FAST THINKING: Biden’s China policy is coming into focus

GET UP TO SPEED

Corporate America is on notice. This week, the Biden administration warned businesses that investing or operating supply chains in Xinjiang province, where China’s repression of the Uighur people includes reports of slave labor, “could run a high risk of violating US law.” Then on Friday, the White House advised companies of the risks of operating in Hong Kong, over which Beijing has tightened its grip in recent months. What do these moves signal about the Biden administration’s emerging China policy? Why is Biden deploying these unusual tools? Our experts on economic statecraft connect the dots.

TODAY’S EXPERT REACTION COURTESY OF

- Daniel Fried (@AmbDanFried): Weiser Family distinguished fellow and former US assistant secretary of state for Europe and Eurasia

- Julia Friedlander (@jfriedlanderdc): C. Boyden Gray senior fellow, deputy director of the GeoEconomics Center, and former US National Security Council director

- David Mortlock (@MortlockDJL): Nonresident senior fellow at the Global Energy Center and former US National Security Council director

- Brian O’Toole (@brianoftoole): Nonresident senior fellow at the GeoEconomics Center and former senior US Treasury Department official

Labor pains

- The Biden administration has said that its goal when it comes to the world’s most important diplomatic relationship is “to strengthen the rules-based international order and press China to play by those rules,” Dan points out. “Now we have an idea what this might mean in practice: It’s a tough-minded use of all-of-government authorities to keep slave labor out of free markets.”

- That approach, Julia notes, includes everything from Commerce Department export controls to Customs and Border Protection moves to detain shipments from Xinjiang. And the European Union is getting in on the act with its own advisory this week on ridding supply chains of forced labor more broadly.

- It’s “a sign that political and technocratic consensus is emerging on both sides of the Atlantic,” Julia says. “It’s also a sign that the dangerous silos between government agencies responsible for economic statecraft are breaking down.”

- Is Biden giving American big business heartburn? Not if they view the advice as a means of protecting “their reputations as law-abiding, ethical, and responsible” and thus presenting “a positive alternative to China’s way of doing business,” David says. “That’s good for business and human rights.”

A new arrow in the quiver

- Economic sanctions have been an increasingly popular way for the United States to punish adversaries and bad actors without resorting to military force. But Biden’s strategy here is a different kind of squeeze, Julia points out. “With China we’re seeing a shift away from a reliance on sanctions, which puts the onus on banks to restrict access to financial resources, to limitations on the transport and import of physical goods,” she says. “This raises the bar for industry and law enforcement and requires whole new facets of cooperation.”

- In the case of Hong Kong, Julia notes, “US government measures are turning defensive—instructing firms on how to protect themselves in an adverse operating environment instead of warning firms of US penalties if they violate sanctions, as was often the case with Russia or Iran. It’s getting clearer who the ‘bad guy’ is.”

- A laser focus on human rights is also more likely to win support from allies, Dan says: “Europeans and others may object to broad sanctions against China; it’s a lot harder to argue in favor of ignoring slave-labor camps.”

No more free ride

- The broad principle here is simple, Brian says: “If Beijing continues to refuse to play by the rules of Western markets, it should not benefit from their incredibly cheap capital and easy access.”

- In recent decades, as China has trampled on international norms like market transparency and property rights, “its companies have gotten a pass that no other economy on earth receives, in large part due simply to the global importance of China’s economy,” Brian argues.

- This week may indicate that the free pass is expiring at last. “Should US capital markets provide financing for China’s military aggressions? Of course not. Should US companies be able to import goods from slave labor? Same answer. Is Hong Kong the same market economy of its past reputation? You see where this is going,” Brian says. “The advisories are notable in many ways—especially on Hong Kong due to the territory’s substantial reliance on US financial markets—but they also are certainly not the last actions. The real question is what comes next.”

Further reading

Tue, Jun 29, 2021

Hong Kong’s future on edge: Countering China’s national security law

Report By

The United States and its allies must take further actions to push back on Beijing’s crackdown in Hong Kong.

Mon, Jun 28, 2021

China’s anti-foreign sanctions law: Companies in the crosshairs

Blog Post By Hung Tran

On June 10, 2021, China’s National People’s Congress passed the Anti-Foreign Sanctions Law. This has raised the complexity and risk of doing business globally, especially as sanctions and counter-sanctions are likely to proliferate in the intensifying US-China strategic competition.

Sun, Apr 25, 2021

Without a trade strategy, Biden can’t win the contest with China

Inflection Points By Frederick Kempe

While President Xi Jinping’s China accelerates his efforts to negotiate multilateral and bilateral trade and investment agreements around the world, both Republicans and Democrats in the United States have grown allergic to such arrangements.

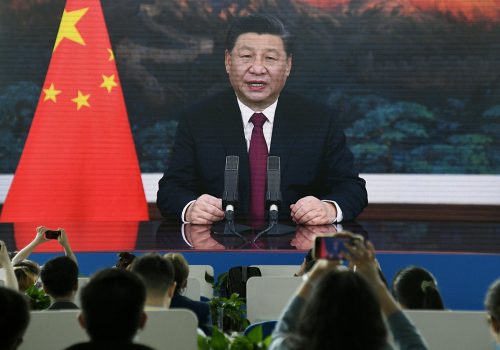

Image: Workers are seen on the production line at a cotton textile factory in Korla, Xinjiang Uighur Autonomous Region, China, on April 1, 2021. Cnsphoto via Reuters.