Experts react: How the world is responding to the courtroom drama around Trump’s tariffs

From Beijing to Buenos Aires, they’re glued to US court dockets. US President Donald Trump’s sweeping tariff regime was thrown into legal limbo this week, thanks to decisions from the New York–based US Court of International Trade and a Washington, DC–based US district judge. Both rulings found that Trump overstepped with the emergency authorities he used for his April 2 “liberation day” tariffs, but the tariffs remain in place for now thanks to a stay granted by a Washington–based appeals court—with this battle likely heading to the US Supreme Court. The legal whiplash comes as countries around the world scramble to negotiate deals with the Trump administration before the global “reciprocal” tariffs kick in on July 9. But are their calculations now changing? We turned to our network of global experts to explore how the courtroom drama is playing among US trading partners.

Click to jump to an expert analysis:

China: There is no cooling off this trade war

European Union: New US tariffs unaffected by the courts could have the biggest bite

United Kingdom: The UK-US deal continues to provide certainty and some unique advantages

India: Its special position means New Delhi should press ahead on a deal

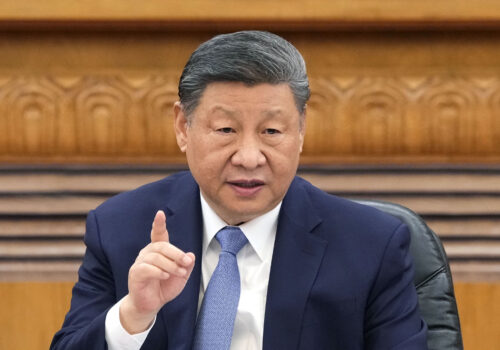

China

There is no cooling off this trade war.

With the future of many of Trump’s tariffs in legal limbo following the Wednesday ruling by the Court of International Trade, including the 30 percent levies recently imposed on China, one might think US-China tensions were in for a cooling-off spell.

They would be wrong.

That’s because it’s become abundantly clear that Washington and Beijing aren’t just involved in a trade and tariffs spat, but instead are competing in a head-to-head, existential struggle over which country gets to rule the future of advanced technology and global supply chains.

In the less than one month since both sides issued a joint statement recognizing the importance of a “sustainable, long-term, and mutually beneficial economic and trade relationship,” Washington has warned companies not to use chips from Huawei, China’s national champion, and has restricted Beijing’s access to airplane technology, software used for advanced semiconductors, and chemical products. And in a bombshell move on Wednesday, Secretary of State Marco Rubio announced that Washington would begin to “aggressively revoke” the visas of some of the 277,000 Chinese students in the United States, including those with connections to the Chinese Communist Party or studying in “critical fields.”

For its part, Beijing has threatened firms and individuals with its Anti-Foreign Sanctions Law, if they “implement or assist” US curbs on Huawei. And most egregiously from Washington’s perspective, Beijing hasn’t lifted restrictions on the export of rare earths, following negotiations between Treasury Secretary Scott Bessent, US Trade Representative Jamieson Greer, and China’s Vice Premier He Lifeng in Geneva earlier this month.

Trouble is, all these hostile trade actions make perfect sense in the context of the larger battle between the two countries over tech and supply chains. And that was obvious from the beginning. China’s dominance over rare earths is an incredibly important source of leverage over the United States and the rest of the world—one that it won’t give up willingly.

Now fissures in what the US president hailed as a “total reset” in relations are becoming public. On Friday, Beijing accused the United States of “[weaponizing] trade and tech issues” and “malicious attempts to block and suppress China.” And Trump vented in all caps on social media that China “HAS TOTALLY VIOLATED ITS AGREEMENT WITH US.”

My answer to both sides: You should have seen it coming.

— Dexter Tiff Roberts is a nonresident senior fellow at the Atlantic Council’s Global China Hub and the Indo-Pacific Security Initiative, which is part of the Atlantic Council’s Scowcroft Center for Strategy and Security. He previously served for more than two decades as China bureau chief and Asia News Editor at Bloomberg Businessweek, based in Beijing.

European Union

New US tariffs unaffected by the courts could have the biggest bite.

The European Union’s (EU’s) negotiations with the United States continue despite this week’s court rulings for multiple reasons.

Countries should assume that the US government will use another legal vehicle to impose tariffs regardless of the outcomes of the legal challenges on the International Emergency Economic Powers Act (IEEPA). For example, as referenced in the Court of International Trade’s ruling, it is perfectly legal for the president to invoke Section 122 of the Trade Act of 1974 to address balance of payments issues. This law allows the president to impose tariffs of up to 15 percent for a period of five months. During those five months, the government can launch an investigation under Section 301 of the 1974 Trade Act, investigating unfair trade practices that burden or restrict US commerce.

An additional pressure point is the ongoing Section 232 cases on sectors that comprise the majority of US-EU trade. The completed cases on steel, iron, and aluminum, as well as on autos and auto parts, levied tariffs of 25 percent. But the outstanding cases, including cases that could be decided in the next month, on pharmaceuticals and semiconductors, could be at different levels. The investigations are also broader in scope, going after “derivative” products, which can include downstream products as well as any supplies needed to make the covered products. The EU’s largest trade deficits in goods with the United States are autos, pharmaceuticals, and chemicals, so these investigations could have a significant impact on the European economy.

The current situation is hurting transatlantic investment and businesses, and European economic actors are demanding certainty. While EU officials may be reviewing and recalibrating their offer to reflect the current circumstances, they are continuing to negotiate with the United States. With world leaders gathering at the Group of Seven (G7) and NATO summits in June, the time to negotiate an agreement and provide clarity for the transatlantic economy is now.

—Penny Naas is a nonresident senior fellow with the Atlantic Council’s Europe Center.

United Kingdom

The UK-US deal continues to provide certainty and some unique advantages.

Trump instinctively likes the United Kingdom and it so happens that, within his paradigm of global trade, the United Kingdom does no harm, as it doesn’t have a large trade surplus with the United States. This meant the United Kingdom was only given the 10 percent “baseline” tariff on the notorious liberation day foam boards, a competitive advantage that has been lost—temporarily at least—since Trump announced a ninety-day pause on “reciprocal” tariffs. Still, the British government plowed ahead with its bilateral negotiations and was the first to secure a deal, albeit one that entrenched the 10 percent baseline.

London feared other countries might blame the United Kingdom for enabling this, but they haven’t. Instead, the US Court of International Trade ruled that blanket tariffs, including the 10 percent baseline tariffs, are illegal. This suggests that the United Kingdom might again be deprived of the hard-fought edge it has with the Trump administration. Only last week, Trump threatened the EU with a blanket 50 percent tariff because he had been briefed that negotiations were not advancing. Still, London can be satisfied with a few of the deal’s achievements. First, it provides most of its firms with certainty that exporting to the United States will involve either the 10 percent baseline or, ideally, no new tariff if the court ruling survives appeals. Second, the deal offers the United Kingdom exemptions within certain quotas from higher sectoral tariffs on cars and steel. These advantages exempt the United Kingdom from tariffs that were not struck down by the court ruling and make the deal worthwhile no matter what happens in the courts.

—Charles Lichfield is the deputy director and C. Boyden Gray senior fellow of the Atlantic Council’s GeoEconomics Center.

Mexico, Canada, and the Americas

While some countries may be in less of a rush, USMCA negotiations will ramp up.

The back and forth on broad-based US tariffs has trading partners around the world, including in the Americas, scratching their heads about what to do next. And it’s not just at the technical level. US judicial processes and court jurisdictions on trade have quickly become front-page news across the hemisphere. But without clarity on how additional courts may rule, and how Trump may then respond, Latin American trade ministers are forced to play out scenarios of what may come next and to try to base their commercial outlook on their preferred hypothesis.

The implications of this uncertainty have direct impacts on Americans. As research from the Adrienne Arsht Latin America Center has recently shown, countries in Latin America and the Caribbean (LAC), particularly Mexico, import more (in value) of US products per capita than other countries of similar income and development levels. And while tariffs are directed at US imports, the recent court decisions will continue to drive trade uncertainty as decision makers adapt their strategies to this new complex scenario.

Since “liberation day,” many LAC countries have rushed to try to line up meetings with the Office of the United States Trade Representative to see what actions can be taken to get a suspension of the 10 percent tariffs. Clarity on a path forward is particularly important for the region since US trade deficits—the top reason for Trump’s tariffs—do not generally apply to LAC. In fact, the United States had a $47 billion trade surplus with South and Central America in 2024—the only major region with such a surplus. With the seesaw in the judicial determination of the president’s legal authority, countries may now be in less of a rush to see what needs to be done to get out from underneath the tariff cloud. Why make concessions if the legality of the original determination is up in the air?

For Mexico, the largest US trading partner in the world, it’s important to remember that goods that comply with the US-Mexico-Canada Agreement (USMCA) are exempt from additional tariffs. However, non-USMCA-compliant goods are subject to a 25 percent tariff, which in Mexico’s case was about half of all its exports to the United States (or around 40 percent of its global exports) in 2024. This situation has introduced uncertainty for businesses engaged in US-Mexico trade, particularly those dealing with noncompliant goods. To avoid what will likely be continued uncertainty, negotiators are looking to expedite USMCA review discussions that were originally supposed to ramp up in 2026, with a mid-2026 deadline for that process to conclude.

—Jason Marczak is vice president and senior director of the Atlantic Council’s Adrienne Arsht Latin America Center.

India

Its special position means New Delhi should press ahead on a deal.

With the decision by the Court of International Trade that Trump’s tariffs invoked under IEEPA are illegal, many capitals around the world are recalculating their risk if they fail to (or choose not to) negotiate a reciprocal tariff deal by July 9. It appears the balance of leverage has shifted, especially if new tariffs are temporarily paused. My advice, as a former US trade negotiator, is to exercise caution in abandoning these negotiations or even slowing them down. One way or another, the Trump administration is likely to find ways to continue to threaten these tariffs (whether under other statutes or by winning a reversal of the Court of International Trade’s judgement) and will be keeping tabs on those who stop playing ball during this new period of uncertainty and instability.

In fact, India is in a special position, although it too seeks relief from Trump’s reciprocal tariffs. The current negotiation is recognized by both sides as the first phase of a larger, comprehensive “Bilateral Trade Agreement,” or BTA. While it is not being called a free trade agreement, its substance looks a lot like one, and India has pushed for this going all the way back to the first Trump administration. As such, the negotiations are not so one-sided—the Trump team has made it clear that the outcomes must be win-win and that it understands that Prime Minister Narendra Modi must show his electorate that he achieves concrete gains beyond avoiding new US tariffs.

I expect India will stay committed to pursuing a first-phase reciprocal tariff deal and build on this to eventually accomplish a fully cooked BTA, which could take several years of negotiations. India will gain new market share in the United States and increased investment in its economy, even as it opens up to more imports of goods and services from the United States.

—Mark Linscott is a nonresident senior fellow with the Atlantic Council’s South Asia Center. He was the assistant US trade representative for South and Central Asian Affairs from 2016 to 2018, and assistant US trade representative for the WTO and Multilateral Affairs from 2012 to 2016.

Further reading

Thu, May 29, 2025

Will Trump’s tariffs survive US courts?

Fast Thinking By

On Wednesday, a federal court blocked the US president from imposing his “liberation day” tariffs on imports under an emergency-powers law.

Thu, Apr 10, 2025

China is ready to ‘eat bitterness’ in the trade war. What about the US?

New Atlanticist By Dexter Tiff Roberts

As the US imposes a 145 percent tariff on Chinese imports, officials in Beijing are turning to a belief that Chinese people will endure hardships in service of a national goal.

Fri, May 16, 2025

The next 120 days of predictably volatile trade policy

Econographics By Barbara C. Matthews

The understandable relief associated with de-escalating the tariff war will soon fade as we enter a long, uncertain summer of tariff pauses and major negotiations. Take a look at some convenings that might be important.

Image: Peter Navarro, Senior Counselor for Trade and Manufacturing to U.S. President Donald Trump, speaks to reporters in front of the West Wing at the White House on May 29, 2025 in Washington, D.C. On Wednesday a federal trade court ruled that President Trump lacked the authority to impose his sweeping tariffs only for a federal appeals court to block the stay imposed by the lower trade court the next day. (Photo by Samuel Corum/Sipa USA)