Russia is ramping up its CBDC. Will Putin’s ‘robot ruble’ work?

The “August curse” has spared the Kremlin this year, but the same cannot be said of Russia’s central bank. The month has periodically been the venue of political surprises in Russia, but Russian President Vladimir Putin has apparently shot down any doubt that he retains full power.

However, a massive exchange rate crash brought on by lower export revenues and higher capital outflows has made for a much bumpier month one mile north of the Kremlin, in the Russian central bank headquarters. On August 15, the central bank increased its key interest rate by 350 basis points to 12 percent, attempting to arrest the ruble’s depreciation and limit exchange-rate pass through inflation.

And yet, on the same day, the bank went ahead with plans to roll out the pilot of its own central bank digital currency (CBDC). Three weeks earlier, the digital ruble had been added to the list of legal non-cash methods of payment in an amendment signed by Putin. Coverage on August 15 was overshadowed by the rate hike, but the “robot ruble,” as some have taken to calling it, has enjoyed substantial attention since, both within and outside of Russia. Interest in the digital currency seems to focus on two questions: What is Russia trying to accomplish with its CBDC? And will it work?

What is Russia trying to accomplish with its CBDC?

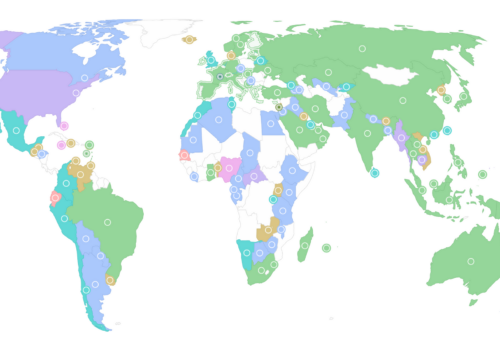

Coming after almost three years of research and exploration by the Russian central bank, the current pilot programs will occur in partnership with thirteen commercial banks in eleven Russian cities and are meant to test the CBDC’s basic operations. Russia joins the likes of India, China, Japan, Turkey, Iran, and fifteen other countries that are in the pilot phase of their CBDC exploration. For the first time, Russian citizens will be able to use the digital ruble while making purchases in thirty retail shops. As of August 15, Promsvyazbank allows users of its app to pay participating businesses for goods and services in digital rubles too, for a 0.3 percent fee.

There are a few interesting caveats that the central bank has been public about. Anatoly Aksakov, head of the Russian parliamentary committee on financial markets, stated that the smart contracting feature of the wallets could be used to restrict undesirable payments. Additionally, while the bill that Putin signed did not provide limits or caps on spending, it gave the central bank authority to do so. Russia is likely to follow other central banks that have limitations on how much money can be held and spent in these accounts. The central bank is also looking to expand the pilot by the end of 2023, gearing toward a full launch in 2025.

Its potential for use in cross-border payments has been brought up as a factor to hasten speedy development of the digital ruble. During a discussion on the digital ruble in late June, Nikolai Zhuravlev, deputy chairman of the Federation Council, said:

“In the current environment, it is important to have independent payment instruments and financial information channels that can be used as part of our trade with foreign partners, which can help increase the speed, transparency and accessibility of international transfers.”

Aksakov said in July that the digital ruble should be exchangeable with other foreign CBDCs, identifying the digital yuan as a successful model.

The Russian central bank official in charge of the digital ruble project, Olga Skorobogatova (whose auspicious surname literally means “soon to be rich”), highlighted the need for bilateral agreements between countries, which would allow any cross-border payments to actually happen. So far, no countries have publicly expressed interest and significant players such as China and India are not likely to for the foreseeable future. Even newly announced plans to expand the BRICS group of Brazil, Russia, India, China, and South Africa are unlikely to spur action in the near term. Skorobogatova also cited the ability to replace the SWIFT messaging system as a motivation for the developments.

Will it work?

Given the extent of financial sanctions following Russia’s full-scale invasion of Ukraine, the removal of many Russian banks from the SWIFT system, and a drop in trade flows into Russia, developing a CBDC that might open alternative channels for cross-border payments is a rational motivation on the part of the Russian government.

But even if Russia were able to test the technical feasibility for cross-border transactions, it does not mean that there will be global demand for digital rubles. Digital rubles will be subject to the same economic conditions as their paper counterpart, which means that falling exchange rates are bad news overall. For a currency to be used in foreign transactions, it needs to be stable and freely exchanged. In addition, it needs to evoke confidence on the part of governments and large financial institutions.

The ruble, in digital or paper form, will not replace the dollar, the euro, the pound, or the yen in cross-border transactions. In fact, as Russia seeks to de-dollarize its economy, a likely avenue will be using the yuan or digital yuan. Last October, Russia became the fourth largest yuan offshore clearing center in the world, and simultaneously, China was a part of the first actual cross-border digital currency transaction. Russia has also taken advantage of China’s broader currency settlement system for transactions with other countries, creating intractable dependencies in the long term. For the time being, robot rubles will accomplish very little for Russia’s burgeoning economic woes.

Ananya Kumar is the associate director for digital currencies at the GeoEconomics Center.

Charles Lichfield is the deputy director and C. Boyden Gray senior fellow of the Atlantic Council’s GeoEconomics Center.

Further reading

Fri, Sep 16, 2022

How long before there’s a digital dollar?

New Atlanticist By

Experts from our GeoEconomics Center break down the new Treasury Department recommendations on digital assets.

Wed, May 24, 2023

Russia’s ‘data glasnost’ didn’t last long. Here’s how to tell whether sanctions are working.

New Atlanticist By Charles Lichfield

Economic data is still coming out of Russia, and Russian Central Bank Governor Elvira Nabiullina and other financial elites have been pushing for making even more data available. But that's changing.

Tue, May 16, 2023

Not so fast: The case for a new SWIFT

New Atlanticist By Josh Lipsky, Ananya Kumar

Imagine a network that combines both messaging and settlement to become a one-stop shop for international payments. It’s time for the US and its allies and partners to make that idea a reality.