Mexico’s fork in the road: Rule of law or authoritarian shift?

table of contents

Introduction

2024 has brought a time of renewed upheaval in Mexico, six years after the election that fundamentally changed the political and economic systems of the country. Claudia Sheinbaum, standard-bearer for the incumbent Morena party, won the presidency in June 2024, the first ever woman to do so. The presidential and legislative elections were among the most decisive in Mexican history. With her victory comes a spate of questions about the political and economic future of the country, as she moves to cement the momentous political reforms her predecessor, Andrés Manuel López Obrador (known as AMLO), set into motion. In such a time of transformation, the Atlantic Council’s Freedom and Prosperity Index remains deeply illuminating.

Starting in the late 1980s, Mexico underwent a series of structural transformations that have significantly modified the nature of the state, the market, and their relationship in the country. At the tail end of the Institutional Revolutionary Party’s seventy-year single-party rule, public and international pressure brought about a democratic transformation that included the emergence of wide-ranging independent and technical institutions, with remits of electoral integrity, monetary policy, competition, statistics, transparency, and the specific regulation of markets. The state’s interventionist role in the economy was reduced, with an overarching privatization process that, among other things, touched banking, telecommunications, and infrastructure. More structural economic change came with free trade agreements and their upward pressure on competition in the private sector. Most notable among them was the North American Free Trade Agreement (NAFTA), which along with its 2018 successor the United States–Mexico–Canada Agreement (USMCA) has shifted the economic matrix over three decades from significantly primary to mostly secondary and tertiary activity: Where oil-related products once represented almost 20 percent of exports in the early-mid 1990s, today they account for less than 5 percent; instead, manufacturing has climbed to approximately 90 percent of exports over the past decade. Several notable milestones have followed:

- Technocratic rule prevailed for years and favored a relatively unfettered private market.

- The ruling party lost in the 2000 presidential election—a first in seven decades—to a right-wing party.

- The 2018 landslide election of a left-leaning populist prompted changes to the nature of the state-market relationship by strongly favoring the role of the state.

- The concentration of power has accelerated since 2024, when the incumbent ruling party achieved a legislative supermajority (via a friendly legal interpretation) and full judicial control (through a constitutional amendment). The promise, at least on paper, is not only to give extraordinary weight to the state but also to give force to the market as an engine for growth and prosperity. The result of this experiment is yet to be known.

Taking a step back to examine the Mexican index from its beginning in 1995, we can see a notable difference between the freedom and prosperity indices. On the one hand, the Prosperity Index has shown a steady, though slow, rise over the past twenty-eight years from 55.4 to 65.8 (the COVID-19 crisis notwithstanding). On the other hand, the Freedom Index shows Mexico rated only slightly higher than in 1995, despite a significant period of improvement in the 2000s. We can see two distinct inflection points that form a kind of “plateau” of higher freedom scores, around the years 2000 and 2018. The former coincides with the election of Vicente Fox, of the National Action Party (PAN), to the presidency, enabled through democratic reforms in the 1980s (including the establishment of the precursor to today’s National Electoral Institute). His rise marked a momentous moment in Mexican politics as the first president from outside the PRI, which had previously enjoyed essentially single-party rule since 1929.

The second inflection point, in 2018, is particularly notable as it includes the effects of two countervailing forces on the Freedom Index. The first is the signing of the USMCA, which according to the index’s methodology resulted in a significant increase in economic freedoms. The second is the election of AMLO, who rose to power on a wave of antielite sentiment. Once in power he began implementing his unique brand of populist governance, combining a redistributive fiscal policy with democratic backsliding and power consolidation. These features have blended to create a notable downward trend in freedoms over a half a decade, as we will explore in detail below, though they also have contributed to the continued improvement in some of the prosperity indices.

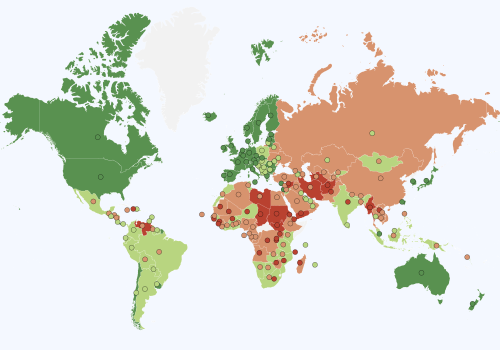

Focusing on the past five years, the index shows the continuation of a trend that is rare in the region and elsewhere—the decoupling of freedom and prosperity. Mexico is one of the few cases in the last five years, together with Nicaragua and Chile, where prosperity has continued to increase while freedom has declined. This is contrary to the wider trend in the Latin America and Caribbean (LAC) region, where both indices have declined.

In a marked shift from its categorization as “mostly free” in the 2023 index, Mexico is classified in the 2024 edition as a “low freedom” country, ranked 90 in the world—reflecting accumulated, significant antidemocratic shifts over the years of the AMLO presidency. Mexico continues to be “moderately prosperous,” though the changes underlying the reductions in freedom can be expected to damage prosperity as well, sooner rather than later.

Atlantic Council research suggests that, in general, the level of freedom in a country plays a significant causal role in its prosperity. The effect of a significant shift in freedoms is usually delayed by several years, taking up to two decades to manifest fully. In the case of the recent reductions in freedom in Mexico, the economic effects are likely to be felt much sooner. For example, as I will discuss below, judicial reforms are likely to pose an enormous challenge for the private sector and the renegotiation of the USMCA in the coming year, which could have severe economic ramifications for the country, as uncertainty affects investment climate. In the context of the current authoritarian shift in Mexican politics, this highlights the importance of steadfast, long-term public policy. That said, whether we continue to see this divergence going forward through the Sheinbaum presidency is yet to be seen.

Evolution of freedom

Mexico’s Freedom Index score has continued its decline, falling almost six points to 63.3 over the five years leading up to 2023. The score is characterized, after a decade of stop-start improvement, by a sharp fall since 2018, driven by declining political and legal freedoms. While Latin American countries have seen declining freedoms in this timeframe, Mexico’s slide is an outlier. Despite starting the period with a higher freedom score than the rest of the region, it has now slipped well below the average of 66.4, ranking eighteenth among the twenty-four nations in LAC, and the trendline continues to be negative. While economic freedom has been steady at around 76 after a notable drop in 2019, legal and political freedom scores have plunged since 2018. Mexico’s legal freedom score is 48.6, down from 54 in 2018; in fact, while the score has steadied in the past year, recent judicial developments (discussed below) suggest that we will see a severe drop next year. Political freedom has recorded an even more severe decline, dropping over ten points to 65.4 in 2023.

We can see several notable declines within the political subindex. Political rights have fallen steeply in the past five years. Mexico has dropped over twelve points and twenty-five places in the international rankings, and well down among the LAC countries in the nineteenth position. This score reflects the adversarial stance of the former AMLO government regarding criticism, opposition, public protest, and most significantly, the freedom of the press. The president presided over a militarized response to anti-femicide protests in Mexico City, for example, and he continued to constantly attack specific press representatives during his mandate. On one occasion in February 2024, he revealed the private phone number of a New York Times journalist during a live press conference; on another, he exposed private income and tax information of a Mexican one.

In another sign of democratic backsliding, the elections score has declined almost three points to 89.1. As president, AMLO often used his platform to campaign for members of his party as well as continuously attack political opponents from his privileged tribune, contrary to legal principles. The decline also reflects the fact that while the National Electoral Institute (INE) remains de jure independent, it has been subject to relentless political pressure and intervention, as well as severe funding cuts. The former president accused the institute of fraud and sought to centralize it under the executive. Furthermore, the legislature—controlled by the ruling party, Movimiento de Regeneración Nacional, or Morena—has continued to leave the Elections Tribunal without its required seven magistrates. Those threats and the loss of funding have yet to translate into a further deterioration of election integrity; nonetheless, it remains part of a worrying trend.

On a similar note, the most severe decline was in the legislative constraints on the executive score, which fell almost thirty points to 36.3 in 2023. This period coincided with AMLO’s sweeping election and legislative majorities (including a supermajority in the Chamber of Deputies), giving the administration a period of total legislative control until the supermajority was lost in 2021 (coinciding with a brief uptick in the constraints score). However, AMLO continued to undermine legislative independence: for example, forcing through legislation in violation of procedure. With Sheinbaum’s election victory in 2024 came not only the presidency but a questionable supermajority in the Congress of the Union. In fact, the ruling coalition now controls 73 percent of the Chamber of Deputies with 54 percent of the popular vote for the chamber, against a constitutional limit of 8 percent for the difference between representation and vote share. Despite initially falling one vote short in the Senate, a subsequent—questionable in its form—defection from the opposition has handed the coalition a supermajority across both bodies for the first time since the 1990s. Morena has also sought to remove additional constraints on executive power, for instance by following through on the elimination of several key autonomous agencies. These include the National Institute of Transparency Access to Information and Data Protection (INAI), an essential resource for government accountability; the Federal Economic Competition Commission, known as COFECE, which has a broad antitrust and competition remit; the National Council for Evaluation of Social Development Policy (CONEVAL), which is in charge of the evaluation of social programs and for poverty reduction strategy; the Federal Telecommunications Institute, the telecom regulator; and the Energy Regulatory Commission. The proposal was passed in November 2024, ostensibly to reduce costs, though the savings will amount to less than 0.05 percent of the federal budget. This follows years of AMLO hamstringing the agencies via unfilled appointments and budget cuts. Additionally, while Sheinbaum’s government made some changes to AMLO’s initial proposal to remain compliant with USMCA provisions, potentially compromised regulatory functions may yet violate the treaty if they end up favoring state-owned entities.

A similar dismantling on presidential checks and balances characterizes the decline in the legal subindex score. Apart from informality, which has been steady, every other legal indicator has fallen sharply since 2018, driving a twenty-one-place drop in global rankings for Mexico. Judicial independence has nose-dived to 50.4 from 62.2, reflecting an extended offensive from the Morena government against the national judiciary. AMLO appointed four justices to the Supreme Court of the Justice of the Nation, including a party insider with no judicial experience. He has repeatedly accused the court of treachery and corruption, encouraged public anger at the court’s president, threatened the pensions of judiciary workers, and slashed the court’s budget. Among the most contentious political issues of the past two years is a radical judicial overhaul, first proposed by AMLO but supported by, and eventually passed under, President Sheinbaum in late 2024. In a world first, the reform aims to require every judge in the system (over 17,000) to be elected by popular vote along with a reduction by two seats in the size of the Supreme Court. A significant portion of the candidates will be prescreened by the ruling Morena party. This presents severe dangers to the rule of law and independence in the judiciary, with judges exposed to the influence of political pressure and public sentiment on what should be a fully indifferent, impartial process. Legal interpretations will become unreliable as politicization in the judiciary results in inconsistent ad-hoc rulings. The role of the judiciary as a check on the executive and legislative will be greatly diminished, primarily by means of its ability to intervene against political parties and other political actors which will now control its judges’ candidacies. Despite the imminent need for significant improvement and the administration’s continuous attacks on and heavy-handed influencing of the court, it had remained de jure independent; but the recent judicial reform throws even that into question.

The ramifications of this fundamental reform, which undermines the capacity and oversight of the judiciary, will be manifold. This includes effects on the Mexican economy, as discussed below, but to start with, top-to-bottom elections set for June 2025 will cost $650 million. These expensive elections come in the context of one of budgets aiming at reducing the historically high fiscal deficit of 2024through severe fiscal consolidation in 2025.

The fight against corruption, which has been a key justification for Morena’s authoritarian measures like the judicial reform, has shown little signs of improvement over the past five years. On the contrary, some notable loci of corruption have only emerged during recent years. In one case, the director of the recently established Institute to Return Stolen Property to the People (INDEP) resigned after explosive revelations of theft within the agency. The agency was established to redistribute the value of assets seized from criminals to the Mexican people (though critics argued it simply renamed an existing agency with the same purpose); instead, “multimillion dollar corruption” has plagued its operations. Additionally, while seized assets were previously used solely to compensate victims of crime, the new agency has opaque authority to distribute funds as it pleases, including to other political priorities, increasing risks of cronyism on top of corruption.

The judicial reform is likely to exacerbate the problem by politicizing judicial officials in lower courts and opening them to the influence of political interests and even crime. Additionally, the elimination of key autonomous oversight agencies, as discussed above, is likely to lead to less transparency and accountability for two reasons. One is that by destroying the agencies and absorbing their functions into the executive branch, regulatory and antitrust capacity are likely to suffer significantly, likely allowing more cases of bad practice to fall through the cracks. Additionally, they would be less likely to scrutinize entities associated with the executive. Similarly, while in office AMLO also directed a growing share of economic power to the sole purview of the military, including seaports, airports, customs processing, and major pet infrastructure projects like Tren Maya (Maya Train) and the Trans-Isthmic Corridor. Removing the requirement of competitive bidding and procurement, along with limited outside oversight of militarized economic activity, raise additional transparency and accountability concerns.

Militarization was also a key component of AMLO’s approach to security. In this case, a relatively flat trendline may belie a regression in Mexico’s internal security situation; the former president’s conciliatory approach to cartel violence has failed to reduce their impunity; despite misleading assurances to the contrary, a government agency confirmed that more homicides occurred during AMLO’s time in office than any other Mexican president in history. He also reversed course on his support for Mexico’s “desaparecidos,” over 100,000 unsolved cases of criminal kidnapping. However, President Sheinbaum’s approach to security may prove to be a case of significantly distancing herself from the previous government. Instead of continuing AMLO’s “hugs, not bullets” strategy, she seems willing to rely more on action than inaction, and on counterintelligence and coordination to combat and deter unsustainable levels of violence. This enormous change will be legitimized (vis-à-vis AMLO) by the need to opt for a completely different approach when put between a rock and a hard place by the United States, threatened with a 25 percent blanket tariff if inaction and lack of cooperation occur in terms of tackling drug-trafficking organizations and migration.

Finally, the clarity of law has also suffered, with Mexico dropping twenty-seven places in global rankings and losing eleven points to reach a score of 37.6. This metric assesses whether Mexican laws are general, public, consistent, and predictably enforced. Indeed, all four of those characteristics were tested repeatedly by the previous administration, perhaps most notably in an anticompetitive electricity reform bill that was struck down by the Supreme Court in early 2024. Now that Morena has pushed through its judicial overhaul, it is likely that such distortions of the clarity of the law will have fewer checks going forward, whether through anticompetitive measures from the government or unpredictable enforcement by a judicial system in disarray. Further reduction in the clarity of the law has taken place via government abridgments of private property rights.

The economic subindex shows only a moderate decline of three points since 2018. However, within the average lies an interesting dynamic, with subindices moving in different directions. On one hand, trade freedom and investment freedom show a marked increase in 2018, following the ratification of the USMCA. Trade freedom especially benefited from the agreement, showing further improvement in 2020 once the agreement was ratified.

On the other hand, the property rights score has decreased dramatically following the 2018 election. Despite being an enshrined principle in the constitution, the previous administration took several notable actions to weaken the right to private property and fair treatment of that property by the government. In 2019, the government passed a law equating tax evasion with organized crime and assigned the corresponding punishment; among its outcomes is the ability to enforce mandatory pretrial detention without bail as well as asset forfeiture prior to a guilty verdict. While this was later overturned by the Supreme Court in 2022, citing unconstitutionality, such court-ordered rollbacks are less likely given the recent erosion of judicial independence. We can see the effect of this law on the sharp drop in the score in 2019. This follows from one of the broader themes of the past AMLO administration, which was active interventionism and an anticompetitive role for the state in a variety of sectors. For example, AMLO’s energy nationalism has resulted in more and more of the government’s fiscal eggs going into the basket of Pemex, the state-owned oil company, at the expense of private investment in both fossil fuel energy production as well as, critically, renewables. This is likely to be another area where President Sheinbaum distances herself from her mentor and predecessor as she recently presented an Energy Plan which included private-sector participation through mixed investment and the reprioritization of energy transition through renewable generation. It is yet to be seen, however, what the practical implementation of such a plan will be and how a much more doubtful private sector will respond to these recent policy shifts.

It is important to also mention that the government showed a particular tendency to infringe on property rights when pushing AMLO’s pet projects; for example, in May 2023 the government illegally seized a privately administered rail track, despite a legal contract granting the company its concession, to advance the Trans-Isthmic Corridor rail initiative. Additionally, in 2023, the government sent armed military, in contravention of court order, to seize the port assets of an American company in Playa del Carmen. In the final days of his presidency, AMLO issued a decree expropriating the entirety of that private land for a nature reserve. He has previously suggested using the rare deepwater port as a cruise dock; it is also the only port in the region capable of transporting the required raw materials for the Tren Maya, which has been subject to considerable environmental and economic criticism from opponents. Neither of those two incidents are reflected in the property rights score for the past two years, but they will affect foreign investment, particularly from the United States, and resulted in a sharp rebuke from the US Senate Foreign Relations Committee. While President Sheinbaum has taken a conciliatory tone with foreign investors so far, it remains to be seen how she will align further concentration of power with an environment of enablement and certainty for business development in Mexico.

By contrast, despite some concerning years when women’s marches were met with the use of force, the women’s economic freedom score has stayed flat at 88.8 and now offers reason for cautious optimism. President Sheinbaum plans to introduce several policies aimed at advancing women’s empowerment, including supplemental pensions for women aged sixty to sixty-four and an extension of parental leave. She also has proposed a National Care System aimed at supporting unpaid work (like childcare) that traditionally falls to women, though funding for the system has yet to be established.

Evolution of prosperity

Despite the dramatic backsliding in political, economic, and legal freedoms, Mexico has mostly resisted a similar decline in the Prosperity Index during the same period, rising six places in the global rankings. Despite a foundation of macroeconomic stability, overall growth has remained frustratingly low relative to its potential. Its score has tracked fairly closely with the regional level since 1995.

While Mexico’s global prosperity score rose above pre-COVID-19 levels in 2022, in contrast to the regional average, the income subindex shows the opposite: Mexico remains below its pre-COVID levels, while the region on average has surpassed them. This can be attributed to the government’s low levels of fiscal support (0.7 percent of gross domestic product) during the pandemic, which stands in stark contrast to others in the region such as Brazil, which spent close to 9 percent of GDP on its response. Even before COVID-19, the economic growth of Mexico suffered a significant deceleration. During the first year of AMLO’s government, the economy contracted by 0.1 percent and the compounded average growth of his term (excluding 2024) is less than 1 percent. The economy notably underperformed compared to the just-under 2 percent compounded annual growth seen over the three preceding administrations from 2001 to 2018.

There are also lagging indicators that suggest constraints on growth going forward. For example, while overall foreign direct investment (FDI) has grown in recent years (mostly due to profit reinvestment), new FDI inflows show a different story. Fresh FDI inflows via equity capital have plunged steeply from $15.3 billion in the first three quarters of 2022 to only $2.0 billion for the same period in 2024, based on the latest Mexican government data.

Despite sluggish income growth, Mexico has made significant strides in reducing inequality since 2018, moving up eleven places in the global rankings and five points to 57.7. This has been driven by AMLO’s social policy; for example, the minimum wage has nearly tripled since 2018 (by decree, rather than as a result of higher productivity and competition), and poverty has declined by 20 percent since 2020, in large part due to a costly and enormous rise in cash transfers. This creates further fiscal pressures at a time when the country is running its highest deficit in almost four decades, at 5.9 percent of GDP. Remittances have also virtually doubled from about $8 billion in the first quarter of 2019 to $14 billion in the first quarter of 2024. (International Monetary Fund research has shown that remittances have a downward effect on inequality in Mexico). It should be noted, however, that the rate of improvement in the inequality score has remained reasonably consistent since 2012.

On the environment, the index shows Mexico suffered only a slight decrease from 67.2 in 2018 to 67 in 2023. This reflects a flat trend, on average, for emissions, air pollution deaths, and access to clean cooking technology. In the case of Mexico, however, this obscures significant setbacks in environmental progress from a policy perspective. Mexico dropped seven places to 39 in the 2024 Climate Change Performance Index, which rated its climate policy as “low performance.” AMLO’s oil nationalism prioritized public investments in the floundering state-owned oil supermajor, pushing out competition and heavily disincentivizing investment in renewable energy and the wider green transition. Additionally, some of the administration’s pet projects, particularly the Tren Maya, have been criticized for environmental damage to sensitive ecosystems of the Yucatán peninsula. According to Global Forest Watch, primary forest loss saw a large increase in 2019 and 2020. This was likely due to the misguided Sembrando Vida (Sowing Life) policy, which aimed to address rural poverty and environmental degradation but resulted in large tracts of forest destroyed for timber or agriculture—despite many of the landowners having been compensated for protecting existing forest under the prior government’s policy regime. The data shows a marked improvement in 2021, suggesting the government acted to stymie Sembrando Vida’s negative externalities.

The path forward

Thus far, democratic backsliding has seemingly been either aligned with the will of the voters; a cost they are willing to pay for cash transfers, a renewed hope derived from populist rhetoric, or as punishment to previous governments. Or perhaps Mexicans simply don’t care or do not acknowledge – due to a lack of effective engagement and communication from previous governments – material benefit from a rather ethereal concept: democracy. AMLO’s presidency came with noticeable material improvements in many lives, as we can see with significant progress on poverty, inequality, remittances (though unrelated to his policies), and the minimum wage. Additionally, the political opposition is in total disarray, tainted with accusations of elitism and corruption—and without capacity to self-assess, regroup, and present a compelling alternative. AMLO, with his singular star power, and now Claudia Sheinbaum with more than 75 percent popularity (in January 2025), have effectively capitalized on their absence with an inclusive narrative of economic nationalism and executive strength.

On top of backsliding, the targeted problems of corruption, lack of security, and a culture of privilege remain largely unsolved. Additionally, the risks of continuing down the path of democratic retrenchment are immense and wide-ranging. The politicization of the judicial system risks an even deeper loss of public trust in the law as well as deeper entrenchment of a single hegemonic party, further reducing the viability of a basic democratic requirement: a strong opposition, which has also inflicted significant self-damage to be seen as an appealing and trustworthy political option.

In addition to driving a cycle of continuously shrinking freedoms, the existing approach may also struggle to generate an adequate growth engine required for improvements in economic vibrancy. The country is facing several headwinds in achieving its growth potential in the medium term. For one thing, returning the budget deficit to manageable levels—Sheinbaum has pledged to meet a 3.9 percent deficit target in 2025—will require fiscal trade-offs. It will require the president to confront her government’s relationship with Pemex, the roughly $100 billion elephant in the room. While her predecessor injected almost $100 billion into Pemex via direct financing and tax breaks, production declined and losses doubled to $8.1 billion in October 2024 compared to a year earlier. The company’s debt now stands at almost 6 percent of the entire country’s GDP and the government has pledged almost $7 billion more this year amid a rapidly tightening budgetary environment. The Pemex albatross will hang heavily on the sovereign balance sheet, as we are seeing already. Along with concerns about the constitutional reform, Pemex’s fiscal burden helped drive Moody’s latest downgrading of Mexico’s debt outlook from “stable” to “negative” in November 2024.

Additionally, Mexico’s macroeconomic scenario is highly dependent on foreign trade, particularly its integration with the United States and Canada via the USMCA. Exports accounted for over 40 percent of Mexico’s GDP in 2022, and over 80 percent of those exports went to the United States. Those who invest and trade with Mexico crave certainty, particularly in a context of transformative changes to international supply chains. However, current uncertainty is driven by two key factors, one domestic and one international. Domestically, dramatic policy change toward concentration of power, fewer checks and balances, and less competitive markets are likely to alarm international investors as well as curtail domestic economic activity. The latter factor concerns Mexico’s trade relationships within North America, especially the outcome of USMCA negotiations and their effect on nearshoring growth. Donald Trump, following his decisive electoral victory in the United States, has advocated for extreme trade protectionism, including against Mexican imports. While rhetoric must soon give way to actual policy implementation for the Trump administration, it remains to be seen if his most severe threats will be realized, such as the imposition of a 25 percent tariff on Mexican imports that would have likely been implemented the first day of February, had the Mexican president not engaged in a forty-five-minute call with Trump in which, among other things, she committed to the immediate deployment of 10,000 military forces in the northern border area of the country. The coming four years, but particularly this year, are expected to be quite uncertain as, according to mostly vague thresholds of cooperation on organized crime and migration, the main anchor of the Mexican economy (trade with the US) will become extremely volatile.

One thing is for sure: There will be uncertain and tense times ahead, beginning with the first months of the second Trump administration and continuing until an agreement for a revamped trade agreement is in place, most probably, one which considers a form of sectoral customs union. Mexico is the main US trading partner and source of imports. Mexico also is among the top trading partners of the majority of the fifty US states, so having a free trade agreement that anchors certainty and promotes competitiveness and productivity in North America is a matter of priority for the United States as well. That said, one should expect a great deal of rhetoric and threats to stand in the way before a consensus emerges. Mexico will have to stay focused and display a sophisticated and effective multilevel strategy to reduce uncertainty and enhance its position in the negotiating process. The most important aspect will be managing the effects of rhetoric on business sentiment and avoiding the implementation of drastic and costly measures for Mexicans and the country’s economy.

The drop in FDI noted above is a foreboding sign. Investors had been awaiting the outcomes of the Mexican judicial reform and the US election, among other factors, and now they watchfully wait to see the Trump administration’s actual policies. Meanwhile, so far, Mexico has seized less of the unique nearshoring opportunity than it should have from Asian competitors like India and Vietnam. To do so, it must still meet important nearshoring requirements such as improvements in infrastructure, energy reliability, and security.

In conclusion, the past several years of deepening democratic retrenchment have culminated in a seismic shift in Mexican politics. Despite continued improvements in poverty and inequality and steady, if low, income growth, these reductions in freedoms may soon threaten Mexico’s prosperity in the medium term. Most of the population has fluctuated between eagerness and indifference vis-à-vis these changes so far. If President Sheinbaum and Morena continue to consolidate power and reduce checks and balances, it may be too late to reverse course once the full effects are felt.

President Sheinbaum has made her choice on the political transformation of the country, moving toward more concentration of power in the executive and the cancellation of several checks and balances which, however imperfect and thus improvable, were there as both limit and anchor. Her second conundrum will be around the economic system, where a series of contradictions derived from the chosen course of action in the political sphere will play out. We have yet to see what can become of a new model and a new trend in the world: regimes with autocratic features or even full-blown autocracies that create the avenues, spaces, and conditions for the private sector to accommodate and flourish in an era of deglobalization and strategic ally shoring; post-truth politics and social media; and a more polarized and volatile ecosystem.

Note: The text of this report was finalized in February of 2025.

Vanessa Rubio-Márquez is professor in practice and associate dean for extended education at the London School of Economics’ (LSE) School of Public Policy. She is also a member of the Freedom and Prosperity Advisory Council at the Atlantic Council, an associate fellow at Chatham House, and a member of organizations such as the Mexican Council of International Affairs, the International Women’s Forum, Hispanas Organized for Political Equality, and LSE’s Latin America and the Caribbean Center. Previously, Rubio-Marquez had a twenty-five-year career in Mexico’s public sector, including serving as three-times deputy minister (Finance, Social Development, and Foreign Affairs) and senator.

Statement on Intellectual Independence

The Atlantic Council and its staff, fellows, and directors generate their own ideas and programming, consistent with the Council’s mission, their related body of work, and the independent records of the participating team members. The Council as an organization does not adopt or advocate positions on particular matters. The Council’s publications always represent the views of the author(s) rather than those of the institution.

Read the previous edition

2024 Atlas: Freedom and Prosperity Around the World

Twenty leading economists and government officials from eighteen countries contributed to this comprehensive volume, which serves as a roadmap for navigating the complexities of contemporary governance.

Explore the data

About the center

The Freedom and Prosperity Center aims to increase the prosperity of the poor and marginalized in developing countries and to explore the nature of the relationship between freedom and prosperity in both developing and developed nations.

Stay connected

Image: People standing on corner road near concrete buildings during daytime, San Miguel de Allende, Mexico. Jezael Melgoza/UNSPLASH.

Keep up with the Freedom and Prosperity Center’s work on social media