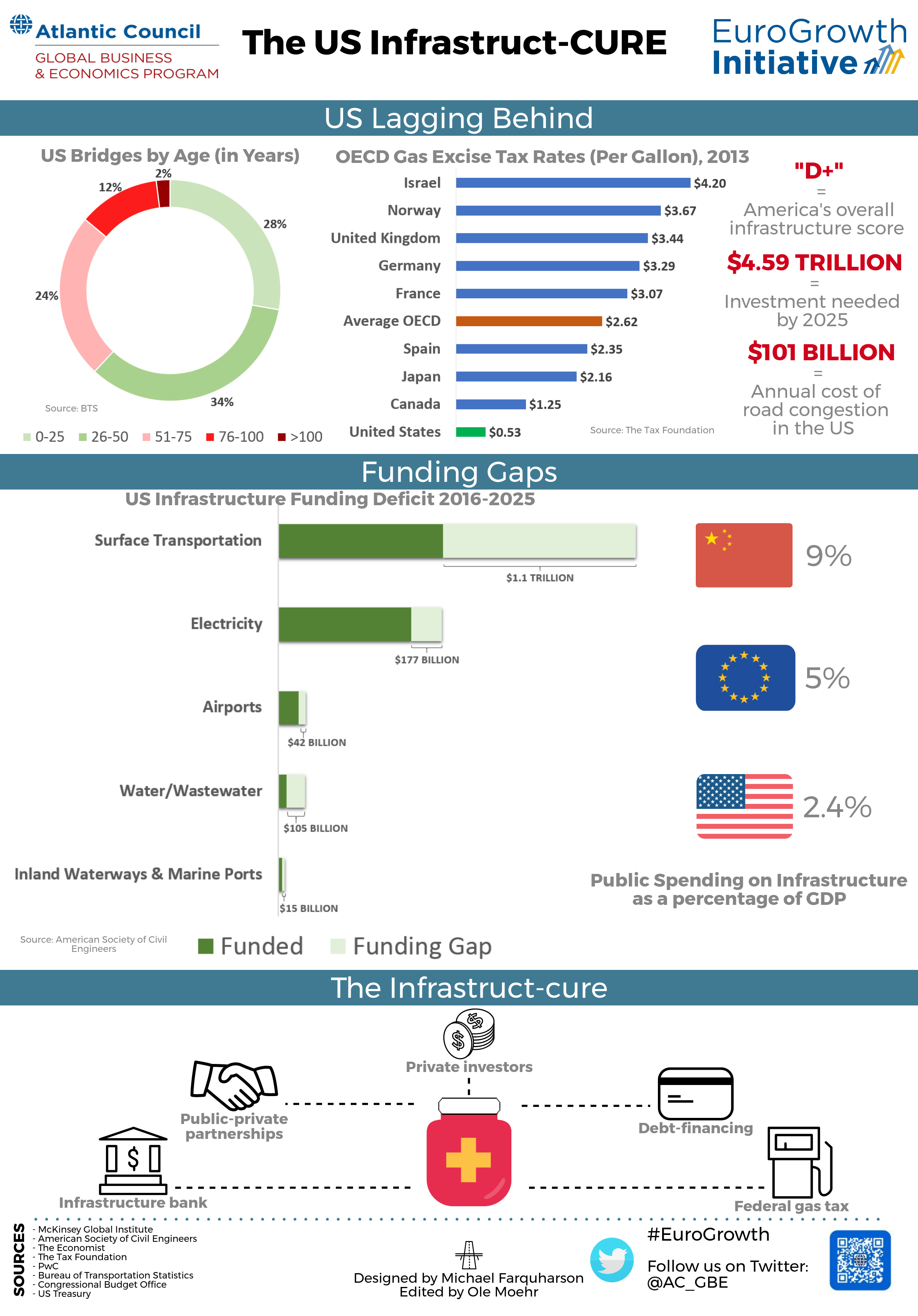

Infrastructure investment stimulates economic growth. According to McKinsey & Company, an increase in infrastructure investment equal to 1 percent of gross domestic product (GDP) would convert into an additional 1.5 million direct and indirect jobs in the United States. America’s infrastructure is in a state of disrepair. The American Society of Civil Engineers scored the country’s infrastructure a collective “D+” in 2017.

The Trump administration has stated its intention to spend $200 billion on improving America’s infrastructure over the course of ten years. According to the plan, the $200 billion in federal money will incentivize an $800 billion increase in investment from the private sector. Details remain unclear, and the plan will need congressional approval, with some members of Congress saying that the issue might not be taken up until 2018.

What can the current administration do to cure the United States’ ailing infrastructure? There is no silver bullet, but there are many existing approaches and tools to stimulate infrastructure investment, as well as lessons to be learned from overseas.

One option to streamline infrastructure project delivery and encourage investment would be the creation of a US federal infrastructure bank. A major issue in the current federal framework is the conflicting mandates and priorities of the various agencies managing infrastructure projects. The new institution would, importantly, create a clear point of authority and accountability within the federal government to streamline the permitting process and reduce the bureaucratic inefficiency that exits today.

The European Investment Bank (EIB) serves as an example for the United States to show what a national infrastructure bank could do. The EIB’s European Fund for Strategic Investments (EFSI), is part of the European Union’s investment plan to mobilize private investment into strategically important projects. The Fund serves as credit protection, incentivizing private capital by de-risking infrastructure projects.

Typical products offered by the EFSI include: long-term senior debt, subordinated loans, and equity and quasi-equity financing. The existing US Transportation Infrastructure Finance and Innovation Act (TIFIA), which provides loans, loan guarantees, and lines of credit to qualified public or private borrowers, could be expanded to function more like the EFSI. Private investors have nearly $120 trillion in assets and are always looking for secure long-term investments. Dynamic and efficient credit programs can be potent tools to attract this vast, and much-needed capital.

Another way to kick-start infrastructure investment in the United States is through public-private partnerships (P3s). According to Moody’s Investors Service, the United States has the potential to become the largest market for P3s in the world. The use of P3s has grown rapidly in recent years. Notable examples include a $3.9 billion contract to redevelop and manage Terminal B at LaGuardia airport and Maryland’s Purple Line light-rail project. Interestingly, through availability payment agreements and other innovative approaches, non-revenue stream projects are also attracting investors; a prime example is Michigan’s Metro Region Freeway Lighting Public-Private Partnership.

Where P3s might not suffice, other options include increasing the federal gas tax—which accounts for the majority of Highway Trust Fund (HTF) revenue—a measure President Trump has previously supported. The federal gas tax has not increased since 1993, and public opinion seems to be shifting in favor of an increase. Debt-financing projects, an alternative to taxation, may be a political no-go area, but should not be ruled out because of the intrinsic productivity gains that result from an increase in infrastructure investment.

Infrastructure investment and economic growth are inextricably linked. There are options going forward: a dedicated infrastructure institution, P3s, private investment, debt-financing, and tax increases, to name a few. There is no panacea, but—assuming there is the political will—a combination of these approaches, implemented over time, could be the infrastuct-cure.