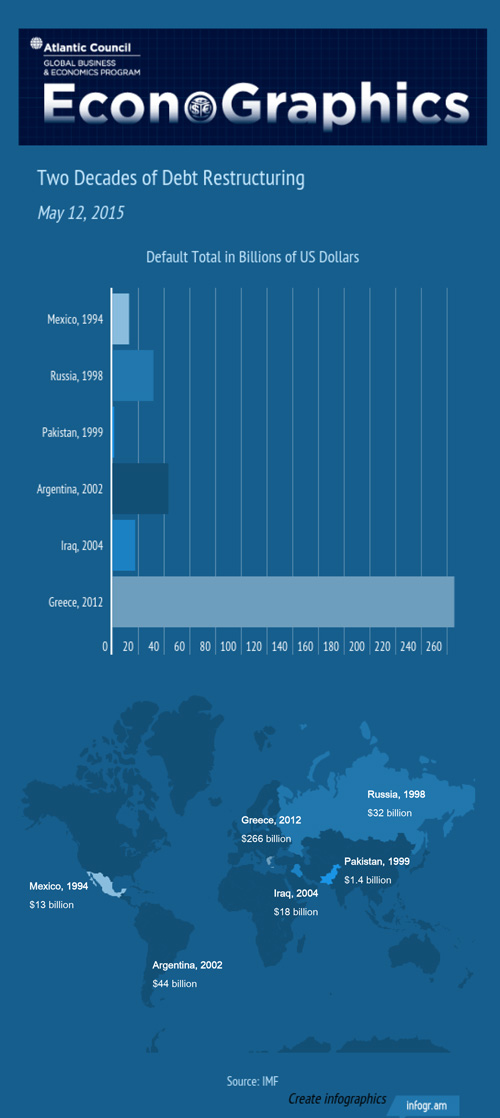

Sovereign default is considered to be a rare event. But as the lessons of the past two decades show, they are far from extraordinary. According to the IMF, the main sovereign debt restructurings from the period spanning 1998 – 2010 totaled $117.6 billion.

When Greece’s 2012 default is added to that sum, it means that more than $383 billion has been restructured since 1998.

The problem of broke states is not limited to the most prominent examples, either. While Argentina and Greece are the best-known instances, Russia too defaulted on $32 billion, while Pakistan could not pay back $1.4 billion in obligations, and Iraq also defaulted on $18 billion in 2004. Mexico’s default in 1994 came to $13 billion in debt that had to be restructured.

To be clear, these numbers represent the old debt that was exchanged in the negotiation after default, not the total debt of those nations.

Sources: (General) IMF, “Sovereign Debt Restructurings 1950–2010: Literature Survey, Data, and Stylized Facts” Udaibir S. Das, Michael G. Papaioannou, and Christoph Trebesch

http://www.imf.org/external/pubs/ft/wp/2012/wp12203.pdf

(Mexico)

IMF, “Tequila Hangover: The Mexican Peso Crisis and Its Aftermath”, James M. Broughton

http://www.imf.org/external/pubs/ft/history/2012/pdf/c10.pdf

(Greece)

“The Greek Debt Restructuring: An Autopsy”, Jeromin Zettelmeyer, Christoph Trebesch, Mitu Gulati

http://scholarship.law.duke.edu/cgi/viewcontent.cgi?article=5343&context=faculty_scholarship