Most consumers in the United States are familiar with the advances in the electrification of cars and, perhaps to a lesser extent, with innovations in automotive biofuel. However, the importance of powering the aviation sector (both military and commercial) through sustainable fuels cannot be overstated. David Hitchcock’s paper, “Ready for takeoff? Aviation biofuels past, present, and future,” provides a keen look at the history of biofuels, current uses of biofuel, and investments in research and development that will yield future dividends.

Hitchcock explains the context of US policy on biofuels, anchored in the revamped Renewable Fuel Standard as part of the 2007 Energy Policy Act, and also examines the interplay between federal and state legislation, using the California Low Carbon Fuel Standard as a case study. Finally, Hitchcock provides an overview of some of the most exciting research in the field, highlighting the Sustainable Bioenergy Research Consortium and its innovations in producing biofuel through aquaculture.

Table of contents

The role and effects of government policies

Achieving success in SAF deployment

Conclusions and recommendations

Executive summary

In the decade since the first biofuel-powered flight of a commercial airliner in 2008, significant progress has been made to advance the aviation biofuels industry. Efforts have included the development, testing, and certification of multiple production pathways to produce aviation-grade fuels from a variety of biomass-derived feedstocks. While critics have raised concerns regarding potential impacts of first-generation biofuels on food production and land use, second-generation aviation biofuels have made significant strides in ensuring life-cycle sustainability, preventing unwanted societal, environmental, or legal implications to their use. This new generation of direct replacement, drop-in sustainable aviation fuels (SAF) have been employed on over 130,000 passenger flights and numerous multinational military operations, helping mitigate greenhouse gas emissions and providing new economic growth opportunities across the world.

Much of this success has come in an environment of beneficial, but often poorly targeted governmental mandates, regulations, and support. Most existing biofuel policies have been focused on renewable diesel and the ground transportation market, and have failed to provide adequate incentives for aviation biofuel development. This focus creates an unnecessary economic tension for biofuel producers between production of renewable diesel and SAF, which is problematic considering the aviation industry’s dependence on liquid energy and the lack of renewable, sustainable energy alternatives to liquid aviation fuel. Commercially successful players in the aviation biofuels space have been few, usually defined by producers adapting proven technologies to prevalent feedstocks, with strong partnerships across the value chain. There have also been costly failures and struggles both to launch these new ventures and to penetrate existing markets and infrastructures, all of which brings the SAF industry to a crossroads.

The next decade will present many opportunities and risks to this new and growing industry. The greatest opportunity comes from the nexus between the robust growth forecast for the commercial aviation industry and evolving efforts to mitigate climate change. To achieve growth in an environmentally responsible manner, the commercial aviation industry has acknowledged the need for increased production and use of lower carbon-intensive fuels. There are additional opportunities derived from new regulatory frameworks with the potential to catalyze investment in biorefinery capacity and provide increased market penetration of biofuels. This includes the pending implementation of two major international initiatives aimed at mitigating emissions from commercial aviation and maritime shipping. Additionally, new innovations in feedstock production and integrated biorefinery models have the promise of providing increased economic incentives to produce advanced biofuels, including SAF. Meanwhile, as some governments expand existing policies to include aviation biofuel, Norway is on the verge of implementing a first-of-its-kind mandate for their use. This report documents these opportunities and makes several recommendations for maximizing the future benefits for SAF technologies:

- consideration of targeted mandates for the use of SAF;

- ensuring that policy incentives target SAF;

- derisking investments in SAF production; and

- continued support of SAF research and development.

The commercial aviation industry will be dependent on liquid fuels for the foreseeable future. If the environmental impacts of this growth are to be mitigated, SAF are required. The implementation of these recommendations could provide additional incentives to biofuel refiners to produce SAF over renewable diesel and create significant impetus for growth in the SAF industry.

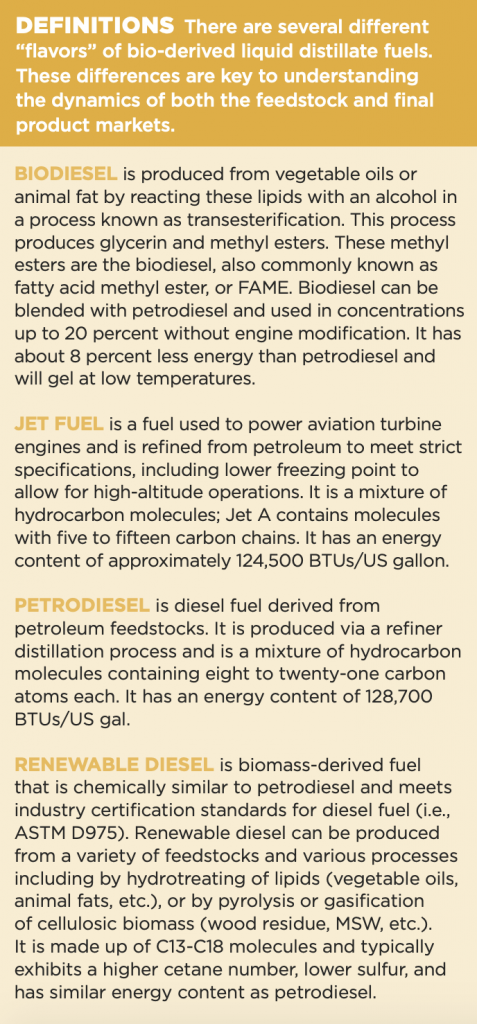

Introduction

Since 2007, global biofuel production has more than doubled, with more than 84 million tons1Metric ton, approximately 2,200 US pounds. of oil equivalent produced in 2017.2BP Statistical Review of World Energy 2018, BP PLC, page 45, https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf. While this is a significant source of clean, renewable energy for transportation, it represents only 2.2 percent of liquid transportation fuels consumed worldwide.3Calculated from BP Statistical Review of World Energy 2018. From page 19 the author derives total oil-derived fuel consumption (light and middle distillates and fuel oil equal 75,195,000 barrels per day/7.33 = 10,258,526 tons per day x 365 days = 3,744,362,210 tons per year. With this, the report calculates the percentage of biofuel in the global mix by 84,121,000 tons oil-equivalent biofuel/3,744,362,210 tons oil-derived fuel production + 84,121,000). A large portion of this growth can be attributed to the doubling of corn ethanol production in the United States between 2007 and 2010, from 6.52 billion gallons to 13.3 billion gallons.4“Global Ethanol Production,” US Department of Energy, Alternative Fuels Data Center, accessed on November 11, 2018, https://afdc.energy.gov/data/10331.Over the last decade, biodiesel production tripled in the United States5“Biofuels Fact Sheet,” University of Michigan, Center for Sustainable Systems, accessed November 11, 2018, http://css.umich.edu/factsheets/biofuels-factsheet. and more than doubled in the European Union (EU).6“EU Production,” European Biodiesel Board, accessed November 11, 2018, http://www.ebb-eu.org/images/1998-2016_prod_stats_big.jpg. More recently, we have seen the development and introduction of second-generation biofuels, such as renewable diesel and SAF. (See the box with definitions for bio-derived liquid distillate fuels.) These fuels are direct replacement, drop-in hydrocarbon blends that function exactly like their petroleum-derived counterparts.7“Renewable Hydrocarbon Biofuels,” US Department of Energy, Alternative Fuels Data Center, accessed on December 1, 2018, https://afdc.energy.gov/fuels/emerging_hydrocarbon.html For the foreseeable future, commercial aviation will be dependent on liquid fuel energy; therefore, SAF development is critical to reducing carbon emissions in the aviation sector.

Biofuel value proposition

Biofuels offer several significant advantages over their fossil-derived alternatives. First, they offer a means to diversify global energy resources. This diversification not only provides alternatives to oil and natural gas; ideally, it is also a lower cost alternative. The best example of this is Brazilian ethanol. Using flex-fuel vehicles and blender pumps at local gasoline stations, Brazilian automobiles can mix gasoline or ethanol seamlessly in any combination up to and including 100 percent ethanol (E100). This advantage allows Brazilian motorists to purchase a biofuel blend delivering the optimum value based on the spot price of each fuel. In addition to lowering average cost, this optionality also reduces overall price volatility for the consumer. Biofuels also tend to stimulate additive economic activity, most often generating local impact in the agricultural sector. Since biofuel feedstocks are generally more challenging to transport than crude oil, biorefineries are likely to be more dispersed than petroleum refineries, leveraging proximity to the feedstock resource. Finally, most biofuels are a lower carbon alternative when compared to petroleum-derived fuels, generating less greenhouse gas (GHG) emissions on a life-cycle basis.8While it may be argued that some biofuels demonstrate life-cycle GHG emissions above or on par with petroleum-derived fuels, per the US Environmental Protection Agency website, a majority of the tested biofuel pathways produce fewer GHG emissions than petroleum-derived alternatives. See https://www.epa.gov/fuels-registration-reporting-and-compliance-help/lifecycle-greenhouse-gas-results. Additionally, biofuels generally burn cleaner, generating less particulate matter (PM) and carbon monoxide (CO) emissions than fuels derived from crude oil.9The Nexus on Biofuels, Climate Change, and Human Health, a workshop summary, Roundtable on Environmental Health Sciences, Research, and Medicine; Board on Population Health and Public Health Practice; Institute of Medicine, (Washington, DC: National Academies Press, 2014), Chapter 4, https://www.ncbi.nlm.nih.gov/books/NBK196452/.

The potential to reduce harmful GHG emissions and other pollutants is an oft-cited driver for increased biofuel use in the energy mix. This attribute is even more compelling considering the sobering findings released in October 2018 by the United Nations Intergovernmental Panel on Climate Change (IPCC). This report stated that limiting global warming to the 1.5° C threshold would require rapid and far-reaching transitions in transportation energy systems.10“Global Warming of 1.5°C, Summary for Policymakers” Intergovernmental Panel on Climate Change, October 6, 2018, http://report.ipcc.ch/sr15/pdf/sr15_spm_final.pdf. However, biofuel development and deployment, while significant, have failed to reach international climate change mitigation goals. The International Energy Agency tracks clean energy technologies and grades progress toward achieving the agency’s Sustainable Development Scenario goals, which are aligned with the climate mitigation strategy of the 2016 Paris Accord.11“Sustainable Development Scenario, A Cleaner and More Inclusive Energy Future,” International Energy Agency, accessed November 9, 2018, https://www.iea.org/weo/weomodel/sds/. Both biofuels for ground transportation and the aviation industry are judged “not on track” by the International Energy Agency.12“Tracking Clean Energy Progress, Informing Energy Sector Transformations,” International Energy Agency, accessed November 9, 2018, https://www.iea.org/tcep/. Due to the relatively shallow penetration in the overall transportation energy mix (approximately 2 percent), biofuels represent a compelling opportunity that can be exploited to help achieve the aggressive GHG emission-reduction goals prescribed in the recent International Panel on Climate Change report. Exploitation of this opportunity will likely require focused governmental and regulatory support.

Biofuels are essential to the aviation sector

The world is increasingly interconnected, becoming more so every day with the advent and growth of the internet and the proliferation of fast, relatively inexpensive air travel. The aviation sector has seen significant growth, nearly doubling from 2.2 billion passengers in 2007 to 4 billion in 2017.13“Air Transport, Passengers Carried,” World Bank website, accessed November 9, 2018, https://data.worldbank.org/indicator/IS.AIR.PSGR. Looking forward, this trend is expected to continue with 5 percent per-year growth forecast in the coming years.14“Cao Confident of Strong Future Growth on Higher Jet Fuel Consumption,” Platts Jet Fuel, S&P Global Platts, August 1, 2016, https://www.platts.com.es/JetFuelNews/26508244.

Modern aircraft engines require energy-dense, distillate-type fuels to operate. Space, weight, and performance demands preclude the use of many forms of alternative transportation energy, such as electricity or natural gas, putting aviation in a unique position to benefit from the use of drop-in biofuels. While solar-powered manned flight has been demonstrated,15Evan Gaj, “The Electric Aircraft Is Taking Off,” TechCrunch, July 8, 2018, https://techcrunch.com/2018/07/08/the-electric-aircraft-is-taking-off/. the use of solar or electrical power for commercial flight is still decades away.16Matt Piotrowski, “Strong Jet Fuel Demand to Have Long-term Impacts on Global Oil Market,” The Fuze, October 23, 2018, http://energyfuse.org/strong-jet-fuel-demand-long-term-impacts-global-oil-market/.

Conversely, other forms of transportation, such as automobiles, buses, and trucks, are well-suited to take advantage of alternate sources of clean, renewable energy. For example, automobile electrification is growing, buses and other forms of public transportation have embraced electrification or cleaner burning natural gas. While biodiesel and renewable diesel are used in heavy trucking, both electrification and natural gas are also demonstrating their viability in this challenging sector. The maritime space is harder to decarbonize than ground transportation, but major shipping lines are exploring liquified natural gas (LNG) as an option, which would bring GHG emissions down by 20 percent.17Paul Speraw, “SEA/LNG Makes the Case for Further Investment in LNG Marine Fuel,” NGV America, July 3, 2018, https://www.ngvamerica.org/2018/07/03/sea-lng-makes-the-case-for-further-investment-in-lng-marine-fuel/.

The average lifespan of a commercial airliner is approximately twenty-five years,18Jason Dean, “Steven F. Udvar-Házy Is Making the World a Smaller Place,” CSQ Magazine, June 6, 2018, https://csq.com/2018/04/steven-f-udvar-hazy-making-the-world-a-smaller-place/#.W9sPV5NKjIU. and sales are robust with more than 1,700 new aircraft delivered in 2017, with a ten-year order backlog.19“Record Global Aircraft Deliveries in 2017: Boeing Ahead of Airbus Again, but behind on Order Backlog,” CAPA – Centre for Aviation, January 24, 2018, https://centreforaviation.com/analysis/reports/record-global-aircraft-deliveries-in-2017-boeing-ahead-of-airbus-again-but-behind-on-order-backlog-393914. Therefore, for the foreseeable future, aviation’s distinct energy density, performance, and weight requirements will continue to demand potent liquid energy.

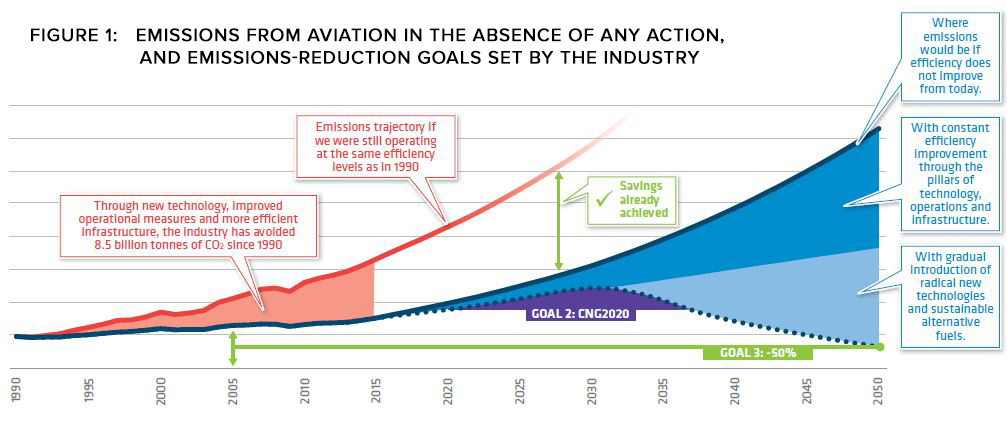

The forecasted growth in commercial aviation also means increased carbon emissions. In 2016, the International Air Transport Association (IATA) estimated that civil aviation emitted 814 million tons of carbon dioxide CO2, roughly 2 percent of all man-made carbon emissions.20Carbon Offsetting for International Aviation, International Air Transport Association, (Montreal: August 15, 2018), 1. IATA recently forecast that in 2018 airline carbon emission will surpass 897 million tons due to higher than expected fuel consumption.21“Global CO2 Emissions from Airlines Expected to Rise 4.4% This Year as Fuel Consumption Continues to Grow,” GreenAirOnline.com, June 4, 2018, http://www.greenaironline.com/news.php?viewStory=2490. This increase comes despite sustained industry efforts to improve aircraft fuel economy and to leverage fuel-saving operational practices. Modern commercial aircraft are becoming lighter and more aerodynamically fuel efficient, and significant improvements are being made in engine technology to reduce overall fuel consumption.22University of Texas at Austin, “Designing the Fuel-efficient Aircraft of the Future,” Science X news service, March 7, 2017, https://phys.org/news/2017-03-fuel-efficient-aircraft-future.html. These efforts to improve efficiency should allow fuel consumption to grow at a slower pace than the general industry, estimated at 3 percent.23“Cao Confident of Strong Future Growth,” S&P Global Platts. However, without low-carbon fuel alternatives, carbon emissions from air travel are likely to rise at a similar rate. While significant advances have been made in the development and deployment of aviation biofuels, market penetration has been shallow.

Of note, SAF are typically more expensive to produce than biofuels destined for on-road or maritime use. This difference is due to the complexity of the jet fuel specification, the expense of the initial certification process, and the ongoing testing and certification costs required to ensure that only fuel certified for flight is introduced into an airport fuel-distribution system. This paper argues that priority in biofuel refining should be given to SAF over maritime biofuels, despite the cost differential, to maximize decarbonization.

Where do we go from here?

In this environment, aviation biofuels are at a crossroads. This report examines the recent history of aviation biofuels, looks forward and attempts to discern what may be on the horizon for the aviation biofuels industry, and makes recommendations designed to increase opportunities for growth. It will first summarize the progress made over the last ten years in aviation biofuel technology, certification, and sustainability. This summary will include a comparison of the implementation and efficacy of various governmental policies and regulations designed to stimulate biofuel utilization, with emphasis on how these policies have impacted the aviation biofuels sector. With the imminent commencement of two major intergovernmental climate change and pollution-mitigation initiatives, the next decade will be a turning point for aviation biofuels. As such, this report will include an analysis of the potential impact of these initiatives and highlight some of the ongoing innovation in the space. Finally, it will conclude with targeted recommendations that have the potential to accelerate development and deployment of aviation biofuels. The report and recommendations are based on the author’s analysis of US and European Union (EU) policies, interviews with industry executives, government officials, and environmental experts, and energy and aviation data trends.

Looking back

Sustainable aviation fuels–ten years of progress

In 2008, Virgin Atlantic made history, flying a Boeing 747-400 from London to Amsterdam with one of the aircraft’s four engines utilizing a 20 percent blend of biojet fuel and petroleum jet fuel.24Graham Dunn, “Partners Carry out First Biofuel Flight Using Virgin 747,” FlightGlobal, February 24, 2008. https://www.flightglobal.com/news/articles/partners-carry-out-first-biofuel-flight-using-virgin-747-221790/. Over the intervening ten years, the aviation biofuels industry has advanced significantly. In 2011, KLM Royal Dutch Airlines (KLM)flew the first commercial passenger flight using biofuels from Amsterdam to Paris.25“History—KLM Corporate.” KLM Royal Dutch Airlines, November 28, 2017. https://www.klm.com/corporate/en/about-klm/history/. Since then, more than 130,000 additional commercial passenger flights have been performed.26“Fact Sheet Sustainable Aviation Fuels,” International Air Transport Association, June 2018, https://www.iata.org/pressroom/facts_figures/fact_sheets/Documents/fact-sheet-alternative-fuels.pdf. Today, SAF are incorporated into the fuel supplies at major airports including Los Angeles International Airport in the United States,27“United Airlines Launches First-ever Jet Biofuels Initiative at LAX with Flight to San Francisco,” Los Angeles World Airports (governing body for LAX), March 11, 2016, https://www.lawa.org/en/News%20Releases/2016/News%20Release%20122 and Oslo and Bergen airports in Norway.28John McKenna, “Norway’s Airports Pump Planes with Biofuels,” World Economic Forum, November 17, 2017, https://www.weforum.org/agenda/2017/11/norway-airports-biofuels-avinor/.

SAF provides significant advantages to the commercial aviation industry. First, this type of fuel offers verifiable and quantifiable environmental benefits in the form of reduced carbon and other harmful emissions, like sulfur and particulates. Second, the development and deployment of alternative liquid fuel resources have the potential to diversify the market and localize aviation fuel sources. Diversification would serve to insulate the aviation sector from fluctuations in global petroleum prices and permit local aviation fuel production, which would help ensure local fuel security and resistance to potential supply disruptions from natural disaster or conflict. Finally, there are important socioeconomic advantages to biofuel production, which can stimulate growth in agricultural production and jobs, often in economically depressed rural locations. Since biofuel production is typically situated close to the feedstock, biorefineries would also provide economic stimulus and opportunities to individuals in these regions.

Shortcomings of first–generation biofuels

To date, first-generation biofuels, typically ethanol or biodiesel, have driven growth in the biofuel industry. This success has not come without considerable controversy and criticism. This criticism has been mainly focused along three veins: food-versus-fuel concerns, impacts to land use and biodiversity, and the fungibility and compatibility with existing engines and infrastructure. Over the last decade or so there has been considerable debate, especially in Washington, DC, over the impact of biofuel production, and particularly corn-based ethanol, on food markets and prices. However, since early spikes in corn prices in 2007 and in the 2010-2012 period, prices have declined as ethanol production and corn yields have increased. Robust harvests and reduced energy costs resulting from the lower price of crude oil drove the change.29“US Food versus Fuel: A Debate Losing its Rage,” Financial Times, September 5, 2016, accessed December 1, 2018, https://www.ft.com/content/bc3b9272-7136-11e6-a0c9-1365ce54b926. While recent EU policy has been aimed at eliminating “food-based” biofuel, there is evidence that market and agricultural-industry adjustments have eliminated negative impacts of grain-based biofuels.30Emmanuel Desplechin, “Five Things You Need to Know about the ‘Food vs Fuel’ Debate,” Politico, March 16, 2017, accessed December 1, 2018, https://www.politico.eu/sponsored-content/five-things-you-need-to-know-about-the-food-vs-fuel-debate/. The best example is increased grain crop yields, which are outpacing demand.31Ibid. However, land-use change and the impacts of biofuel production on biodiversity in certain geographies have been much more concerning to both government officials and environmental advocates. Most notable have been the impacts of increased palm oil demand on Indonesian rain forests.32Abrahm Lustgarten, “Palm Oil Was Supposed to Help Save the Planet. Instead It Unleashed a Catastrophe,” New York Times Magazine, November 20, 2018, accessed December 1, 2018, https://www.nytimes.com/2018/11/20/magazine/palm-oil-borneo-climate-catastrophe.html. Biofuel mandates in both the United States and the EU spurred a significant demand for vegetable oil as a feedstock for biodiesel production; the unintended consequence of these mandates has been deforestation in Borneo (and other places) to address this market.33Abrahm Lustgarten, “Palm Oil Was Supposed to Help Save the Planet. Instead It Unleashed a Catastrophe,” New York Times Magazine, November 20, 2018, accessed December 1, 2018, https://www.nytimes.com/2018/11/20/magazine/palm-oil-borneo-climate-catastrophe.html. The resulting land-use changes wipe out any environmental benefits gained from the production and use of the resulting lower carbon fuels. On a life-cycle basis, fuels produced from palm oil often have a higher carbon footprint than petroleum-derived fuels.34Ibid. First-generation fuels have also faced infrastructure challenges. Due to differing chemical properties in both ethanol and biodiesel, most engines cannot tolerate high blend ratios of these fuels without costly modifications.35To learn more about biodiesel impacts, see “Using Biodiesel Fuel in Your Engine,” Pennsylvania State University,June 9, 2016 Can E15 Gasoline Really Damage Your Engine?” by Mike Allen inPopular Mechanics, December 21, 2010, https://www.popularmechanics.com/cars/hybrid-electric/a6244/e15-gasoline-damage-engine/. These same issues can also negatively impact fuel transportation, storage, and delivery infrastructure.

Defining sustainability

Sustainable aviation fuel can be defined as a certified, drop-in, distillate fuel that satisfies jet fuel form, fit, and function requirements, while meeting verifiable sustainability standards. Adopting and complying with established sustainability standards will ensure these fuels are produced in an ethical and sustainable manner, and that their use will deliver equal performance with a lower life-cycle GHG footprint.

There are a variety of internationally recognized sustainability certification regimes, most of which are tied closely to a specific issue or industry. The International Social and Environmental Accreditation and Labelling Alliance is the global membership association which provides community standards for certification systems, ensuring that these regimes utilize best practices and credible sustainability standards.36“About ISEAL,” ISEAL Alliance, accessed November 9, 2018, https://www.isealalliance.org/about-iseal. The two Alliance-recognized regimes most widely utilized by aviation biofuel producers to accredit their sustainability are the Roundtable on Sustainable Biomaterials (RSB) and the International Sustainability & Carbon Certification (ISCC).

In general, any certification regime will focus on at least three critical aspects of sustainability: ecological, social, and legal. The ecological impacts to soil and water conservation, air quality, life-cycle GHG emissions, waste management, and indirect land-use change, including the protection of biodiversity and avoidance of deforestation, are quantified and assessed. Social impacts, including human rights, fair labor practices and work conditions, local food security, and rural development are considered. Finally, the certification regime will ensure that the biofuels are produced in a manner that complies with applicable local, regional, and international laws and treaties, including climate change, emissions, or GHG reduction mandates. Different certification regimes and their environmental impact are described in more detail below.

There is a fourth, unwritten but extremely important, factor that defines a “sustainable” biofuel technology: financial sustainability. This aspect is driven by input (feedstock) availability, predictability, value, conversion costs, certification costs, end-user demand, and often governmental financial or regulatory support. Some technologies have been better able than others to achieve this final measure of sustainably and achieve a level of commercial success. Financial sustainability is a critical component of SAF’s history and future.

Proven performance and compatibility through rigorous fuel certification

Jet fuel is a kerosene-grade fuel formulated to meet stringent commercial or military performance standards, including energy content, combustion quality, stability, lubricity, fluidity, volatility, noncorrosivity, and cleanliness.37Aviation Fuels Technical Review, Chevron Products Co., 2007, 3-13. Jet fuel is a mixture of hydrocarbon molecules; Jet A contains molecules with five to fifteen carbon chains and has an energy content of approximately 124,500 British Thermal Units/US gallon. The most widely recognized commercial performance standards38Please note that these ASTM standards measure fuel performance only and do not address environmental benefits or sustainability. are ASTM International’s D1655 Standard Specification for Aviation Turbine Fuels39“ASTM D1655-18a, Standard Specification for Aviation Turbine Fuels,” ASTM International, accessed November 9, 2018, https://www.astm.org/Standards/D1655.htm. in the United States and Defence Standard 91-91 in the United Kingdom.40“Civil Jet Fuel, Grades and Specifications,” Royal Dutch Shell PLC, accessed November 9, 2018, https://www.shell.com/business-customers/aviation/aviation-fuel/civil-jet-fuel-grades.html. To be utilized in flight, SAF must be thoroughly tested and must meet the same rigorous standards as petroleum-derived fuels.

To date, the majority of SAF gallons have been developed and produced in the United States. US certification efforts have been facilitated by the Commercial Aviation Alternative Fuels Initiative, a consortium of aircraft and jet-engine manufacturers, biojet fuel producers, airline end users, academic and research entities, and other interested parties.41“About CAAFI,” Commercial Aviation Alternative Fuels Initiative (CAAFI), accessed November 9, 2018, http://www.caafi.org/about/caafi.html. The certification process is governed by ASTM’s D4054 Standard Practice for Evaluation of New Aviation Turbine Fuels and Fuel Additives.42“ASTM D4054-17, Standard Practice for Evaluation of New Aviation Turbine Fuels and Fuel Additives,” ASTM International, accessed November 9, 2018, https://www.astm.org/Standards/D4054.htm. This is a multiphase process consisting of lab analysis, testing, and verification, independent third-party ground and airborne component and engine testing, technical and functional assessments by aircraft and engine manufacturers, ASTM evaluation and approval, and a final review by the Federal Aviation Administration.43Steve Czonka, “Sustainable Aviation Jet Fuel (SAJF): Progress, Challenges, and Path Forward,” CAAFI presentation to Washington Sustainable Aviation Biofuel Working Group, September 17, 2018. This process generally takes several years to complete and can represent a significant financial and technical barrier to nascent technologies.44Alternative Aviation Fuels: Overview of Challenges, Opportunities, and Next Steps, US Department of Energy, Office of Energy Efficiency and Renewable Energy, March 2017, 15. Once certified, the new SAF “pathway” is listed as an annex to ASTM’s D7566 Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons, and shall be regarded as D1655-compliant turbine fuel.45“ASTM D7566-18, Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons,” ASTM International, accessed November 9, 2018, https://www.astm.org/Standards/D7566.htm.

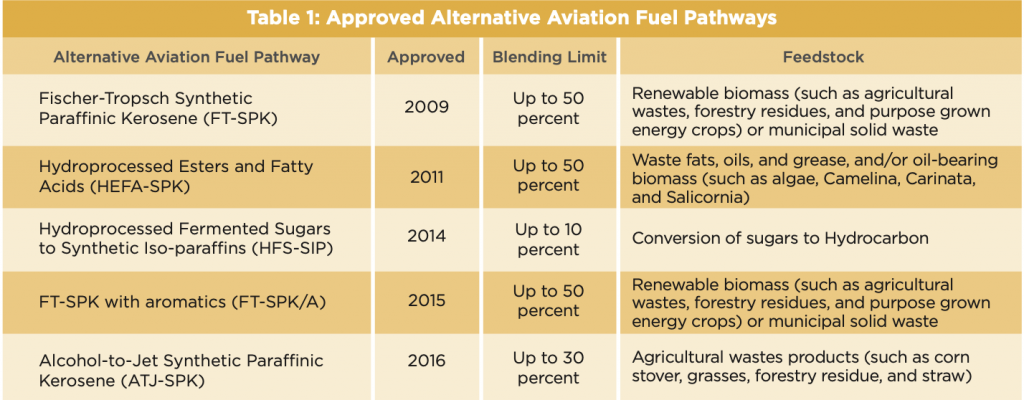

These certified fuels are direct replacement, “drop-in” fuels. This means that they are fully compatible with the existing transportation, storage, and distribution networks and all engines specified to use traditional petroleum turbine fuels. These drop-in SAFs have the same energy density and will perform as well as, or in some cases better than, petroleum fuels of the same specification and grade. While there is the potential to develop a 100 percent bio-based SAF,46Andrea Watters, “Navy Tests 100-percent Advanced Biofuel,” Naval Aviation News, September 16, 2016, https://www.navy.mil/submit/display.asp?story_id=96702. all currently certified pathways require blending with petroleum fuel at various concentrations from 10 percent to 50 percent SAF for the fuel blend to meet all performance specifications such as lubricity, freeze point, and aromatics content. As of publication of this report, there have been five pathways certified under ASTM D4054. Details of these pathways, including typical feedstock resources, are summarized in Table 1 below.47Table adapted from Air Transport Action Group’s Beginner’s Guide to Sustainable Aviation Fuel: Edition 3, (Geneva: 2017), 19.

In addition to the five pathways above, several other technologies have initiated the certification process utilizing various thermochemical or biochemical processes. Further, there are numerous other entities exploring innovative technologies or business models leveraging one of the five currently approved pathways. One of these innovative approaches, led by the Masdar Institute of Science and Technology, will be highlighted in greater detail later in the report.

The role and the effects of government policies

Given the benefits described above, numerous governmental policies have been enacted, with varying effect, in an attempt to promote the development, production, and use of biofuels. Generally, these policies have been fuel-type and technology agnostic, designed to promote biofuel use to achieve socioeconomic or GHG reduction goals. As we will see, this lack of specificity has proven problematic for SAF development.

Governmental programs can be regional, national, or global in reach. The most prominent are the US Renewable Fuel Standard, the EU’s Renewable Energy Directive, the California Low Carbon Fuel Standard, and the soon-to-be-implemented International Civil Aviation Authority’s Carbon Offsetting and Reduction Scheme for International Aviation.

The US approach: renewable fuel standard 2

The cornerstone of US policy on biofuels is the Renewable Fuel Standard (RFS). The standard was passed into law in 2005 as part of the Energy Policy Act48Energy Policy Act of 2005, Pub. L. 109-58, 119 Stat. 594 (2005). and then modified and expanded in 2007 as part of the Energy Independence and Security Act.49Energy Independence and Security Act of 2007, Pub. L. 110-140, 121 Stat. 1492 (2007). The revamped RFS, best known as RFS2, is still in force. RFS2 is administered by the Environmental Protection Agency (EPA) and like any other federal regulation, much of the detail of execution is found in the regulatory rulemaking and the decisions made by the EPA regarding implementation and enforcement.

RFS2 mandates the use of biofuels by imposing biofuel-blending obligations on petroleum fuel refiners or importers proportional to their share of the US ground-transportation fuel market (gasoline and diesel). The mandate takes the form of annual volumetric quotas of specified biofuel categories. Petroleum refiners may comply with their annual volumetric mandates either by blending the specified biofuel into transportation fuels sold in the United States, or by obtaining credits, known as renewable identification numbers (RINs), from others who comply50.“Overview of the Renewable Fuel Standard,” US Environmental Protection Agency, accessed November 2, 2018, https://www.epa.gov/renewable-fuel-standard-program/overview-renewable-fuel-standard.

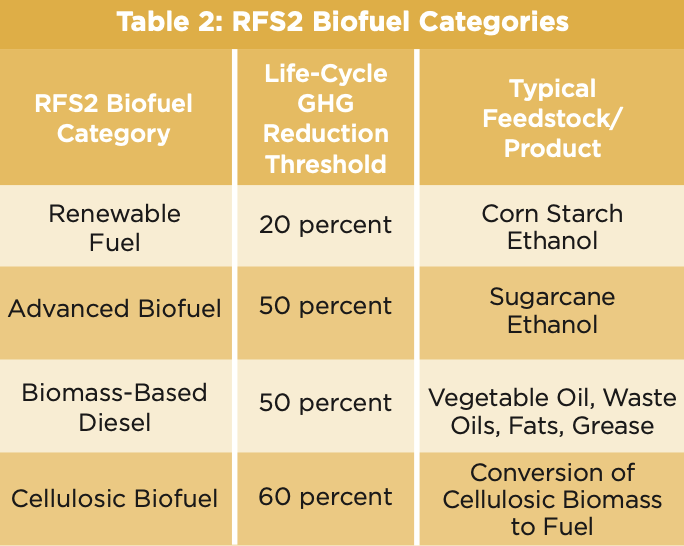

RFS2 identifies four categories of biofuels: renewable fuel, advanced biofuel, bio-based diesel, and cellulosic biofuel. Each type must meet a defined life-cycle GHG reduction standard, versus a 2005 petroleum-fuel threshold, to be utilized for compliance. (See Table 2 below.) Under RFS2, only gasoline and diesel sales are used to determine a refiner’s compliance obligation; petroleum-derived jet fuel does not count toward the refiner’s obligation. However, SAF producers are permitted by the regulation to generate RINs, which can be sold and used by obligated parties for compliance. While RFS2 is a biofuels mandate, it does not specifically mandate the use of SAF.

RINs represent added value that can be captured by biofuel producers, including those that produce and sell SAF in the United States. RINs are traded in open markets and their prices can fluctuate based on supply and demand. As of October 18, 2018, RINs range in price from $0.1115 per gallon for renewable fuel (corn starch ethanol), to $0.30525 per gallon for advanced biofuel, $0.33475 for biomass-based diesel, and $1.9835 per gallon for the harder-to-come-by cellulosic biofuel.51“Ethanol & Biodiesel Information Service,” Oil Price Information Service, 15, No. 43, October 22, 2018, 1. Refiners are obligated to show compliance in each of these categories, commensurate with their respective share of the gasoline and diesel market. SAF can fit into one or more of these classifications (bio-based diesel, advanced biofuel, or cellulosic biofuel) depending on the production process and feedstock,52“Approved Pathways for Renewable Fuel,” US Environmental Protection Agency, accessed November 2, 2018, https://www.epa.gov/renewable-fuel-standard-program/approved-pathways-renewable-fuel. and can generate RINs to be traded in the respective market.

While the RFS has provided a powerful incentive for the production and use of biofuels in the United States, there have also been considerable challenges and controversy. Initially, the program was beset by RIN fraud. Entities would fraudulently claim biofuel production in a computerized tracking system, generate a RIN, and then sell the RIN to an obligated party without producing and blending the associated biofuel. This practice was exposed and resulted in several high-profile prosecutions.53Mario Parker, Jennifer A. Glouhy, and Brian Gruley, “The Fake Factory That Pumped Out Real Money,” Bloomberg, July 13, 2016, https://www.bloomberg.com/features/2016-fake-biofuel-factory/; “Fraudulent RIN Cases Underscore Continuing Concerns for Renewable Fuel Credit Program,” Husch Blackwell, October 17, 2016, https://www.emergingenergyinsights.com/2016/10/fraudulent-rin-cases-underscore-continuing-concerns-renewable-fuel-credit-program/. There also is an annual battle between biofuel producers and obligated parties over EPA adjustment of volumetric mandates. The 2007 Energy Independence and Security Act incorporated annual biofuel targets within RFS2, but also authorized the EPA to adjust those targets (generally downward) to match expected biofuel production capacities. Obligated parties advocate for lower targets that would lower compliance costs, while biofuel producers fight for higher quotas that would increase RIN values and market share. An additional challenge is the perceived uncertainty about RFS2 after 2022, the final year with stated volumetric targets in the governing law. This uncertainty affects investor confidence in the mandate and the associated financial value of RIN sales. Finally, the EPA has granted compliance waivers from time to time, allowing obligated parties to delay or avoid compliance costs altogether, which further depresses RIN values.54Meghan Sapp, “RIN Prices Fall to Lowest Level Since January 2014,” Biofuels Digest, October 8, 2018, http://www.biofuelsdigest.com/bdigest/2018/10/08/rin-prices-fall-to-lowest-level-since-january-2014/. While well-intentioned, RFS2’s complexity has proven problematic and produced uncertainty that make financing of biorefinery projects challenging.55Antoine Schellinger, “2019 Proposed RFS Volumes: The Deep-Dive Analysis,” Biofuels Digest, August 23, 2018, https://www.biofuelsdigest.com/bdigest/2018/08/23/2019-proposed-rfs-volumes-the-deep-dive-analysis/.

The European approach: Red II

The EU has established policies and ambitious goals designed to reduce carbon emissions and to achieve or exceed the GHG reduction goals established by the 2016 Paris Accord.56“Tackling Climate Change in the EU,” European Council, October 23, 2017, https://www.consilium.europa.eu/en/policies/climate-change/. In June 2018, the European Commission, European Parliament, and European Council reached an agreement on a revised Renewable Energy Directive (RED II) that set new, more ambitious targets for renewable energy consumption; by 2030, renewables are to account for 32 percent of all energy consumed, with renewables providing 14 percent of the transportation fuels.57Erin Voegele,“EU Reaches Deal on REDII, Sets New Goals for Renewables,” Biomass Magazine, June 14, 2018, http://biomassmagazine.com/articles/15371/eu-reaches-deal-on-redii-sets-new-goals-for-renewables. RED II also incorporates a provision that would limit and then phase out first-generation biofuels that have been shown to impact food markets or have significant indirect land-use change impacts.58Ibid. In order to qualify, advanced biofuels will have to meet strict GHG reduction standards that start at 50 percent and grow to 65 percent by 2021. While some caution that these goals are too ambitious and may result in unintended consequences59Sarantis Michalopoulos,“EU Set Bar ‘Too High’ on Advanced Biofuels,” Euractiv.com, March 19, 2018, https://www.euractiv.com/section/agriculture-food/news/eu-set-bar-too-high-on-advanced-biofuels/. (such as the aforementioned land-use change), others argue that such ambitious and long-range goal setting will provide the surety required to spur investment in renewable energy projects, generally, and biofuel production, specifically.60Voegele, “EU Reaches Deal on REDII.”

Of note, just like the US RFS2, RED II does not mandate use of SAF for compliance by the aviation sector. Instead, to incentivize the development and use of SAF, RED II provided a compliance multiplier for SAF, allowing 1 liter of SAF to receive 1.2 liters of credit. While this is certainly beneficial, it may not suffice in overcoming the cost premium of SAF relative to the renewable diesel alternative currently available to biofuel refiners. IATA, the air transportation industry group, advocated a two-times multiplier and was “disappointed in the outcome of RED II.”61“Sustainable Aviation Fuels Incentive under New EU Renewable Energy Directive Not Enough, Says IATA,” GreenAirOnline.com, June 19, 2018, http://www.greenaironline.com/news.php?viewStory=2493. The IATA spokesman went on to observe that “the important issue was to create a differential from maritime sustainable fuels, which are much easier to produce and therefore if there is no differential we won’t expect to see much incentive to produce SAF.”62Ibid. This highlights the fundamental challenge to growth in SAF deployment, much like in the United States. Without a mandate or strong economic incentive, biorefinery operators often choose to produce lower-cost renewable diesel, which can be used in road or maritime transportation applications, over the more complex and expensive-to-produce SAF.

Policy case study: California low carbon fuel standard

California has become the center of SAF development and deployment in the United States. The primary driver has been a strong commitment by the state government to reducing GHG emission as part of a larger climate change mitigation effort. In 2011, California put in place an ambitious program to reduce the GHG footprint of transportation, the Low Carbon Fuel Standard (LCFS). This program successfully spurred the development and deployment of electric vehicles and alternative fuels such as hydrogen and biofuels. The LCFS is administered by the California Air Resources Board (CARB) and requires petroleum-fuel manufacturers to reduce the life-cycle carbon intensity (CI)63Definition of carbon intensity (CI) per California Air Resources Board: “CI is expressed as the amount of lifecycle greenhouse gas emissions per unit of fuel energy in grams of carbon dioxide equivalent per megajoule (gCO2e/MJ). CIs include the direct effects of producing and using this fuel, as well as indirect effects that may be associated with how the fuel impacts other products and markets,” https://www.arb.ca.gov/fuels/lcfs/fuelpathways/fuelpathways.htm. of their fuel 10 percent by 2020 and 20 percent by 2030.64“CARB Extends Low Carbon Fuel Standard by 10 Years, Doubles the Intensity Reduction Target to 20 Percent,” Green Car Congress, September 28, 2018, http://www.greencarcongress.com/2018/09/20180928-lcfs.html. Petroleum refiners can accomplish this by developing their own lower carbon products, or by buying credits from others who develop and deploy lower CI transportation technologies and fuels. Like RFS2, the petroleum refiner’s obligation is set proportionally to their market share of road transportation fuels, namely gasoline and diesel.

Of special note, CARB voted on September 27, 2018, to allow producers of SAF to “opt in” to the program and generate LCFS credits. Like RFS2 and RED II, aviation fuel would not add to the refiner’s obligation, but provide additive credits to the compliance markets. The LCFS does require biofuel producers to certify their pathway and obtain a CI “score” that would determine the credit value of their product. The CI score is compared to a petroleum fuel baseline; the differential establishes the magnitude of the credit for a specific biofuel product, rewarding carbon reduction over volumes sold. These LCFS credits provide an additional financial incentive to biofuel producers to deliver and sell fuel in California. CARB currently uses the Greenhouse gases, Regulated Emissions, and Energy use in Transportation (GREET®) model 2.065“CA-GREET Model,” California Air Resources Board, accessed November 10, 2018, https://www.arb.ca.gov/fuels/lcfs/ca-greet/ca-greet.htm. developed by Argonne National Lab66“GREET Model,” Argonne National Lab, accessed November 10, 2018, https://greet.es.anl.gov/. to calculate CI scores. However, during the HEFA-SPK SAF67See Table 1 above. pathway certification process, the GREET model calculated, and CARB adopted, a smaller CI differential between SAF and petroleum-based jet (petrojet) fuel than the one established between renewable diesel and petrodiesel.68Graham Noyes, “Proposed LCFS Regulations Pertaining to Alternative Jet Fuel,” Comments to California Air Resources Board, April 23, 2017, made on behalf of alternative jet-fuel producers by Noyes Law Firm, Nevada City, CA. Given the greater CI differential, biorefineries have an economic incentive to produce renewable diesel over SAF.

Road transportation fuels (gasoline and diesel) are sold to retailers via a wholesale fuel terminal, not directly from a refinery. The point in the terminal where individual fuel trucks are loaded for shipment to retail locations is known as the “rack.” As part of its Cap-and-Trade Program, California imposes “rack fees,” such as the Cap at the Rack (CAR) fee,69For more information about these fees, see “Projecting the Costs of California’s Cap & Trade and Low Carbon Fuel Standard Programs,” by Jim Mladenik and Kendra Seymour, Stillwater Associates, October 25, 2018, https://stillwaterassociates.com/projecting-the-costs-of-californias-cap-trade-and-low-carbon-fuel-standard-programs/. on petrodiesel that are not imposed on petrojet at this juncture. Jet fuel, biodiesel, and renewable diesel are not distributed in this manner, and are not subject to these fees. Since renewable diesel is exempt from the CAR fee, this represents another economic incentive for renewable diesel production over SAF production. Depending on the process, biorefineries can modulate up or down the amount of SAF range molecules they produce. The unintended consequence of the CI differential delta and the rack fees is to disincentivize SAF production to maximize renewable diesel output.

Several biorefineries in operation or under construction will have the option to “opt in” and earn LCFS credits when producing SAF. In 2016, AltAir launched the world’s first SAF biorefinery in Paramount, CA, and began supplying HEFA-SPK SAF for use at Los Angeles International Airport. This marked the first use of SAF in routine commercial operations.70Chelsea Harvey, “United Airlines Is Flying on Biofuels. Here’s Why That’s a Really Big Deal,” Washington Post, March 11, 2016, https://www.washingtonpost.com/news/energy-environment/wp/2016/03/11/united-airlines-is-flying-on-biofuels-heres-why-thats-a-really-big-deal/?utm_term=.f99cc1f7f8ce. On October 24, 2018, AltAir, now part of World Energy,71Jim Lane, “The Paramount Deal: World Energy Takes off with Audacious $72M Acquisition of AltAir and the Paramount Oil Refinery,” Biofuels Digest, March 19, 2018, http://www.biofuelsdigest.com/bdigest/2018/03/19/the-paramount-deal-world-energy-takes-off-with-audacious-72m-acquisition-of-altair-and-the-paramount-oil-refinery/. announced an additional $350 million investment to expand capacity at this facility. At the end of the two-year expansion project, the facility will be able to process over 300 million gallons per year of SAF, renewable diesel, renewable gasoline, and propane.72Sarah Pollo, “World Energy to Complete Conversion of California Petroleum Refinery to Renewable Fuels.” GlobeNewswire, October 24, 2018, http://www.globenewswire.com/news-release/2018/10/24/1626529/0/en/World-Energy-to-Complete-Conversion-of-California-Petroleum-Refinery-to-Renewable-Fuels.html. In addition to the World Energy facility, Fulcrum BioEnergy Inc. has broken ground73“Fulcrum BioEnergy Breaks Ground On Sierra BioFuels Plant,” PR Newswire, May 16, 2018, https://www.prnewswire.com/news-releases/fulcrum-bioenergy-breaks-ground-on-sierra-biofuels-plant-300649908.html. on a new Fischer-Tropsch (FT-SPK) municipal solid waste-to-biofuel facility near Reno, Nevada. The low-carbon syncrude74“Fulcrum BioEnergy Facilities,” Fulcrum BioEnergy, accessed November 2, 2018, http://fulcrum-bioenergy.com/facilities/. produced at this facility can be refined into renewable diesel or SAF, and Fulcrum has already submitted a renewable diesel LCFS pathway application to CARB with an impressive CI value of 37.5 (for reference, petroleum diesel has a CI of approximately 100).75“Fulcrum BioEnergy Files LCFS Application for Municipal Solid Waste to FT Diesel Pathway with Low CI of 37.47 g/MJ,” Green Car Congress, January 3, 2016, http://www.greencarcongress.com/2016/01/20160103-fulcrum.html. Fulcrum has established offtake agreements with multiple airline partners including United Airlines, Cathay Pacific, and Japan Air Lines. In Oregon, Red Rocks Biofuels LLC has also broken ground on an FT-SPK facility that will convert woody biomass waste to biofuel, including SAF, for customers Southwest Airlines, FedEx Corp., and the US Department of Defense.76Kurt Liedtke, “Fueled for the Future: Red Rock Biofuels Facility Breaks Ground in Lakeview,” Herald and News, July 19, 2018, https://www.heraldandnews.com/news/local_news/fueled-for-the-future/article_b824da9c-49ad-5094-acac-21e71828b49d.html. However, based on this facility’s location along Oregon’s southern border, it is logical to assume the bulk of the biofuels produced there will be renewable diesel sold in California to take advantage of the LCFS credit market.

In application, the LCFS has clear advantages as public policy over the RFS. First, its focus on carbon reduction, not gallons sold, rewards outcomes over effort.77Jim Lane, “LCFS vs RFS: As Two Contend for the Renewables Heavyweight Championship, Who Is the Greatest?” Biofuels Digest, May 10, 2017, https://www.biofuelsdigest.com/bdigest/2017/05/10/lcfs-vs-rfs-as-two-contend-for-the-renewables-heavyweight-championship-who-is-the-greatest/. Second, while both are complex, the LCFS carbon market approach is simpler and less prone to fraud and abuse than RIN trading. Third, California, the world’s fifth-largest economy, has shown steadfast governmental and regulatory commitment to the LCFS, in contrast to the US government’s inconsistent approach to the RFS2. However, the higher costs to produce and certify SAF can make it less financially attractive to a biorefinery, compared to on-road renewable diesel. Without an SAF mandate, and with economic incentives favoring renewable diesel production, the LCFS is not optimized to drive increased SAF production and use.

International civil aviation organization: charting a path to carbon-neutral growth

The International Civil Aviation Organization (ICAO) is tasked with creating and maintaining international standards to help ensure “a safe, efficient, secure, economically sustainable, and environmentally responsible civil aviation sector.”78“About ICAO,” International Civil Aviation Organization. Since 2004, ICAO has embraced a goal of reducing the impact of aviation-generated GHG on the global climate.79“Environmental Protection,” International Civil Aviation Organization, accessed November 2, 2018, https://www.icao.int/environmental-protection/Pages/default.aspx. This goal has been reaffirmed in ICAO Assembly resolutions adopted in 2016 and 2018.

ICAO’s stated objective is to achieve carbon-neutral growth in civil aviation from 2020 onward. It is utilizing a “basket of measures”80“Resolution A39-3,” Resolutions Adopted by the Assembly, 39th Session, International Civil Aviation Authority, Montreal, September 27- October 6, 2016, https://www.icao.int/Meetings/a39/Documents/Resolutions/a39_res_prov_en.pdf. strategy to achieve this goal. These measures include improvements in aircraft technology, such as increased aerodynamic efficiency, the use of lightweight materials, and greater engine efficiency; and the implementation of innovative operational strategies designed to reduce fuel consumption and emissions, such as Global Positioning System-enabled direct routing, single engine taxiing, and reduced use of the auxiliary power unit while parked. While these efforts will help, they will not be adequate to achieve carbon-neutral growth, given the projected increase of 5 percent per year in global commercial passengers, and 3 percent per year in fuel consumption.81“Cao Confident of Strong Future Growth,” S&P Global Platts. Therefore, deployment and use of low-carbon SAF is the third item in the “basket of measures” and is viewed as an integral and essential part of ICAO’s strategy. This is a pointed and direct endorsement of SAF as a vital component of a global, industrywide GHG-reduction scheme. See Figure 1 above.

Unfortunately, the pace of SAF development and deployment has not been robust enough to meet ICAO goals, so in 2016, a global market-based measure was adopted that provides a method to offset carbon emission above targets.82“Resolution A39-3.” This program will require entities that fail to meet their GHG emissions-reduction targets to purchase the difference in carbon credits. This additional compliance cost should encourage more rapid technological improvements and greater operational efficiencies, and it may spur increased utilization of SAF to meet the ICAO’s goals.

ICAO believes that a single, global, market-based measurement scheme that will allow entities an option to purchase offsets as needed to meet overall GHG reduction goals is preferable to a patchwork of regional or national schemes with individual and possible divergent compliance requirements.83Carbon Offsetting for International Aviation, 3. ICAO’s program is known as Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)84“Resolution A39-3.” and will be implemented in phases. During the two-year period from January 2019 through December 2020, all operators will have to report emissions from all international flights. This information will be used to establish the 2020 baseline. From 2021 to 2026, participation will be voluntary, and by November 2018, seventy-six states had indicated their intent to participate.85“CORSIA States for Chapter 3 State Pairs,” International Civil Aviation Organization, accessed on November 11, 2018, https://www.icao.int/environmental-protection/CORSIA/Pages/state-pairs.aspx. Beginning in 2027, all international flights (with exceptions for developing or isolated countries) between ICAO signatory states will be subject to CORSIA.86Carbon Offsetting for International Aviation, 2, 6.

ICAO has yet to publish specific sustainability standards for SAF for compliance credit under CORSIA, however it may be assumed that these standards will closely align to generally accepted sustainability certification practices like those discussed earlier. Since ICAO’s environmental policies are focused on attaining carbon-neutral growth, it should be expected that ICAO’s yet-to-be-published standards will place emphasis on CO2 reduction. Each certified biofuel-production pathway and feedstock combination should have a verifiable CO2 avoidance score, likely depicted in a percentage of CO2 reduction versus a petroleum fuel baseline. SAF have the potential to deliver up to an 80 percent reduction in CO2 emissions across their life cycle.87Beginner’s Guide, 7. When coupled with certification under a sustainability-certification regime like the Roundtable on Sustainable Biomaterials or the International Sustainability & Carbon Certification, the SAF would be both sustainable and effective in reducing CO2 emissions in support of the ICAO CORSIA or other GHG emission-reduction schemes.

Achieving success in SAF deployment

The supportive, if untargeted, regulatory environment, along with the successes in certification of the various pathways, has led to a steady stream of demonstrations of the technology and limited commercial successes. Over twenty airlines have conducted demonstration flights,88Beginner’s Guide, 7. SAF have been regularly introduced into the aircraft fueling logistics at several major airports, including Los Angeles International Airport (LAX), and these fuels have been used in both demonstrations and operations by the US military. There have been dozens of research and development or offtake agreements for future production announced between airlines and SAF producers, as airlines try to gain access to the SAF market in anticipation of both public interest and regulatory initiatives aimed at reducing GHG emissions. The importance of partnerships across the value chain cannot be overstated, and one of the most significant successes demonstrates how partnerships, both public and private, are a key enabler of success.

Alternative support mechanisms

While incentives and mandates can be effective, they are not the only tools available or employed by governments to spur growth in the second-generation, drop-in biofuel industry. Research grants are also helpful and have been employed by national and local governments in the United States, Brazil, Europe, and the Middle East to facilitate research in biofuel feedstocks and production technologies. In the United States, the Department of Energy’s Bioenergy Technologies Office89“Bioenergy Technologies Office,” US Department of Energy Office of Energy Efficiency & Renewable Energy, accessed November 7, 2018, https://www.energy.gov/eere/bioenergy. and the Department of Transportation’s Volpe Center90“Volpe National Transportation Systems Center,” Volpe National Transportation Systems Center, US Department of Transportation, accessed November 7, 2018, https://www.volpe.dot.gov/. have each provided numerous grants to developers of SAF technologies, including funding initial pathway-certification efforts in coordination with the Commercial Aviation Alternative Fuels Initiative. In addition to providing funding, these efforts have also helped create partnerships among researchers, feedstock providers, fuel producers, government regulators, industry experts, and end users.

Another example of government involvement that created partnerships and opportunity for biofuels was the US Department of the Navy’s Great Green Fleet initiative. In response to the challenges of rising energy costs and global climate change, as well as a desire to reduce the liquid-fuel demands of deployed forces, then-US Secretary of the Navy Ray Mabus announced an array of initiatives designed to reduce the navy’s and Marine Corps’ reliance on fossil energy. One of the key elements of this comprehensive program was the Great Green Fleet.91“The Great Green Fleet Explained,” US Department of the Navy, June 27, 2016, https://www.navy.mil/submit/display.asp?story_id=95398. The concept, announced in 2009, was to demonstrate fleet operations, including ships and aircraft, on a biofuel blend in 2012, followed by a fleet deployment using a biofuel blend by 2016. To accomplish this effort, the navy partnered with the US Department of Energy and the US Department of Agriculture, with the latter two entities providing support for and expertise in biofuel technologies and feedstock supply chains, respectively.

The US Department of Defense is the single largest consumer of petroleum in the US.92Daniel Orchard-Hays and Laura A. King, “Realize the Great Green Fleet,” Proceedings, U.S. Naval Institute, August 2017, https://www.usni.org/magazines/proceedings/2017-08/realize-great-green-fleet. Therefore, the navy provided an enormous market opportunity to biofuel producers. The challenge was to produce fuel that met military performance requirements and was cost competitive with petroleum alternatives. Working with its governmental partners and industry, the navy was able to conduct a series of stepping-stone demonstrations,93Liz Wright, “Navy Tests Biofuel-Powered ‘Green Hornet,’a” US Department of the Navy, April 22, 2010, https://www.navy.mil/submit/display.asp?story_id=52768. culminating in 2012 with a fleet demonstration during the annual Rim of the Pacific exercise near the Hawaiian Islands. During this demonstration, 900,000 gallons of a 50/50 blend of renewable distillate fuel and petrodiesel were utilized by naval ships and aircraft, including 200,000 gallons of SAF.94Jim Lane, “The Navy’s Green Strike Group Sails on Biofuels Blend: Will It Sail Again?” Biofuels Digest, July 19, 2012, http://www.biofuelsdigest.com/bdigest/2012/07/19/the-navys-green-strike-group-sails-on-biofuels-blend-will-it-sail-again/. However, due to the relatively small volume purchased and the associated high costs of production, the biofuel use in this demonstration was purchased at an average cost of $26 per gallon.95Jim Lane, “Launch of the Great Green Fleet,” Biofuels Digest, January 20, 2016, http://www.biofuelsdigest.com/bdigest/2016/01/20/launch-of-the-great-green-fleet/.

Despite the high initial cost, the effort continued, and in 2016, the Great Green Fleet initiative culminated with the purchase of over 7.7 million gallons of neat, unblended biofuel. This fuel was produced in a commercial-scale facility and sold to the navy at an average price of $2.05 per gallon. The biorefinery also would have captured RFS2 RIN revenue, and possibly a biodiesel-production tax credit.96Ron Kotrba, “Retroactive Biodiesel Tax Credit Signed into Law for 2017 Only,” Biodiesel Magazine, February 9, 2018, accessed on December 2, 2018, http://biodieselmagazine.com/articles/2516276/retroactive-biodiesel-tax-credit-signed-into-law-for-2017-only. It is unclear if the biorefinery received any benefit from LCFS on this transaction. This highlights the importance of governmental-incentive support to this industry. In addition to meeting performance requirements, this cost-competitive price point is critical since current US Department of Defense policy states: “Alternative fuels for operational purposes [may be] purchased when cost competitive with traditional fuels and when qualified as compatible with existing equipment and infrastructure.”97“DoD Management Policy for Energy Commodities and Related Services,” US Department of Defense Instruction Number 4140.25, Change 2, August 31, 2018, 2.

This fuel was blended at 10 percent concentration to produce over 77 million gallons of blended fuel, supporting the deployment of a carrier strike group from San Diego, CA.98Jim Lane, “Navy to Launch Great Green Fleet with 77 Million Gallon Buy of Cost-Competitive, Non-Food Advanced Biofuels Blends,” Biofuels Digest, January 7, 2016, http://www.biofuelsdigest.com/bdigest/2016/01/07/navy-to-launch-great-green-fleet-with-77-million-gallon-buy-of-cost-competitive-non-food-advanced-biofuels/. The fuel was supplied by World Energy’s Paramount, CA refinery, the same facility that currently provides SAF for airline use at LAX. This effort also clearly demonstrated the drop-in nature of second-generation biofuels, including renewable diesel and SAF. As expected, the drop-in biofuel blends performed exactly like the petroleum products they displaced, with no noticeable effect on ship or aircraft operations. The key enabler for the success of this project was the strong government and industry collaboration, which provided research and development funding, technological expertise, off-take agreements, and the political will to see the project to completion.

Biorefinery capacity lag

Despite these successes in biofuel certification, cost reduction, and policy support, biorefinery capacity remains relatively small. During 2017, only 84 million tons oil equivalent,99BP Statistical Review 2018, BP, 45. 143 billion liters100Renewables 2018 Global Status Report, Renewable Energy Policy Network for the 21st Century (REN21), (Paris: 2018), 72-73. of biofuels, were produced worldwide. While this may sound like a substantial amount, it is still less than the 92 million tons of oil produced on average worldwide each day of that same year.101BP Statistical Review 2018, BP, 14 First-generation ethanol accounted for 65 percent of this total, fatty acid methyl ester biodiesel represented 29 percent, and second-generation renewable diesel accounted for 6 percent. Of the three, renewable diesel exhibited the fastest rate of growth, expanding from 5.9 to 6.5 billion liters, roughly 10 percent over the year.102Ibid.

Unfortunately, this is a negligible amount when the entirety of the liquid fuels market is considered. Even if all renewable diesel produced worldwide were upgraded to SAF and dedicated to the aviation market, current installed capacity of 6.5 billion liters per year production would only represent 1.8 percent of the 356-billion-liter annual worldwide aviation fuel market.103Ninety-four (94) billion gallons estimated in 2018 equals approximately 356 billion liters; see “Global CO2 Emissions from Airlines Expected to Rise,” GreenAirOnline.com. However, the recently announced expansion of World Energy’s Paramount, California, facility (for an additional 130 million gallons per year), coupled with the commencement of construction in 2018 at both Red Rocks Biofuel’s facility in Lakeview, Oregon, (15 million gallons per year), and Fulcrum Bioenergy’s Sierra Biofuels Plant in Nevada (10+ million gallons per year) represent over 155 million gallons or nearly 600 million liters per year of additional capacity—a 10 percent increase in the global supply.

Challenges to success in a mature market

While the past decade has been one of success and advancement for the biofuels industry, there have also been headwinds and failures. The volatility of global oil markets has taken a toll. The distillate fuel market is benchmarked by the price of ultra-low sulfur diesel (ULSD) in the US market. For the week ending on October 18, 2018, the average for ULSD was approximately $2.32 per gallon on both the Chicago and New York commodity markets.104“Ethanol & Biodiesel Information Service,” Oil Price Information Service, 1. As the global price for crude oil goes up or down, this benchmark will rise and fall in a similar fashion. During 2008, the year of the first biofuel flight, Brent crude peaked above $134 per barrel. It fell to below $40 per barrel before the end of that year. While the price hovered above $100 per barrel from 2011 to 2014, it was back below $40 by 2016. This volatility and uncertainty can be very challenging, especially for new biofuel production technologies seeking investment.

The market price of ULSD, plus any additional value derived from the associated RINs, LCFS carbon credits, and other governmental supports, like the Blenders Tax Credit,105Kotrba, “Retroactive Biodiesel Tax Credit Signed into Law for 2017.” represent the revenue potential of a gallon of biodiesel or renewable diesel in the US market. Most of these same incentives would be available to SAF producers, however the higher cost to produce and certify SAF may make it an unattractive alternative to the less cost-intensive on-road diesel market.

In addition to these economic challenges, there have been high-profile failures in the space that have affected the public perception of the industry. The prime example of this in the United States was KiOR, a highly touted, well-financed biofuel production company with the goal of using a modified thermo-catalytic process known as “catalytic cracking.”106Katie Fehrenbacher, “How A Tech Billionaire’s Biofuel Dream Went Bad,” Fortune, December 4, 2015, http://fortune.com/kior-vinod-khosla-clean-tech/. The process is commonly used in petroleum refineries to convert woody biomass to a “renewable crude” that can then be upgraded into drop-in biofuels. The company secured significant venture funding and a large incentive package from the state of Mississippi to convert a former paper mill near the city of Columbus into a biorefinery designed to convert locally-sourced wood chips to biofuel. Unfortunately, the company was attempting to leap from the lab to commercial production before results and processes were proven at demonstration scale.107Jim Lane, “KiOR: The Inside True Story of a Company Gone Wrong,” Biofuels Digest, May 17, 2016, https://www.biofuelsdigest.com/bdigest/2016/05/17/kior-the-inside-true-story-of-a-company-gone-wrong/9/. The results were predictable as the Columbus facility struggled with chronically poor yields, while still experiencing operational challenges typical of new plant commissioning. In 2014, KiOR shut down the Columbus facility; before the end of that year, the company had filed for bankruptcy protection.108Fehrenbacher, “How A Tech Billionaire’s Biofuel Dream Went Bad.”

Looking ahead

How will CORSIA affect SAF development?

It is very challenging to quantify the potential impacts of CORSIA implementation on the SAF industry. The market-based aspect of CORSIA will allow “carbon neutral” growth in the commercial aviation industry through either avoidance by using low-carbon SAF or offsetting through the purchase of carbon credits from global carbon-credit exchanges. Despite the aviation industry’s vocal support for SAF development, this optionality was built in by design. It allows the industry to stay ahead of climate change mitigation measures and public perception, while providing them the ability to choose the most cost-effective means of compliance. Therefore, while some parties may choose to purchase SAF as a compliance measure, many will also choose offsets, with this decision rationally driven by the relative economics.

In addition to this optionality, it is also very difficult to estimate the overall cost of compliance. CORSIA is designed to ensure carbon-neutral growth above the to-be-established 2020 baseline, not carbon-neutral operations. CORSIA also only applies to international flights; it is not applicable to domestic commercial operations. Moreover, during the pilot phase (2021-2023) and first phase (2024-2026), only flights between participating states will be subject to the regulation.

As of November 5, 2018, seventy-six states, representing over 75 percent of international aviation activity, have committed to voluntarily participate in CORSIA from the outset.109“CORSIA States for Chapter 3 State Pairs,” ICAO website, accessed November 9, 2018, https://www.icao.int/environmental-protection/CORSIA/Pages/state-pairs.aspx. What this means, however, is that only carbon emissions from international flights that represent market growth between participating states will be subject to CORSIA. IATA has stated that “CORSIA will mitigate around 2.5 billion tons of CO2 between 2021 and 2035, which is an annual average of 164 million tons of CO2.”“110Fact Sheet on CORSIA,” International Air Transportation Association, October 29, 2018, 1-2. With carbon offsets recently trading at €20, or approximately $23, per ton,111Rachel Morrison and Jeremy Hodges, “Carbon Reaches 10-Year High, Pushing Up European Power Prices,” Bloomberg, August 23, 2018, https://www.bloomberg.com/news/articles/2018-08-23/carbon-reaching-20-euros-a-ton-in-europe-raises-price-for-power. this represents an average annual cost of $3.77 billion. However, since only growth will be offset, the cost will likely be nonlinear.

The financial impact to individual airlines or countries is harder to determine. Industry representatives from international airlines and airline-industry groups admit that their organizations have used internal, proprietary estimations of market demand and growth to estimate their own specific CORSIA compliance costs, but they are understandingly unwilling to share these estimates publicly. While it would be speculative to attempt to estimate the impact of CORSIA on individual airlines or member states, it is possible to calculate the relative impact of the regulation on the price (in today’s dollars) of a gallon of fuel consumed in a regulated flight operation, which is defined as market growth between participating states.

Burning a ton of aviation fuel produces 3.24 tons of CO2.112Per the US Energy Information Administration, one gallon of jet fuel produces 21.1 pounds of CO2. At 6.5 pounds per gallon this equates to 3.24 pounds of CO2 per pound of fuel. See https://www.eia.gov/environment/emissions/co2_vol_mass.php. At $23 per ton, the current cost to offset these emissions would be $74.66. With 2,204 pounds per ton, and using 6.5 pounds per gallon of jet fuel,113Paul Laherty, “Calculating Aircraft CO2 Emissions,” January 26, 2015, https://paullaherty.com/2015/01/10/calculating-aircraft-co2-emissions/. there are 339 gallons of jet fuel per ton. Dividing the $74.66 compliance cost across these gallons results in $0.22 per gallon in compliance cost. The carbon intensity of SAF varies by feedstock and conversion pathway, but for the purposes of this example assume that the subject fuel achieves a 67 percent reduction in CO2 emissions. Appling this factor to the compliance cost nets a per gallon premium of $0.148. In this example, in order to be the more economical compliance option compared to purchasing carbon-offset credits, SAF would need to be no more than $0.14 per gallon more expensive than the petrojet alternative. Even given the potential for the $3.77 billion in annual compliance cost noted above, it is unlikely that a 14-cent CORSIA premium alone will be adequate to cover the additional costs of producing SAF versus the simpler renewable diesel.

Feedstock innovation

The majority of current and soon-to-be-operational SAF production utilizes one of the well-established, technologically mature pathways, HEFA-SPK or FT-SPK. In either case, tight feedstock supply, caused by short supply or competition, can increase the cost of production. The supply of waste oil and grease is finite, and the market demand for this feedstock is high. As of November 2018, the spot price for “yellow grease,” as this material is known, on the West Coast of the United States ranged between $0.205 and $0.245 per pound.114“National Weekly Ag Energy Round-Up,” US Department of Agriculture, Agricultural Marketing Service, accessed November 10, 2018, https://www.ams.usda.gov/mnreports/lswagenergy.pdf. Fisher-Tropsch processes using municipal solid waste (MSW) compete with landfills and waste-to-power companies,115“Energy from Waste,” Covanta, accessed November 10, 2018, https://www.covanta.com/Sustainability/Energy-from-Waste. while an FT process that uses wood waste as a feedstock will have to compete with wood-to-power and wood pellet mills for their feedstocks.116“About Enviva,” Enviva, accessed November 10, 2018, http://www.envivabiomass.com/about/. More work is needed to develop innovative feedstock supply chains that can supply biorefineries with low-cost inputs, without unintended negative impacts on food production or land use.

Numerous public and private entities are working to create novel feedstock models. The best option for increasing the global supply of HEFA feedstock is to expand farming of purpose-grown oilseed crops. For example, the Canadian company Agrisoma Biosciences Inc. is developing Carinata, a nonfood oilseed plant that can be grown on fallow land or as an off-season cover crop.117“About Agrisoma,” Agrisoma Biosciences Inc., accessed November 10, 2018, https://agrisoma.com/biofuel/about. Others are working to expand production, reduce conversion cost, and increase output of purpose-grown lignocellulosic biomass resources.Allyson Mann, “Gene Improves Plant Growth and Conversion to Biofuels,”118Science X news service, February 13, 2018, https://phys.org/news/2018-02-gene-growth-conversion-biofuels.html#jCp; “ISEE Helps Secure $6M in New Grants,” Institute for Sustainability, Energy, and Environment, University of Illinois at Urbana-Champaign, September 14, 2018, https://sustainability.illinois.edu/isee-helps-secure-6m-in-new-research-grants-for-university/. Some of these crops could be thermochemically converted to sugars and then processed into biofuels and biochemicals. As noted earlier, SAF could be produced in this manner via the approved ATJ-SPK pathway. This biomass could also be converted using existing FT-SPK technologies. Access to lower cost, purpose-grown biomass feedstocks would benefit biofuel production by increasing feedstock supply and avoiding competition inherent in the wood market.

Innovation case study: sustainable bioenergy research consortium

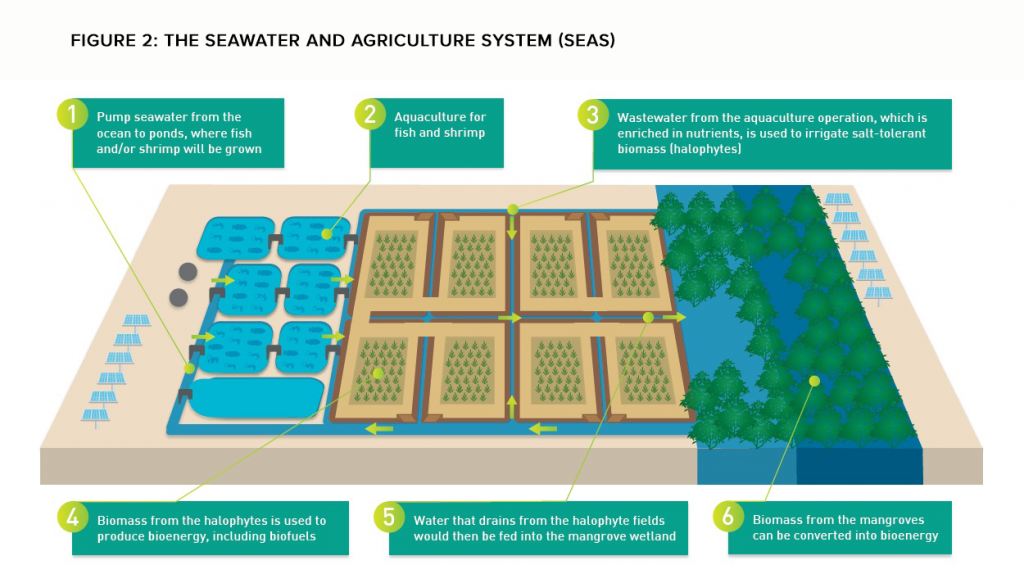

One way to increase the use of renewable energy resources, including SAF and renewable diesel, is through innovative models that integrate feedstock production with other products, creating an economic ecosystem that delivers multiple value streams. An example of this type of innovation can be found in the United Arab Emirates (UAE), where a dedicated team of scientists and engineers is working on an integrated approach to deliver food protein and energy from saltwater and nonarable desert land.