Is it a bird? Is it a plane? Pinning down exactly what Bitcoin is like identifying Superman in old comics.

Is it a bird? Is it a plane? Pinning down exactly what Bitcoin is like identifying Superman in old comics.

Legal, financial, and political experts approach the issue from different angles—labeling Bitcoin into categories which established governments and institutions can understand and control. Meanwhile, technologists and innovators view virtual currencies as nothing less than a revolution in how we exchange goods and services. Conversation on Friday, April 11 at the Atlantic Council centered on how to define virtual currencies in legal terms and comprehend how this innovation will transform the way society transacts currency and more in the future.

Resources |

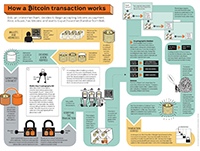

Dr. Chris Brummer articulated the difficulty regulators have in pinning down Bitcoin as a currency,a commodity, a payment system, or a hybrid type of financial instrument. Regulators don’t really know what to do with it. One thing is certain, the system that arose from the creation of Bitcoin – the public ledger, the spine of Bitcoin, known as the blockchain – is making waves in the way we complete future financial transactions.

Mr. Kevin Houk pointed out that Bitcoin might not survive the next decade or two but the idea of making financial and legal transactions public, democratizing the functions of currency, and possibly other transactions, will certainly endure. Younger generations are expecting and demanding more accountability and transparency – which technology is enabling – from traditional institutions while also seeking more control over user data in regards to privacy and security, a hurdle Bitcoin has yet to overcome.

The important question, however, is now whether Bitcoin itself will last, but whether virtual currencies will be secure enough to have a sustainable future. The recent fallout caused by the Heartbleed virus underscores the vulnerabilities of the Internet and heightened public skepticism that the internet can be secure. Mr. Jason Healey pointed out that if Bitcoin is ever going to gain more followers and become mainstream, we need better guarantees and protocols on security and privacy. Unfortunately, these guarantees are hard to make and even tougher for the private sector and governments to keep.

Mr. Ronald Marks was quick to point out that if government or society is to embrace Bitcoin as a system, or even a currency, governance itself will need to change. Current governments follow centuries old political theory and structure, unable to adapt to rapidly emerging twenty-first century technologies and challenges. Virtual currencies are a game changer that already have us rethinking how traditional government services, such as currency regulation, will be administered in the future.

Bitcoin might not last but the system of transactions underlying it and other virtual currencies is revolutionary and governments will have to take these systems seriously if they want to adapt to and grow in the twenty-first century.