Leading oil and gas into a net-zero world

The urgency of climate action has clouded the future of oil and gas in the energy transition. Pressure on oil and gas producers to adapt their operations to fit into a net-zero world has grown, from both policymakers and the investment community. But a supply crisis and price spikes have illustrated the danger of moving away from these fuels without a sufficient corresponding uptake of cleaner alternatives. Most models of the energy transition also suggest that continued petrochemical demand and use in transportation will ensure a considerable level of oil and gas demand, even in a net-zero scenario.

Oil and gas will thus continue to play a key role in the energy transition. It will be incumbent on the industry, policymakers, and investors to walk a precarious tightrope, keeping markets stable through sufficient continued oil and gas production while pursuing ambitious decarbonization targets. Technologies like clean hydrogen and carbon capture, utilization, and storage, with the potential to lessen oil and gas’ traditionally emissions-intensive footprint, could help. So could carbon offsetting. But clarity is needed, and without it, supply-demand mismatches could rage on without any meaningful emissions reductions to speak of. For the transition to be both smooth and comprehensive, oil and gas will require both rigorous accountability and support for the practices and technologies that can help make them compatible with a net-zero world.

This paper builds upon the Atlantic Council Global Energy Center’s 2020 report, The Role of Oil and Gas Companies in the Energy Transition, to reevaluate if and how oil and gas companies can adapt to play a productive role in a decarbonized world. It examines how the escalating ambitions for a net-zero world can provide a landscape for oil and gas companies to participate in the energy transition; how policy, technology, and financial markets are shaping—and being shaped by—net-zero targets; and what pathways and opportunities oil and gas companies should consider in order to enable a net-zero future.

Executive Summary

Leading oil and gas into a net-zero world

With the challenge of mitigating climate change growing increasingly urgent, demand for climate action has dramatically accelerated. What was once a push for a steady transformation of the global energy system has now, by necessity, transformed into a focus on how the global energy sector can achieve net-zero emissions by 2050. As momentum has accelerated, driven by new policy and greater social awareness, pressure has mounted on the oil and gas industry to evolve, and to become compatible with a net-zero world.

Even as momentum on climate action builds and the deployment of low-carbon technologies accelerates, oil and gas will continue to play a key role. Indeed, the war in Ukraine and resulting crisis in global energy markets highlight the critical role oil and gas will play for the foreseeable future. And, even in the long run, oil and gas demand are likely to persist in a net-zero world, albeit in a different capacity. In BP’s Net-Zero by 2050 scenario, for example, roughly twenty-five million barrels per day (mbd) of oil demand is projected to remain in 2050, thanks to sustained petrochemical demand and continued use in transportation, particularly in the developing world; in the International Energy Agency’s (IEA) net-zero scenario, 2050 oil demand is slightly lower, at twenty-four million barrels per day.1 Recognizing that reality, the oil and gas industry’s ability to decarbonize its continued operations, and to rapidly pivot toward low-carbon technologies, will be critical to global efforts to achieve net zero. Many international and national oil and gas companies have begun to recognize this by announcing net-zero pledges of their own, whether limited to scope 1 and scope 2 emissions, or extending to scope 3, which encompasses the entire value chain from extraction to consumption.

This paper builds upon the Atlantic Council Global Energy Center’s 2020 report, “The Role of Oil and Gas Companies in the Energy Transition,” to reevaluate if and how oil and gas companies can adapt to play a productive role in a decarbonized world, including: how the escalating ambitions for a netzero world can provide a landscape for oil and gas companies to participate in the energy transition; how policy, technology, and financial markets are shaping—and being shaped by—net-zero targets; and what pathways and opportunities oil and gas companies should consider in order to enable a netzero future.

Despite the uncertainty around the exact end state for oil and gas as the world transitions toward a lower-carbon—and, ultimately, net-zero—energy system, current climate scenario modeling generally implies that the transition will be smooth, with supply and demand moving in lockstep to a lower-carbon future. While smooth transitions are naturally a result of the economic equilibrium modeling used in those scenarios, this belies multiple underlying risks and potential for volatility in the transition to net zero. Indeed, the current crisis in global energy markets suggests this transition will be anything but smooth.

Looking forward, the future of the oil and gas industry—and even the broader feasibility of the energy transition—will be shaped by four fundamental climate transition risks: first, the financial risk to operators and countries of stranded assets; second, the risk of energy supply instability as a result of ramping down oil and gas production without the requisite increase in renewable production to ensure reliability, a risk that has been exemplified by recent oil and gas market tightness; third, the risk of the continued operation of emissions-intensive assets, rather than their decommissioning or decarbonization; and, finally, the risk that a rapid transition away from oil and gas will result in geopolitical instability as major producers react to reduced roles in global politics and economics.

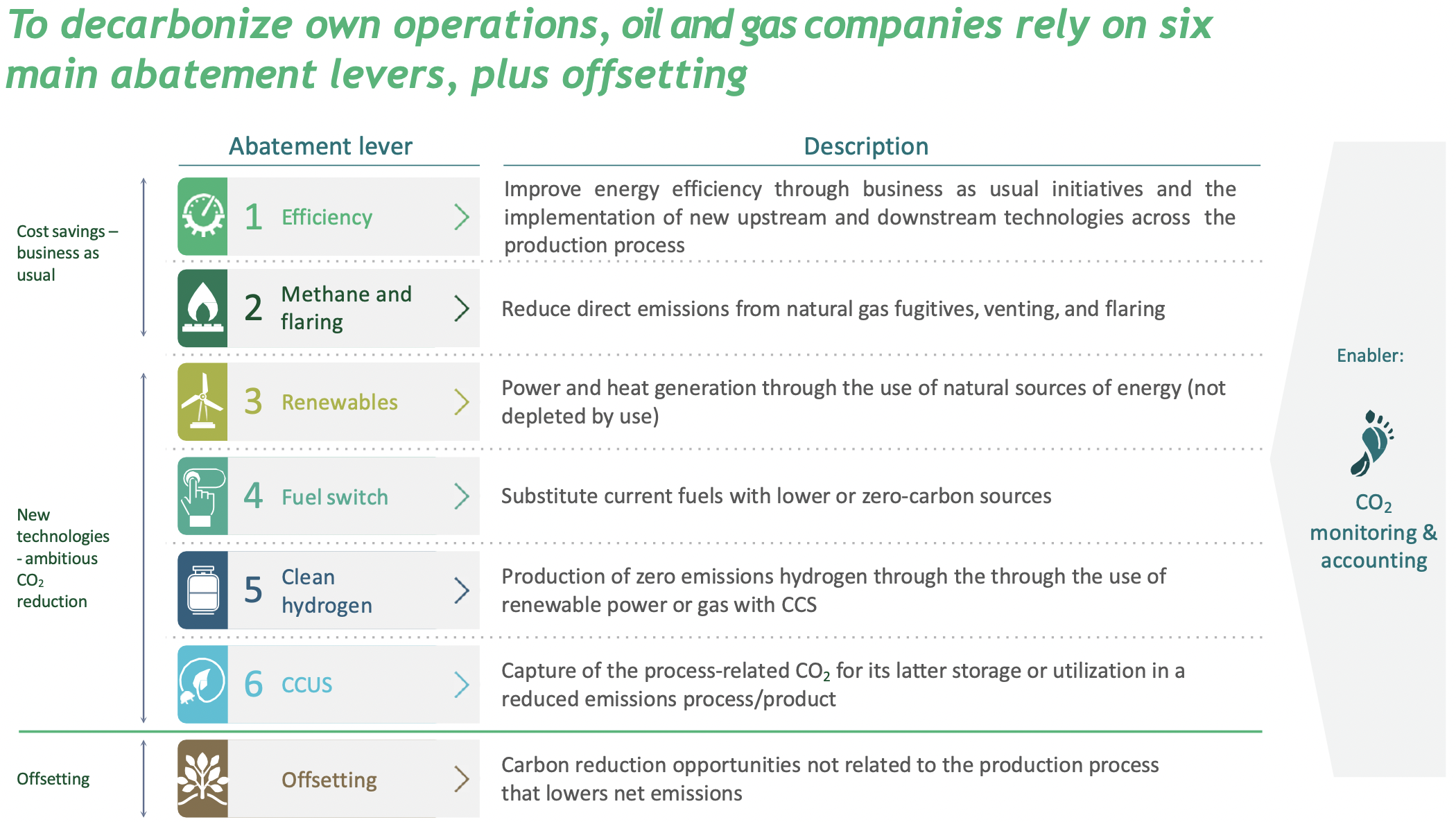

Oil and gas companies will play a critical role in managing all of these risks. For some, there will be new opportunities that emerge from a net-zero transition. As they consider these risks and opportunities, there are multiple pathways that oil and gas companies can follow on the path to net zero. Among the transition options, perhaps the clearest is the pursuit of greenhouse gas (GHG) emissions-management opportunities, initially through methane emission abatement, followed by the development and deployment of key industrial decarbonization technologies; in particular, carbon capture, utilization, and storage (CCUS) technologies. A second, related pathway is that of pivoting toward renewable energy technologies and toward playing an active role in developing a hydrogen economy. Importantly for the long-term viability of the industry, companies must find a way to leverage these steps into bridging between scope 1 and scope 2 emissions reductions into scope 3, by spurring knock-on downstream deployment of these methods and technologies. And, finally, carbon offsetting and carbon removal technology development is a major opportunity for the industry writ large to enable a net-zero pathway, but policymakers and companies will need to create a verifiable and standardized system, and to implement meaningful policy-based incentives for this to be a viable long-term pathway.

The growing urgency to accelerate climate action through both policy and investment levers—along with the energy market turmoil that has spurred an energy supply crisis across the globe—has elucidated the complicated moment facing policymakers and the oil and gas industry. Reducing emissions from oil and gas production and consumption—and, indeed, reducing that consumption—will be critical to global efforts to mitigate climate change. And yet, the global energy system is, and will likely continue to be, reliant on those fuels, even in a net-zero world. To meet the apparent conflict between those two realities, and to ensure that the industry can play a constructive role in enabling the transition to net zero, this report recommends three critical and interconnected sets of actions required by oil and gas companies, governments, and the financial sector.

First, clarity on the demand-side transition is imperative. This will require governments moving beyond climate pledges to implement clear enabling policies; in turn, it will be incumbent on oil and gas companies to support net-zero policies and appropriately pivot toward low-carbon business models (i.e., toward scope 3 net zero).

Second, the supply side must also be managed to minimize direct GHG emissions from oil and gas (scope 1 and scope 2). This will require both much more ambitious decarbonization measures from corporate actors and stronger and more harmonized regulations among governments.

Third, the role of private finance in the oil and gas sector must be clarified, both by financial institutions directly and by governments. This will be crucial for providing oil and gas companies a path forward to continue investing appropriate levels in oil and gas assets to maintain supply stability, while also providing a means of transition away from unabated oil and gas.

1 BP, BP Energy Outlook 2022, 2021, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/ energy-outlook/bp-energy-outlook-2022.pdf; IEA, Net Zero by 2050, 2021, https://www.iea.org/reports/net-zero-by-2050.

I. Introduction

Introduction

With the challenge of mitigating climate change growing increasingly urgent, demand for climate action has dramatically accelerated. What was once a push for a steady transformation of the global energy system has now, by necessity, transformed into a focus on how the global energy sector can achieve net-zero emissions by 2050. COP26 in November 2021 further underscored this shift, as commitments to a net-zero world have only grown in number, and policy, market, and corporate activity around net-zero ambitions have followed suit.

Even as momentum on climate action builds, and the deployment of low-carbon technologies accelerates, oil and gas will continue to play a necessary role in a net-zero future. Indeed, the war in Ukraine and resulting crisis in global energy markets highlight the critical role oil and gas will play in the energy system for the foreseeable future. The impact the crisis has on the energy transition, while outside the scope of this paper, could be quite large, though in which direction remains unclear. On the one hand, the crisis is accelerating some energy transition policies in Europe.2 On the other hand, some countries have to turned back to coal for power generation because of the price of gas, while policymakers have called for a rapid ramp up of oil and gas production.3

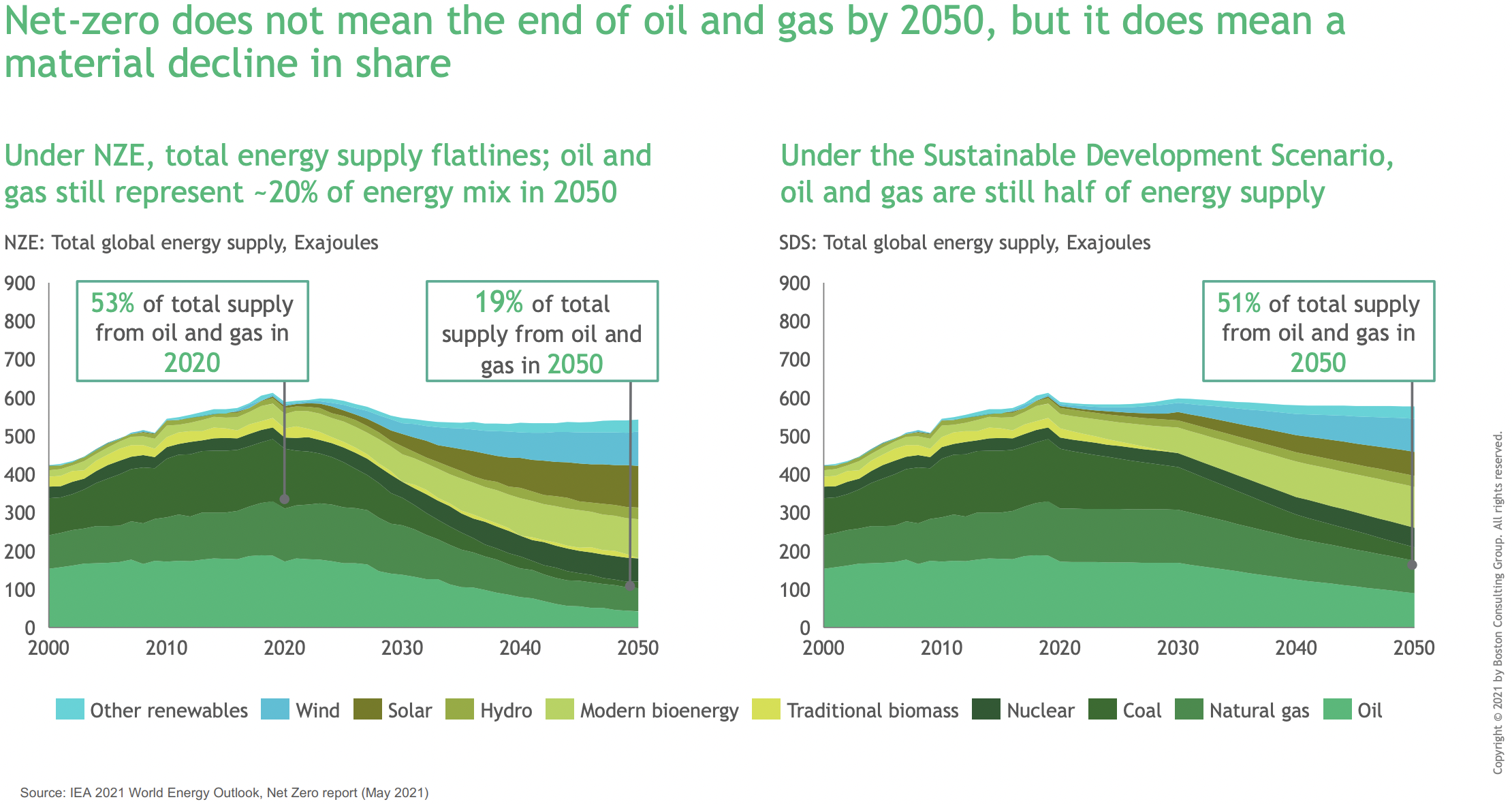

As the timeline, outcome, and impacts of the war in Ukraine are unknowable, this report will assume the march to net-zero will continue apace and examine the role of oil and gas in that potential world. And even in the most aggressive net-zero scenarios, oil and gas will still play a critical role.

In BP’s Net-Zero by 2050 scenario, for example, roughly twenty-five mbd of oil demand is projected to remain in 2050, thanks to sustained petrochemical demand and continued use in transportation, particularly in the developing world; in the IEA’s netzero scenario, 2050 oil demand is slightly lower, at twenty-four mbd.4 These numbers still represent a significant decline from pre-pandemic oil demand of 99.5 mbd, and represent an enormous, nearly unprecedented challenge, though they are also a far from complete substitution of oil in the energy system.5 It is possible that a net-zero-emissions world could see even more oil demand, depending on what types of technologies are commercialized and deployed, for example, direct air capture technologies.

Gas, for its part, is projected to be an even larger part of a net-zero future, with roughly 2,300 billion cubic meters (bcm) remaining in the energy mix in the BP scenario, as gas balances renewables, provides a solution for intermittency, enables the development of a hydrogen economy, and offers a necessary alternative to coal or diesel fuel in parts of the world where energy demand is poised to grow quickly, such as Africa. Gas demand is, thus, also projected to decline—from a pre-pandemic high of four thousand bcm—but by far less than oil.6

This underscores that oil and gas must also be part of a broader net-zero conversation, and the technologies and business models needed to decarbonize the industry should not be forgotten as policymakers aggressively pursue much-needed climate action. However, both oil and natural gas face challenges as the industry seeks to navigate profound changes to the energy system as the push for net zero accelerates. A rapidly evolving financial environment focused on sustainability, led by the growth of environmental, social, and governance (ESG) investing, may limit or reshape future capital investment into oil and gas projects. Public scrutiny of the role of oil and gas in the energy transition— especially the development of oil and gas infrastructure—complicates the ability of policymakers to include oil and gas within broader energy policy packages. Oil and gas producers must, therefore, consider their future role, effectively communicate their own commitment to the global consensus to decarbonize, and work to deploy the accompanying technologies, business strategies, and policy frameworks in partnership with the private sector, broader public, and policymakers. Only if they do so will their commitments to reach net zero and be part of the solution be taken seriously.

To this end, numerous opportunities are on the table. To contribute to a net-zero emission energy mix, oil and gas operators will need to rapidly deploy new and emerging decarbonization technologies across their operations at scale in order to keep pace with advancing decarbonization commitments. Ongoing policy decisions around the world to advance netzero goals will also shape the role of oil and gas in different national contexts, transforming the geopolitics of oil and gas moving forward as producers and consumers adjust to a new market landscape. Though growing pressure from the financial community may limit available capital for oil and gas and encourage divestment—as both the industry’s “license to operate” and “license to invest” become increasingly challenged—companies that can effectively demonstrate business models that contribute to climate goals can create competitive advantage, by reducing the emissions intensity of existing operations and by growing new, low-carbon lines of business. An open-minded pursuit of these opportunities will be necessary to ensure that ongoing activity within the oil and gas sector is compatible with, and enables, net-zero emissions goals.

This paper, which builds on the Atlantic Council Global Energy Center’s 2020 report, “The Role of Oil and Gas Companies in the Energy Transition,” aims to explain: how the escalating ambitions for a net-zero world can provide a landscape for oil and gas companies to participate in the energy transition; how policy, technology, and financial markets are shaping—and being shaped by—net-zero targets; and what pathways and opportunities oil and gas companies should consider in order to enable a net-zero future.7

6 IEA, Natural Gas Information: Overview, 2021, https://www.iea.org/reports/natural-gas-information-overview. 7 Robert (“RJ”) Johnston, Reed Blakemore, and Randolph Bell, “The role of oil and gas companies in the energy transition,” Atlantic Council, January 9, 2020, https://www.atlanticcouncil.org/in-depth-research-reports/report/the-role-of-oil-and-gas-companies-in-the-energytransition/. To this end, numerous opportunities are on the table. To contribute to a net-zero emission energy mix, oil and gas operators will need to rapidly deploy new and emerging decarbonization technologies across their operations at scale in order to keep pace with advancing decarbonization commitments. Ongoing policy decisions around the world to advance netzero goals will also shape the role of oil and gas in different national contexts, transforming the geopolitics of oil and gas moving forward as producers and consumers adjust to a new market landscape. Though growing pressure from the financial community may limit available capital for oil and gas and encourage divestment—as both the industry’s “license to operate” and “license to invest” become increasingly challenged—companies that can effectively demonstrate business models that contribute to climate goals can create competitive advantage, by reducing the emissions intensity of existing operations and by growing new, low-carbon lines of business. An open-minded pursuit of these opportunities will be necessary to ensure that ongoing activity within the oil and gas sector is compatible with, and enables, net-zero emissions goals. This paper, which builds on the Atlantic Council Global Energy Center’s 2020 report, “The Role of Oil and Gas Companies in the Energy Transition,” aims to explain: how the escalating ambitions for a net-zero world can provide a landscape for oil and gas companies to participate in the energy transition; how policy, technology, and financial markets are shaping—and being shaped by—net-zero targets; and what pathways and opportunities oil and gas companies should consider in order to enable a net-zero future.7

2 European Commission, Press Release: “REPowerEU: Joint European action for more affordable, secure and sustainable energy,” March 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_1511.

3 Sara Schonhart, “Coal’s on a comeback in energy-desperate Europe,” E&E News, March 11, 2022, https://www.eenews.net/articles/coals-ona-comeback-in-energy-desperate-europe/.

4 IEA, Net Zero by 2050, 2021, https://www.iea.org/reports/net-zero-by-2050.

5 IEA, Oil Market Report, December 2021, https://www.iea.org/reports/oil-market-report-december-2021.

6 IEA, Natural Gas Information: Overview, 2021, https://www.iea.org/reports/natural-gas-information-overview.

7 Robert (“RJ”) Johnston, Reed Blakemore, and Randolph Bell, “The role of oil and gas companies in the energy transition,” Atlantic Council, January 9, 2020, https://www.atlanticcouncil.org/in-depth-research-reports/report/the-role-of-oil-and-gas-companies-in-the-energytransition/.

II. State of Play and the Pace of Change

State of Play and the Pace of Change

The oil and gas industry has grown increasingly aware of the prospective risks and opportunities of a global community focused on climate action and a decarbonizing energy system. For the past several years, the range of responses from the oil and gas community to the energy transition has varied, from investment in new, low-carbon technologies and industries, to support for emissions-reduction policies and wholesale shifts in business models. Importantly, these pursuits have occurred across policy environments with varying levels of enthusiasm for climate action, which suggests that such changes in the oil and gas industry are in response to a longer-term set of drivers rather than simply adapting to the preference of particular policy circles.

Nonetheless, the context for the oil and gas industry’s response has dramatically changed in the past year, specifically in terms of the level of ambition for the pace of climate action in the lead-up to, and during, COP26. Questions around navigation of the “energy transition” are now questions of survival and contributions to a “net zero by 2050” world. Such a contextual change, and what it means for the paths forward from oil and gas, is a direct result of a perspective shift from the global community (policy, finance, and non-energy companies, in particular) aimed at eliminating emissions from the energy system in order to meet the goals of the Paris Agreement. Articulating the extent to which this perspective shift has moved the goalposts for the energy transition is a necessary first step to crafting a strategy for oil and gas companies moving forward.

Policy

Significant increases in net-zero pledges from governments have laid the groundwork for the “net zero by 2050” future. The cumulative climate pledges resulting from COP26 would put the world on a lessthan-two-degree pathway.8 Notably, multiple major oil- and gas-producing countries have now committed to net zero, including Saudi Arabia by 2060 and the United Arab Emirates (UAE) by 2050.9 Major purchasers have also committed to carbon neutrality, including in the developing world: China aims to achieve net zero by 2060, and India by 2070.10

One of the most significant drivers of this change is the re-entry of the United States into climate-focused diplomacy. Indeed, the Biden administration has made climate action and decarbonization key priorities, both at home and abroad, in its first year, with the call to “raise ambitions” for nationally determined contributions (NDCs) at COP26 representing a significant expenditure of diplomatic capital. Whether or not the aggressive US campaign to encourage stronger NDCs at COP26 was the inflection point in an expansion of net-zero commitments in the past year is up to interpretation. However, the shift in attitude from the world’s second-largest emitter of carbon dioxide between the Trump and Biden administrations in the past year is a clear change in the global community’s approach to the climate crisis, and a significant signal in the pathway to net-zero emissions.11

The implementation of policies to pursue more ambitious NDCs is a more complex picture. Elevated climate ambitions have yet to result in correspondingly ambitious climate actions, and critical gaps remain between NDCs and enabling policies. Nonetheless, the past year has also seen regulatory and fiscal policy developments begin to catch up, with many such policies being developed with “net zero” in mind. Direct regulation of methane emissions is growing around the world, with more than one hundred countries—representing 70 percent of global gross domestic product (GDP)—signing the global methane pledge at COP26.12 Financial oversight and climate risk disclosure policies have also grown dramatically. Carbon pricing is also growing more widespread, and prices are increasing: China and the United Kingdom both introduced emissions trading systems (ETS) in 2021 (the latter as a result of its departure from the European Union’s (EU’s) ETS), and the EU ETS has reached multiple record price levels above 90 euros per ton since December 2021.13 Proposed carbon border adjustment mechanism (CBAM) policies are gaining traction in the EU and elsewhere, placing additional scrutiny on the source of power generation and emissions intensity of key industrial sectors. Additionally, the dramatic expansion of government fiscal stimulus during the COVID-19 pandemic has accelerated investments in low-carbon technologies in packages like the US Infrastructure Investment and Jobs Act, which provides more than $100 billion for climate measures, and the European Union’s 800-billion-euro recovery plan, which will put 30 percent of its funding toward combating climate change.14

Importantly, elevated NDCs have also begun to translate into transition policies in the Global South. South Africa’s November 2021 deal with the United States, United Kingdom, European Union, Germany, and France provides $8.5 billion in grants and low-interest loans to build its renewable sector, retire coal assets, and transition coal-dependent communities.15 China’s net zero by 2060 plan aims to peak emissions by 2030 through the implementation of its new ETS; investments to deploy nuclear power, renewables, electric vehicles (EVs), and automation; and research and development investments into batteries and hydrogen. The country aims to have 80 percent of its energy come from non-hydrocarbon sources by 2060.16 India’s decarbonization has focused largely on its energy sector, which is responsible for 93 percent of its carbon dioxide emissions (and three-quarters of its total greenhouse gas emissions), and it seeks to derive half of its power from non-fossil sources by 2030, which will require expanding renewable generation fivefold in that time period.17 Though representative examples, such developments point to a more rapidly evolving landscape of climate policies than that of previous years.

8 Fatih Birol, “COP26 climate pledges could help limit global warming to 1.8°C, but implementing them will be the key,” IEA, November 4, 2021, https://www.iea.org/commentaries/cop26-climate-pledges-could-help-limit-global-warming-to-1-8-c-but-implementing-them-will-be-the-key.

9 Aya Batrawy, “Saudi Arabia pledges 2060 target of net-zero emissions,” Associated Press, October 23, 2021, https://apnews.com/article/climate-business-middle-east-dubai-united-arab-emirates-1335e47922965f7db43f5e7057cf7265.

10 “How China Plans to Become Carbon-Neutral by 2060,” Bloomberg, August 10, 2021, https://www.bloomberg.com/news/ articles/2021-08-10/how-china-plans-to-become-carbon-neutral-by-2060-quicktake?sref=a9fBmPFG.

11 “Global Emissions,” Center for Climate and Energy Solutions, 2019, https://www.c2es.org/content/international-emissions/.

12 “Launch by United States, the European Union, and Partners of the Global Methane Pledge to Keep 1.5C Within Reach,” European Commission, November 2, 2021, https://ec.europa.eu/commission/presscorner/detail/en/STATEMENT_21_5766.

13 Bianca Nogrady, “China launches world’s largest carbon market: but is it ambitious enough?” Nature, July 20, 2021, https://www.nature. com/articles/d41586-021-01989-7; Susanna Twidale, “EU carbon price may hit 100 euros this year, buoyed by gas price surge,” Reuters, December 8, 2021, https://www.reuters.com/markets/commodities/eu-carbon-price-could-hit-100-euros-by-year-end-after-record-runanalysts-2021-12-08/.

14 Morgan Higman, The Infrastructure Investment and Jobs Act Will Do More to Reach 2050 Climate Targets than Those of 2030, Center for Strategic and International Studies, August 18, 2021, https://www.csis.org/analysis/infrastructure-investment-and-jobs-act-will-do-morereach-2050-climate-targets-those-2030; “Recovery plan for Europe,” European Commission, November 4, 2021, https://ec.europa.eu/info/ strategy/recovery-plan-europe_en.

15 Nicholas Kumleben, “South Africa’s Coal Deal Is a New Model for Climate Progress,” Foreign Policy, November 12, 2021, https://foreignpolicy.com/2021/11/12/coal-climate-south-africa-cop26-agreement/.

16 “How China Plans.”

17 “India’s ambitious climate goals: Why decarbonization of hard-to-abate sectors will be critical,” Economic Times Energy World, November 24, 2021, https://energy.economictimes.indiatimes.com/news/renewable/indias-ambitious-climate-goals-why-decarbonization-of-hard-toabate-sectors-will-be-critical/87895246.

Finance

In tandem with growing political momentum behind climate action, the financial sector has become a significant driver of a more rapid transition toward a net-zero pathway. This is occurring both in response to, and in anticipation of, a policy environment that promotes a transition away from carbon-intensive energy sources.

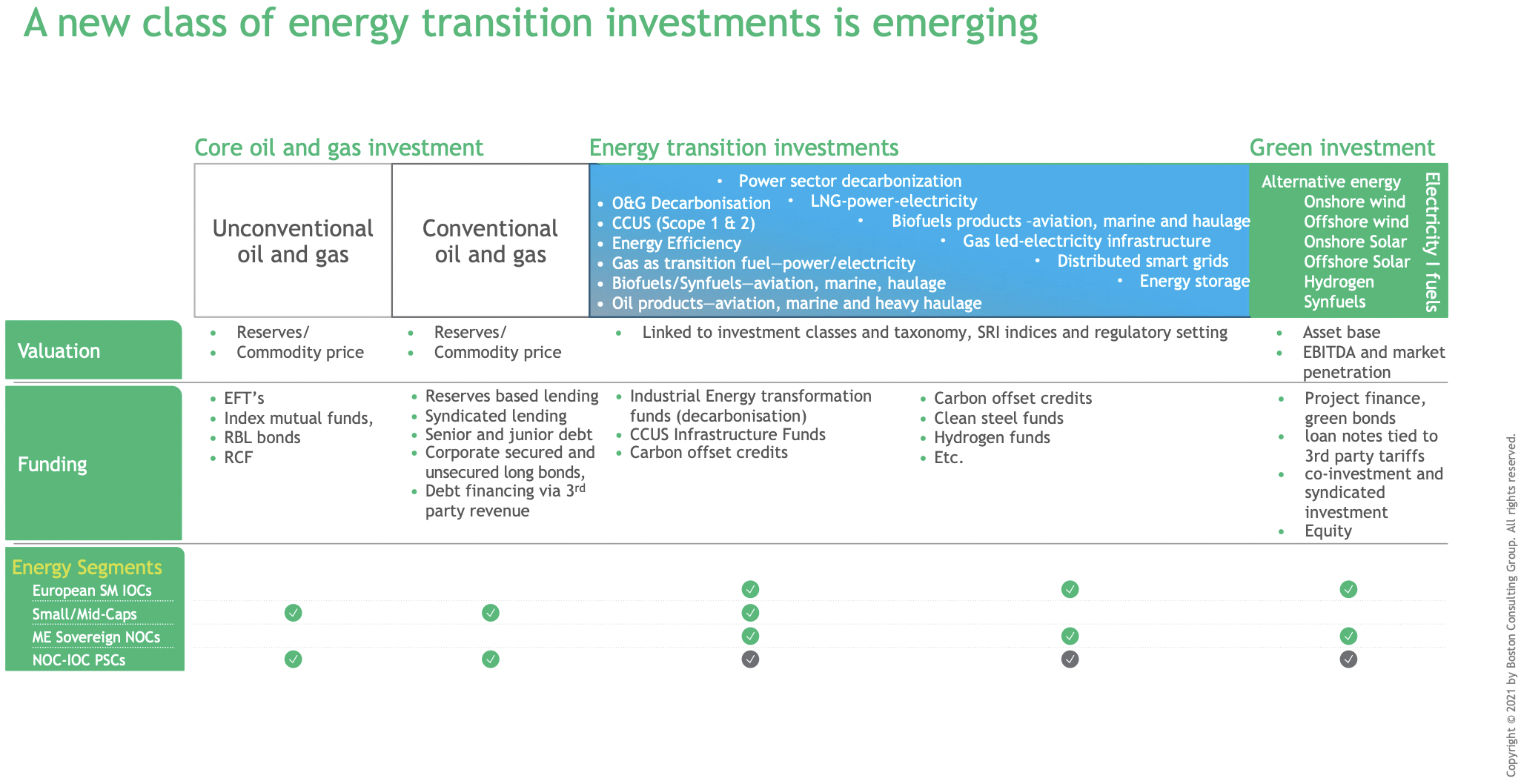

In equity markets, for example, institutional investors are now aligning their portfolios with net zero. New sources of equity are being raised, including green investment funds. In ESG-aligned investments, which already accounted for one-third of US assets under management by the end of 2020, contributions to climate action or net-zero preparedness have become the most important ESG investing factor. From January to October 2021, nearly $42 billion of ESG investments went to environmental or climate-aligned assets, versus social and governance-aligned funds, which attracted only about $18.5 billion over the same period.18 This trend is reinforced by investor expectations that oil demand will peak by 2030, and the majority of investors expect that the role of oil and gas in their portfolios will decline over the next decade. These investors—60 percent of whom report pressure from clients to divest—expect short-term returns from the industry, but doubt the long-term viability of oil and gas projects, unless companies take rapid steps to become compatible with low-carbon futures.19

Similar transitions are taking hold across debt markets. Net-zero banking commitments are increasing, notably with the rise of the Net-Zero Banking Alliance, whose ninety-two banks account for $66 trillion, more than 43 percent of banking assets worldwide.20 The four largest US retail banks, as well as investment giants Goldman Sachs and Morgan Stanley, have all committed to net-zero emissions by 2050. While some banks like JP Morgan are applying intensity-based targets to sectoral scope 1 and scope 2 emissions, others are still using absolute targets, which may prompt a delisting of the oil and gas sector, or companies overall. 21

18 Deborah Nason, “‘Sustainable investing’ is surging, accounting for 33% of total U.S. assets under management,” CNBC, December 21, 2020, https://www.cnbc.com/2020/12/21/sustainable-investing-accounts-for-33percent-of-total-us-assets-under-management.html.

19 Maurice Berns, Rebecca Fitz, Lars Holm, Jamie Webster, and Betsy Winnike, How Institutional Investors See the Future of Oil and Gas, January 6, 2022, https://www.bcg.com/en-us/publications/2022/how-investors-see-future-of-oil-gas.

20 UN Environment Programme, Net-Zero Banking Alliance Reaches Milestone with Over 90 Banks Committed, November 3, 2021, https://www.unepfi.org/news/industries/banking/net-zero-banking-alliance-reaches-milestone-with-90-banks-committed.

21 Dan Ennis, “US Bank pledges net-zero emissions by 2050, in a first among regionals,” Utility Drive, November 15, 2021, https://www.utilitydive.com/news/us-bank-pledges-net-zero-emissions-by-2050-in-a-first-among-regionals/610039/.

Corporate Activity

A growing group of large corporations are also now setting net-zero targets, covering their own scope 1 and scope 2 emissions, as well as upstream scope 3 emissions. Not only will this drive direct investment in decarbonization, but it is also creating new pressures on supply chains to decarbonize. Of the two hundred and thirty-nine firms that signed on to the Science Based Targets Initiative in 2020, 94 percent committed to reduce emissions from customers and suppliers. For many businesses, scope 3 accounts for 80 percent of their overall climate footprint.22 This has placed additional scrutiny on oil and gas companies in particular, which still account for a considerable majority of energy used in the global supply chain.

Additionally, a more climate-focused investment community has placed a spotlight on climate risk, demanding corporate disclosure of risks to profitability as a result of climate change. This is embodied by the Task Force on Climate-Related Financial Disclosures (TCFD), consisting of 32 members from across the G20, representing both preparers and users of financial disclosures.23 As corporations align with TCFD disclosures, a new focus on climate-related transition risk is emerging. This is, in turn, creating greater pressure on asset disposals, and may impact valuations of emissions-intensive assets.

The result of these developments from the policy, finance, and non-energy corporate sector (many of which have advanced considerably, or only begun to take shape, in the past year) is a mutually reinforcing growth in momentum. Policy goals and implemented climate action policies further establish the “ground rules” for a net-zero world, to which finance and non-energy companies react in an effort to avoid the possible risks of failing to meet new climate standards. Meanwhile, proactive finance and non-energy companies also now have an incentive to support stronger climate policy as a means of enabling their own climate goals.

In this way, narratives around “net zero” can quickly become self-fulfilling, suggesting that the pursuit of net-zero emissions is quickly becoming more a question of “how” than “if.”

22 Engaging The Chain: Driving Speed and Scale, CDP Worldwide, February 2022, https://www.cdp.net/en/research/global-reports/engagingthe-chain.

23 “Task Force Members,” Task Force on Climate-Related Financial Disclosures, accessed March 16, 2022, https://www.fsb-tcfd.org/ about/#task-force-members.

Pathways to Net Zero

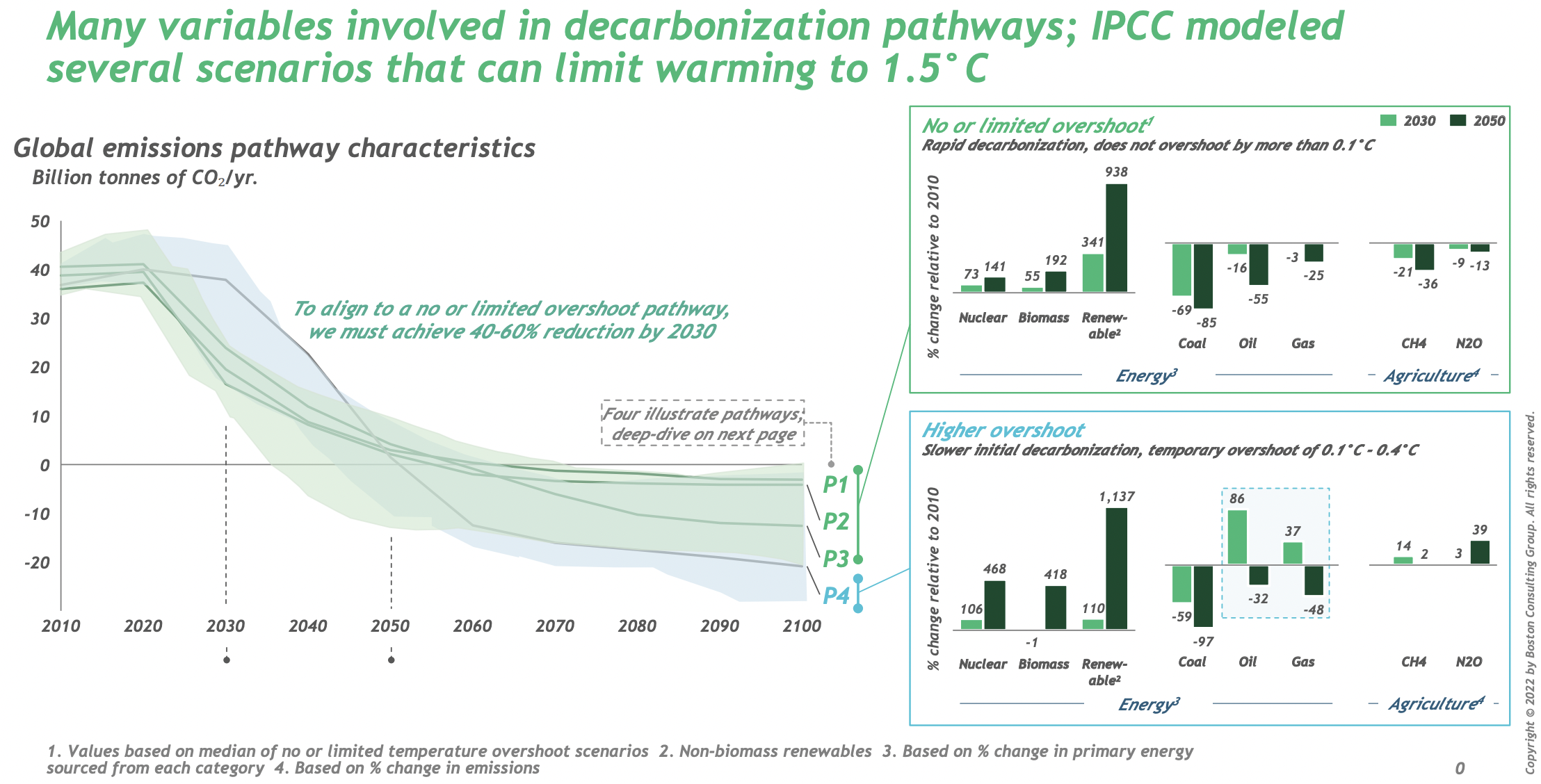

As the global community coalesces around the need to build a net-zero emissions world by 2050, the clear shift in expectations for the oil and gas industry in that world immediately raises the question of what the pathway to net zero will be, and what that will mean for the role of hydrocarbons, and especially if that role enters a terminal state. The Intergovernmental Panel on Climate Change (IPCC) fifteenth assessment (AR15) provides a strong foundation for understanding future scenarios.24 Generally, it shows a range of four pathways to stabilize warming at 1.5 degrees, with two key factors driving the potential trajectory.

- When emissions peak: These pathways range from a slower transition, with emissions peaking around 2030, to a more rapid transition starting now. In all scenarios, net-negative emissions are required in the latter half of the century, ranging from near zero to twenty gigatons (GT) per year. How significant that role is depends

- Role of oil and gas in net zero: Based on the IPCC scenarios, there is significant uncertainty, both in the pace of a shift away from oil and gas and in the consumption of oil and gas, as the scenario reaches 2050 and hydrocarbon consumption reaches a terminal decline. This makes setting milestones for that shift a particular challenge, compounded by exogenous events.25 Indeed, oil and natural gas consumption would need to significantly decline in all scenarios, but the peak could be as late as the early 2030s for oil, and the late 2040s for natural gas. Liquefied natural gas (LNG), in particular, has a longer time horizon, given its longer-term growth potential in Asia. As such, Asia is expected to account for 95 percent of global LNG demand growth between 2020 and 2022, according to Wood Mackenzie.26 Furthermore, in the long term, there may be sustained oil and gas consumption even if warming is limited to 1.5 degrees, based on the scale of CCUS and carbon-removal adoption in natural gas-consuming sectors. In sum, 1.5-degree scenario modeling by the IPCC shows a wide range of potential outcomes for the role of oil and natural gas in 2050, ranging from 3 to 27 percent of the global energy mix for oil, and 3 to 35 percent for natural gas.27

Other industry modeling shows similar trends. The BP Energy Outlook 2020 cites the gas outlook in net-zero scenarios as “more resilient than oil” due to CCUS, switching from higher-carbon fuel sources, and developing countries’ expanding use of gas. Its net-zero scenario features 5.5 GT of carbon dioxide captured by 2050, mainly in hydrogen and power production.28 Shell’s “Sky” scenario foresees fossil fuel use halved by 2070 (the scenario’s net-zero target date), with emissions managed by direct CCS. In this scenario, even coal is still used fifty years from now, albeit greatly reduced (peaking in the 2010s) and supplanted by gas, which itself peaks in 2040.29

Yet, outliers remain. A net zero by 2050 scenario published by the International Energy Agency in May 2021 was given significant attention for its call for an end to new upstream gas supply projects—in addition to those in coal and oil—in order to reach net zero by 2050.30 Similarly, the IEA’s 2021 World Energy Outlook predicts peak oil demand will occur in 2025 as net-zero initiatives gain pace.31 The IEA’s net zero by 2050 scenario does allow for investments in current oil and gas fields, but no investment at all in coal mines, existing or otherwise. In that scenario, unabated coal demand declines by 98 percent by 2050, but oil and gas by far less, with oil demand falling 75 percent to 24 million barrels per day (mbpd), and gas down only 55 percent to 1,750 bcm.32

24 IPCC, Global Warming of 1.5 ºC, 2019, https://www.ipcc.ch/sr15/.

25 KAPSARC’s Circular Carbon Economy Index provides a useful framework to measure progress in oil and gas producing countries towards achieving a “circular carbon economy,” the Kingdom of Saudi Arabia’s plan for reducing emissions while continuing to play a major role in international oil and gas markets. King Abdullah Petroleum Studies and Research Center, Circular Carbon Economy Index, June 2021 https://www.kapsarc.org/research/projects/the-circular-carbon-economy-index/.

26 Abigail Ng, “The prize for LNG sellers will be ‘significant’ as demand in Asia grows, energy consultancy says,” CNBC, May 19, 2021, https://www.cnbc.com/2021/05/20/prize-for-lng-sellers-significant-as-demand-in-asia-grows-woodmac.html.

27 IPCC, Global Warming of 1.5 °C.

28 BP, Energy Outlook: 2020 Edition, 2020, https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energyeconomics/energy-outlook/bp-energy-outlook-2020.pdf; “Sky Scenario,” Shell, accessed March 16, 2022, https://www.shell.com/energyand-innovation/the-energy-future/scenarios/shell-scenario-sky.html.

29 Ibid.

30 Nina Chestney, “End new oil, gas and coal funding to reach net zero, says IEA,” Reuters, May 18, 2021, https://www.reuters.com/business/ environment/radical-change-needed-reach-net-zero-emissions-iea-2021-05-18/.

31 IEA, World Energy Outlook 2021, 2021, https://www.iea.org/reports/world-energy-outlook-2021. 32 IEA, Net Zero by 2050.

Consequences for the Oil and Gas Industry

In short, the rules of the game have changed dramatically in the past year. The long-term role for oil and gas is less clear. Debate about whether and how “peak demand” for oil will occur has been replaced by discussion of when and where demand declines. As for gas, the discourse has shifted from its role as a transition fuel to whether it has a role in the transition at all.

Regardless of the future share of oil and gas in the global energy mix, the timeline for action has accelerated, and the stakes have increased. New pledges, as well as implementing policies—notably “green stimulus” measures during COVID—are moving forward the timing of the transition.33 A broader set of stakeholders is also now engaged, demanding accelerated action from corporations. In May 2021, for example, climate activist investment fund Engine No. 1 landed three independent directors on ExxonMobil’s board, despite holding only .02 percent of Exxon’s shares.34 Notably, financial institutions are increasingly involved, including not just equity investors, but also banks providing debt financing.

Yet, the future is not predetermined. At the same time, awareness is increasing about the uncertainty and the potential role for oil and gas companies in a net-zero world. Furthermore, the rapid advancement of technologies like hydrogen and CCUS are providing new opportunities for oil and gas companies to participate. For example, a production tax credit for hydrogen, like that proposed in Congress, could enable a $16–24-billion market in the United States by 2030.35 The pressures being placed on oil and gas companies in the form of downside risk to demand, regulatory pressures, and financial constraints are more likely to reshape the landscape of risk and opportunities in the years to come than to eliminate the industry outright.

33 Ibid.

34 Saijel Kishan, “Charlie Penner the Investor Reshaping Exxon from the Inside,” Bloomberg, December 1, 2021, https://www.bloomberg.com/ news/features/2021-12-01/charlie-penner-engine-no-1-investor-reshaping-exxon-bloomberg-50-2021?sref=a9fBmPFG.

35 “Green Hydrogen,” Next Era Energy, accessed March 16, 2022, https://www.nexteraenergy.com/company/work/green-hydrogen.html.

III. The Role of the Oil and Gas industry in Navigating the Transition

The Role of the Oil and Gas industry in Navigating the Transition

Despite the uncertainty around the exact end state for oil and gas as the world transitions toward lower-carbon energy, current climate modeling generally implies that the transition will be smooth, whether on track for meeting Paris Agreement targets or not. This belies multiple underlying risks and potential for volatility in the transition to net zero. How the oil and gas industry manages these risks will shape both its future outcomes and the broader social, economic, and geopolitical impacts from the transition to net zero, and the industry will be critical to the success of the transition overall.

Stranded Assets

One clear and well-articulated risk is that of stranded oil and gas assets, which has been raised by climate activists and an increasingly wide range of investors. According to a February 2020 estimate from the Financial Times, approximately $900 billion of value in projects and resources would be lost if governments more aggressively squeezed out fossil fuel production and consumption to limit climate change to 1.5 degrees Celsius.36 Given the need for oil and gas consumption to decline over the longterm, it is incumbent on all companies to articulate either how they anticipate ramping down oil and gas production or why they are competitively advantaged in maintaining production, and gaining share as a result. Four fundamental strategies will be critical to avoiding stranded assets while maintaining market share.

- Low cost: High variability in global lifting of costs for oil and for gas production will advantage low-cost producers as the market begins to decline, potentially squeezing higher-cost producers out of the market entirely unless the former cut production or the latter cut costs themselves. Data from Rystad Energy suggest that the cost of new oil production can range from an average $32-per-barrel breakeven price for onshore Middle East sources to $54 for Russian onshore and $55 for oil sands-derived production.37 In the IEA’s net-zero scenario, global oil prices will fall to $35 per barrel by 2030, before slipping further to $25 by 2050.38 While the exact price outlook for oil and gas is uncertain in the energy transition, positioning on the left of the supply curve by reducing costs of production will be critical for ensuring long-term viability for any producer.

- Short-cycle investments: Flexibility in deploying capital over time will be critical to companies’ taking advantage of short-term market opportunities without locking in longer-cycle return capital investments, either through mature basins where incremental uplift in production is possible and relatively inexpensive, or through shale resources. This will present a challenge for more frontier basins and deepwater, which have higher capital expenditure and, thus, are longer-cycle projects

- Low emissions intensity: Generally, lower emissions intensity corresponds with lower lifting costs, given that energy intensity is a driver of both cost and emissions. However, assets where emissions intensity is already low, or can be managed down in a cost-effective way, will be advantaged. And, particularly as policy increasingly favors—and perhaps prices in— low-carbon energy resources, the viability of low-emissions-intensity assets will increase visà-vis higher-carbon assets.

- Focus on value chain integration: Upstream production linked with export markets and downstream value chains will also be advantaged in the transition, as integrated producers will be able to manage costs more effectively. This includes gas production linked to existing LNG liquefaction capacity, refineries configured to specific crude slates, and other export-oriented pipeline infrastructure.

36 Alan Livsey, “Lex in depth: the $900bn cost of ‘stranded energy assets,’” Financial Times, February 4, 2020, https://www.ft.com/content/95efca74-4299-11ea-a43a-c4b328d9061c.

37 “As falling costs make new oil cheaper to produce, climate policies may fail unless they target demand,” Rystad Energy, November 17, 2021, https://www.rystadenergy.com/newsevents/news/press-releases/as-falling-costs-make-new-oil-cheaper-to-produce-climate-policies-mayfail-unless-they-target-demand/.

38 IEA, Net Zero by 2050.

Stable Supply

Opposite to the stranded assets risk is the risk of undersupply of oil and gas as investment shifts away from the sector faster than demand shifts away. While the IEA has indicated that no additional investment in new fields is required in a netzero scenario, further investment is required to sustain production in currently producing fields. The IEA notes that production from existing fields will decline by 8 percent each year absent any new investment, a supply decline that significantly outpaces any likely demand scenario.39 Furthermore, additional investment is required in LNG production to supply growing demand, particularly in Asia: Morgan Stanley expects total LNG demand to rise 25–50 percent by 2030.40 Articulating a clear strategy to avoid stranded assets will be foundational to this, but multiple additional steps will be critical to mobilize capital to finance stable supply. In short, the industry needs to secure its “license to invest” (and importantly, re-invest) through these interrelated steps.

- Maintaining investor trust through commodity cycles: In past commodity cycles, oil and gas operators have responded by quickly ramping production, leading to a boom-bust cycle. US shale production has particularly contributed to this rapid flexing of supply. From a 2014 high of nearly two thousand shale rigs in operations in the United States, there were fewer than five hundred by 2016, recovering to more than one thousand in 2018–2019, before falling lower than four hundred in 2020. More than fifty North American shale companies went bankrupt in the first half of 2016, following a fall in oil prices.41 With the current price increase, producers will need to demonstrate commitment not to overextend investment in oil and gas, and to continue their transition toward lower-carbon technologies.

- Clarifying the role of gas and LNG: Oil and gas are often lumped together, but there are distinct roles for each in future climate pathways. For natural gas and LNG, in particular, not only is there room for growth in net-zero aligned pathways, but there are opportunities to decarbonize gas infrastructure through the deployment of CCUS, hydrogen, and biomethane. Burning natural gas produces half of the carbon emissions of coal and one-third those of petroleum, and the IEA estimates that coal-to-gas switching has reduced emissions by five hundred million metric tons between 2010 and 2019.42 Of course, the gas emissions advantage depends heavily upon upstream stewardship of methane emissions, and upon the efficiency of use downstream. Still, this differs from oil, which has fewer options for decarbonization and is at greater risk of displacement through transport electrification, biofuels, hydrogen, and circular economy (for plastics).

- Identifying future oil supply/demand imbalances, geographically and across the barrel: A transition away from oil will not be consistent around the world or across different products. Asian and other emerging markets’ demand will remain robust for longer. The IEA’s March 2021 oil market report forecasts that global demand in 2026 will grow 4.4 mbpd from 2019 levels, solely on the strength of economic growthbased demand in emerging and developing markets, which will also likely be more durable than demand in established markets.43 Also, different oil products are likely to transition at different times; jet kerosene and petrochemical uses are likely to be slower transitions than those for gasoline. Defining how investment will play in these specific markets will be key.

39 IEA, The Oil and Gas Industry in Energy Transitions, 2020, https://www.iea.org/reports/the-oil-and-gas-industry-in-energy-transitions.

40 Jessica Jaganathan, “LNG demand to rise 25-50% by 2030, fastest growing hydrocarbon – Morgan Stanley,” Reuters, October 25, 2021, https://www.reuters.com/article/asia-lng/lng-demand-to-rise-25-50-by-2030-fastest-growing-hydrocarbon-morgan-stanleyidUKL1N2RL0KO.

41 Derek Brower, “Boom to bust in the US shale heartlands,” Financial Times, May 22, 2020, https://www.ft.com/content/0d84c47d-4b93- 43a9-948e-c0340acff97c.

42 “Natural Gas,” C2ES, accessed March 16, 2022, https://www.c2es.org/content/natural-gas; IEA, The Role of Gas in Today’s Energy Transitions, 2019, https://www.iea.org/reports/the-role-of-gas-in-todays-energy-transitions.

43 IEA, Oil 2021, March 2021 https://www.iea.org/reports/oil-2021.

Decarbonizing or Decommissioning High Emissions-Intensity Assets

In total, embedded scope 1 and scope 2 emissions associated with the production and processing of oil and gas represent about 20 percent of total lifecycle emissions. Within that average, however, there is a wide range of emissions intensities across oil and gas production depending on the asset; for example, just in the US upstream, GHG emissions intensity can range from less than two kilograms (kg) to close to fifty kilograms of carbon dioxide (CO2) per barrel of oil equivalent (BOE).44 As many of the oil majors have set scope 1 and scope 2 emissions targets, they are now disposing of high emissions-intensity assets through sales. According to data from BloombergNEF, large oil companies sold nearly $200 billion worth of fossil assets between 2015 and 2020, but often to private owners who will continue to operate them.45 Evidence is already mounting that this is occurring in the United States, as many of the highest emissions-intensity sources of production are now owned by private companies; the World Economic Forum estimates that $100 billion in high-emitting assets were sold by oil and gas majors in 2021, mainly to private equity at bargain prices.46 Private equity is estimated to have invested $1.1 trillion into the energy sector since 2010, only 12 percent of which went into renewables.47 Thus, a key challenge for the industry is to ensure that emissions intensity is reduced, or that assets are decommissioned rather than simply sold to insulated corporations. Multiple strategies can help to achieve this.

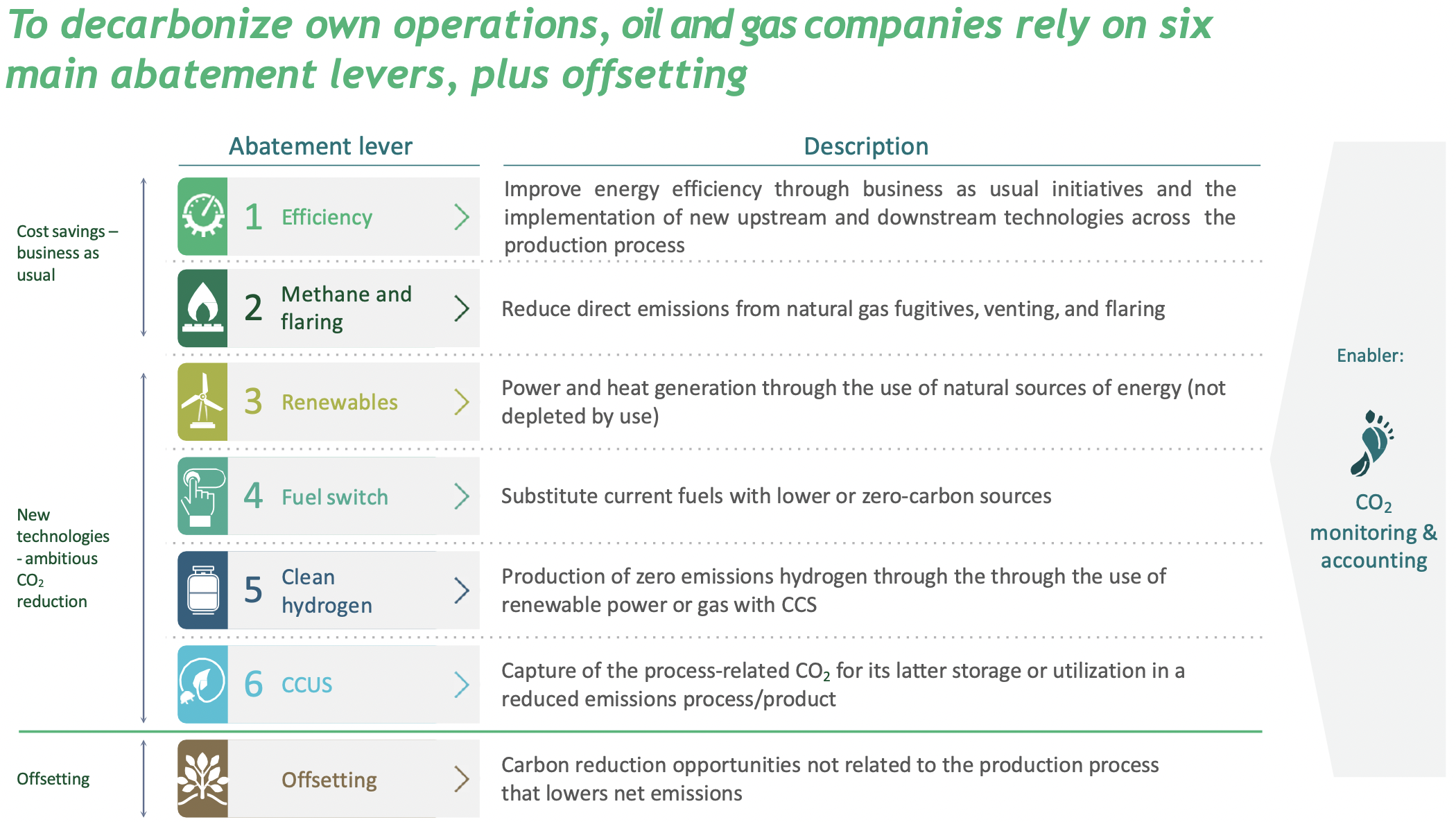

Grey-to-green transformations: Companies and investors should outline value creation approaches for either reducing the emissions intensity of assets or using those assets for low-carbon growth, as an attractive alternative to asset divestment for investors.48 Incorporating even a modest shadow or internal cost of carbon is one way to start, which many oil and gas companies now do. Equinor was able to reduce the carbon footprint of its offshore John Sverdup field by connecting it to the grid to electrify its operations, and that upstream electrification for most producers would cost $10/tonnes of carbon dioxide equivalent (tCO2e), depending on local electricity costs.49 Meanwhile, reducing fugitive methane emissions in gas can be done at relatively low costs of less than $25/tCO2e, given that captured gas can be remonetized to recoup the costs.50 According to the IEA, more than half of annual global methane emissions could be abated for a net profit.51

Not only does emissions intensity vary greatly across upstream production, but so do the cost and complexity of reducing emissions intensity. High emissions intensity that can be addressed by methane abatement or electrification of oilfield operations is comparatively advantaged to that requiring more costly decarbonization investments, such as hydrogen. Even across CCUS projects, costs are highly variable, with carbon capture in high-concentration streams from natural gas processing often costing less than $20 per ton, whereas low-concentration post-combustion capture costs are still closer to $100 per ton.52 Additionally, some assets will be competitively advantaged as anchors for broader low-carbon development; for example, natural gas processing or refineries as anchors for the development of CCUS hubs. One example is the Oil and Gas Climate Initiative’s Clean Gas Project, which partners BP, Eni, Equinor, Occidental, Shell, and TotalEnergies in a full supply chain CCUS plant in northern England.53 Still, investors will need to value asset decarbonization where the alternative is sale to private companies that are relatively insulated from investor and public pressure.

Common industry standards: For some assets that are high emitting and late life, there is not a clear business case for additional investment in decarbonization. For these types of assets, decommissioning is the more sensible option. There are not yet any consistent standards for these types of assets, though, and there is a general collective action challenge with decommissioning them, especially for managing end-of-life liabilities. Brad Handler and Morgan Bazilian at the Payne Institute for Public Policy suggest governments should look into “carbon retirement portfolios” that would allow investors to buy high-carbon assets with an eye toward retiring them, with a “carbon avoidance bonus” that would price each ton of CO2e avoided.54

Role of private capital: As with industry operating standards, there are not yet any common standards for investors to judge or recognize whether investments are continuing to extend the life of high-emitting assets. With net-zero ambitions now being translated into action, a more immediate need is for common standards to judge whether capital flows are helping to maintain high emissions-intensive assets, or simply burning through those assets for short-term profits (and exacerbating natural declines in the process). Fourteen countries plus the European Union have in place, or are developing, green or transition taxonomies, but that is just a start; further clarity will be needed to proactively guide investors.55

Between each of these elements is the complex nature of what the investment community considers “private capital,” given that it is frequently referenced in comparison to public international oil majors but can comprise both private equity or family money, as well as state-backed oil and gas production. The available pressure points to influence either are different, and should be highlighted. True private equity frequently requires debt support from state or multilateral institutions in their acquisitions, suggesting that the institutional investment community could serve as a valuable check on the risks of private acquisition discussed above. On the other hand, state-backed investment will likely require diplomatic levers to prevent “dirty” oil and gas production, such as the Net-Zero Producers Forum announced by the United States, Canada, Qatar, Norway, and Saudi Arabia.

44 Robert LaCount, Tom Curry, Luke Hellgren, and Pye Russell, Benchmarking Methane and Other GHG Emissions, Clean Air Task Force, June 2021, https://www.catf.us/wp-content/uploads/2021/06/OilandGas_BenchmarkingReport_FINAL.pdf.

45 The Bloomberg editorial board piece calls this “climate arbitrage.” “What to do with the Dirty Stuff,” Bloomberg, October 27, 2021, https://www.bloomberg.com/opinion/articles/2021-10-07/oil-and-gas-asset-sales-amount-to-climate-arbitrage?sref=a9fBmPFG.

46 “Private Equity: The New Home for High-Emitting Assets?” World Economic Forum, September 20, 2021, https://www.weforum.org/events/ sustainable-development-impact-summit-2021/sessions/private-equity-the-new-home-for-high-emitting-assets.

47 Hiroko Tabuchi, “Private Equity Firms Funds, Sensing Profit in Tumult are Propping Up Oil,” New York Times, October 13, 2021, https://www.nytimes.com/2021/10/13/climate/private-equity-funds-oil-gas-fossil-fuels.html.

48 Rich Hutchinson, Vinay Shandal, Judith Wallenstein, Mark Wiseman, David Young, and Kilian Berz, “Six Steps to a Sustainability Transformation,” BCG, August 31, 2021, https://www.bcg.com/publications/2021/steps-to-a-sustainability-transformation.

49 “Power cable being installed at Johan Sverdrup makes field best in class for CO2 emissions,” Equinor, May 14, 2018, https://www.equinor.com/en/news/14may2018-power-cable-johan-sverdrup.html.

50 Chantal Beck, Sahar Rashidbeigi, Occo Roelofsen, and Eveline Speelman, “The future is now: How oil and gas companies can decarbonise,” OGV Energy, April 4, 2020, https://ogv.energy/news-item/the-future-is-now-how-oil-and-gas-companies-can-decarbonise.

51 IEA, Global methane abatement cost curve, by policy option, November 2, 2021, https://www.iea.org/data-and-statistics/charts/globalmethane-abatement-cost-curve-by-policy-option.

52 Alex Dewar and Bas Sudmeijer, “The Business Case for Carbon Capture,” BCG, September 24, 2019, https://www.bcg.com/ publications/2019/business-case-carbon-capture.

53 “OGCI Climate Investments announces progression of the UK’s first commercial full-chain Carbon Capture, Utilization and Storage Project,” Oil and Gas Climate Initiative, November 28, 2019, https://www.ogci.com/climate-investments-announces-progression-of-the-uks-firstcommercial-full-chain-carbon-capture-utilization-and-storage-project/.

54 Brad Handler and Morgan Bazilian, “Decommissioning coal, oil, gas: how funds can buy and retire the assets,” Energy Post, September 7, 2021, https://energypost.eu/decommissioning-coal-oil-gas-how-funds-can-buy-and-retire-the-assets/.

Global Development

Energy access is central to human development, as recognized in the United Nations (UN) Sustainable Development Goals. Globally, 759 million people lacked access to electricity in 2019, according to the World Bank, and 2.6 billion—one-third of the global population—lacked access to clean cooking.56 Gas, in particular, can play a key role in reducing energy poverty and, when it displaces diesel generators, can have an immediate local air quality and climate impact. However, renewables combined with battery storage are increasingly the cheaper option in many geographies, and are more future proof in a net-zero world.

Furthermore, the oil and gas industry is a critical source of trade and foreign direct investment for many developing countries. Nigeria’s overall foreign investment fell by more than half—from $1.91 billion to $875.62 million—from the first to second quarter in 2021, driven largely by oil after Shell decided to divest from the high-cost, high-emissions fields of the Niger Delta.57 Thus, a disruptive and unmanaged transition away from oil and gas presents some risk to global development. A previous Atlantic Council study establishes an Oil Market Transition Resilience Index that forecasts a decline in market share for a group of “fragile and failing” countries—including Nigeria, Venezuela, Angola, and Libya—to established Gulf, North American, and Russian producers as the energy transition continues.58 At the same time, multiple studies have indicated that it is the world’s poorest who are the most at risk from the impacts of climate change. A climate change index from German insurer Munich Re shows a strong correlation between the rate of casualties and property damage from extreme weather events and a country’s GDP per capita.59 So, to balance the need for taking rapid action to reduce emissions while also maintaining a stable transition, the oil and gas industry can take several steps.

- Development-aligned oil and gas investment: The first task of the industry is to more clearly define how and where sustained investment in oil and gas actually contributes to global development. There can be major differences in economic multipliers depending on the asset type (e.g., export-oriented crude vs. localized value chains). Some oil and gas firms have adopted the International Council on Mining and Metals’ “Mining: Partnerships for Development” (MPD) toolkit. In 2013, BG, a Financial Times Stock Exchange 100 (FTSE100) gas exploration and production company conducted a lifecycle analysis based on the MPD toolkit to assess how development of Tanzania’s offshore gas reserves for the LNG market could contribute to the country’s employment, exports, government revenues, and GDP, presenting the findings to the government.60 Greater effort by the industry to clarify and assess the development value of oil and gas investment activity will be a strong start.

- Energy access: Focusing on investment that is most clearly aligned with enabling localized energy access is a critical step for aligning oil and gas investment with development objectives to reduce energy poverty. Promoting investment in localized natural gas power generation is one step that has been deployed previously. For example, Eni has long been a major investor in projects aimed at building energy access across the African continent associated with its upstream investment.61 A study from the Energy for Growth Hub found that if sub-Saharan Africa—with its population of one billion people—tripled its energy use and got 100 percent of its power from natural gas, it would only increase global emissions by 0.62 percent, less of a contribution than the US state of Louisiana.62 Still, with renewable energy prices continuing to fall, the role of oil and gas in expanding energy access will continue to shrink. It will be constrained to the short and medium terms, and to those contexts in which renewable energy is uncompetitive or unviable (a rapidly narrowing set of contexts).

- Transition pathways for developing countries: Developing countries already producing oil and gas will be particularly at risk from the economic dislocation resulting from a decline in oil demand. In these countries, it will be critical for the industry to identify how to transition to a lower-carbon-intensity pathway. This should include both clear planning around economic diversification in preparation for potential declines in oil production and rents, and proactive investment in the decarbonization of oil and gas activities. In some cases, it can include both, such as the use of existing oil and gas assets to promote the development of low-carbon infrastructure. This is the logic behind the Oil and Gas Climate Initiative (OGCI) CCUS Kickstarter initiative, which is intended to promote the development of CCUS hubs anchored in the oil and gas industry.63

56 “Report: Universal Access to Sustainable Energy Will Remain Elusive Without Addressing Inequalities,” World Bank, June 7, 2021, https://www.worldbank.org/en/news/press-release/2021/06/07/report-universal-access-to-sustainable-energy-will-remain-elusive-withoutaddressing-inequalities.

57 “End of oil bonanza casts shadow on Nigeria’s FDI appeal,” FDI Intelligence, November 1, 2021, https://www.fdiintelligence.com/ article/80303.

58 Robert J. Johnston, Shifting Gears: Geopolitics of the Global Energy Transition, Atlantic Council, June 2021, https://www.atlanticcouncil.org/wp-content/uploads/2021/06/Final-Shifting_Gears_Geopolitics-of-the-Global-Energy-Transition.pdf.

59 Gero Rueter, “Climate change hit poorest countries hardest in 2019,” DW, January 25, 2021, https://www.dw.com/en/climate-change-hitpoorest-countries-hardest-in-2019/a-56334708.

60 Kathryn McPhail, “Enhancing Sustainable Development from Oil, Gas, and Mining” in Extractive Industries: The Management of Resources as a Driver of Sustainable Development, Tony Addison and Alan Roe (London: Oxford University Press, 2018).

61 Pasquale Salzano, Eni at the Heart of Africa’s Development, European Centre for Development Policy Management, February 2013, https://ecdpm.org/great-insights/growth-to-transformation-role-extractive-sector/eni-heart-of-africas-development/.

62 Todd Moss and Jacob Kincer, “What Happens to Global Emissions If Africa Triples Down On Natural Gas For Power?” Energy For Growth Hub, August 7, 2020.

63 “CCUS hubs,” Oil and Gas Climate Initiative, accessed March 16, 2022, https://www.ogci.com/action-and-engagement/removing-carbondioxide-ccus/our-kickstarter-hubs/.

Geopolitical Stability

Along with the development challenges posed by a disruptive transition, there are also myriad geopolitical risks associated with a volatile and rapid transition away from oil and gas, driven by the reshaping of energy supply and security. Oil price volatility is, of course, always a risk to petrostates, but the transition to net zero presents a range of additional, deeper risks to geopolitical stability. In addition to the role of oil and gas resources and supply chains in geopolitical tension, and relationships shifting as the energy system reduces reliance on those resources, competition between petrostates for remaining market share may introduce new geopolitical opportunities and fault lines. The transition will produce winners and losers; proactively managing these risks through a number of steps will be essential to mitigate impact on oil and gas producing countries that see revenue declines and subsequent instability.64 Options include:

- Sovereign wealth and a bridge to the energy transition: For petrostates with material sovereign wealth, the energy transition is an opportunity. Saudi Arabia launched a $10.4-billion Middle East Green Initiative to fund regional clean energy projects, and the kingdom’s sovereign wealth fund is planning a green bond issue.65 While diversification has traditionally been the focus of sovereign wealth investment, the energy transition presents a new set of opportunities. Cementing an early leadership position in the hydrogen economy, low-carbon technologies, and decarbonizing supply chains can both reduce risk from the transition and capture emerging margin pools. Sovereign wealth funds in 2020 made $2.3 billion worth of climate-mitigating investments—double the $1.1 billion invested in 2019—according to the International Forum of Sovereign Wealth Funds.66

- Transition assistance for revenue-dependent petrostates: A greater challenge will be for governments that lack the ability to invest in a transition or diversification. These governments face a fundamental challenge of diversification, which is not new. South Sudan, for example, derives more than 70 percent of its revenue from petroleum, and its GDP per capita is only $700.67 But, if not approached with appropriate development assistance and diplomatic engagement, the result could be greater geopolitical instability.

- National oil company (NOC) transition enablement: Regardless of the fiscal status of any oil-producing state, NOCs will have a specific set of challenges while managing the transition. Given their largely similar focus and inherent lack of diversification, as well as the outsized role many play in maintaining employment and economic opportunities, specific consideration must be given to enabling their participation in the transition. Self-funded NOCs are more likely to have wider latitude, especially in leveraging cash-flow generation and not relying nearly as much on ESG-focused capital markets, but NOCs that rely on external financing and technical support may be especially challenged. Norway’s Equinor is an example of a diversified NOC, reporting that $1.34 billion of its $2.66-billion after-tax earnings came from its renewables division in the first quarter of 2021. The Norwegian government is Equinor’s majority shareholder.68

Each of these risks in the energy transition will need to be managed by policymakers, investors, and companies across the supply chain. Any strategy that turns a blind eye to one or several of these challenges—whether disregarding the challenge of stranded assets, the need for continued stable supply (even if reduced), the geopolitical implications of the transition, or the risk that misplaced incentives actually extend the life of high carbon-intensity assets—will be ineffective at best, and disastrous at worst. Particularly in the short and medium terms, oil and gas will continue to play a role in the energy system, international development, and geopolitics, and managing that role to minimize the above risks will be a far more effective path forward than rejecting it. To that end, major oil and gas companies can and must take steps to become compatible with the energy transition and ensure that the path to net zero is as smooth as possible.

64 Robert Johnston, “Shifting Gears: The Geopolitics of the Energy Transition”, Atlantic Council, June 2021. https://www.atlanticcouncil.org/ in-depth-research-reports/report/shifting-gears-geopolitics-of-the-global-energy-transition/.

65 Saeed Azhar and Yousef Saba, “Saudi Arabia outlines plans under Mideast Green Initiative,” Reuters, October 25, 2021, https://www.reuters. com/business/cop/mideast-green-initiative-invest-104-bln-says-saudi-crown-prince-2021-10-25/; Vivien Nereim and Matthew Martin, “Wealth-Fund of Oil Rich Saudi Arabia Plans Green Debt ‘Soon,’” Bloomberg, September 21, 2021, https://www.bloomberg.com/news/ articles/2021-09-21/saudi-wealth-fund-plans-green-bond-works-with-blackrock-on-esg?sref=a9fBmPFG.

66 Alastair Marsh “Sovereign Wealth Funds Invest in Climate Technology, Renewables,” Bloomberg, May 11, 2021, https://www.bloomberg.com/news/articles/2021-05-11/sovereign-wealth-funds-invest-in-climate-technology-renewables?sref=a9fBmPFG.

67 Michael J. Coren, “Climate action is poised to punch a $9 trillion hole in petrostates’ budgets,” Quartz, February 10, 2021, https://qz.com/1970294/economies-reliant-on-oil-will-lose-trillions-to-climate-action/; “South Sudan GDP per capita,” Trading Economics, accessed March 16, 2022, https://tradingeconomics.com/south-sudan/gdp-per-capita.

68 Robert Rapier, “Equinor Blazes A Renewable Path, But Can Other Oil Companies Follow?” Forbes, May 7, 2021, https://www.forbes.com/ sites/rrapier/2021/05/07/equinor-blazes-a-renewable-path-but-can-other-oil-companies-follow/?sh=d3e64dfc5012.

IV. Company Capabilities and Decision Pathways

Company Capabilities and Decision Pathways

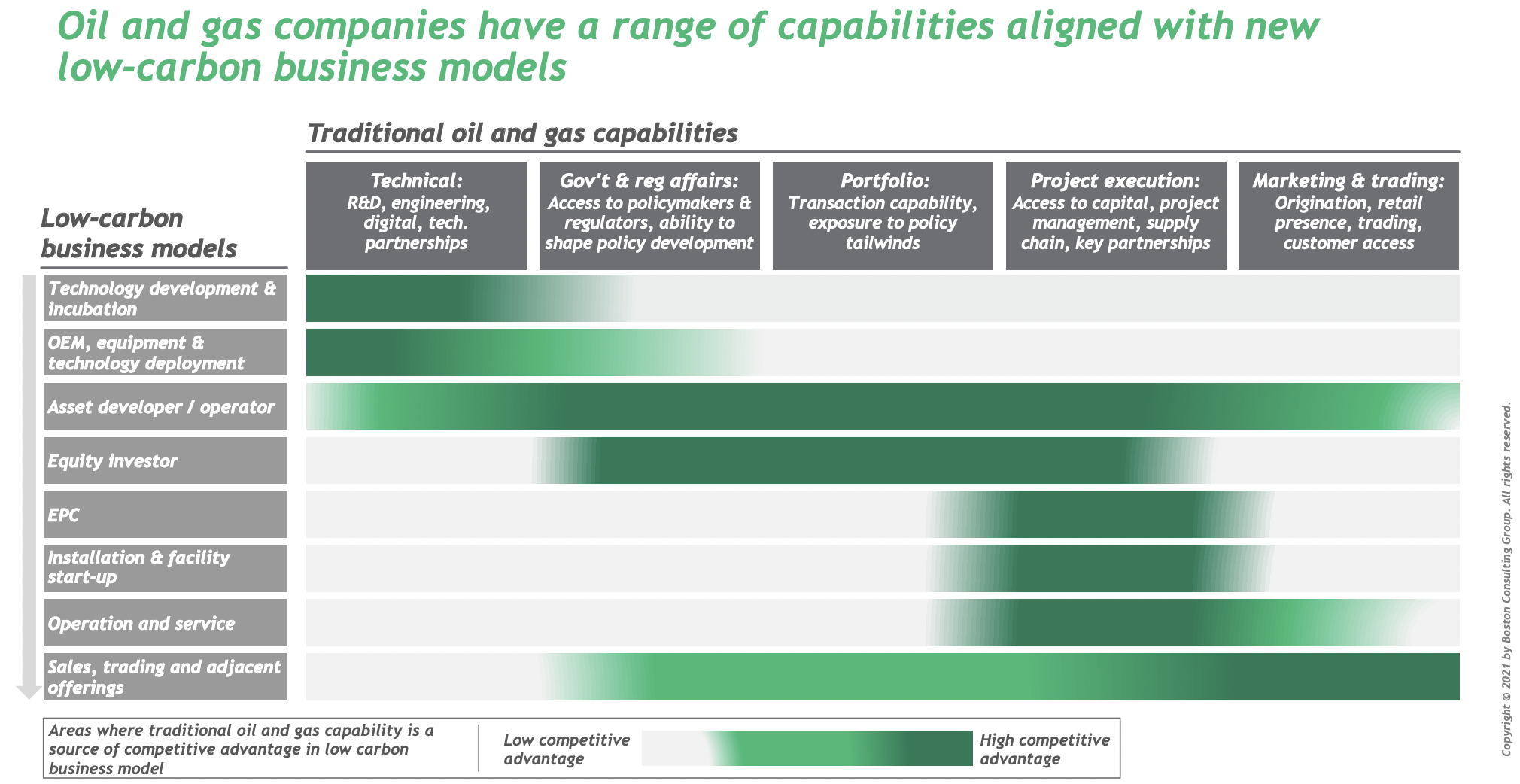

The risks and opportunities emerging from a net-zero future shape the available pathways for oil and gas companies to pursue, survive, and enable a more climatefocused (though still energy-hungry) world. A key principle here, however, is the plurality of pathways for oil and gas companies to pursue. Indeed, while the changing landscape of finance and policy has introduced significant constraints to the traditional operations of oil and gas companies, room remains within those boundary lines for companies to leverage unique capabilities, geographic advantages, and policy environments to carve out a role within a net-zero future.

Emissions Management

A foundation of any net-zero pathway is a quick and material response to managing down current emissions in the production of energy, starting with scope 1 and scope 2 emissions in the oil and gas sector. Momentum has rapidly accelerated on this within the industry, with the first scope 1 and scope 2 operations goals set in 2017 by Shell, followed by the first holistic net-zero (scope 1 through 3) goals coming in 2019 from Repsol.69 The momentum has also widened, having started with European companies, but now bridging nearly all leading international oil companies (IOCs) and NOCs.

However, several notable divisions remain across the industry. These divisions are notably geographic in nature, reinforcing how significant policy is in driving commitments to reduce emissions in anticipation of a net-zero world. However, these divisions also characterize the variance in how oil and gas companies are able—or perhaps willing—to adjust their operations in an immediate response to accelerating ambitions for a net-zero world, which is a useful point of reference, especially as other drivers grow in importance.

For example, as a group, European IOCs have largely aligned on net-zero operations. All of the European majors and integrated operators have now set netzero 2050 targets for scope 1 and scope 2 operations. Also, they all have now set interim targets as well, based on emissions intensity, ranging from 15 to 50 percent emissions-intensity reductions by 2030.70 These targets are already being translated into action, contributing to notable divestments of high emissions-intensity assets, as well as additional capital allocation to asset decarbonization; for example, BP sold all of its assets from the US state of Alaska in 2019—worth about $5.6 billion— wiping one-sixth of its 2019 emissions from its carbon account, while Shell divested $8.5 billion of its Canadian oil sands assets—a source of fuel with a highly carbon-intensive extraction process—in 2017 amid a bid to reduce the firm’s operating emissions.71

While slower to announce scope 1 and scope 2 emissions-reduction targets, US operators have largely set emissions-intensity goals over the past two years. This has been led by the US majors ExxonMobil and Chevron, which have now both pledged to achieve net-zero scope 1 and scope 2 emissions by 2050.72 Leading US independents are also now setting similar targets, namely Occidental, ConocoPhillips, and EOG, which also have portfolio-wide, or at least basin-level, net-zero emissions targets and interim emissions-intensity goals.73 Beyond that group, there is a much broader set of US independents that have largely set shorter-term emissions-intensity goals, such as Devon Energy, which is targeting a 50-percent reduction in scope 1 and scope 2 total GHG emissions intensity and a 65-percent decline in methane intensity by 2030; and Pioneer Natural Resources, which likewise plans to reduce total GHG intensity by 50 percent and methane intensity by 75 percent by 2030.74

NOCs, for their part, are also now setting net-zero standards. While slower initially to set scope 1 and scope 2 emissions targets, NOCs have begun to move quickly. Saudi Aramco pledged in October 2021 to achieve net-zero scope 1 and scope 2 emissions by 2050.75 Net-zero operations targets from Petronas, Lukoil, and the Chinese NOCs have also followed.76

A more contentious topic is that of setting scope 3 emissions targets. For companies with significant upstream and downstream operations, extending momentum behind scope 1 and scope 2 emissions reduction to scope 3 will be essential to compatibility with the energy transition. (Without debating the challenges of scope 3 emissions accounting, this is likely a larger issue for companies with a significant downstream business than pure-play upstream companies.) So far, only Repsol, Shell, Equinor, and Eni have set full scope 3 net-zero targets, but with varying degrees of specificity on what that will entail.77 Meanwhile, TotalEnergies and BP have set 60- and 50-percent scope emissions-intensity-reduction targets by 2050, respectively.78 A central question across all of these targets is whether and when oil and gas production will be managed down, which does not necessarily align with net-zero ambitions. For example, BP and Eni have provided a high degree of specificity on this, despite having divergent overarching scope 3 goals. BP has pledged to reduce hydrocarbon production by 40 percent and increase renewable output by a factor of twenty by 2030, while Eni plans to phase out oil production in 2025.79

Indeed, the future sources of hydrocarbon demand will likely have some effect on the nature of scope 3 emissions, and will likewise be shaped by industry efforts to limit those emissions. For instance, oil producers may switch the direction of their crude sales toward petrochemical refining, rather than transportation. The latter, in this case, has a significantly more complex scope 3 emissions profile, which suggests that shifting export flows toward petrochemicals could significantly limit (if not eliminate) exposure to scope 3 emissions. Such a change would likely emerge over time regardless, as hydrocarbon demands evolve in response to the deployment of clean energy technologies. But, companies could also look to pre-emptively shift toward less scope 3-exposed demand industries, as some oil and gas companies such as Saudi Aramco are already demonstrating.

69 “Management Day 2017: Shell updates company strategy and financial outlook, and outlines net carbon footprint ambition,” Shell plc, November 28, 2017, https://www.shell.com/media/news-and-media-releases/2017/management-day-2017-shell-updates-company-strategy. html; “Repsol will be a net zero emissions company by 2050,” Repsol, March 12, 2019, https://www.repsol.com/en/press-room/pressreleases/2019/repsol-will-be-a-net-zero-emissions-company-by-2050/index.cshtml.

70 “European Oil Majors Maintain Lead in Energy Transition Plans,” Fitch Ratings, November 8, 2021, https://www.fitchratings.com/research/ corporate-finance/european-oil-majors-maintain-lead-in-energy-transition-plans-08-11-2021.

71 Rachel Adams-Heard, “What happens when an oil giant walks away,” Bloomberg, April 15, 2021, https://www.bloomberg.com/ graphics/2021-tracking-carbon-emissions-BP-hilcorp/?sref=a9fBmPFG; Karolin Schaps, “Shell sells Canadian oil sands, ties bonuses to emissions cuts,” Reuters, March 9, 2017, https://www.reuters.com/article/us-shell-divestiture-cdn-natural-rsc/shell-sells-canadian-oil-sandsties-bonuses-to%E2%80%9Demissions-cuts-idUSKBN16G0PH.

72 “Lower carbon intensity of our operations,” Chevron, accessed March 16, 2022, https://www.chevron.com/sustainability/environment/ lowering-carbon-intensity.

73 “Occidental Petroleum sets low-carbon business targets for CEO’s bonus,” Reuters, March 26, 2021, https://www.reuters.com/article/usoccidental-pay-proxy/occidental-petroleum-sets-low-carbon-business-targets-for-ceos-bonus-idUSKBN2BI36W; “Emissions Reduction Targets,” Conoco Phillips, accessed March 16, 2022, https://www.conocophillips.com/sustainability/managing-climate-related-risks/metricstargets/ghg-target/.

74 “Devon Energy Establishes New Environmental Performance Targets Including Net Zero GHG Emissions,” Devon Energy Corporation, accessed March 16, 2022, https://investors.devonenergy.com/investors/press-releases/press-release-details/2021/Devon-EnergyEstablishes-New-Environmental-Performance-Targets-Including-Net-Zero-GHG-Emissions/default.aspx; “Pioneer Natural Resources Releases 2021 Sustainability Report, Announcing Net Zero Ambition and Enhanced Emissions Reduction Targets,” Pioneer Natural Resources, September 15, 2021, https://investors.pxd.com/news-releases/news-release-details/pioneer-natural-resources-releases-2021- sustainability-report.

75 Matthew Martin, “Saudi Aramco Pledges to Reach Net-Zero Emissions by 2050,” Bloomberg, October 23, 2021, https://www.bloomberg. com/news/articles/2021-10-23/saudi-aramco-will-achieve-ambition-of-net-zero-by-2050-nasser?sref=a9fBmPFG.