Ukraine’s economic stability is uncertain as the conflict with Russia endures. Alongside the negative impacts to growth, exports, and investment, the level of Ukraine’s debts are especially worrisome. Last month, the rating agency Standard & Poor’s placed Ukraine’s debts at “CC”, one level above “C”—the grade that is typically used to indicate the process of bankruptcy. S&P wrote that there was “a virtual certainty of a restructuring or exchange offer in the near term“, making it relevant who those creditors are. As the Ukraine edges closer to repayment while speaking with its creditors, the country’s Parliament passed a law to halt payments on some debt.

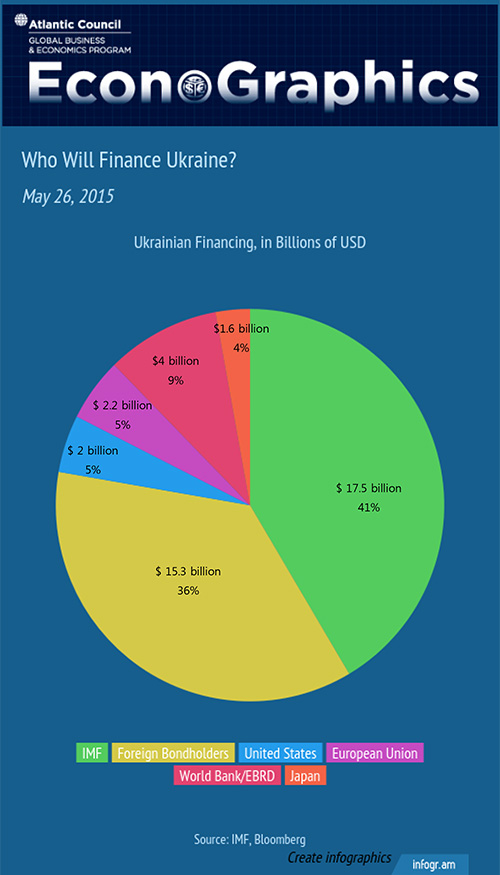

On March 11, the International Monetary Fund approved an extended fund facility for Ukraine is a front-loaded, four-year loan program of $40 billion. The second most important contribution is supposed to be made by foreign bondholders, who are asked to contribute 15.3 billion through delays and haircuts.

Of Ukraine’s $40 billion, the majority ($17.5 billion or 43%) is covered by the IMF, with bondholders coming in second at $15.3 billion—more than 1/3 of the total. Several US firms are holders of large amounts of Ukrainian debt, most prominently Franklin Templeton, which owns approximately $7.8 billion.

But Russia also has an active economic stake in the outcome, including a unique $3 billion bond agreed to in December 2013 with former Ukrainian President Yanukovych, during a time of mass protests. Russia’s economic leverage of Ukraine is considerable, given the proximity and connectedness of the two economies. Russia’s holding of Ukrainian debt complicates any possible deal with other, Western creditors.

So while Europe’s attention is focused on Greece, Ukraine may be the debt crisis around the corner.

Sources:

Bloomberg: http://www.bloombergview.com/articles/2015-02-12/ukraine-s-imf-bailout-is-small-enough-to-work

IMF: http://www.imf.org/external/pubs/ft/survey/so/2014/new043014a.htm